|

市場調查報告書

商品編碼

1871168

離網電池儲能市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Off Grid Battery Storage Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

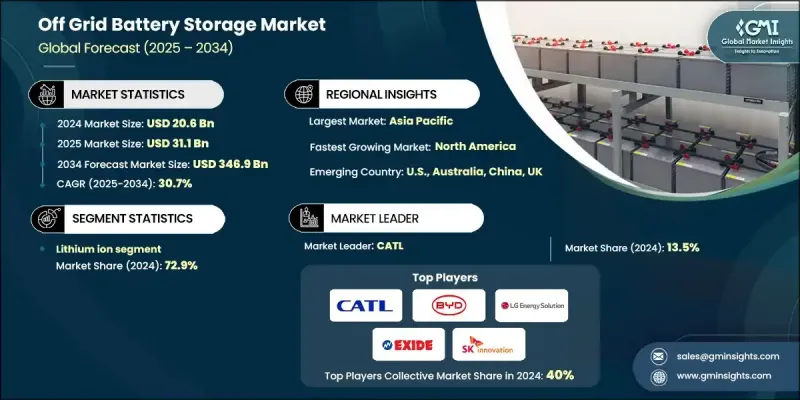

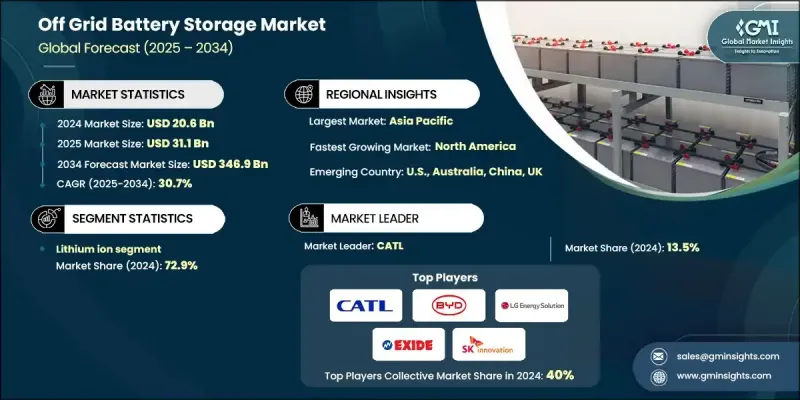

2024 年全球離網電池儲能市場價值為 206 億美元,預計到 2034 年將以 30.7% 的複合年成長率成長至 3,469 億美元。

強勁的成長源自於電網覆蓋有限或缺失地區對可靠電力需求的不斷成長。在電力基礎設施不穩定或完全缺失的地區,離網電池系統能夠提供可靠的能源,尤其對教育、醫療和電信等關鍵服務至關重要。太陽能和風能的間歇性進一步推動了對高效儲能的需求,以便在發電量低谷期維持電力供應。隨著再生能源裝置容量的成長,離網電池系統在確保不間斷供電方面變得至關重要。電池技術(尤其是鋰離子電池)成本的大幅下降也使市場受益,使得更廣泛的用戶和產業能夠更有效地採用離網儲能技術。這種可負擔性正在加速農業、電信和分散式工業營運等領域的部署。旨在減少排放和擴大清潔能源使用的政府措施和私人投資,正在強化對離網儲能的需求,使其成為分散式能源系統和氣候適應基礎設施的支柱。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 206億美元 |

| 預測值 | 3469億美元 |

| 複合年成長率 | 30.7% |

鋰離子電池市佔率高達72.9%,預計到2034年將以29.3%的複合年成長率成長。鋰離子電池以其高能量密度、長循環壽命、輕量化結構和卓越的充放電性能而著稱,是大多數離網應用的首選。其靈活的模組化設計使其能夠無縫整合到固定式和移動式能源系統中,而快速充電功能則可滿足不可預測的能源需求。隨著全球太陽能和風能計畫的激增,鋰離子電池仍然是獨立式儲能系統的核心。

2034年,美國離網電池儲能市場規模將達101億美元。該國的成長得益於政府旨在增強能源韌性的有利政策、激勵措施和戰略性資金支持。關鍵促進因素包括稅收抵免和補助計劃,這些計劃旨在促進在高風險和偏遠地區使用長時儲能解決方案。住宅、關鍵基礎設施和國防領域對備用能源需求的成長進一步推動了市場擴張。更廣泛的電氣化目標和基礎設施升級也為農村和低度開發地區帶來了新的機會。

離網電池儲能市場的主要參與者包括寧德時代(CATL)、特斯拉(Tesla)、LG、東芝(Toshiba)、埃克塞德(Exide)、西門子(Siemens)、三星(Samsung)、松下(Panasonic)、日立(Hitachi)、江森自控(Johnson Controls)、Hitachi)、GSA)、GS Yuasa和SK Innovation。為了鞏固自身地位,離網電池儲能產業的企業正在實施多項核心策略。這些策略包括擴大生產規模以滿足不斷成長的全球需求,以及增加研發投入以提高電池壽命、安全性和儲能效率。此外,各企業也與再生能源開發商和政府建立策略合作夥伴關係,將儲能技術整合到離網能源專案中。許多企業正在推動本地化生產以降低成本和縮短交貨時間,同時專注於模組化和可擴展的產品線,以滿足農村、住宅或工業部署的需求。此外,他們還在拓展分銷網路,並提供整合軟體解決方案,以最佳化能源管理和系統效能。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 關鍵材料供應鏈圖

- 製造設備和製程要求

- 品質控制和測試基礎設施

- 供應鏈整合機遇

- 監管環境

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

- 價格趨勢分析(美元/兆瓦)

- 按地區

- 投資和融資環境分析

- 新興科技趨勢和發展

第4章:競爭格局

- 介紹

- 按地區分類的公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

- 戰略儀錶板

- 策略舉措

- 重要夥伴關係與合作

- 主要併購活動

- 產品創新與發布

- 市場擴張策略

- 競爭性標竿分析

- 創新與永續發展格局

第5章:市場規模及預測:依電池類型分類,2021-2034年

- 主要趨勢

- 鋰離子

- 硫磺鈉

- 鉛酸

- 液流電池

- 其他

第6章:市場規模及預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 俄羅斯

- 西班牙

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 世界其他地區

第7章:公司簡介

- BYD

- CATL

- Exide

- GS Yuasa

- Hitachi

- Johnson Controls

- Leclanche

- LG

- Panasonic

- Samsung

- Siemens

- SK Innovation

- Tesla

- Toshiba

- Varta

The Global Off Grid Battery Storage Market was valued at USD 20.6 Billion in 2024 and is estimated to grow at a CAGR of 30.7% to reach USD 346.9 Billion by 2034.

The strong growth is fueled by increasing demand for reliable electricity in regions with limited or no grid access. In areas where power infrastructure is inconsistent or entirely absent, off-grid battery systems deliver a reliable energy source, particularly for essential services such as education, healthcare, and telecommunications. The intermittent nature of solar and wind energy further drives the need for efficient storage that can maintain supply during periods of low generation. As renewable energy capacity grows, off-grid battery systems are becoming critical in ensuring uninterrupted energy delivery. The market is also benefiting from major cost reductions in battery technologies, especially lithium-ion, making adoption more viable across a wider range of users and industries. This affordability is accelerating deployment in sectors like agriculture, telecom, and decentralized industrial operations. Government initiatives and private investments aimed at reducing emissions and expanding clean energy use are reinforcing demand for off-grid storage as a pillar of decentralized energy systems and climate-resilient infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $20.6 Billion |

| Forecast Value | $346.9 Billion |

| CAGR | 30.7% |

The lithium-ion segment held 72.9% share and is projected to grow at a CAGR of 29.3% through 2034. Known for high energy density, long lifecycle, lightweight construction, and excellent charge-discharge performance, lithium-ion batteries are the preferred choice across most off-grid applications. Their flexible and modular design allows seamless integration into both stationary and mobile energy systems, while fast charging supports unpredictable energy demands. As solar and wind projects multiply globally, lithium-ion continues to be the backbone of energy storage for standalone setups.

United States Off Grid Battery Storage Market will reach USD 10.1 Billion by 2034. Growth in the country is supported by favorable government policies, incentives, and strategic funding aimed at enhancing energy resilience. Key drivers include tax credits and grant programs, which promote the use of long-duration storage solutions in high-risk and remote zones. Increased demand for backup energy in residential housing, critical infrastructure, and defense sectors further supports market expansion. Broader electrification goals and infrastructure upgrades are also opening new opportunities across rural and underserved regions.

Prominent players in the Off Grid Battery Storage Market include CATL, Tesla, LG, Toshiba, Exide, Siemens, Samsung, Panasonic, Hitachi, Johnson Controls, Varta, Leclanche, BYD, GS Yuasa, and SK Innovation. To strengthen their position, companies in the off-grid battery storage industry are employing several core strategies. These include scaling up manufacturing capabilities to meet rising global demand and investing heavily in R&D to improve battery lifespan, safety, and storage efficiency. Companies are also forming strategic partnerships with renewable energy developers and governments to integrate storage into off-grid energy projects. Many are localizing production to reduce costs and lead times, while focusing on modular and scalable product lines that can be tailored for rural, residential, or industrial deployment. Additionally, they are expanding distribution networks and offering integrated software solutions to optimize energy management and system performance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Critical materials supply chain mapping

- 3.1.2 Manufacturing equipment and process requirements

- 3.1.3 Quality control and testing infrastructure

- 3.1.4 Supply chain integration opportunities

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Price trend analysis (USD/MW)

- 3.7.1 By region

- 3.8 Investment and funding landscape analysis

- 3.9 Emerging technology trends and developments

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Rest of World

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Battery, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 Lithium ion

- 5.3 Sodium sulphur

- 5.4 Lead acid

- 5.5 Flow battery

- 5.6 Others

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.2.3 Mexico

- 6.3 Europe

- 6.3.1 UK

- 6.3.2 France

- 6.3.3 Germany

- 6.3.4 Italy

- 6.3.5 Russia

- 6.3.6 Spain

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 Australia

- 6.4.3 India

- 6.4.4 Japan

- 6.4.5 South Korea

- 6.5 Rest of World

Chapter 7 Company Profiles

- 7.1 BYD

- 7.2 CATL

- 7.3 Exide

- 7.4 GS Yuasa

- 7.5 Hitachi

- 7.6 Johnson Controls

- 7.7 Leclanche

- 7.8 LG

- 7.9 Panasonic

- 7.10 Samsung

- 7.11 Siemens

- 7.12 SK Innovation

- 7.13 Tesla

- 7.14 Toshiba

- 7.15 Varta