|

市場調查報告書

商品編碼

1871170

合成生物學食品配料市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Synthetic Biology Food Ingredients Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

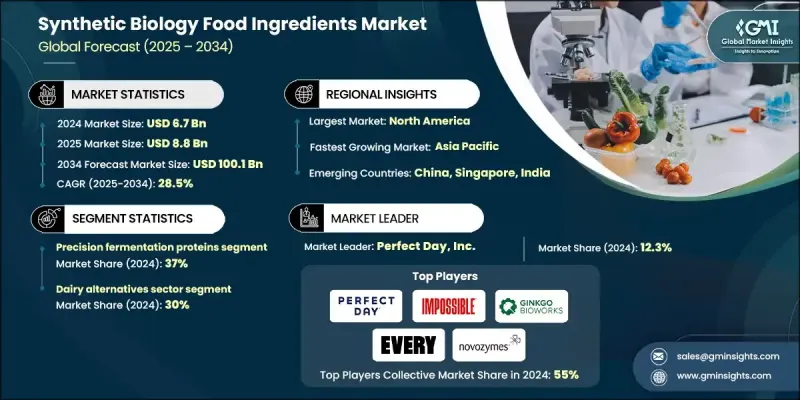

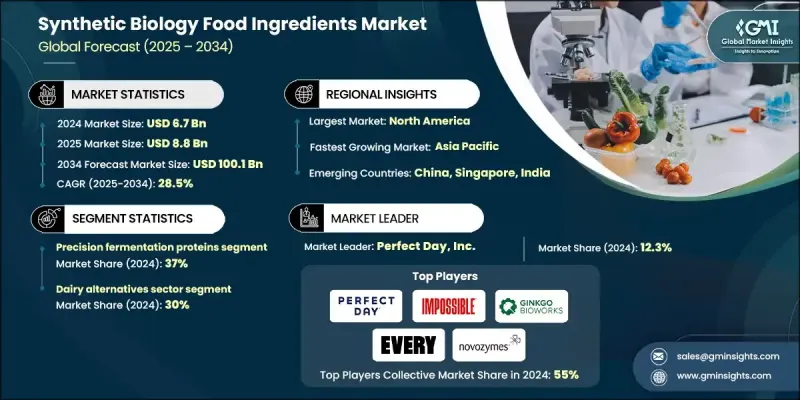

2024 年全球合成生物學食品配料市場價值為 67 億美元,預計到 2034 年將以 28.5% 的複合年成長率成長至 1001 億美元。

這種快速擴張凸顯了合成生物學技術在食品生產領域的巨大變革潛力。基因工程、生物製程最佳化和精準發酵技術的進步,正推動著永續、功能性強且對環境友善的食品配料的開發。消費者需求正顯著轉向更健康且生產過程對環境影響最小的食品。不同產品類別的市場接受度各不相同,目前酵素和維生素產品佔據主導地位,這得益於完善的監管框架和消費者對其認可度的良好驗證。包括乳製品替代品和雞蛋替代品等蛋白質配料在內的新興領域正在迅速發展,而新型脂肪和複雜的功能性化合物也正在進入市場。 CRISPR-Cas系統和代謝工程等尖端平台能夠對微生物進行精確編程,從而高效且經濟地生產蛋白質、酵素、維生素和特殊化合物。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 67億美元 |

| 預測值 | 1001億美元 |

| 複合年成長率 | 28.5% |

到2024年,精準發酵蛋白細分市場將佔據37%的市場佔有率,預計到2034年將以27.8%的複合年成長率成長。此細分市場的成長主要得益於乳製品替代品、雞蛋替代品和功能性蛋白質的成功商業化。產業內的合作正在推動乳清蛋白和酪蛋白的規模化生產,將消費者接受度與成本效益高、可擴展的生產流程相結合。該細分市場受益於清晰的價值主張、強大的功能特性以及對永續蛋白替代品日益成長的需求。

2024年,乳製品替代品市佔率達到30%,預計到2034年將以27.8%的複合年成長率成長。該領域的成功歸功於完善的基礎設施、消費者對乳製品替代品的熟悉程度以及生物同源蛋白的功能優勢。口感與質地與傳統乳製品相近、價格具有競爭力以及營養成分提升等關鍵因素,也促進了乳製品替代品的廣泛應用。

2024年美國合成生物學食品配料市場規模為22億美元,預計2034年將達30億美元。該地區的市場領先地位得益於先進的生物技術基礎設施、強力的監管支持和健全的創投生態系統。成熟的生物技術公司、學術研究中心以及消費者對替代蛋白的早期接受度進一步推動了市場成長。政府措施、監管路徑和定向資金也對市場擴張起到了積極作用。

全球合成生物學食品配料市場的主要企業包括Ginkgo Bioworks Holdings、DSM-Firmenich、EVERY Company、Perfect Day、Impossible Foods、Novozymes和Nature's Fynd。這些企業正透過大力投資研發來增強精準發酵和合成生物學平台,並與食品生產商建立策略合作夥伴關係,同時擴大生產能力以實現規模化的商業部署,從而鞏固其市場地位。他們致力於改善替代蛋白的口感、質地和營養成分,以滿足消費者的期望,同時利用創投和政府激勵措施來加速創新。全球擴張、合規監管和強力的行銷策略有助於企業提高市場滲透率和品牌知名度,從而在這個快速成長的行業中佔據競爭優勢。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 市場機遇

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場規模及預測:依產品類型分類,2021-2034年

- 主要趨勢

- 精準發酵蛋白

- 乳蛋白

- 雞蛋蛋白

- 膠原蛋白和明膠替代品

- 新型功能蛋白

- 精準發酵酶

- 食品加工酶

- 質地改質酶

- 增味酶

- 精準發酵維生素和營養素

- B群維生素

- 胺基酸和胜肽

- ω-3脂肪酸

- 人乳低聚醣

- 精準發酵風味和香氣

- 天然香料化合物

- 芳香分子

- 味覺調節劑

- 生質能發酵產物

- 微生物蛋白濃縮物

- 菌絲體成分

- 藻類衍生成分

- 細胞農業產品

- 人工養殖肉類成分

- 細胞培養乳製品原料

- 海產品細胞成分

第6章:市場規模及預測:依應用領域分類,2021-2034年

- 主要趨勢

- 乳製品替代品

- 植物奶應用

- 起司和優格的替代品

- 冰淇淋和冷凍甜點

- 肉類替代品

- 植物肉製品

- 雜交肉製品

- 人造肉的應用

- 飲料

- 蛋白質飲料

- 功能飲料

- 風味飲料

- 嬰兒營養

- 嬰兒配方奶粉強化劑

- 兒科專科營養

- 母乳強化劑

- 功能性食品

- 強化食品

- 營養保健品應用

- 醫用食品

- 烘焙食品和糖果

- 蛋替代品應用

- 紋理增強

- 增強風味和香氣

第7章:市場規模及預測:依最終用途分類,2021-2034年

- 主要趨勢

- 食品飲料製造

- 大型食品加工商

- 特種食品製造商

- 合約製造組織

- 膳食補充劑行業

- 營養保健品公司

- 運動營養品製造商

- 功能性補充劑生產商

- 嬰兒配方奶粉生產

- 優質嬰幼兒營養品牌

- 特殊醫學營養

- 有機嬰兒食品製造商

- 食品服務業

- 速食店

- 機構餐飲

- 食品配送平台

- 寵物食品業

- 優質寵物營養

- 獸用治療性飲食

- 特色寵物零食

第8章:市場規模及預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Perfect Day

- Impossible Foods

- Ginkgo Bioworks Holdings

- The EVERY Company

- Novozymes

- Cauldron Ferm

- Ajinomoto

- DSM-Firmenich

- Spiber

- Nature's Fynd

- Remilk

- Onego Bio

- Superbrewed Food

- Imagindairy

- The Better Meat

The Global Synthetic Biology Food Ingredients Market was valued at USD 6.7 Billion in 2024 and is estimated to grow at a CAGR of 28.5% to reach USD 100.1 Billion by 2034.

This rapid expansion highlights the transformative potential of synthetic biology technologies in food production. Advances in genetic engineering, bioprocess optimization, and precision fermentation are enabling the development of sustainable, functional, and environmentally conscious food ingredients. Consumer demand is shifting strongly toward foods that are not only healthier but also produced with minimal environmental impact. Market adoption varies across product categories, with enzymes and vitamins currently dominating due to established regulatory frameworks and proven consumer acceptance. Emerging segments, including protein ingredients such as dairy alternatives and egg replacers, are gaining momentum, while novel fats and complex functional compounds are entering the market. Cutting-edge platforms like CRISPR-Cas systems and metabolic engineering allow precise programming of microorganisms to produce proteins, enzymes, vitamins, and specialty compounds efficiently and cost-effectively.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.7 Billion |

| Forecast Value | $100.1 Billion |

| CAGR | 28.5% |

The precision fermentation proteins segment held a 37% share in 2024, with a CAGR of 27.8% through 2034. Growth in this segment is driven by the successful commercialization of dairy alternatives, egg replacers, and functional proteins. Partnerships within the industry are supporting the production of whey and casein proteins at scale, combining consumer acceptance with cost-effective, scalable manufacturing processes. This segment benefits from clear value propositions, strong functional properties, and rising demand for sustainable protein alternatives.

The dairy alternatives segment held a 30% share in 2024 and is forecasted to grow at a CAGR of 27.8% through 2034. Success in this sector is attributed to well-established infrastructure, consumer familiarity with alternative dairy, and the functional advantages of bio-identical proteins. Key factors such as taste and texture matching conventional dairy, competitive pricing, and enhanced nutritional profiles contribute to widespread adoption.

U.S. Synthetic Biology Food Ingredients Market was valued at USD 2.2 Billion in 2024 and is expected to reach USD 3 Billion by 2034. Market leadership in this region is driven by advanced biotechnology infrastructure, strong regulatory support, and a robust venture capital ecosystem. The presence of established biotech firms, academic research centers, and early consumer adoption of alternative proteins further bolsters growth. Government initiatives, regulatory pathways, and targeted funding contribute positively to market expansion.

Major companies active in the Global Synthetic Biology Food Ingredients Market include Ginkgo Bioworks Holdings, DSM-Firmenich, The EVERY Company, Perfect Day, Impossible Foods, Novozymes, and Nature's Fynd. Companies in this market are strengthening their presence by investing heavily in research and development to enhance precision fermentation and synthetic biology platforms, securing strategic partnerships with food manufacturers, and expanding production capabilities for scalable commercial deployment. They focus on improving the taste, texture, and nutritional profiles of alternative proteins to meet consumer expectations, while also leveraging venture capital and government incentives to accelerate innovation. Global expansion, regulatory compliance, and robust marketing strategies help firms increase market penetration and brand visibility, positioning them competitively in this rapidly growing sector.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Application

- 2.2.3 End Use

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Product Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Precision fermentation proteins

- 5.2.1 Dairy proteins

- 5.2.2 Egg proteins

- 5.2.3 Collagen & gelatin alternatives

- 5.2.4 Novel functional proteins

- 5.3 Precision fermentation enzymes

- 5.3.1 Food processing enzymes

- 5.3.2 Texture modification enzymes

- 5.3.3 Flavor enhancement enzymes

- 5.4 Precision fermentation vitamins & nutrients

- 5.4.1 B-complex vitamins

- 5.4.2 Amino acids & peptides

- 5.4.3 Omega-3 fatty acids

- 5.4.4 Human milk oligosaccharides

- 5.5 Precision fermentation flavors & aromas

- 5.5.1 Natural flavoring compounds

- 5.5.2 Aroma molecules

- 5.5.3 Taste modulators

- 5.6 Biomass fermentation products

- 5.6.1 Microbial protein concentrates

- 5.6.2 Mycelium-based ingredients

- 5.6.3 Algae-derived components

- 5.7 Cellular agriculture products

- 5.7.1 Cultivated meat components

- 5.7.2 Cell-based dairy ingredients

- 5.7.3 Cellular seafood components

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Dairy alternatives

- 6.2.1 Plant-based milk applications

- 6.2.2 Cheese & yogurt alternatives

- 6.2.3 Ice cream & frozen desserts

- 6.3 Meat substitutes & alternatives

- 6.3.1 Plant-based meat products

- 6.3.2 Hybrid meat products

- 6.3.3 Cultivated meat applications

- 6.4 Beverages

- 6.4.1 Protein beverages

- 6.4.2 Functional drinks

- 6.4.3 Flavored beverages

- 6.5 Infant nutrition

- 6.5.1 Infant formula enhancement

- 6.5.2 Specialized pediatric nutrition

- 6.5.3 Breast milk fortifiers

- 6.6 Functional foods

- 6.6.1 Fortified food products

- 6.6.2 Nutraceutical applications

- 6.6.3 Medical food products

- 6.7 Bakery & confectionery

- 6.7.1 Egg replacement applications

- 6.7.2 Texture enhancement

- 6.7.3 Flavor & aroma enhancement

Chapter 7 Market Size and Forecast, By End Use, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverage manufacturing

- 7.2.1 Large-scale food processors

- 7.2.2 Specialty food manufacturers

- 7.2.3 Contract manufacturing organizations

- 7.3 Dietary supplement industry

- 7.3.1 Nutraceutical companies

- 7.3.2 Sports nutrition manufacturers

- 7.3.3 Functional supplement producers

- 7.4 Infant formula manufacturing

- 7.4.1 Premium infant nutrition brands

- 7.4.2 Specialized medical nutrition

- 7.4.3 Organic baby food manufacturers

- 7.5 Food service industry

- 7.5.1 Quick service restaurants

- 7.5.2 Institutional catering

- 7.5.3 Food delivery platforms

- 7.6 Pet food industry

- 7.6.1 Premium pet nutrition

- 7.6.2 Veterinary therapeutic diets

- 7.6.3 Specialty pet treats

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East & Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Perfect Day

- 9.2 Impossible Foods

- 9.3 Ginkgo Bioworks Holdings

- 9.4 The EVERY Company

- 9.5 Novozymes

- 9.6 Cauldron Ferm

- 9.7 Ajinomoto

- 9.8 DSM-Firmenich

- 9.9 Spiber

- 9.10 Nature's Fynd

- 9.11 Remilk

- 9.12 Onego Bio

- 9.13 Superbrewed Food

- 9.14 Imagindairy

- 9.15 The Better Meat