|

市場調查報告書

商品編碼

1871094

鈦酸鋰(LTO)電池市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Lithium Titanate Oxide (LTO) Battery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

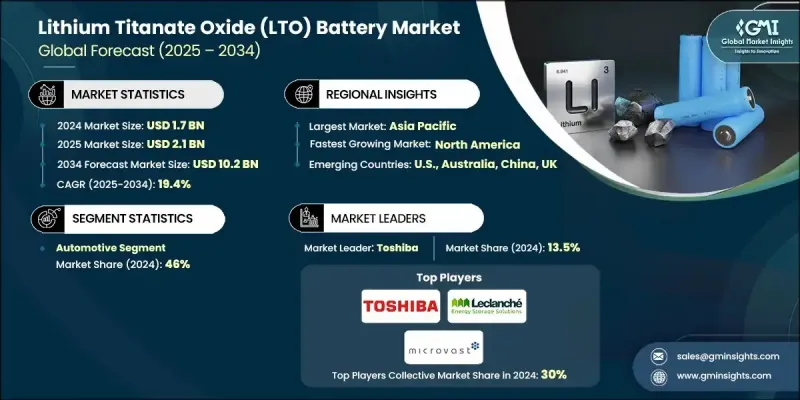

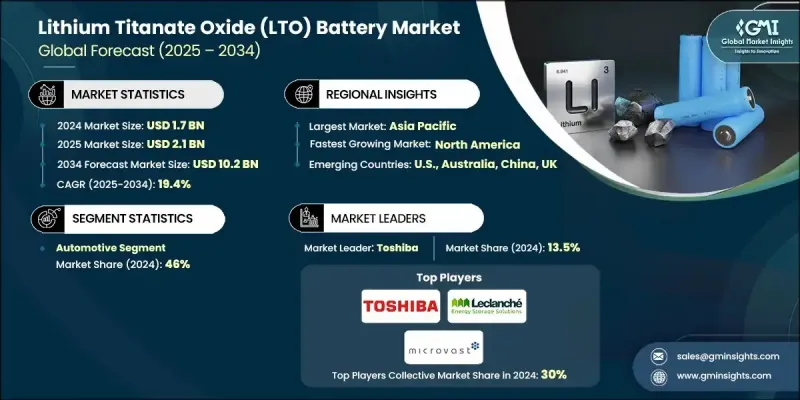

2024 年全球鈦酸鋰 (LTO) 電池市場價值為 17 億美元,預計到 2034 年將以 19.4% 的複合年成長率成長至 102 億美元。

鈦酸鋰(LTO)電池憑藉其卓越的充電性能和超長的循環壽命,正迅速改變現代能源和交通運輸系統。這些電池可在短短幾分鐘內充電至80%,實現快速充電,最大限度地減少停機時間,最佳化車隊運作。這些優勢使其成為電動出行和固定式儲能的首選解決方案。世界各國政府都在投資清潔交通和永續能源項目,這直接促進了鈦酸鋰市場的成長。鈦酸鋰電池能夠實現超過20,000次的完整充放電循環而容量損失極小,這使其在電動交通和儲能應用領域都極具優勢。鈦酸鋰電池堅固的尖晶石晶格結構可有效防止枝晶形成,確保更高的可靠性和更長的使用壽命。隨著電池即服務(BaaS)模式的日益普及,尤其是在亞太地區,鈦酸鋰電池的高耐久性和快速充電能力使其成為換電系統以及電動車隊和電網應用中其他高需求應用場景的理想選擇。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 17億美元 |

| 預測值 | 102億美元 |

| 複合年成長率 | 19.4% |

2024年,汽車領域佔據46%的市場佔有率,預計到2034年將以19.5%的複合年成長率成長。該領域的強勁表現主要得益於LTO電池在城市電動出行領域的日益普及,快速充電和延長電池壽命對於日常營運至關重要。與傳統的鋰離子電池不同,LTO電池可在10分鐘內充電至80%,為電動計程車、公車和物流車隊等高利用率車輛提供了切實可行的解決方案。隨著大都市地區向零排放交通和更嚴格的環保法規轉型,車隊營運商正在採用基於LTO電池的電動車,以滿足性能和永續性方面的要求。這種向快速充電車輛平台的轉變持續推動著該領域在私人和商業出行領域的擴張。

到2034年,美國鈦酸鋰(LTO)電池市場規模將達到26億美元。美國大力推動清潔能源轉型和電動車普及,並為此推出了一系列聯邦計畫、撥款和激勵措施。支持電動車基礎設施擴建、電池製造和智慧電網升級的各項舉措,為LTO電池製造商創造了巨大的發展機會。憑藉其快速充電、長壽命和高安全標準等優勢,LTO電池正成為美國公共交通和商用車輛電氣化計畫的重要組成部分。

全球鈦酸鋰(LTO)電池市場的主要參與者包括東芝公司、銀龍能源、Altairnano、Leclanche SA、Microvast、PLANNANO、Nichicon Corporation 和 Nav Prakriti。為了鞏固市場地位,鈦酸鋰電池產業的企業正積極推行以技術創新、規模化生產和策略合作為核心的策略。許多製造商正投資先進材料科學,以提高電池的能量密度、充電速度和熱穩定性。與電動車原始設備製造商(OEM)和能源公司建立戰略合作夥伴關係,使企業能夠獲得長期供應契約,並拓展到儲能和換電網路等新興應用領域。此外,各公司也正在最佳化其全球供應鏈,以確保成本效益和及時的產品交付。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 監管環境

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

- 技術組件分析

- 投資和融資環境分析

- 新興科技趨勢和發展

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 戰略儀錶板

- 策略舉措

- 重要夥伴關係與合作

- 主要併購活動

- 產品創新與發布

- 市場擴張策略

- 競爭性標竿分析

- 創新與永續發展格局

第5章:市場規模及預測:依應用領域分類,2021-2034年

- 主要趨勢

- 汽車

- 儲能

- 工業的

- 其他

第6章:市場規模及預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 韓國

- 日本

- 澳洲

- 世界其他地區

第7章:公司簡介

- Altairnano

- Leclanche SA

- Microvast

- Nav Prakriti

- Nichicon Corporation

- PLANNANO

- Toshiba Corporation

- Yinlong Energy

The Global Lithium Titanate Oxide (LTO) Battery Market was valued at USD 1.7 Billion in 2024 and is estimated to grow at a CAGR of 19.4% to reach USD 10.2 Billion by 2034.

The rapid adoption of LTO batteries is transforming modern energy and mobility systems through their superior charging performance and exceptional cycle life. These batteries can reach up to 80% charge within just a few minutes, enabling quick recharges that minimize downtime and optimize fleet operations. Such advantages make them a preferred solution for electric mobility and stationary storage. Governments across the world are investing in clean transportation and sustainable energy initiatives, directly benefiting the growth of the LTO market. Their unique ability to deliver more than 20,000 full charge-discharge cycles without significant capacity loss enhances their suitability for both electric transport and energy storage applications. The robust spinel lattice structure of LTO batteries prevents dendrite formation, ensuring higher reliability and longer operational lifespan. With growing interest in Battery-as-a-Service (BaaS) models, particularly across Asia-Pacific, LTO's high endurance and rapid charging capabilities make it ideal for battery-swap systems and other high-demand use cases across electric fleets and grid applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $10.2 Billion |

| CAGR | 19.4% |

The automotive segment held a 46% share in 2024 and is expected to grow at a CAGR of 19.5% through 2034. The segment's strong performance is driven by the increasing use of LTO batteries in urban electric mobility, where fast-charging and extended battery life are critical for daily operations. Unlike conventional lithium-ion chemistries, LTO can achieve 80% charge in under 10 minutes, offering a practical solution for high-utilization vehicles such as electric taxis, buses, and logistics fleets. As metropolitan regions move toward zero-emission transportation and stricter environmental regulations, fleet operators are adopting LTO-based electric vehicles to meet performance and sustainability requirements. This growing shift toward rapid-charging vehicle platforms continues to fuel the segment's expansion across both private and commercial mobility sectors.

U.S. Lithium Titanate Oxide (LTO) Battery Market will reach USD 2.6 Billion by 2034. The country's commitment to clean energy transition and electric mobility adoption is reinforced by large-scale federal programs, grants, and incentives. Initiatives supporting the expansion of electric vehicle infrastructure, battery manufacturing, and smart grid upgrades are creating strong opportunities for LTO battery manufacturers. Given their fast-charging capabilities, extended life cycle, and high safety standards, LTO batteries are emerging as a critical component for public transportation and commercial fleet electrification projects in the United States.

Leading players in the Global Lithium Titanate Oxide (LTO) Battery Market include Toshiba Corporation, Yinlong Energy, Altairnano, Leclanche SA, Microvast, PLANNANO, Nichicon Corporation, and Nav Prakriti. To strengthen their market presence, companies in the lithium titanate oxide battery industry are pursuing strategies centered on technological innovation, production scaling, and strategic collaboration. Many manufacturers are investing in advanced material science to improve battery density, charging speed, and thermal stability. Strategic partnerships with electric vehicle OEMs and energy utilities are enabling companies to secure long-term supply contracts and expand into emerging applications such as energy storage and battery-swapping networks. Firms are also enhancing their global supply chains to ensure cost efficiency and timely product delivery.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Technology component analysis

- 3.8 Investment and funding landscape analysis

- 3.9 Emerging technology trends and developments

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Automotive

- 5.3 Energy storage

- 5.4 Industrial

- 5.5 Others

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.3 Europe

- 6.3.1 UK

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Italy

- 6.3.5 Spain

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 South Korea

- 6.4.3 Japan

- 6.4.4 Australia

- 6.5 Rest of World

Chapter 7 Company Profiles

- 7.1 Altairnano

- 7.2 Leclanche SA

- 7.3 Microvast

- 7.4 Nav Prakriti

- 7.5 Nichicon Corporation

- 7.6 PLANNANO

- 7.7 Toshiba Corporation

- 7.8 Yinlong Energy