|

市場調查報告書

商品編碼

1871118

門用隱形鉸鏈市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Door Invisible Hinges Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

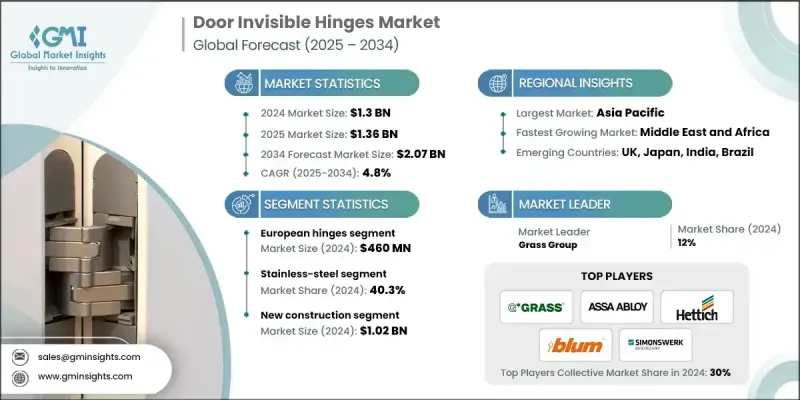

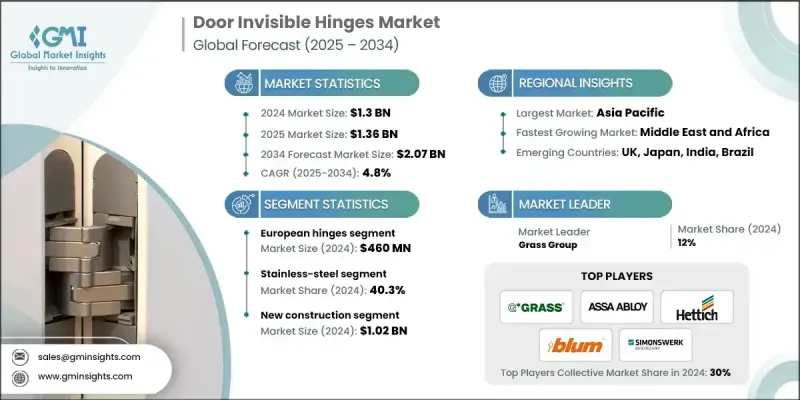

2024 年全球門隱形鉸鏈市場價值為 13 億美元,預計到 2034 年將以 4.8% 的複合年成長率成長至 20.7 億美元。

快速的城市化進程和不斷演變的建築趨勢,尤其是對簡潔、極簡和無縫設計的追求,促使建築商和設計師採用隱藏式五金解決方案,既能保持美觀,又能確保功能性。翻新項目,尤其是在高檔住宅、酒店和辦公空間中,擴大採用隱形鉸鏈來實現齊平的門設計、簡潔的線條和現代化的室內氛圍。模組化建築和智慧建築技術的興起,進一步拓展了鉸鏈系統的應用前景,使其能夠輕鬆整合到自動門和門禁控制系統中,凸顯了其在各種應用領域日益成長的重要性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 13億美元 |

| 預測值 | 20.7億美元 |

| 複合年成長率 | 4.8% |

為了打造齊平的門體安裝效果、簡潔的線條和現代美感,建築師和室內設計師越來越頻繁地選擇隱形鉸鏈。這種日益成長的需求推動了對兼具功能性和美觀性的五金配件的強勁需求。尤其是在歐洲和北美,舊建築的翻新改造為室內升級提供了契機,隱形鉸鏈正是無需改變建築結構即可實現室內升級的理想選擇。永續設計概念和智慧建築整合也在蓬勃發展,而隱形鉸鏈不僅能提供節能密封,還能與自動化系統完美相容。

2024年,歐洲鉸鏈市場規模達4.6億美元。歐洲製造商正致力於將美觀與性能完美融合,提供可與現代櫥櫃和家具無縫銜接的隱藏式緩閉鉸鏈。這些特性不僅提升了室內美感,還透過降低噪音和磨損,改善了使用者體驗。包括運動感測器、阻尼機構和物聯網系統在內的創新技術正逐漸成為標準配置,與日益普及的智慧家庭趨勢相契合。

2024年,不鏽鋼鉸鏈佔據了40.3%的市場。其強度高、經久耐用且耐腐蝕,使其非常適合高濕度和高強度使用環境。這些特性確保了其在住宅和商業應用中的持久性能,也促成了其在全球範圍內的廣泛應用。

美國隱形門鉸鏈市場佔據78.6%的市場佔有率,預計2024年市場規模將達3億美元。市場成長主要得益於建築活動的增加、房屋翻新以及對堅固耐用、技術先進的五金配件的需求。自動鎖定、遠端存取和其他智慧功能越來越受歡迎,這得益於電子商務的普及,使全國各地的消費者都能獲得創新的鉸鏈解決方案。

全球隱形門鉸鏈市場的主要參與者包括海福樂集團 (Hafele Group)、百隆 (Blum)、戈德瑞博伊斯製造公司 (Godrej & Boyce Manufacturing)、裡舍留五金 (Richelieu Hardware)、哈德溫 (Hardwyn)、SOSS製造公司 (SOSS Manufacturing)、西蒙斯合本集團 (SimonAx) Group)、AGB(阿爾班·賈科莫股份公司,Alban Giacomo Spa)、申剛五金 (Shengang Hardware)、格拉斯集團 (Grass Group)、Sugatsune America、多爾馬卡巴控股 (Dormakaba Holding)、安塞爾米 (Anselmi) 和海蒂詩集團 (Hettich Group)。隱形門鉸鏈市場的領導者正在採取各種策略來鞏固其市場地位並擴大市場佔有率。這些策略包括投資研發以推出創新、智慧和自動化的鉸鏈解決方案;建立策略合作夥伴關係以拓展分銷網路;以及擴展產品組合以滿足多樣化的設計和功能需求。此外,各公司也注重永續性和節能解決方案,並利用電子商務平台觸及更廣泛的消費群。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 建築和翻新活動日益增多

- 鉸鏈技術和智慧解決方案的進步

- 對客製化和美觀型硬體的需求不斷成長

- 產業陷阱與挑戰

- 市場參與者之間的競爭非常激烈

- 原物料價格波動

- 機會

- 模組化建築與預製

- 智慧建築整合

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品類型分類,2021-2034年

- 主要趨勢

- 歐洲鉸鏈

- 暗裝式合頁

- 樞軸隱藏式鉸鏈

- 圓柱形/圓柱形隱藏式鉸鏈

- 隱藏式鉸鏈

- 隱藏式彈簧門鉸鏈

第6章:市場估計與預測:依技術分類,2021-2034年

- 主要趨勢

- 基本型隱藏式鉸鏈

- 自閉式鉸鏈

- 緩緩閉鉸鏈

- 3D可調式鉸鏈

- 重型鉸鏈

- 快拆鉸鏈

- 防火鉸鏈

第7章:市場估計與預測:依年級分類,2021-2034年

- 主要趨勢

- 一級(優質)

- 二年級(標準)

- 三年級(基礎)

- 工業級

第8章:市場估算與預測:依材料類型分類,2021-2034年

- 主要趨勢

- 不銹鋼

- 鋅合金

- 碳鋼

- 黃銅/青銅

- 鋁合金

第9章:市場估計與預測:依價格分類,2021-2034年

- 主要趨勢

- 低的

- 中等的

- 高的

第10章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 住宅

- 商業的

- 機構

- 工業的

第11章:市場估計與預測:依最終用途產業分類,2021-2034年

- 主要趨勢

- 新建工程

- 改造/翻新

第12章:市場估算與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 直銷

- 間接銷售

第13章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第14章:公司簡介

- AGB (Alban Giacomo Spa)

- Anselmi

- ASSA ABLOY Group

- Blum

- Dormakaba Holding

- Godrej & Boyce Manufacturing

- Grass Group

- Hafele Group

- Hardwyn

- Hettich Group

- Richelieu Hardware

- Shengang Hardware

- Simonswerk

- SOSS Manufacturing

- Sugatsune America

The Global Door Invisible Hinges Market was valued at USD 1.3 Billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 2.07 Billion by 2034.

Rapid urbanization and evolving architectural trends favoring sleek, minimal, and seamless designs are prompting builders and designers to adopt concealed hardware solutions that maintain aesthetic integrity while ensuring functionality. Renovation projects, particularly in upscale homes, hotels, and office spaces, increasingly rely on invisible hinges to achieve flush door designs, clean lines, and modern interiors. The rise of modular construction and smart building technologies further expands opportunities for hinge systems that integrate easily with automated doors and access control solutions, highlighting their growing relevance across diverse applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $2.07 Billion |

| CAGR | 4.8% |

Architects and interior designers are requesting invisible hinges more frequently to create flush door installations, clean profiles, and contemporary aesthetics. This growing preference is generating strong demand for hardware that balances functionality with visual appeal. Renovation cycles in older buildings, especially across Europe and North America, are creating retrofitting opportunities where invisible hinges are ideal for updating interiors without altering structural frameworks. Sustainable design practices and smart building integrations are also on the rise, with invisible hinges offering energy-efficient sealing and full compatibility with automated systems.

In 2024, the European hinges accounted for USD 460 million. European manufacturers are blending aesthetics and performance, offering concealed and soft-close hinges that seamlessly integrate with modern cabinetry and furniture. These features enhance interior appeal while improving user experience by reducing noise and wear. Innovations, including motion sensors, damping mechanisms, and IoT-enabled systems, are becoming standard, aligning with growing smart home adoption.

The stainless-steel hinges held a 40.3% share in 2024. Their strength, durability, and resistance to corrosion make them highly suitable for high-humidity and heavily used environments. These properties ensure long-lasting performance in both residential and commercial applications, which contributes to their widespread global acceptance.

United States Door Invisible Hinges Market held a 78.6% share, generating USD 300 million in 2024. Growth is driven by increasing construction activity, home renovations, and demand for robust and technologically advanced hardware. Automated locking, remote access, and other smart features are growing in popularity, supported by widespread e-commerce availability that provides customers nationwide with access to innovative hinge solutions.

Key players in the Global Door Invisible Hinges Market include Hafele Group, Blum, Godrej & Boyce Manufacturing, Richelieu Hardware, Hardwyn, SOSS Manufacturing, Simonswerk, ASSA ABLOY Group, AGB (Alban Giacomo Spa), Shengang Hardware, Grass Group, Sugatsune America, Dormakaba Holding, Anselmi, and Hettich Group. Leading companies in the Door Invisible Hinges Market are adopting strategies to strengthen their position and expand their footprint. These include investing in research and development to introduce innovative, smart, and automated hinge solutions, forming strategic partnerships and collaborations to widen distribution networks, and expanding product portfolios to meet diverse design and functional requirements. Companies are also emphasizing sustainability and energy-efficient solutions while leveraging e-commerce platforms to reach broader consumer bases.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Technology

- 2.2.4 Grade level

- 2.2.5 Material type

- 2.2.6 Price

- 2.2.7 Application

- 2.2.8 End use industry

- 2.2.9 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing construction and renovation activities

- 3.2.1.2 Advancements in hinge technology and smart solutions

- 3.2.1.3 Rising demand for customized and aesthetic hardware

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High competition among market players

- 3.2.2.2 Fluctuations in raw material prices

- 3.2.3 Opportunities

- 3.2.3.1 Modular construction & prefabrication

- 3.2.3.2 Smart building integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Million units)

- 5.1 Key trends

- 5.2 European hinges

- 5.3 Mortise concealed hinges

- 5.4 Pivot concealed hinges

- 5.5 Barrel/Cylindrical concealed Hinges

- 5.6 Concealed hinges

- 5.7 Concealed spring door hinges

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Billion) (Million units)

- 6.1 Key trends

- 6.2 Basic concealed hinges

- 6.3 Self-closing hinges

- 6.4 Soft-close hinges

- 6.5 3D adjustable hinges

- 6.6 Heavy-duty hinges

- 6.7 Quick-release hinges

- 6.8 Fire-rated hinges

Chapter 7 Market Estimates and Forecast, By Grade Level, 2021 - 2034 (USD Billion) (Million units)

- 7.1 Key trends

- 7.2 Grade 1 (Premium)

- 7.3 Grade 2 (Standard)

- 7.4 Grade 3 (Basic)

- 7.5 Industrial grade

Chapter 8 Market Estimates and Forecast, By Material Type, 2021 - 2034 (USD Billion) (Million units)

- 8.1 Key trends

- 8.2 Stainless steel

- 8.3 Zinc alloy

- 8.4 Carbon steel

- 8.5 Brass/bronze

- 8.6 Aluminum alloy

Chapter 9 Market Estimates and Forecast, By Price, 2021 - 2034 (USD Billion) (Million units)

- 9.1 Key trends

- 9.2 Low

- 9.3 Medium

- 9.4 High

Chapter 10 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Million units)

- 10.1 Key trends

- 10.2 Residential

- 10.3 Commercial

- 10.4 Institutional

- 10.5 Industrial

Chapter 11 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Million units)

- 11.1 Key trends

- 11.2 New construction

- 11.3 Retrofit/renovation

Chapter 12 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Million units)

- 12.1 Key trends

- 12.2 Direct sales

- 12.3 Indirect sales

Chapter 13 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Million units)

- 13.1 Key trends

- 13.2 North America

- 13.2.1 U.S.

- 13.2.2 Canada

- 13.3 Europe

- 13.3.1 Germany

- 13.3.2 UK

- 13.3.3 France

- 13.3.4 Italy

- 13.3.5 Spain

- 13.4 Asia Pacific

- 13.4.1 China

- 13.4.2 Japan

- 13.4.3 India

- 13.4.4 Australia

- 13.4.5 South Korea

- 13.5 Latin America

- 13.5.1 Brazil

- 13.5.2 Mexico

- 13.5.3 Argentina

- 13.6 Middle East and Africa

- 13.6.1 South Africa

- 13.6.2 Saudi Arabia

- 13.6.3 UAE

Chapter 14 Company Profiles

- 14.1 AGB (Alban Giacomo Spa)

- 14.2 Anselmi

- 14.3 ASSA ABLOY Group

- 14.4 Blum

- 14.5 Dormakaba Holding

- 14.6 Godrej & Boyce Manufacturing

- 14.7 Grass Group

- 14.8 Hafele Group

- 14.9 Hardwyn

- 14.10 Hettich Group

- 14.11 Richelieu Hardware

- 14.12 Shengang Hardware

- 14.13 Simonswerk

- 14.14 SOSS Manufacturing

- 14.15 Sugatsune America