|

市場調查報告書

商品編碼

1871141

基於憶阻器的汽車記憶體市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Memristor-Based Automotive Memory Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

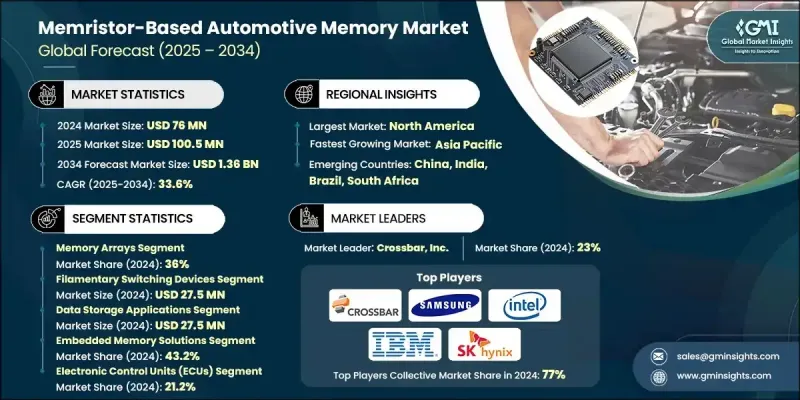

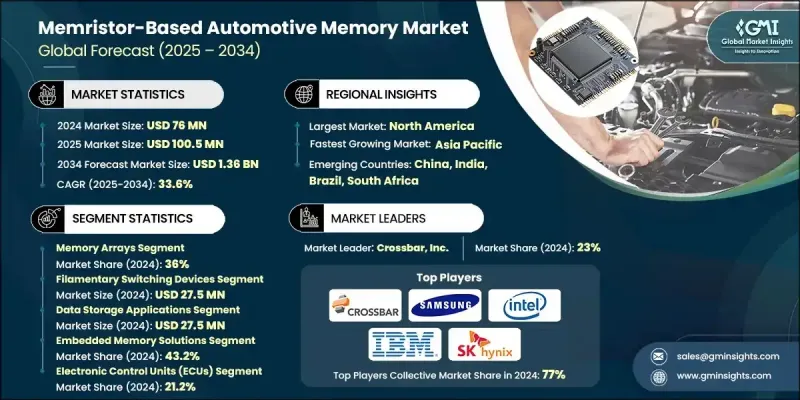

2024 年全球基於憶阻器的汽車記憶體市值為 7,600 萬美元,預計到 2034 年將以 33.6% 的複合年成長率成長至 13.6 億美元。

憶阻器技術和材料的持續進步正在重塑汽車記憶體的格局。電阻開關材料的進步,包括創新的金屬氧化物和自旋電子結構,顯著提升了憶阻器的性能、耐久性和可擴展性,使其遠勝於傳統記憶體技術。新的製造流程使得憶阻器能夠無縫整合到微控制器和系統單晶片 (SoC) 架構中,從而實現更快的處理速度和更低的延遲。模擬憶阻器的研究進展也使得車輛內部更有效率的即時人工智慧處理成為可能。這些創新正在拓展憶阻器的應用範圍,使其從傳統的車載系統擴展到先進的自主導航和人工智慧驅動的運算領域,並使其成為下一代汽車記憶體的基石。高級駕駛輔助系統 (ADAS) 和自動駕駛技術的興起,正在加速快速、節能且非揮發性儲存組件的需求。由於這些系統依賴對大量感測器資料的即時分析,憶阻器卓越的速度和低能耗特性使其成為感知、規劃和預測系統最佳化等即時決策任務的理想選擇。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 7600萬美元 |

| 預測值 | 13.6億美元 |

| 複合年成長率 | 33.6% |

預計到2024年,儲存陣列市佔率將達到36%,並呈現強勁成長勢頭,因為連網汽車對緊湊、節能且高容量的資料儲存解決方案的需求日益成長。這些儲存陣列對於支援現代汽車網路中的資訊娛樂、進階駕駛輔助系統(ADAS)和邊緣運算功能至關重要。製造商正致力於開發可擴展且耐用的陣列,使其在極端溫度條件下保持穩定的性能,同時滿足嚴格的汽車可靠性標準。

2024年,絲狀開關裝置市場規模預計將達2,750萬美元。這類裝置的快速切換能力、高能源效率和高可靠性是其應用日益廣泛的驅動力,使其成為下一代智慧汽車系統的理想選擇。絲狀開關元件能夠實現更快的資料傳輸、更低的延遲和更高的可靠性,尤其適用於需要即時運算和安全保障的關鍵車輛應用。其可擴展性和耐久性使其成為未來注重性能和永續性的汽車電子架構的首選。

2024年,北美憶阻器汽車記憶體市佔率達到34.2%。該地區強勁的市場地位得益於自動駕駛和互聯汽車的廣泛應用、先進的汽車電子產品以及完善的研發基礎設施。面向高級駕駛輔助系統(ADAS)、資訊娛樂系統和自動駕駛平台的記憶體技術創新正在推動北美市場的成長。有利的政府政策、完善的基礎設施以及消費者對先進汽車技術的早期接受,為憶阻器汽車記憶體解決方案的進一步拓展創造了有利環境。

活躍於憶阻器汽車記憶體市場的主要公司包括英特爾公司、Crossbar公司、富士通有限公司、IBM公司、美光科技公司、SK海力士公司、東芝公司、eMemory Technology公司、索尼公司、瑞薩電子公司、松下控股公司、Weebit Nanom、三星電子有限公司、Rambus Technologies公司、惠普企業(HPE Technologies)公司、三星公司和美國部門。憶阻器汽車記憶體市場的領導者正透過持續的技術創新、產能擴張和策略合作來鞏固其市場地位。許多公司正大力投資研發以提升憶阻器的效能,重點在於提高其可擴展性、開關速度和耐久性。與半導體製造商和汽車OEM廠商建立的策略聯盟和合作夥伴關係,正幫助他們將憶阻器技術整合到下一代汽車系統中。多家廠商正在開發針對自動駕駛汽車和電動車最佳化的客製化、節能型記憶體架構。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 憶阻器技術與材料的進步

- 對ADAS和自動駕駛汽車的需求日益成長

- 日益關注能源效率和熱管理

- 將邊緣運算和物聯網技術整合到連網汽車中

- 產業陷阱與挑戰

- 高昂的研發和製造成本

- 標準化程度有限,相容性問題

- 市場機遇

- 混合記憶體架構的開發

- 針對特定汽車功能的客製化

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 美國

- 加拿大

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

- 技術格局

- 當前趨勢

- 新興技術

- 管道分析

- 未來市場趨勢

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品分類,2021-2034年

- 主要趨勢

- 記憶體控制器

- 記憶體陣列

- 神經形態處理器

- 安全模組

- 其他

第6章:市場估算與預測:依技術架構分類,2021-2034年

- 主要趨勢

- 絲狀開關裝置

- 相變記憶體(PCM)

- 磁隧道接面(MTJ)裝置

- 鐵電儲存裝置

第7章:市場估計與預測:依功能應用分類,2021-2034年

- 主要趨勢

- 資料儲存應用程式

- 記憶體計算應用

- 安全性和身份驗證應用程式

第8章:市場估算與預測:依整合方法,2021-2034年

- 主要趨勢

- 嵌入式儲存解決方案

- 離散儲存組件

- 混合系統解決方案

第9章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 電子控制單元(ECU)

- 高級駕駛輔助系統(ADAS)

- 自動駕駛系統

- 資訊娛樂系統

- 動力總成控制系統

- 安全系統

- 車身控制系統

- 互聯/遠端資訊處理系統

- 其他

第10章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第11章:公司簡介

- Crossbar, Inc.

- eMemory Technology Inc.

- Everspin Technologies, Inc.

- Fujitsu Ltd.

- Hewlett Packard Enterprise (HPE)

- IBM Corporation

- Intel Corporation

- Knowm Inc.

- Micron Technology, Inc.

- Panasonic Holdings Corporation

- Rambus Inc.

- Renesas Electronics Corporation

- Samsung Electronics Co., Ltd.

- SK Hynix, Inc.

- Sony Corporation

- STMicroelectronics NV

- Toshiba Corporation

- Weebit Nano Ltd.

- Western Digital Corporation

The Global Memristor-Based Automotive Memory Market was valued at USD 76 million in 2024 and is estimated to grow at a CAGR of 33.6% to reach USD 1.36 Billion by 2034.

Continuous advancements in memristor technologies and materials are reshaping the automotive memory landscape. Progress in resistive switching materials, including innovative metal oxides and spintronic structures, has enhanced performance, durability, and scalability, making memristors far more capable than conventional memory technologies. New manufacturing approaches allow seamless integration of memristors into microcontrollers and system-on-chip (SoC) architectures, achieving faster processing and lower latency. Research developments in analog memristors are also enabling more efficient real-time AI processing within vehicles. These innovations are expanding the applications of memristors from traditional in-vehicle systems to advanced autonomous navigation and AI-driven computing, positioning them as a cornerstone of next-generation automotive memory. The rise of Advanced Driver Assistance Systems (ADAS) and autonomous driving technologies is accelerating demand for fast, power-efficient, and non-volatile memory components. Since these systems depend on instant analysis of large volumes of sensor data, memristors' superior speed and low energy usage are ideal for real-time decision-making tasks such as perception, planning, and predictive system optimization.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $76 Million |

| Forecast Value | $1.36 Billion |

| CAGR | 33.6% |

The memory arrays segment held a 36% share in 2024 and is experiencing robust growth as connected vehicles increasingly require compact, energy-saving, and high-capacity data storage solutions. These memory arrays are essential for supporting infotainment, ADAS, and edge computing functions within modern automotive networks. Manufacturers are focusing on developing scalable and durable arrays that maintain consistent performance in extreme temperature conditions while meeting stringent automotive reliability standards.

The filamentary switching devices segment generated USD 27.5 million in 2024. Growing adoption of these devices is driven by their rapid switching capability, energy efficiency, and resilience, which make them ideal for next-generation intelligent automotive systems. Filamentary switching devices enable quicker data transmission, lower latency, and higher reliability in critical vehicle applications, particularly in systems that demand real-time computation and safety assurance. Their scalability and endurance are making them a preferred choice for future automotive electronic architectures focused on performance and sustainability.

North America Memristor-Based Automotive Memory Market held a 34.2% share in 2024. The region's strong presence is supported by widespread adoption of autonomous and connected vehicles, advanced automotive electronics, and extensive R&D infrastructure. Growth opportunities across North America are being fueled by innovation in memory technologies designed for ADAS, infotainment, and autonomous mobility platforms. Favorable government programs, developed infrastructure, and early consumer acceptance of advanced vehicle technologies are creating a fertile environment for further expansion of memristor-based automotive memory solutions.

Major companies active in the Memristor-Based Automotive Memory Market include Intel Corporation, Crossbar, Inc., Fujitsu Ltd., IBM Corporation, Micron Technology, Inc., SK Hynix, Inc., Toshiba Corporation, eMemory Technology Inc., Sony Corporation, Renesas Electronics Corporation, Panasonic Holdings Corporation, Weebit Nano Ltd., Samsung Electronics Co., Ltd., Rambus Inc., Hewlett Packard Enterprise (HPE), STMicroelectronics N.V., Everspin Technologies, Inc., Knowm Inc., and Western Digital Corporation. Leading participants in the Memristor-Based Automotive Memory Market are strengthening their market position through continuous technological innovation, capacity expansion, and strategic collaboration. Many companies are investing heavily in R&D to enhance memristor performance, focusing on improving scalability, switching speed, and endurance. Strategic alliances and partnerships with semiconductor manufacturers and automotive OEMs are helping them integrate memristor technology into next-generation vehicle systems. Several players are developing customized, energy-efficient memory architectures optimized for autonomous and electric vehicles.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Vector trends

- 2.2.3 Delivery method trends

- 2.2.4 Gene type trends

- 2.2.5 Indication trends

- 2.2.6 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Advancements in memristor technology and materials

- 3.2.1.2 Growing demand for ADAS and autonomous vehicles

- 3.2.1.3 Rising focus on energy efficiency and thermal management

- 3.2.1.4 Integration of edge computing and IoT in connected vehicles

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development and manufacturing costs

- 3.2.2.2 Limited standardization and compatibility issues

- 3.2.3 Market opportunities

- 3.2.3.1 Development of hybrid memory architectures

- 3.2.3.2 Customization for specific automotive functions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current trends

- 3.5.2 Emerging technologies

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Memory controllers

- 5.3 Memory arrays

- 5.4 Neuromorphic processors

- 5.5 Security modules

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Technology Architecture, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Filamentary switching devices

- 6.3 Phase Change Memory (PCM)

- 6.4 Magnetic Tunnel Junction (MTJ) devices

- 6.5 Ferroelectric memory devices

Chapter 7 Market Estimates and Forecast, By Functional Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Data storage applications

- 7.3 In-memory computing applications

- 7.4 Security and authentication applications

Chapter 8 Market Estimates and Forecast, By Integration Approach, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Embedded memory solutions

- 8.3 Discrete memory components

- 8.4 Hybrid system solutions

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Electronic Control Units (ECUs)

- 9.3 Advanced Driver Assistance Systems (ADAS)

- 9.4 Autonomous driving systems

- 9.5 Infotainment systems

- 9.6 Powertrain control systems

- 9.7 Safety systems

- 9.8 Body control systems

- 9.9 Connectivity/telematics systems

- 9.10 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Crossbar, Inc.

- 11.2 eMemory Technology Inc.

- 11.3 Everspin Technologies, Inc.

- 11.4 Fujitsu Ltd.

- 11.5 Hewlett Packard Enterprise (HPE)

- 11.6 IBM Corporation

- 11.7 Intel Corporation

- 11.8 Knowm Inc.

- 11.9 Micron Technology, Inc.

- 11.10 Panasonic Holdings Corporation

- 11.11 Rambus Inc.

- 11.12 Renesas Electronics Corporation

- 11.13 Samsung Electronics Co., Ltd.

- 11.14 SK Hynix, Inc.

- 11.15 Sony Corporation

- 11.16 STMicroelectronics N.V.

- 11.17 Toshiba Corporation

- 11.18 Weebit Nano Ltd.

- 11.19 Western Digital Corporation