|

市場調查報告書

商品編碼

1871171

緊湊型重合閘市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Compact Recloser Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

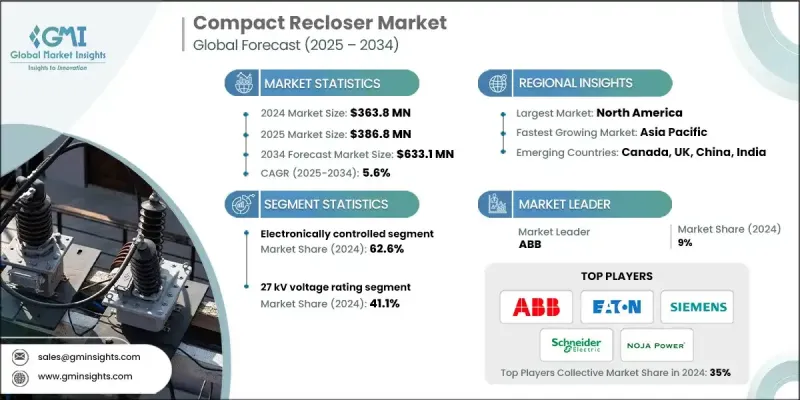

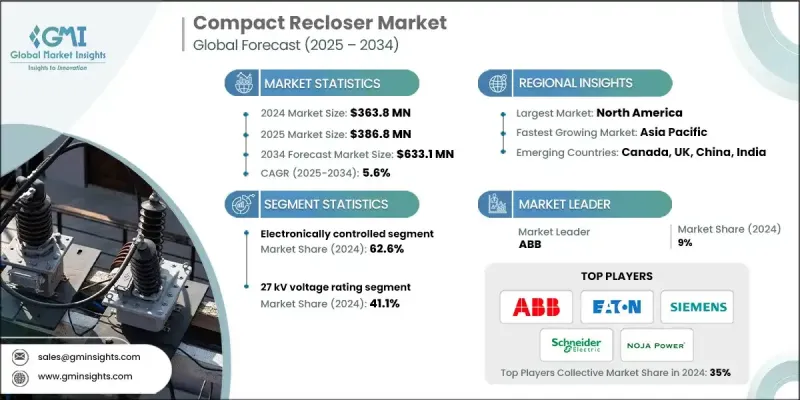

2024 年全球緊湊型重合閘市場價值為 3.638 億美元,預計到 2034 年將以 5.6% 的複合年成長率成長至 6.331 億美元。

老舊電網的快速現代化改造和再生能源的廣泛應用是推動這個市場的主要動力。隨著電力公司向智慧化、高彈性電網系統轉型,緊湊型重合閘因其能夠自動檢測、隔離和恢復故障而變得不可或缺。這些系統有助於最大限度地減少停電,提高電力可靠性,使其成為現代電網運作的關鍵組成部分。其小巧靈活的設計使得電力公司無需對現有基礎設施進行大規模改造即可將其整合到現有系統中。此外,全球能源政策和電力公司的大規模投資也越來越傾向於採用能夠增強遠端監控、電網靈活性和系統彈性的技術,而緊湊型重合閘恰好能夠有效地實現這些功能。持續向再生能源發電轉型也加劇了對快速反應的故障管理工具的需求。緊湊型重合閘有助於穩定受波動能量流影響的電網,維持分散式系統的平穩電力分配,並確保中斷後快速恢復供電。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3.638億美元 |

| 預測值 | 6.331億美元 |

| 複合年成長率 | 5.6% |

2024年,電子控制緊湊型重合器市佔率達到62.6%,預計到2034年將以6.2%的複合年成長率成長。數位通訊技術的日益普及、智慧感測器的整合以及對模組化和空間高效設備的需求,是推動該細分市場成長的主要因素。先進的電子重合器目前支援IEC 61850、Modbus和DNP3等通訊標準,可與數位化變電站和集中監控系統進行即時互動。整合感測器可提供電壓、電流和故障事件的連續資料,從而提高態勢感知能力,並增強電網性能和安全性。

預計到2034年,15 kV緊湊型重合器市場將以5.6%的複合年成長率成長。城市配電網路最佳化日益受到重視,以及新興地區單相系統的普及,正加速15 kV重合器的應用。這些重合器非常適合密集的城市電網和郊區環境,其緊湊的設計和簡化的安裝是關鍵優勢。它們的高效性和適應性使其成為低壓、空間受限應用的理想選擇。

美國小型重合閘市場佔58.1%的市場佔有率,預計2024年市場規模將達8,380萬美元。該地區電網現代化進程正在快速推進,這主要得益於用智慧自動化重合閘系統取代老舊基礎設施。小型重合閘正被廣泛應用,以提高供電可靠性、減少停機時間並最佳化電網整體性能。美國和加拿大的電力公司正優先推進數位化升級,以實現更快的故障隔離、更短的恢復時間和更長遠的成本效益。

全球小型重合器市場的主要參與者包括ABB、西門子、伊頓、施耐德電氣、S&C電氣公司、NOJA Power Switchgear Pty Ltd、Tavrida Electric、G&W Electric、ENTEC Electric & Electronic Co., Ltd、Arteche Group、Hughbell Power Systems、Camlin Group、Poman Electric & Electronic Co., Ltd、Arteche Group、Hughbell Power Systems、Camlin Group、Pomanique & Electronic Co., Ltd、Arteche Group、Hughbell Power Systems、Camlin Group、Pomanique & Electronic Co., Ltd、Arteche Group、Hughbell Power Systems、Camlin Group、Pomanique & Electronic Co., Ltd、Arteche Group、Hughbell Power Systems、Camlin Group、Pomanique & Electronic Co., Ltd、Arteche Group、Hughbell Power Systems、Camlin Group、Pomanique & Electronic Co., Ltd、Arteche Group、Hughbell Power Systems、Camlin Group、Pomanique & Electronic Co., Ltd、Arteche Group、Hughbell Power Systems、Camlin Group、Pomanique & Electronic Co., Ltd. Electric、溫州瑞納電氣有限公司、浙江法拉第電力科技有限公司、重慶藍傑科技有限公司和浙江格雅電氣有限公司。為了鞏固其市場地位,緊湊型重合器市場的企業正致力於一系列策略性舉措。這些舉措包括持續投資產品創新、整合基於物聯網和人工智慧的監控功能,以及開發專為下一代智慧電網量身定做的緊湊型免維護設計。與公用事業公司和區域分銷商建立策略合作夥伴關係有助於擴大地域覆蓋範圍,而併購則加速了技術進步。許多公司也將研發作為優先事項,以提高故障檢測精度和通訊互通性。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 監管環境

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

- 新興機會與趨勢

- 數位化和物聯網整合

- 新興市場滲透

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 策略舉措

- 競爭性標竿分析

- 戰略儀錶板

- 創新與技術格局

第5章:市場規模及預測:依控制方式分類,2021-2034年

- 主要趨勢

- 電子的

- 油壓

第6章:市場規模與預測:依中斷類型分類,2021-2034年

- 主要趨勢

- 油

- 真空

第7章:市場規模及預測:依電壓等級分類,2021-2034年

- 主要趨勢

- 15千伏

- 27千伏

- 38千伏

第8章:市場規模及預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

第9章:公司簡介

- ABB

- Arteche Group

- Camlin Group

- Chongqing Blue Jay Technology Co., Ltd

- Eaton

- ENTEC Electric & Electronic Co., Ltd

- G&W Electric

- Hubbell Power Systems

- Hughes Power System

- NOJA Power Switchgear Pty Ltd

- Pomanique Electric

- Rockwill Electric Group

- S&C Electric Company

- Schneider Electric

- Siemens

- Sriwin Electric

- Tavrida Electric

- Wenzhou Rena Electric Co., Ltd

- Zhejiang Farady Powertech Co., Ltd

- Zhejiang Geya Electrical Co., Ltd

The Global Compact Recloser Market was valued at USD 363.8 million in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 633.1 million by 2034.

The rapid modernization of outdated electrical networks and the widespread integration of renewable power sources are the primary forces driving this market. As utilities move toward intelligent, highly resilient grid systems, compact reclosers have become indispensable for their ability to automate fault detection, isolation, and restoration. These systems help minimize outages and improve power reliability, making them essential for modern grid operations. Their small, flexible design allows utilities to retrofit them into existing setups without the need for extensive infrastructure modifications. In addition, global energy policies and large-scale utility investments are increasingly directed toward technologies that enhance remote monitoring, grid flexibility, and system resilience capabilities that compact reclosers deliver efficiently. The ongoing shift toward renewable energy generation has also intensified the need for responsive fault management tools. Compact reclosers help stabilize grids impacted by variable energy flows, maintaining smooth power distribution across decentralized systems and ensuring quick recovery after disruptions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $363.8 Million |

| Forecast Value | $633.1 Million |

| CAGR | 5.6% |

The electronically controlled compact reclosers segment held 62.6% share in 2024 and is expected to grow at a CAGR of 6.2% through 2034. The growing adoption of digital communication technologies, integration of smart sensors, and demand for modular and space-efficient equipment are fueling this segment's growth. Advanced electronic reclosers now support communication standards such as IEC 61850, Modbus, and DNP3, which enable real-time interaction with digital substations and centralized monitoring systems. Integrated sensors provide continuous data on voltage, current, and fault events, improving situational awareness and enhancing grid performance and safety.

The 15 kV compact recloser segment is forecasted to grow at a CAGR of 5.6% through 2034. Increasing focus on urban power distribution network optimization and the expansion of single-phase systems across emerging regions are accelerating the adoption of 15 kV units. These reclosers are well-suited for dense city grids and suburban environments where compact design and simplified installation are key advantages. Their efficiency and adaptability make them a preferred choice for managing low-voltage, space-limited applications.

United States Compact Recloser Market held 58.1% share, generating USD 83.8 million in 2024. The region is experiencing rapid advancements in grid modernization, driven by the replacement of outdated infrastructure with intelligent, automated recloser systems. Compact reclosers are being implemented widely to enhance service reliability, reduce downtime, and optimize overall grid performance. Utilities across the U.S. and Canada are prioritizing digital upgrades that allow faster fault isolation, improved restoration times, and long-term cost efficiency.

Leading players in the Global Compact Recloser Market include ABB, Siemens, Eaton, Schneider Electric, S&C Electric Company, NOJA Power Switchgear Pty Ltd, Tavrida Electric, G&W Electric, ENTEC Electric & Electronic Co., Ltd, Arteche Group, Hubbell Power Systems, Camlin Group, Pomanique Electric, Rockwill Electric Group, Hughes Power System, Sriwin Electric, Wenzhou Rena Electric Co., Ltd, Zhejiang Farady Powertech Co., Ltd, Chongqing Blue Jay Technology Co., Ltd, and Zhejiang Geya Electrical Co., Ltd. To strengthen their position, companies in the Compact Recloser Market are focusing on a combination of strategic initiatives. These include continuous investment in product innovation, integration of IoT and AI-based monitoring capabilities, and development of compact, maintenance-free designs tailored for next-generation smart grids. Strategic partnerships with utilities and regional distributors help expand geographic presence, while mergers and acquisitions accelerate technological advancement. Many firms are also prioritizing R&D to enhance fault detection accuracy and communication interoperability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Control trends

- 2.1.3 Interruption trends

- 2.1.4 Voltage trends

- 2.1.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Control, 2021 - 2034 (USD Million, Units)

- 5.1 Key trends

- 5.2 Electronic

- 5.3 Hydraulic

Chapter 6 Market Size and Forecast, By Interruption, 2021 - 2034 (USD Million, Units)

- 6.1 Key trends

- 6.2 Oil

- 6.3 Vacuum

Chapter 7 Market Size and Forecast, By Voltage Rating, 2021 - 2034 (USD Million, Units)

- 7.1 Key trends

- 7.2 15 kV

- 7.3 27 kV

- 7.4 38 kV

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Chile

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Arteche Group

- 9.3 Camlin Group

- 9.4 Chongqing Blue Jay Technology Co., Ltd

- 9.5 Eaton

- 9.6 ENTEC Electric & Electronic Co., Ltd

- 9.7 G&W Electric

- 9.8 Hubbell Power Systems

- 9.9 Hughes Power System

- 9.10 NOJA Power Switchgear Pty Ltd

- 9.11 Pomanique Electric

- 9.12 Rockwill Electric Group

- 9.13 S&C Electric Company

- 9.14 Schneider Electric

- 9.15 Siemens

- 9.16 Sriwin Electric

- 9.17 Tavrida Electric

- 9.18 Wenzhou Rena Electric Co., Ltd

- 9.19 Zhejiang Farady Powertech Co., Ltd

- 9.20 Zhejiang Geya Electrical Co., Ltd