|

市場調查報告書

商品編碼

1871182

超豪華智慧家庭市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Ultra-Luxury Home Automation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

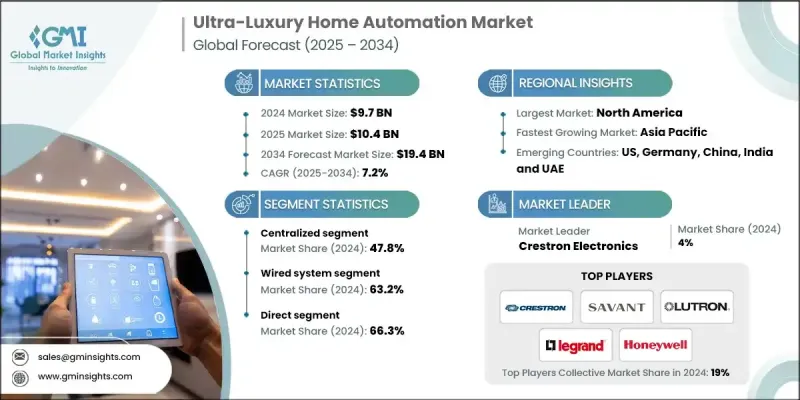

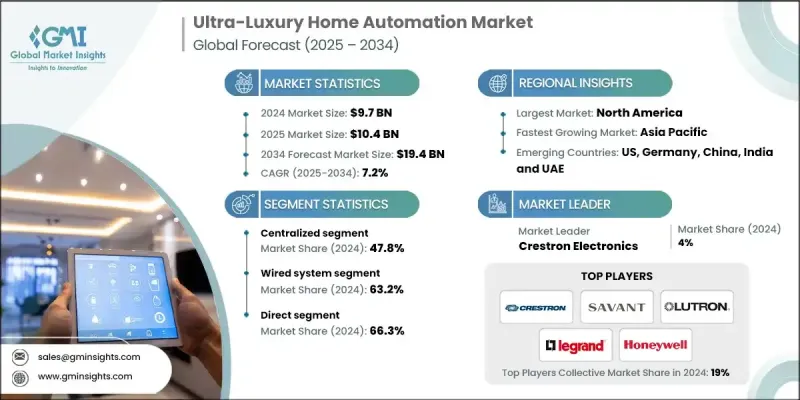

2024 年全球超豪華家庭自動化市場價值為 97 億美元,預計到 2034 年將以 7.2% 的複合年成長率成長至 194 億美元。

隨著富裕消費者日益追求智慧互聯和高度個人化的生活體驗,市場正呈現強勁成長動能。科技創新,尤其是在人工智慧、物聯網和節能自動化領域的創新,正在重塑高階住宅業主與家居空間的互動方式。各大品牌強調永續性、卓越舒適性和無縫控制,同時融入精緻美學,提升便利性和風格。對直覺控制、更高安全性和能源最佳化的需求持續推動著專為高階住宅環境設計的尖端系統的應用。生態系統內的合作、技術供應商之間的整合以及不斷拓展的數位化零售管道,使得智慧家庭產品能夠實現更高的客製化程度和更廣泛的應用。連接性和用戶介面技術的進步正在重新定義高階住宅業主管理其環境的方式,推動市場蓬勃發展,並加劇全球市場的競爭。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 97億美元 |

| 預測值 | 194億美元 |

| 複合年成長率 | 7.2% |

2024年,集中式自動化市佔率達到47.8%,預計2025年至2034年將以7.3%的複合年成長率成長。集中式系統仍然佔據主導地位,因為它們透過一個統一的介面,對照明、溫度控制、娛樂和安防等核心家居功能進行全面控制。其一致性、可靠性和可擴展性使其成為需要精準自動化的高階住宅的理想選擇。這些系統能夠提供個人化且安全的體驗,滿足豪華住宅業主輕鬆管理複雜房產的需求。

2024年,有線系統市佔率達到63.2%,預計到2034年將以6.6%的複合年成長率成長。有線配置因其卓越的可靠性、強大的性能和高資料頻寬容量而備受青睞。在超豪華住宅領域,有線基礎設施可確保不間斷的連接和精準的控制,這對於管理龐大的自動化網路至關重要。這些系統因其長期耐用性、低干擾程度以及在多個設備間實現穩定運作的能力而備受推崇,為業主提供可靠安全的自動化體驗。

2024年,美國超豪華智慧家庭市場佔77.2%的市場佔有率,市場規模達31億美元。北美地區憑藉著強勁的經濟實力、先進的技術基礎設施和較高的可支配收入水平,繼續在全球市場佔據主導地位。豪華房地產市場的穩定成長,以及消費者對便利性和安全性的日益成長的需求,持續推動智慧家居技術的普及。美國市場受益於成熟的製造商、系統整合商和高度重視尖端創新和生活方式自動化的消費者生態系統。

全球超豪華智慧家居市場的主要參與者包括施耐德電氣、Savant Systems、Honeywell、ABB、Bang & Olufsen、Integrated AV、Ecobee、Aurum HomeTech、Vivint、羅格朗、江森自控、路創電子、Snap One、快思聰電子和Heyo Smart。這些市場領導者正透過創新、策略合作和技術整合來鞏固其市場地位。許多企業正在投資人工智慧驅動的自動化系統、節能技術和雲端平台,以增強個人化控制和永續性。設備製造商和軟體開發商之間的合作正在提高互通性和無縫系統整合。此外,各公司也正在拓展產品組合,推出可擴展的高階解決方案,以滿足高階住宅專案的需求。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 對智慧互聯住宅的需求不斷成長

- 提高富裕消費者的可支配收入

- 奢華生活方式和家居個性化的趨勢日益成長

- 產業陷阱與挑戰

- 較高的初始投資和安裝成本

- 複雜的系統整合和互通性問題

- 機會

- 與豪華房地產開發商和建築師合作

- 整合人工智慧驅動的自動化和生物辨識安全等尖端技術

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按自動化類型

- 監理框架

- 標準和合規要求

- 區域監理框架

- 認證標準

- 貿易統計

- 主要進口國

- 主要出口國

- 波特五力分析

- PESTEL 分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品類型分類,2021-2034年

- 主要趨勢

- 照明設備

- 牆內模組/智慧燈泡

- 智慧開關

- 智慧插座

- 其他(智慧型調光器等)

- 智慧安防設備

- 運動/到達感應器

- 門窗感應器

- 警報

- 智慧無線鈴

- 智慧門鎖

- 其他(監視器等)

- 娛樂裝置

- 揚聲器/音訊分配

- 影片分發

- 其他(虛擬私人助理等)

- 保護感測器

- 洪水/火災感測器

- 紫外線感測器

- 其他(濕度感測器等)

- 其他(氣候控制裝置等)

第6章:市場估算與預測:依自動化類型分類,2021-2034年

- 主要趨勢

- 分散式

- 集中

- 混合

第7章:市場估計與預測:依技術分類,2021-2034年

- 主要趨勢

- 有線系統

- 無線系統

- 無線上網

- 藍牙

- ZigBee

- 其他(Z-Wave 等)

第8章:市場估算與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 直接的

- 間接

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- ABB

- Aurum HomeTech

- Bang & Olufsen

- Crestron Electronics

- Ecobee

- Heyo Smart

- Honeywell

- Integrated AV

- Johnson Controls

- Legrand

- Lutron Electronics

- Savant Systems

- Schneider Electric

- Snap One

- Vivint

The Global Ultra-Luxury Home Automation Market was valued at USD 9.7 Billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 19.4 Billion by 2034.

The market is witnessing strong momentum as affluent consumers increasingly seek intelligent, connected, and highly personalized living experiences. Technological innovation, particularly in AI, IoT, and energy-efficient automation, is reshaping how luxury homeowners interact with their spaces. Brands are emphasizing sustainability, superior comfort, and seamless control while incorporating refined aesthetics that enhance both convenience and sophistication. Demand for intuitive control, heightened security, and energy optimization continues to drive the adoption of cutting-edge systems designed for premium residential settings. Partnerships across the ecosystem, integration among technology providers, and expanding digital retail channels are enabling greater customization and availability of home automation products. Advances in connectivity and user interface technologies are redefining how luxury homeowners manage their environments, fueling exceptional growth and intensifying competition in the global marketplace.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.7 Billion |

| Forecast Value | $19.4 Billion |

| CAGR | 7.2% |

The centralized automation segment held 47.8% share in 2024 and is anticipated to grow at a CAGR of 7.3% from 2025 to 2034. Centralized systems remain dominant as they provide unified control over core household functions such as lighting, climate management, entertainment, and security through one cohesive interface. Their ability to deliver consistency, reliability, and scalability makes them ideal for high-end residences requiring precise automation. These systems enable a personalized and secure experience that aligns with the expectations of luxury homeowners seeking effortless management of complex estates.

In 2024, the wired systems segment held 63.2% share and is expected to grow at a CAGR of 6.6% through 2034. Wired configurations are preferred for their superior reliability, robust performance, and high data bandwidth capacity. In the ultra-luxury housing sector, wired infrastructure ensures uninterrupted connectivity and precise control, which are critical for managing extensive automation networks. These systems are valued for their long-term durability, low interference levels, and ability to deliver consistent operation across multiple devices, providing homeowners with dependable and secure automation experiences.

United States Ultra-Luxury Home Automation Market held 77.2% share in 2024, generating USD 3.1 Billion. North America continues to dominate globally, supported by strong economic conditions, advanced technological infrastructure, and high disposable income levels. The steady growth of the luxury real estate segment, coupled with increasing demand for convenience and safety, continues to boost the adoption of smart home technologies. The US market benefits from a mature ecosystem of manufacturers, system integrators, and highly aware consumers who value cutting-edge innovation and lifestyle automation.

Key companies active in the Global Ultra-Luxury Home Automation Market include Schneider Electric, Savant Systems, Honeywell, ABB, Bang & Olufsen, Integrated AV, Ecobee, Aurum HomeTech, Vivint, Legrand, Johnson Controls, Lutron Electronics, Snap One, Crestron Electronics, and Heyo Smart. Leading players in the Ultra-Luxury Home Automation Market are strengthening their market foothold through innovation, strategic collaborations, and technology integration. Many are investing in AI-driven automation systems, energy-efficient technologies, and cloud-based platforms to enhance personalized control and sustainability. Partnerships between device manufacturers and software developers are improving interoperability and seamless system integration. Companies are also expanding their product portfolios with scalable, high-end solutions designed to cater to exclusive residential projects.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Automation type

- 2.2.4 Technology type

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for smart and connected homes

- 3.2.1.2 Increasing disposable incomes of affluent consumers

- 3.2.1.3 Growing trend of luxury lifestyle and home personalization

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and installation costs

- 3.2.2.2 Complex system integration and interoperability issues

- 3.2.3 Opportunities

- 3.2.3.1 Partnership with luxury real estate developers and architects

- 3.2.3.2 Integration of cutting-edge technologies like AI-driven automation and biometric security

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By automation type

- 3.7 Regulatory framework

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behaviour analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behaviour

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Lighting devices

- 5.2.1 In-wall modules/ smart bulbs

- 5.2.2 Smart switches

- 5.2.3 Smart plugs

- 5.2.4 Others (smart dimmer etc.)

- 5.3 Smart security devices

- 5.3.1 Motion/arrival sensor

- 5.3.2 Door/window sensor

- 5.3.3 Alarms

- 5.3.4 Smart wireless bells

- 5.3.5 Smart door locks

- 5.3.6 Others (security cameras etc.)

- 5.4 Entertainment devices

- 5.4.1 Speakers/ audio distribution

- 5.4.2 Video distribution

- 5.4.3 Others (virtual personal assistant etc.)

- 5.5 Protection sensors

- 5.5.1 Flood/fire sensors

- 5.5.2 UV sensors

- 5.5.3 Others (humidity sensors etc.)

- 5.6 Others (climate control devices etc.)

Chapter 6 Market Estimates & Forecast, By Automation Type, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Distributed

- 6.3 Centralized

- 6.4 Hybrid

Chapter 7 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Wired system

- 7.3 Wireless system

- 7.3.1 Wi-Fi

- 7.3.2 Bluetooth

- 7.3.3 ZigBee

- 7.3.4 Others (Z-Wave etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.1.1 Direct

- 8.1.2 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Aurum HomeTech

- 10.3 Bang & Olufsen

- 10.4 Crestron Electronics

- 10.5 Ecobee

- 10.6 Heyo Smart

- 10.7 Honeywell

- 10.8 Integrated AV

- 10.9 Johnson Controls

- 10.10 Legrand

- 10.11 Lutron Electronics

- 10.12 Savant Systems

- 10.13 Schneider Electric

- 10.14 Snap One

- 10.15 Vivint