|

市場調查報告書

商品編碼

1871097

天然有機化妝品市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Natural and Organic Cosmetics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

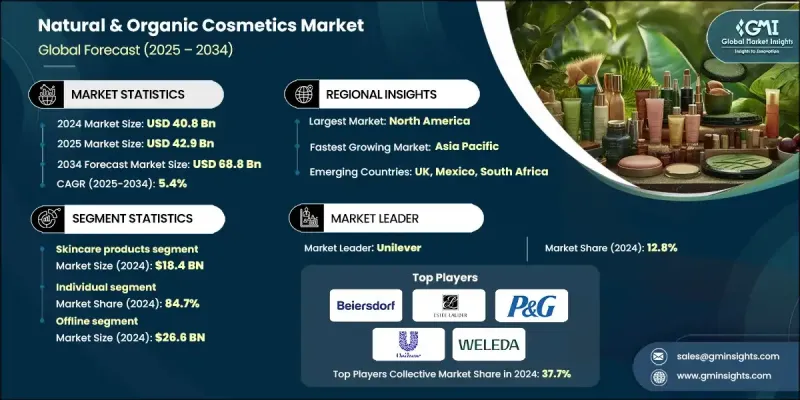

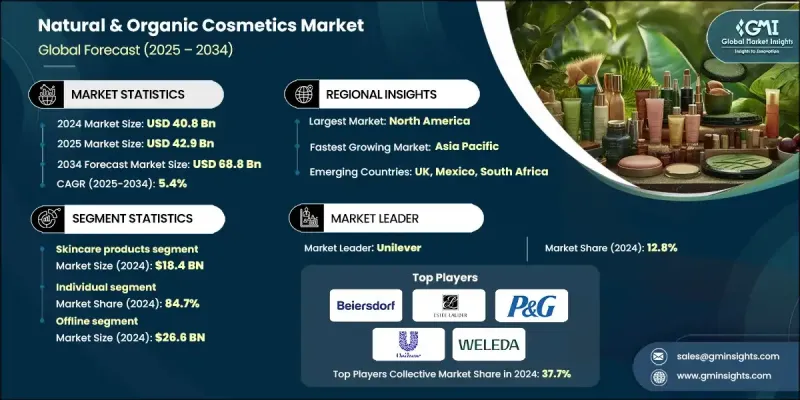

2024年全球天然和有機化妝品市場價值為408億美元,預計到2034年將以5.4%的複合年成長率成長至688億美元。

消費者對健康和環保產品的日益重視,推動了對清潔標籤美妝產品的需求。消費者越來越傾向選擇不含合成化學物質、符合道德和環境價值的化妝品。透明度、成分可追溯性和清晰的產品標籤已成為重中之重。如今,很大一部分消費者積極尋找永續的產品,並願意為此支付更高的價格。數位平台和社群媒體在影響消費者的購買習慣方面發揮著重要作用,並促使品牌承擔更多責任。消費者心態的這種轉變也促使企業採取更誠實的行銷方式,並將道德採購放在首位。除了不斷提高的消費者期望外,監管支援和標籤標準的完善也推動了市場擴張。然而,缺乏統一的全球認證體系給尋求國際擴張的品牌帶來了挑戰。儘管不同地區的信任度存在差異,但對真實可靠、負責任生產的產品的需求仍在持續成長,為護膚、彩妝和個人護理領域創造了新的機會。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 408億美元 |

| 預測值 | 688億美元 |

| 複合年成長率 | 5.4% |

2024年,保養品市場規模預計將達184億美元。隨著越來越多的消費者在日常護膚中更加重視成分天然、植物萃取,市場正穩步成長。天然保濕霜、洗面乳、精華液和護膚品等產品因其多功能性和溫和配方而備受青睞。消費者尋求不含刺激性化學物質、兼具護理和滋養功效的替代品,因此對環保護膚色的需求持續攀升。植物萃取、精油和草本混合物如今已成為產品研發的核心要素。

就終端用戶而言,個人用戶群在2024年佔據了84.7%的市場。如今,消費者比以往任何時候都更了解產品訊息,也更積極地參與購買決策。他們會主動查看成分錶,尋求無動物實驗認證,並要求產品來源和生產過程透明化。這種意識的轉變改變了品牌設計和標註產品的方式,使其更加重視清潔配方,以體現消費者對健康和永續性的價值。如今,道德消費主義和個人健康問題已成為品牌忠誠度和市場定位的核心。

2024年,美國天然和有機化妝品市場佔據81.8%的市場佔有率,市場規模達118億美元。該地區市場受益於消費者意識的增強、成熟的零售基礎設施以及積極的產品創新。美國消費者始終追求成分純淨、採用經認證的有機成分且供應鏈可追溯的美容產品。隨著人們對綠色化學和永續包裝的日益關注,該地區已成為新興天然美容品牌的聚集地。認證和監管框架也有助於建立信任並提升產品信譽。

全球天然有機化妝品市場的主要企業包括寶潔、聯合利華、雅詩蘭黛、維蕾德、歐萊雅、強生、拜爾斯道夫、德國世家、True Botanicals、科蒂、Josie Maran Cosmetics、Haus Labs、Herbivore Botanicals、Wala Heilmittel 和 Burt's Bees。這些領先品牌正大力投資於清潔創新和符合道德規範的採購,以鞏固其市場地位。許多公司正在重新配製產品,去除合成添加劑,並優先使用天然成分。與認證供應商建立合作關係有助於確保整個供應鏈的透明度。品牌也尋求環保包裝解決方案,並利用數位化平台加強與消費者的直接互動。通過公認標準的認證有助於確保產品的真實性,並提升消費者信任度。企業正透過收購、進入新的地域市場以及推出針對注重健康的消費者的利基產品線來擴張業務。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 對清潔標籤和透明成分的需求日益成長

- 電子商務和網紅行銷的成長

- 天然配方監理支持

- 產業陷阱與挑戰

- 天然原料和生產成本高

- 保存期限有限和保存問題

- 機會

- 拓展新興市場

- 永續包裝和循環美容領域的創新

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品類型分類,2021-2034年

- 主要趨勢

- 保養品

- 乳霜和保濕霜

- 潔面產品及卸妝產品

- 精華液和抗衰老

- 防曬霜和紫外線防護

- 爽膚水和精華液

- 其他(去角質產品和磨砂膏等)

- 護髮產品

- 洗髮精和護髮素

- 護髮油

- 造型產品

- 染髮劑和染料

- 其他(頭皮護理產品等)

- 彩妝及化妝品

- 唇膏及唇部護理

- 粉底和遮瑕膏

- 眼妝和睫毛膏

- 指甲油

- 其他(腮紅、修容粉等)

- 口腔護理產品

- 牙膏和牙粉

- 漱口水和口腔沖洗液

- 其他(牙齒美白產品等)

- 其他(香水等)

第6章:市場估算與預測:依成分分類,2021-2034年

- 主要趨勢

- 植物性和植物性

- 精油

- 植物萃取物和草藥

- 水果和蔬菜衍生物

- 其他(花卉及花瓣萃取物等)

- 礦物基

- 粘土和土壤礦物

- 海鹽和礦物鹽

- 礦物顏料和著色劑

- 海洋來源成分

- 海藻和藻類萃取物

- 其他(海洋膠原蛋白和蛋白質等)

- 生物技術衍生的天然成分

- 其他(經認證的有機農產品等)

第7章:市場估計與預測:依消費族群分類,2021-2034年

- 主要趨勢

- 男人

- 女性

- 男女通用的

第8章:市場估算與預測:依價格分類,2021-2034年

- 主要趨勢

- 低的

- 中等的

- 高的

- 優質的

第9章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 個人

- 專業的

- 美容院

- 水療和康體中心

- 醫療專業人員

- 飯店及度假村

- 其他(美容院等)

第10章:市場估價與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 線上

- 電子商務

- 公司網站

- 離線

- 專賣店

- 藥局

- 其他(百貨公司等)

第11章:市場估計與預測:按地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- Beiersdorf

- Burt's Bees

- Coty

- Dr. Hauschka

- Estee Lauder

- Haus Labs

- Herbivore Botanicals

- Johnson & Johnson

- Josie Maran Cosmetics

- L'Oreal

- Procter & Gamble

- True Botanicals

- Unilever

- Wala Heilmittel

- Weleda

The Global Natural and Organic Cosmetics Market was valued at USD 40.8 Billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 68.8 Billion by 2034.

Growing consumer preference for health-conscious and eco-friendly choices is driving demand for clean-label beauty products. Buyers are increasingly favoring cosmetics free from synthetic chemicals and aligned with ethical and environmental values. Transparency, ingredient traceability, and clear product labeling have become top priorities. A large portion of consumers now actively seek sustainable options and are willing to pay premium prices for them. Digital platforms and social media are playing a major role in influencing purchasing habits and pushing brands to be more accountable. This shift in consumer mindset is also prompting companies to adopt more honest marketing practices and prioritize ethical sourcing. Alongside rising consumer expectations, regulatory support, and labeling standards are contributing to market expansion. However, the lack of a unified global certification system presents challenges for brands seeking to scale internationally. Even with varying trust levels across regions, the demand for authentic and responsibly made products continues to accelerate, creating new opportunities across skincare, makeup, and personal care.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $40.8 billion |

| Forecast Value | $68.8 billion |

| CAGR | 5.4% |

The skincare segment generated USD 18.4 Billion in 2024. This segment is growing steadily as more consumers prioritize clean, plant-based ingredients in their everyday beauty routines. Products like natural moisturizers, face washes, serums, and skin treatments are favored for their multipurpose functions and gentle formulations. With consumers seeking alternatives that both treat and nourish without harsh chemicals, the demand for eco-conscious skincare is climbing steadily. Botanical extracts, essential oils, and herbal blends are now core elements in product development.

In terms of end users, the individual segment held 84.7% share in 2024. Consumers are more informed and engaged in their purchase decisions than ever before. They actively evaluate ingredient lists, seek cruelty-free certifications, and demand transparency in sourcing and production. This awareness has shifted how brands design and label their products, focusing on clean formulations that reflect consumer values around wellness and sustainability. Ethical consumerism and personal health concerns are now central to brand loyalty and market positioning.

U.S. Natural and Organic Cosmetics Market held 81.8% share and generated USD 11.8 Billion in 2024. The regional market benefits from strong consumer awareness, mature retail infrastructure, and active product innovation. Consumers in the U.S. consistently demand clean beauty products with certified organic ingredients and traceable supply chains. With increasing interest in green chemistry and sustainable packaging, the region has become a hub for emerging natural beauty brands. Certifications and regulatory frameworks are also helping to build trust and enhance product credibility.

Major companies operating in the Global Natural and Organic Cosmetics Market include Procter & Gamble, Unilever, Estee Lauder, Weleda, L'Oreal, Johnson & Johnson, Beiersdorf, Dr. Hauschka, True Botanicals, Coty, Josie Maran Cosmetics, Haus Labs, Herbivore Botanicals, Wala Heilmittel, and Burt's Bees. Leading brands in the Global Natural and Organic Cosmetics Market are investing heavily in clean innovation and ethical sourcing to strengthen their market position. Many companies are reformulating products to eliminate synthetic additives and prioritize naturally derived ingredients. Partnerships with certified suppliers help ensure transparency across the supply chain. Brands are also pursuing eco-friendly packaging solutions and leveraging digital platforms to enhance direct-to-consumer engagement. Certification through recognized standards supports product authenticity and boosts consumer trust. Firms are expanding through acquisitions, entering new geographic markets, and launching niche product lines tailored to wellness-conscious consumers.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Ingredients

- 2.2.4 Consumer Group

- 2.2.5 Price

- 2.2.6 End use

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for clean-label and transparent ingredients

- 3.2.1.2 Growth of e-commerce and influencer marketing

- 3.2.1.3 Regulatory support for natural formulations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of natural ingredients and production

- 3.2.2.2 Limited shelf life and preservation issues

- 3.2.3 Opportunities

- 3.2.3.1 Expansion into emerging markets

- 3.2.3.2 Innovation in sustainable packaging and circular beauty

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Skincare products

- 5.2.1 Face creams & moisturizers

- 5.2.2 Cleansers & makeup removers

- 5.2.3 Serums & anti-aging

- 5.2.4 Sunscreens & UV protection

- 5.2.5 Toners & essences

- 5.2.6 Others (exfoliators & scrubs etc.)

- 5.3 Haircare products

- 5.3.1 Shampoos & conditioners

- 5.3.2 Hair oils

- 5.3.3 Styling products

- 5.3.4 Hair coloring & dyes

- 5.3.5 Others (scalp care products etc.)

- 5.4 Color cosmetics & makeup

- 5.4.1 Lipsticks & lip care

- 5.4.2 Foundations & concealers

- 5.4.3 Eye makeup & mascara

- 5.4.4 Nail polish

- 5.4.5 Others (blushes & bronzers etc.)

- 5.5 Oral care products

- 5.5.1 Toothpaste & tooth powders

- 5.5.2 Mouthwash & oral rinses

- 5.5.3 Others (teeth whitening products etc.)

- 5.6 Others (fragrances etc.)

Chapter 6 Market Estimates and Forecast, By Ingredients, 2021 - 2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Plant-based & botanical

- 6.2.1 Essential oils

- 6.2.2 Plant extracts & herbal

- 6.2.3 Fruit & vegetable derivatives

- 6.2.4 Others (flower & petal extracts etc.)

- 6.3 Mineral-based

- 6.3.1 Clays & earth minerals

- 6.3.2 Sea salts & mineral salts

- 6.3.3 Mineral pigments & colorants

- 6.3.4 Marine-derived ingredients

- 6.3.5 Seaweed & algae extracts

- 6.3.6 Others (marine collagen & proteins etc.)

- 6.4 Biotechnology-derived natural ingredients

- 6.5 Others (certified organic agricultural etc.)

Chapter 7 Market Estimates and Forecast, By Consumer Group, 2021 - 2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Men

- 7.3 Women

- 7.4 Unisex

Chapter 8 Market Estimates and Forecast, By Price, 2021 - 2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

- 8.5 Premium

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Individual

- 9.3 Professional

- 9.3.1 Beauty salons

- 9.3.2 Spa & wellness centers

- 9.3.3 Medical professionals

- 9.3.4 Hotel & resort

- 9.3.5 Others (beauty institutes etc.)

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce

- 10.2.2 Company website

- 10.3 Offline

- 10.3.1 Specialty Stores

- 10.3.2 Pharmacies

- 10.3.3 Others (departmental stores, etc.)

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Beiersdorf

- 12.2 Burt's Bees

- 12.3 Coty

- 12.4 Dr. Hauschka

- 12.5 Estee Lauder

- 12.6 Haus Labs

- 12.7 Herbivore Botanicals

- 12.8 Johnson & Johnson

- 12.9 Josie Maran Cosmetics

- 12.10 L'Oreal

- 12.11 Procter & Gamble

- 12.12 True Botanicals

- 12.13 Unilever

- 12.14 Wala Heilmittel

- 12.15 Weleda