|

市場調查報告書

商品編碼

1871083

生物水泥建築應用市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Biocement for Construction Application Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

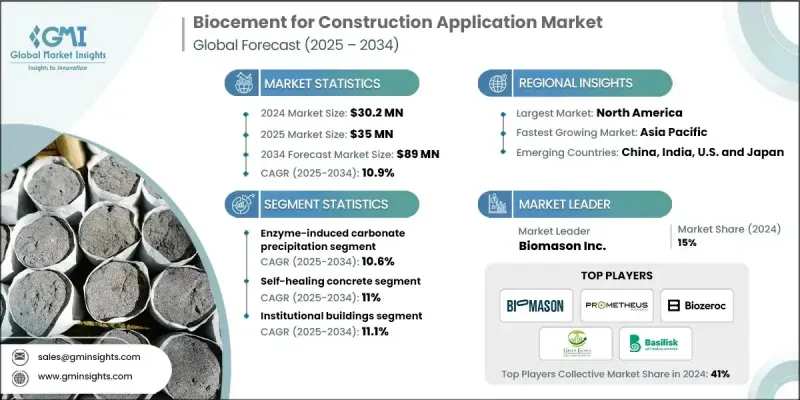

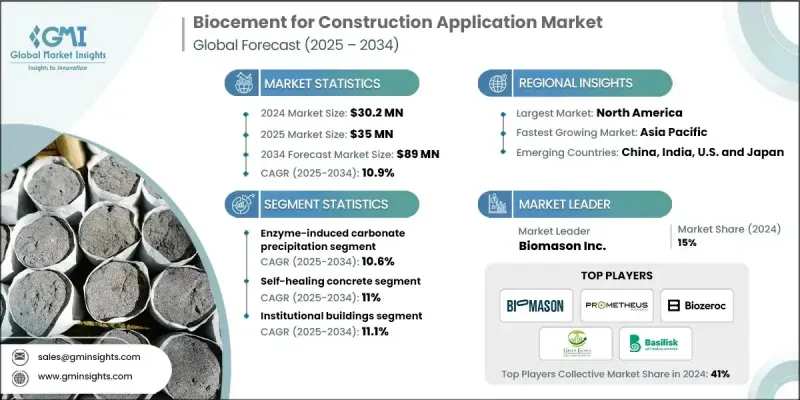

2024 年全球建築用生物水泥市場價值為 3,020 萬美元,預計到 2034 年將以 10.9% 的複合年成長率成長至 8,900 萬美元。

全球對永續和環保建築材料的日益關注正在推動生物水泥市場的快速成長。生物水泥是傳統波特蘭水泥的更清潔替代品,後者以其高碳排放而聞名。生物水泥透過微生物過程誘導方解石沉澱而生產,為現代建築需求提供了耐用、低碳的黏結解決方案。該材料卓越的環境效益、更低的能耗和更高的強度特性正在推動其在基礎設施、住宅和商業項目中廣泛應用。生物基材料和微生物技術的不斷進步,使生產更有效率且經濟,增強了其與傳統水泥的競爭力。全球永續發展計劃和監管要求也在加速生物水泥在大型專案中的應用。不斷成長的研發投入正在拓展其在土壤穩定、修復工程和預製構件方面的應用潛力。日益增強的環境保護意識和消費者對綠建築實踐的偏好,持續推動全球建築業對生物水泥的整體需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3020萬美元 |

| 預測值 | 8900萬美元 |

| 複合年成長率 | 10.9% |

到了2024年,微生物誘導碳酸鹽沉澱(MICP)技術佔60%的市場佔有率。此工藝利用天然存在的細菌沉澱碳酸鈣,從而形成強度高、耐久性強的黏結材料,非常適合建築應用。大量研究驗證了MICP技術的商業可行性和環境效益,鞏固了其在產業中的領先地位。持續的技術進步以及在混凝土加固和土壤穩定等領域的專門應用開發,預計將在未來幾年繼續保持其主導地位。

工業和製造設施領域佔據29.8%的市場佔有率,預計到2024年將以10.6%的複合年成長率成長。這些行業的需求主要源於對具有卓越耐久性、耐化學性和自修復性能的建築材料的需求。生物水泥能夠延長使用壽命並最大限度地降低維護成本,使其在極端運行條件下的工業環境中尤為重要。其優異的耐化學腐蝕性和即使在嚴苛環境下也能保持結構完整性的能力,使其成為工業建築的關鍵材料。

2024年,北美建築用生物水泥市佔率達到43.5%,預計到2034年將以11.1%的複合年成長率成長。該地區的成長主要歸功於民眾強烈的環保意識、政府的永續發展舉措以及對傳統水泥生產的嚴格限制。美國在綠色建築基礎設施和環保建築標準方面投入巨資,繼續保持領先地位;加拿大則透過促進永續城市發展的政策不斷擴大市場佔有率。生物水泥配方的持續創新,以及不斷成長的研究活動和製造商之間的合作,預計將進一步加速該地區的市場擴張。

生物水泥建築應用市場的主要企業包括Carbicrete Inc.、Biozeroc Ltd.、Biomason Inc.、Prometheus Materials Inc.、Green Island International Ltd.和Basilisk BV。這些領導企業正致力於研發創新、策略合作和生產規模化,以提升其市場地位。許多公司正大力投資研發,以提高微生物效率、最佳化方解石沉澱,並開發更快、更永續的固化製程。生技公司、建築公司和學術機構之間的合作正在加速產品開發並拓展應用領域。多家公司正努力透過自動化和先進的生物工程技術來擴大生產規模並降低生產成本。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 市場機遇

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 按產品類別

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依技術類型分類,2021-2034年

- 主要趨勢

- 微生物誘導碳酸鹽沉澱(MICP)

- 尿素分解細菌系統

- 巴氏芽孢桿菌的應用

- 芽孢桿菌屬的實施

- 酵素碳酸鹽沉澱(EICP)

- 基於碳酸酐酶的系統

- 二氧化碳捕獲酵素系統

- 環境溫度下的碳酸化

- 增強二氧化碳封存

- 鐵呼吸細菌系統

第6章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 自癒混凝土

- 自主裂縫修復系統

- 膠囊細菌技術

- 長期耐久性增強

- 土壤穩定與地基改良

- 基礎加固

- 液化預防

- 侵蝕控制系統

- 基礎設施維修與修復

- 裂縫密封應用

- 表面壓實

- 結構修復

- 預製建築構件

- 建築元素

- 結構部件

- 裝飾應用

- 道路和路面應用

- 道路維修與養護

- 除塵系統

- 臨時基礎設施

第7章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 住宅建築

- 機構建築

- 辦公大樓

- 學校

- 醫院

- 零售設施

- 商業建築

- 道路

- 橋樑

- 機場

- 其他

- 工業和製造設施

- 倉庫

- 工廠

- 物流中心

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- Biomason Inc.

- Prometheus Materials Inc.

- Biozeroc Ltd.

- Green Island International Ltd.

- Basilisk BV

- Carbicrete Inc.

The Global Biocement for Construction Application Market was valued at USD 30.2 million in 2024 and is estimated to grow at a CAGR of 10.9% to reach USD 89 million by 2034.

The rising global focus on sustainable and eco-friendly construction materials is fueling the rapid growth of this market. Biocement offers a cleaner alternative to traditional Portland cement, which is known for its high carbon emissions. Produced through microbial processes that induce calcite precipitation, biocement provides a durable, low-carbon binding solution for modern construction needs. The material's superior environmental benefits, lower energy consumption, and improved strength characteristics are driving adoption across infrastructure, residential, and commercial projects. Continuous advancements in bio-based materials and microbial technologies are making production more efficient and cost-effective, enhancing competitiveness with conventional cement. Global sustainability initiatives and regulatory mandates are also accelerating biocement's integration into large-scale projects. Growing investment in research and development is expanding its potential for soil stabilization, repair works, and precast components. The increasing awareness of environmental conservation and consumer inclination toward green building practices continue to drive the overall demand for biocement across construction sectors worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $30.2 Million |

| Forecast Value | $89 Million |

| CAGR | 10.9% |

The microbially induced carbonate precipitation (MICP) segment held 60% share in 2024. This process utilizes naturally occurring bacteria to precipitate calcium carbonate, resulting in strong and durable binding properties that are ideal for construction applications. Extensive research validating the commercial and environmental viability of MICP has reinforced its leadership in the industry. Ongoing technological advancements and the development of specialized applications for concrete reinforcement and soil stabilization are expected to sustain its dominance in the coming years.

The industrial and manufacturing facilities segment held 29.8% share, growing at a CAGR of 10.6% in 2024. The demand from these sectors is driven by the need for construction materials with exceptional durability, chemical resistance, and self-healing properties. Biocement's ability to extend service life and minimize maintenance costs makes it particularly valuable in industrial environments that experience extreme operational conditions. Its resistance to chemical degradation and capacity to maintain structural integrity even in demanding settings have positioned it as a key material in industrial construction.

North America Biocement for Construction Application Market held 43.5% share in 2024, with an anticipated CAGR of 11.1% through 2034. The region's growth is largely attributed to strong environmental awareness, government sustainability initiatives, and strict limitations on traditional cement production. The United States remains at the forefront with major investments in green building infrastructure and eco-friendly construction standards, while Canada continues to expand through policies promoting sustainable urban development. Ongoing innovation in biocement formulations, combined with increasing research activity and collaboration among manufacturers, is expected to further accelerate the region's market expansion.

Key companies operating in the Biocement for Construction Application Market include Carbicrete Inc., Biozeroc Ltd., Biomason Inc., Prometheus Materials Inc., Green Island International Ltd., and Basilisk B.V. Leading players in the Biocement for Construction Application Market are employing strategies focused on research innovation, strategic collaborations, and production scalability to enhance their market position. Many companies are investing heavily in R&D to improve microbial efficiency, optimize calcite precipitation, and develop faster, more sustainable curing processes. Partnerships between biotechnology firms, construction companies, and academic institutions are helping accelerate product development and expand application areas. Several firms are working to scale manufacturing capacity and lower production costs through automation and advanced bioengineering techniques.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology type

- 2.2.3 Application

- 2.2.4 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product category

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Technology Type, 2021-2034 (USD Million & Tons)

- 5.1 Key trends

- 5.2 Microbially induced carbonate precipitation (MICP)

- 5.2.1 Ureolytic bacteria systems

- 5.2.2 Sporosarcina pasteurii applications

- 5.2.3 Bacillus species implementations

- 5.3 Enzyme-induced carbonate precipitation (EICP)

- 5.4 Carbonic anhydrase-based systems

- 5.4.1 Co2-capturing enzyme systems

- 5.4.2 Ambient temperature carbonation

- 5.4.3 Enhanced co2 sequestration

- 5.5 Iron-respiring bacterial systems

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million & Tons)

- 6.1 Key trends

- 6.2 Self-healing concrete

- 6.2.1 Autonomous crack repair systems

- 6.2.2 Encapsulated bacterial technologies

- 6.2.3 Long-term durability enhancement

- 6.3 Soil stabilization & ground improvement

- 6.3.1 Foundation strengthening

- 6.3.2 Liquefaction prevention

- 6.3.3 Erosion control systems

- 6.4 Infrastructure repair & rehabilitation

- 6.4.1 Crack sealing applications

- 6.4.2 Surface consolidation

- 6.4.3 Structural restoration

- 6.5 Precast building components

- 6.5.1 Architectural elements

- 6.5.2 Structural components

- 6.5.3 Decorative applications

- 6.6 Road & pavement applications

- 6.6.1 Road repair & maintenance

- 6.6.2 Dust control systems

- 6.6.3 Temporary infrastructure

Chapter 7 Market Estimates and Forecast, By End Use, 2021-2034 (USD Million & Tons)

- 7.1 Key trends

- 7.2 Residential construction

- 7.3 Institutional buildings

- 7.3.1 Office buildings

- 7.3.2 Schools

- 7.3.3 Hospitals

- 7.3.4 Retail facilities

- 7.4 Commercial structures

- 7.4.1 Roads

- 7.4.2 Bridges

- 7.4.3 Airports

- 7.4.4 Others

- 7.5 Industrial & manufacturing facilities

- 7.5.1 Warehouses

- 7.5.2 Factories

- 7.5.3 Logistic centers

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Biomason Inc.

- 9.2 Prometheus Materials Inc.

- 9.3 Biozeroc Ltd.

- 9.4 Green Island International Ltd.

- 9.5 Basilisk B.V.

- 9.6 Carbicrete Inc.