|

市場調查報告書

商品編碼

1871098

再生混凝土骨材市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Recycled Concrete Aggregate Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

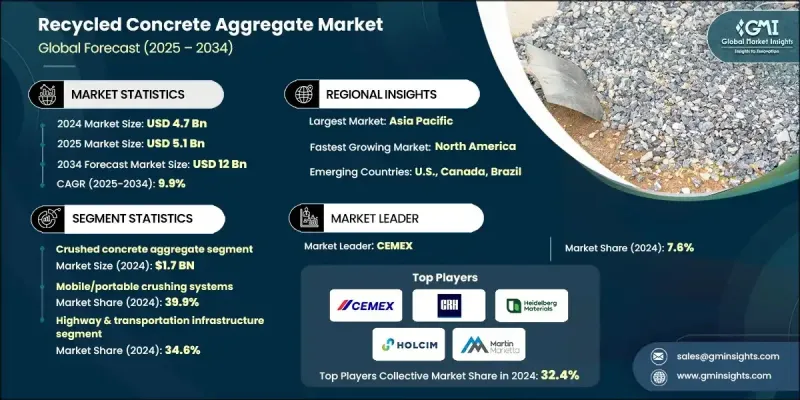

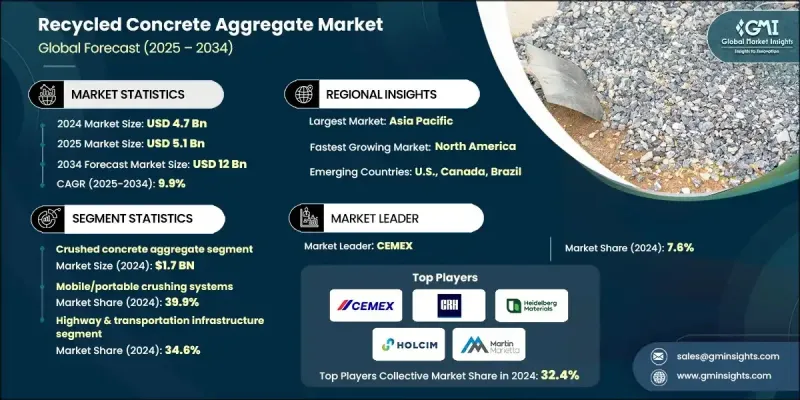

2024 年全球再生混凝土骨材市場價值為 47 億美元,預計到 2034 年將以 9.9% 的複合年成長率成長至 120 億美元。

再生混凝土骨材是透過將拆除的混凝土材料加工成可用的骨材替代品而製成的,從而減少了對日益減少的自然資源的依賴。由於許多地區的天然骨材供應迅速減少,各國政府和企業正在加強資源保護策略。人們日益關注建築業的環境惡化和碳排放問題,這加速了對再生混凝土骨材等永續替代品的需求。現代基礎設施建設和對環保施工方法的日益重視是推動這一趨勢的關鍵因素。此外,再生混凝土骨材具有顯著的成本優勢,可最大限度地減少原料成本、降低運輸需求並減少環境合規成本。亞太地區目前處於市場領先地位,這得益於快速的城市發展和基礎設施擴張,從而產生大量可回收垃圾。同時,歐洲的成長速度最快,這主要得益於嚴格的永續發展要求和對尖端回收技術的持續加大投資。這些區域動態反映了全球建築業向循環經濟模式的轉變,再生材料在住宅、商業和公共基礎設施領域正獲得越來越大的應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 47億美元 |

| 預測值 | 120億美元 |

| 複合年成長率 | 9.9% |

2024年,碎混凝土骨材市場規模預計將達17億美元。這種材料透過初級和二級破碎工藝生產出各種粒徑的碎料,用途廣泛,涵蓋基層、排水以及新混凝土生產等領域。各工廠透過精細調整級配水平,以滿足特定專案的需求,從而最佳化產量,確保更高的通用性和應用相關性。

2024年,行動和攜帶式破碎系統市佔率達到39.9%。此細分市場持續佔據主導地位,主要得益於其能夠在拆除現場直接處理物料。現場處理的優點在於成本效益高、環境足跡小、物流便捷,這些特點使得移動式系統成為各類專案的首選解決方案。此外,這些設備的移動性也使得回收作業能夠更靈活地回應專案進度和物料需求。

預計2025年至2034年間,北美再生混凝土骨材市場將以9.7%的複合年成長率成長。區域成長的主要驅動力是永續建築實踐的日益普及以及旨在減少廢棄物的監管框架的強化。政府鼓勵建築和拆除廢棄物再利用的措施正在推動對先進回收基礎設施的投資。加工技術的持續創新提高了再生混凝土骨材的性能、品質和可靠性,使其能夠應用於道路建設、預製構件和支撐框架等結構領域。

全球再生混凝土骨材市場的主要參與者包括Tarmac集團、上海澤尼特礦業有限公司、CEMEX、海德堡材料公司、西卡集團、RUBBLE MASTER、CRH集團、馬丁瑪麗埃塔材料公司、豪瑞集團和CDE集團。為了鞏固自身市場地位,再生混凝土骨材市場的企業正積極推行以產能擴張、創新和策略合作為重點的策略。許多企業正在投資移動式破碎技術,以提高生產靈活性並降低加工成本。研發工作致力於提升骨材的品質和性能,以擴大其在高規格建築中的應用。與建築公司、市政當局和廢棄物管理機構的合作,有助於最佳化材料供應鏈並提高產量。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 自然骨材消耗與資源保護需求

- 基礎設施現代化與永續建築成長

- 與天然開採相比,成本優勢顯著。

- 產業陷阱與挑戰

- 品質變異性和效能一致性挑戰

- 加工設備投資及營運成本

- 市場機遇

- 高性能混凝土應用開發

- 先進分離技術整合

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼說明:僅提供重點國家的貿易統計)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品分類,2021-2034年

- 主要趨勢

- 粗粒再生混凝土骨材

- 細再生混凝土骨材

- 碎混凝土骨材

- 回收混凝土材料

- 其他

第6章:市場估算與預測:依加工方式分類,2021-2034年

- 主要趨勢

- 行動/攜帶式破碎系統

- 固定式破碎設備

- 顎式破碎技術

- 先進分離技術

- 其他

第7章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 公路和交通基礎設施

- 路面基層/底基層

- 橋樑建設與維修應用

- 機場跑道和滑行道建設

- 港口和海洋基礎設施開發

- 鐵路道砟與軌道床應用

- 預拌混凝土生產

- 結構混凝土

- 非結構混凝土

- 預製混凝土構件生產

- 建築混凝土及裝飾應用

- 大體積混凝土及基礎應用

- 瀝青混凝土生產

- 熱拌瀝青混合料(HMA)生產

- 溫拌瀝青(WMA)應用

- 冷拌瀝青及修補材料

- 瀝青基層施工

- 表面處理和碎石封層應用

- 建築和拆除回收

- 一般填土和回填

- 場地開發與平整

- 公用設施溝槽回填及地下施工

- 景觀設計及場地準備

- 臨時道路施工

- 預製混凝土製造

- 預製建築構件(板材、梁、柱)

- 基礎設施預製件(涵洞、管線、護欄)

- 建築預製件和立面構件

- 預力混凝土應用

- 混凝土砌塊和磚石

- 混凝土塊(CMU)生產

- 鋪路石和互鎖式鋪路磚

- 擋土牆砌塊

- 建築砌體和裝飾塊

- 其他

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- CDE Group

- CEMEX

- CRH Plc

- Heidelberg Materials

- Holcim

- Martin Marietta Materials

- RUBBLE MASTER

- Shanghai Zenith Mineral Co.,Ltd.

- Sika AG

- Tarmac Group

The Global Recycled Concrete Aggregate Market was valued at USD 4.7 Billion in 2024 and is estimated to grow at a CAGR of 9.9% to reach USD 12 Billion by 2034.

Recycled concrete aggregate is derived by processing demolished concrete materials into usable aggregate substitutes, reducing reliance on dwindling natural resources. As the availability of natural aggregates declines rapidly in many regions, governments and industries are strengthening resource conservation strategies. Growing concern over environmental degradation and carbon emissions in construction is accelerating the demand for sustainable alternatives like RCA. Modern infrastructure development and increased focus on eco-friendly construction methods are key contributors to this trend. Additionally, RCA provides a compelling cost advantage minimizing raw material expenses, cutting down transportation needs, and lowering environmental compliance costs. The Asia-Pacific region is currently leading the market, fueled by rapid urban development and infrastructure expansion that produces high volumes of recyclable debris. Meanwhile, Europe is seeing the fastest growth, driven by strict sustainability mandates and increased investment in cutting-edge recycling technologies. These regional dynamics reflect a global shift toward circular economy practices in construction, with recycled materials gaining stronger traction across residential, commercial, and public infrastructure sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.7 Billion |

| Forecast Value | $12 Billion |

| CAGR | 9.9% |

The crushed concrete aggregate segment generated USD 1.7 Billion in 2024. This material is produced in various particle sizes through primary and secondary crushing processes, serving multiple applications ranging from base layers and drainage to use in new concrete production. Facilities are optimizing output by fine-tuning gradation levels to align with specific project requirements, ensuring greater versatility and application relevance.

In 2024, the mobile and portable crushing systems segment accounted for a 39.9% share. This segment continues to dominate due to its ability to process materials directly at the demolition site. The appeal of on-site processing lies in its cost efficiency, reduced environmental footprint, and streamlined logistics, which make mobile systems the preferred solution across diverse projects. The mobility of these units also allows recycling operations to be more agile and responsive to project timelines and material needs.

North America Recycled Concrete Aggregate Market is projected to grow at a CAGR of 9.7% between 2025 and 2034. Regional growth is being driven by stronger adoption of sustainable construction practices and reinforced regulatory frameworks aimed at waste reduction. Government initiatives promoting the reuse of construction and demolition debris are pushing investment in advanced recycling infrastructure. Continued innovations in processing technology have improved the performance, quality, and reliability of RCA, enabling its use in structural applications such as road construction, precast components, and supporting frameworks.

Key players operating in the Global Recycled Concrete Aggregate Market include Tarmac Group, SHANGHAI ZENITH MINERAL CO., LTD., CEMEX, Heidelberg Materials, Sika AG, RUBBLE MASTER, CRH Plc, Martin Marietta Materials, Holcim, and CDE Group. To strengthen their position, companies in the Recycled Concrete Aggregate Market are pursuing targeted strategies focused on capacity expansion, innovation, and strategic partnerships. Many are investing in mobile crushing technologies to enhance flexibility and reduce processing costs. R&D efforts are being directed toward improving aggregate quality and performance to expand its use in high-specification construction. Collaborations with construction firms, municipalities, and waste management entities are helping streamline material supply chains and boost volume throughput.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product trends

- 2.2.2 Processing method trends

- 2.2.3 End Use trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Natural aggregate depletion & resource conservation mandates

- 3.2.1.2 Infrastructure modernization & sustainable construction growth

- 3.2.1.3 Cost advantages against natural extraction

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Quality variability & performance consistency challenges

- 3.2.2.2 Processing equipment investment & operational costs

- 3.2.3 Market opportunities

- 3.2.3.1 High-performance concrete applications development

- 3.2.3.2 Advanced separation technology integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Future market trends

- 3.10 Technology and Innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent Landscape

- 3.12 Trade statistics (HS code Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Coarse recycled concrete aggregate

- 5.3 Fine recycled concrete aggregate

- 5.4 Crushed concrete aggregate

- 5.5 Reclaimed concrete material

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Processing Method, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Mobile/portable crushing systems

- 6.3 Stationary crushing plants

- 6.4 Jaw crushing technology

- 6.5 Advanced separation technologies

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By End Use, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Highway & transportation infrastructure

- 7.2.1 Pavement base/subbase

- 7.2.2 Bridge construction & repair applications

- 7.2.3 Airport runway & taxiway construction

- 7.2.4 Port & marine infrastructure development

- 7.2.5 Railway ballast & track bed applications

- 7.3 Ready-mix concrete production

- 7.3.1 Structural concrete

- 7.3.2 Non-structural concrete

- 7.3.3 Precast concrete element production

- 7.3.4 Architectural concrete & decorative applications

- 7.3.5 Mass concrete & foundation applications

- 7.4 Asphalt concrete production

- 7.4.1 Hot mix asphalt (HMA) production

- 7.4.2 Warm mix asphalt (WMA) applications

- 7.4.3 Cold mix asphalt & patching materials

- 7.4.4 Asphalt base course construction

- 7.4.5 Surface treatment & chip seal applications

- 7.5 Construction & demolition recycling

- 7.5.1 General fill & backfill

- 7.5.2 Site development & grading

- 7.5.3 Utility trench backfill & underground construction

- 7.5.4 Landscaping & site preparation

- 7.5.5 Temporary road construction

- 7.6 Precast concrete manufacturing

- 7.6.1 Precast building elements (Panels, beams, columns)

- 7.6.2 Infrastructure precast (Culverts, pipes, barriers)

- 7.6.3 Architectural precast & facade elements

- 7.6.4 Prestressed concrete applications

- 7.7 Concrete block & masonry

- 7.7.1 Concrete masonry units (CMU) production

- 7.7.2 Paving stones & interlocking pavers

- 7.7.3 Retaining wall blocks

- 7.7.4 Architectural masonry & decorative blocks

- 7.8 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 CDE Group

- 9.2 CEMEX

- 9.3 CRH Plc

- 9.4 Heidelberg Materials

- 9.5 Holcim

- 9.6 Martin Marietta Materials

- 9.7 RUBBLE MASTER

- 9.8 Shanghai Zenith Mineral Co.,Ltd.

- 9.9 Sika AG

- 9.10 Tarmac Group