|

市場調查報告書

商品編碼

1871089

汽車射出成型自動化市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Automotive Injection Molding Automation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

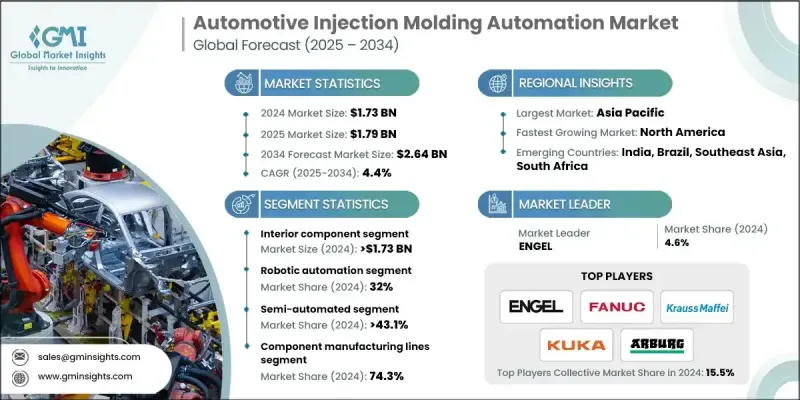

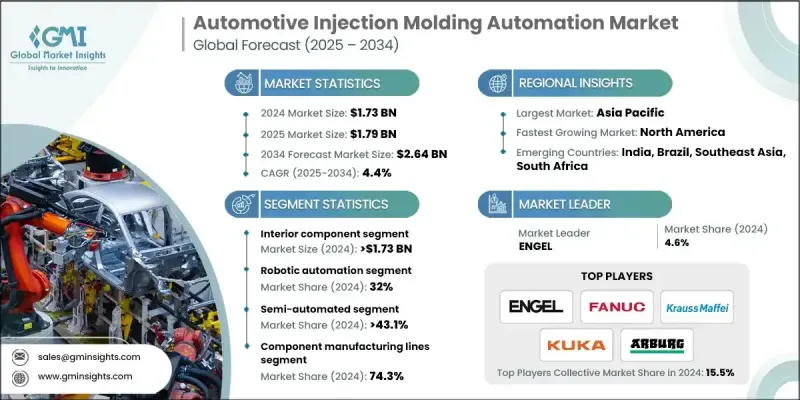

2024 年全球汽車射出成型自動化市場價值為 17.3 億美元,預計到 2034 年將以 4.4% 的複合年成長率成長至 26.4 億美元。

製造業自動化程度的不斷提高,源自於對更高生產力、更穩定品質和更少人工依賴的需求。機器人搬運、自動化品質檢測和整合成型系統正幫助製造商最大限度地減少缺陷、縮短生產週期並提升整個生產過程的效率。這一趨勢在全球一級供應商和OEM組裝廠中日益明顯。電動車(EV)的成長加速了對輕量化、高精度和耐熱塑膠零件的需求。自動化注塑成型能夠生產具有高重複性和尺寸精度的複雜零件。將人工智慧(AI)、物聯網(IoT)和機器學習技術融入成型操作,可實現即時監控、預測性維護和流程最佳化。利用互聯自動化單元的智慧工廠正在推動基於數據的決策,減少停機時間並最大限度地減少材料浪費,從而進一步強化了汽車注塑成型製程對自動化的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 17.3億美元 |

| 預測值 | 26.4億美元 |

| 複合年成長率 | 4.4% |

2024年,汽車內裝組件市場規模達到17.3億美元,預計2025年至2034年將以5%的複合年成長率成長。隨著電動車和先進資訊娛樂系統的普及,市場對輕量化、耐用且精密的內裝組件的需求日益成長。自動化生產線能夠以高產量、低廢品率和穩定的品質生產儀錶板、面板和控制台,從而在提升乘客舒適度的同時降低生產成本。

預計到2024年,機器人自動化領域將佔據32%的市場。整合於取放、插件裝載和堆疊流程的機器人系統能夠提高效率、減少人工干預、增強重複性並縮短週期時間。由於勞動成本壓力和對大批量生產的需求,機器人技術在已開發市場和新興市場的應用都在不斷擴展。

2024年,美國汽車射出成型自動化市佔率將達86.4%。向電動和混合動力汽車的轉型正在推動電池外殼、連接器和電子外殼等零件的自動化應用。自動化可確保重複的精度、尺寸準確性和可重複性,使原始設備製造商 (OEM) 和一級供應商能夠在高效生產大批量零件的同時,滿足嚴格的品質標準。

汽車注塑成型自動化市場的主要參與者包括庫卡(KUKA)、住友(SHI-Demag)、恩格爾(ENGEL)、海天(Haitian)、阿博格(ARBURG)、發那科(FANUC)、克勞斯瑪菲(KraussMaffei)、威特曼巴頓菲爾德(Wittmann BatNUC)、克勞斯瑪菲(KraussMaffei)、威特曼巴頓菲爾德(Wittmann Battenfeld)和日精塑膠工業(Nissle)。這些企業正利用創新、技術整合和策略合作來鞏固其市場地位。他們投資研發,以改善機器人系統、人工智慧驅動的品質控制和智慧工廠解決方案。與原始設備製造商(OEM)和一級供應商的合作有助於擴大市場覆蓋範圍,並將解決方案直接整合到生產線中。各公司也專注於模組化自動化系統,以滿足多樣化的製造需求並提供可擴展的解決方案。數位化和物聯網(IoT)的整合改進了製程監控和預測性維護,從而減少了停機時間和營運成本。此外,各公司也重視客戶支援、培訓計畫和售後服務,以增強客戶信任。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預報

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 原物料供應商

- 零件製造商

- 系統整合商

- OEM

- 最終用途

- 供應商格局

- 產業影響因素

- 成長促進因素

- 汽車製造自動化程度不斷提高

- 電動車和輕量化趨勢

- 工業4.0/智慧工廠應用

- 大批量生產需求

- 提高品質和安全標準

- 產業陷阱與挑戰

- 高初始資本投入

- 熟練勞動力需求

- 市場機遇

- 新興市場的成長

- 將現有生產線進行自動化改造

- 先進機器人和人工智慧整合

- 對永續和節能系統的需求

- 成長促進因素

- 成長潛力分析

- 監管環境

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 目前技術

- 新興技術

- 專利分析

- 價格趨勢分析

- 按組件

- 按地區

- 成本細分分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 未來趨勢

- 新興科技趨勢

- 電動車影響分析

- 永續發展與回收機遇

- 工業4.0演進

- 區域成長熱點

- 投資機會

- 風險評估與緩解

- 總擁有成本分析

- 實施時程和專案規劃

- 培訓和技能發展要求

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 重要新聞和舉措

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:依組件分類,2021-2034年

- 主要趨勢

- 內部組件

- 外部元件

- 其他

第6章:市場估算與預測:依自動化程度分類,2021-2034年

- 主要趨勢

- 機器人自動化

- 製程控制自動化

- 物料搬運自動化

- 品質檢測自動化

- 包裝及後處理自動化

第7章:市場估算與預測:依自動化程度分類,2021-2034年

- 主要趨勢

- 半自動系統

- 全自動系統

- 智慧/工業4.0系統

第8章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 零件生產線

- 精密模具工程

- 二次生產和精加工

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐

- 荷蘭

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- 全球參與者

- FANUC

- ENGEL

- KraussMaffei

- ARBURG

- Sumitomo Heavy Industries

- Husky Injection Molding Systems

- Milacron

- 區域玩家

- Star Automation

- Baumuller

- Haitian

- Moog

- Wittmann Battenfeld

- JSW Plastics Machinery

- Toyo Machinery & Metal

- Nissei Plastic Industrial

- 新興參與者和顛覆者

- JR Automation

- Absolute Haitian

- Sepro

- Yizumi

- Tederic Machinery

- LK Technology

- Specialized Automation Suppliers

- ABB Robotics

- KUKA

- Universal Robots

- Staubli

- Kawasaki Robotics

- Comau

- Denso Robotics

- Epson Robots

- Omron Adept

- Yaskawa Motoman

The Global Automotive Injection Molding Automation Market was valued at USD 1.73 Billion in 2024 and is estimated to grow at a CAGR of 4.4% to reach USD 2.64 Billion by 2034.

The rising adoption of automation in manufacturing is driven by the need for higher productivity, consistent quality, and reduced reliance on manual labor. Robotic handling, automated quality checks, and integrated molding systems are helping manufacturers minimize defects, shorten cycle times, and enhance efficiency throughout production. This trend is increasingly evident among Tier-1 suppliers and OEM assembly plants worldwide. The growth of electric vehicles (EVs) has accelerated demand for lightweight, precise, and heat-resistant plastic components. Automated injection molding enables the production of complex components with high repeatability and dimensional accuracy. Incorporating AI, IoT, and machine learning in molding operations allows real-time monitoring, predictive maintenance, and process optimization. Smart factories leveraging connected automation cells are driving data-based decision-making, reducing downtime, and minimizing material waste, further strengthening demand for automation across automotive injection molding processes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.73 Billion |

| Forecast Value | $2.64 Billion |

| CAGR | 4.4% |

The interior component segment generated USD 1.73 Billion in 2024 and is expected to grow at a CAGR of 5% from 2025 to 2034. Demand for lightweight, durable, and precise interior components is rising, especially with the growth of EVs and advanced infotainment systems. Automated production lines deliver dashboards, panels, and consoles with high throughput, low scrap rates, and consistent quality, enhancing passenger comfort while reducing production costs.

The robotic automation segment captured a 32% share in 2024. Robotic systems integrated with pick-and-place, insert loading, and stacking processes improve efficiency, reduce human intervention, enhance repeatability, and shorten cycle times. The adoption of robotics is expanding in both developed and emerging markets due to labor cost pressures and the need for high-volume production.

U.S. Automotive Injection Molding Automation Market held 86.4% share in 2024. The shift to electric and hybrid vehicles is driving the use of automation for battery housings, connectors, and electronic enclosures. Automation ensures repeated precision, dimensional accuracy, and repeatability, enabling OEMs and Tier-1 suppliers to meet stringent quality standards while efficiently producing high-volume parts.

Key players in the Automotive Injection Molding Automation Market include KUKA, Sumitomo (SHI-Demag), ENGEL, Haitian, ARBURG, FANUC, KraussMaffei, Wittmann Battenfeld, and Nissei Plastic Industrial. Companies in the Automotive Injection Molding Automation Market are leveraging innovation, technological integration, and strategic partnerships to strengthen their market position. They invest in R&D to enhance robotic systems, AI-driven quality controls, and smart factory solutions. Collaborations with OEMs and Tier-1 suppliers help expand reach and integrate solutions directly into production lines. Firms are also focusing on modular automation systems to cater to diverse manufacturing needs and offer scalable solutions. Digitalization and IoT integration improve process monitoring and predictive maintenance, reducing downtime and operational costs. Additionally, companies emphasize customer support, training programs, and after-sales services to enhance client trust.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Component

- 2.2.2 Automation

- 2.2.3 Level of automation

- 2.2.4 End Use

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material suppliers

- 3.1.1.2 Component manufacturers

- 3.1.1.3 System integrators

- 3.1.1.4 OEM

- 3.1.1.5 End use

- 3.1.1 Supplier landscape

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising automation in automotive manufacturing

- 3.2.1.2 EV and lightweighting trend

- 3.2.1.3 Industry 4.0 / smart factory adoption

- 3.2.1.4 High-volume production needs

- 3.2.1.5 Increasing quality and safety standards

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial capital investment

- 3.2.2.2 Skilled workforce requirement

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in emerging markets

- 3.2.3.2 Retrofitting existing lines with automation

- 3.2.3.3 Advanced robotics and AI integration

- 3.2.3.4 Demand for sustainable and energy-efficient systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle east and Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technology

- 3.7.2 Emerging technology

- 3.8 Patent analysis

- 3.9 Price Trends Analysis

- 3.9.1 By component

- 3.9.2 By region

- 3.10 Cost Breakdown Analysis

- 3.11 Sustainability and Environmental Aspects

- 3.11.1 Sustainable Practices

- 3.11.2 Waste Reduction Strategies

- 3.11.3 Energy Efficiency in Production

- 3.11.4 Eco-friendly Initiatives

- 3.11.5 Carbon Footprint Considerations

- 3.12 Future trends

- 3.12.1 Emerging Technology Trends

- 3.12.2 Electric Vehicle Impact Analysis

- 3.12.3 Sustainability & Recycling Opportunities

- 3.12.4 Industry 4.0 Evolution

- 3.12.5 Regional Growth Hotspots

- 3.12.6 Investment Opportunities

- 3.12.7 Risk Assessment & Mitigation

- 3.13 Total Cost of Ownership Analysis

- 3.14 Implementation Timeline & Project Planning

- 3.15 Training & Skill Development Requirements

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key news and initiatives

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Interior Components

- 5.3 Exterior Components

- 5.4 Others

Chapter 6 Market Estimates & Forecast, By Automation, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Robotic automation

- 6.3 Process control automation

- 6.4 Material handling automation

- 6.5 Quality inspection automation

- 6.6 Packaging & Post-Processing Automation

Chapter 7 Market Estimates & Forecast, By Level of Automation, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Semi-Automated systems

- 7.3 Fully Automated systems

- 7.4 Smart/Industry 4.0-Enabled Systems

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Component Manufacturing Lines

- 8.3 Precision Tooling & Mold Engineering

- 8.4 Secondary Production & Finishing

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Netherlands

- 9.3.8 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 FANUC

- 10.1.2 ENGEL

- 10.1.3 KraussMaffei

- 10.1.4 ARBURG

- 10.1.5 Sumitomo Heavy Industries

- 10.1.6 Husky Injection Molding Systems

- 10.1.7 Milacron

- 10.2 Regional Players

- 10.2.1 Star Automation

- 10.2.2 Baumuller

- 10.2.3 Haitian

- 10.2.4 Moog

- 10.2.5 Wittmann Battenfeld

- 10.2.6 JSW Plastics Machinery

- 10.2.7 Toyo Machinery & Metal

- 10.2.8 Nissei Plastic Industrial

- 10.3 Emerging Players and Disruptors

- 10.3.1 JR Automation

- 10.3.2 Absolute Haitian

- 10.3.3 Sepro

- 10.3.4 Yizumi

- 10.3.5 Tederic Machinery

- 10.3.6 LK Technology

- 10.4 Specialized Automation Suppliers

- 10.4.1 ABB Robotics

- 10.4.2 KUKA

- 10.4.3 Universal Robots

- 10.4.4 Staubli

- 10.4.5 Kawasaki Robotics

- 10.4.6 Comau

- 10.4.7 Denso Robotics

- 10.4.8 Epson Robots

- 10.4.9 Omron Adept

- 10.4.10 Yaskawa Motoman