|

市場調查報告書

商品編碼

1871080

用於自動駕駛汽車的神經形態晶片市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Neuromorphic Chips for Autonomous Vehicles Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

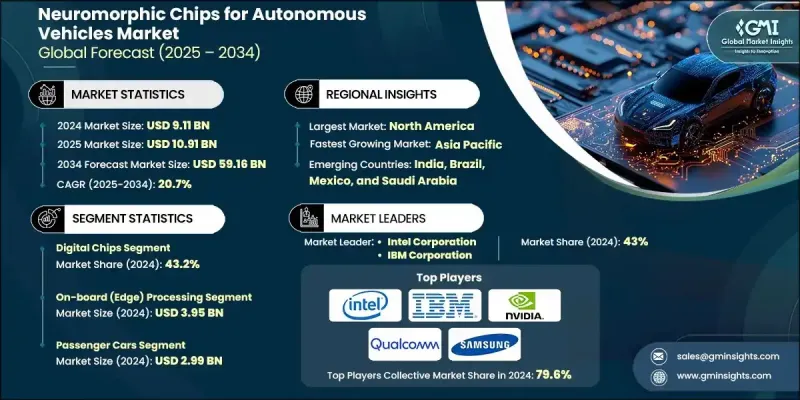

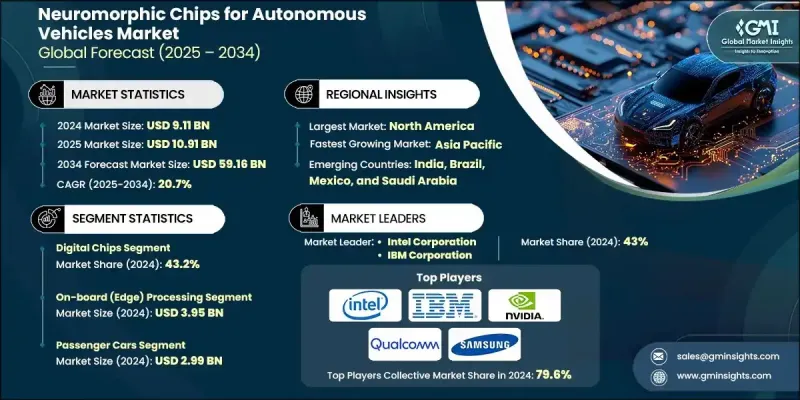

2024 年全球自動駕駛汽車神經形態晶片市值為 91.1 億美元,預計到 2034 年將以 20.7% 的複合年成長率成長至 591.6 億美元。

對自動駕駛汽車日益成長的需求推動了對能夠快速處理大量感測器輸入的先進運算系統的需求。模擬人腦結構的神經形態晶片,相較於傳統處理器,能夠實現更快的決策速度和更高的能源效率。隨著車輛整合多個攝影機、LiDAR和雷達技術以提升安全性和可靠性,對瞬時資料處理的需求也持續成長。隨著電動車和自動駕駛汽車的發展,能源最佳化和散熱管理已成為關鍵問題。傳統的GPU和CPU在持續執行AI任務時經常面臨過熱降頻的問題,這限制了其可擴展性。相較之下,神經形態處理器利用平行事件驅動運算僅處理相關資料,從而顯著降低功耗並提升電動車的電池效能。感測器系統的進步進一步推動了神經形態技術的廣泛應用。新一代仿生和事件驅動型感測器能夠產生針對神經形態處理最佳化的資料流,從而實現傳統架構無法實現的非同步和脈衝驅動資料處理。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 91.1億美元 |

| 預測值 | 591.6億美元 |

| 複合年成長率 | 20.7% |

2024年,數位神經形態晶片市佔率達43.2%。其主導地位源於與現有汽車人工智慧系統和電子控制單元的無縫整合,使汽車製造商無需進行重大重新設計即可實現應用。與現有人工智慧框架的兼容性,以及頂級半導體製造商的大力支持,確保了該領域的可擴展性、可靠性和持續創新。

由於車載(邊緣)部署模式在即時感測器資料處理中發揮關鍵作用,預計到2024年,該模式將創造39.5億美元的市場規模。邊緣運算使車輛能夠在本地分析訊息,從而消除延遲,並實現對道路和交通狀況的即時響應。這種架構對於需要瞬間決策的安全應用至關重要,例如自動煞車和碰撞預防。

預計到2024年,美國用於自動駕駛汽車的神經形態晶片市場規模將達25億美元。美國持續受益於公共和私營部門對人工智慧和自動駕駛技術的強勁投資。強大的創新生態系統和眾多關鍵技術公司的存在,推動了用於高速即時決策的神經形態計算技術的持續研究。美國對智慧節能汽車系統的日益重視,進一步加速了神經形態晶片在汽車產業的應用。

全球自動駕駛汽車神經形態晶片市場的主要參與者包括埃森哲、Applied Brain Research Inc.、Aspinity Inc.、博格華納、BrainChip Holdings Ltd.、Cadence Design Systems Inc.、Figaro Engineering Inc.、General Vision Inc.、Grayscale AI、Gyrfalcon Technology Inc.、惠普企業發展有限公司、IBMem、Mem. Inc.、英偉達公司、Polyn Technology、Prophesee SA、高通技術公司、三星電子有限公司和索尼公司。為了鞏固自身地位,自動駕駛汽車神經形態晶片市場的領導者正優先考慮策略合作、產品創新和可擴展的生產製造。許多企業正大力投資研發,以提高晶片效率、降低功耗並提升資料處理精度。半導體公司與汽車製造商之間的合作正在加速下一代汽車系統的整合和測試。一些企業也致力於擴大其地理覆蓋範圍,並與人工智慧軟體開發商結盟,以使神經形態技術與新興的汽車標準保持一致。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 衝擊力

- 成長促進因素

- 先進自動駕駛汽車的採用

- 節能運算與邊緣人工智慧

- 汽車感測器整合

- 產學合作與研發

- 先進自動駕駛汽車的採用

- 產業陷阱與挑戰

- 高昂的開發和實施成本

- 複雜系統整合

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 新興商業模式

- 合規要求

- 消費者情緒分析

- 專利和智慧財產權分析

- 地緣政治與貿易動態

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 市場集中度分析

- 對主要參與者進行競爭基準分析

- 財務績效比較

- 收入

- 利潤率

- 研發

- 產品組合比較

- 產品範圍廣度

- 科技

- 創新

- 地理位置比較

- 全球足跡分析

- 服務網路覆蓋

- 按地區分類的市場滲透率

- 競爭定位矩陣

- 領導人

- 挑戰者

- 追蹤者

- 小眾玩家

- 戰略展望矩陣

- 財務績效比較

- 2021-2024 年主要發展動態

- 併購

- 夥伴關係與合作

- 技術進步

- 擴張和投資策略

- 數位轉型計劃

- 新興/新創企業競爭對手格局

第5章:市場估算與預測:依晶片架構分類,2021-2034年

- 主要趨勢

- 模擬

- 數位的

- 混合訊號

第6章:市場估算與預測:依部署方式分類,2021-2034年

- 主要趨勢

- 板載(邊緣)處理

- 雲端輔助處理

- 混合處理

第7章:市場估價與預測:依車輛類別分類,2021-2034年

- 主要趨勢

- 搭乘用車

- 商用車輛

- 卡車

- 公車

- 自動駕駛接駁車和無人駕駛計程車

- 越野及特種車輛

- 農業

- 礦業

- 建造

- 其他

第8章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 汽車原廠設備製造商

- 一級供應商

- 售後解決方案提供商

- 研究與開發實體

- 其他

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Accenture

- Applied Brain Research Inc.

- Aspinity Inc.

- BorgWarner Inc.

- BrainChip Holdings Ltd.

- Cadence Design Systems, Inc.

- Figaro Engineering Inc.

- General Vision Inc.

- Grayscale AI

- Gyrfalcon Technology Inc.

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- Innatera Nanosystems BV

- Intel Corporation

- MemryX Inc.

- Micron Technology, Inc.

- Mythic Inc.

- NVIDIA Corporation

- Polyn Technology

- Prophesee SA

- Qualcomm Technologies, Inc.

- Samsung Electronics Co., Ltd.

- Sony Corporation

- SynSense AG

- Syntiant Corp.

- Vicarious Corp.

- Vivum Computing

The Global Neuromorphic Chips for Autonomous Vehicles Market was valued at USD 9.11 Billion in 2024 and is estimated to grow at a CAGR of 20.7% to reach USD 59.16 Billion by 2034.

The accelerating demand for self-driving vehicles is driving the need for advanced computing systems that can rapidly process vast amounts of sensory input. Neuromorphic chips, which emulate the human brain's structure, enable faster decision-making and greater energy efficiency than traditional processors. As vehicles integrate multiple cameras, LiDAR, and radar technologies to enhance safety and reliability, the requirement for instantaneous data processing continues to rise. With the evolution of electric and autonomous vehicles, energy optimization and heat management have become key concerns. Conventional GPUs and CPUs often face thermal throttling during continuous AI tasks, which limits scalability. In contrast, neuromorphic processors handle only relevant data using parallel, event-driven computation, which significantly reduces power consumption and improves battery performance in electric vehicles. The growing adoption of neuromorphic technology is further supported by advancements in sensor systems. Next-generation bio-inspired and event-based sensors produce data streams optimized for neuromorphic processing, enabling asynchronous and spike-driven data handling that is not possible with conventional architectures.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.11 billion |

| Forecast Value | $59.16 billion |

| CAGR | 20.7% |

In 2024, the digital neuromorphic chips segment accounted for a 43.2% share. Their dominance stems from seamless integration with existing automotive AI systems and electronic control units, allowing automakers to implement them without major redesigns. Their compatibility with current AI frameworks, along with strong support from top semiconductor manufacturers, ensures scalability, reliability, and consistent innovation in this segment.

The on-board (edge) deployment model generated USD 3.95 Billion in 2024, owing to its critical role in real-time sensor data processing. Edge computing allows vehicles to analyze information locally, eliminating latency and enabling instantaneous response to road and traffic conditions. This architecture is crucial for safety applications that require split-second decision-making, such as automated braking and collision prevention.

United States Neuromorphic Chips for Autonomous Vehicles Market generated USD 2.5 Billion in 2024. The U.S. continues to benefit from robust investment in artificial intelligence and autonomous driving technologies, supported by both public and private sectors. A strong innovation ecosystem and the presence of key technology firms contribute to ongoing research in neuromorphic computing for high-speed, real-time decision-making. The nation's growing focus on intelligent and energy-efficient vehicle systems further accelerates the integration of neuromorphic chips in the automotive industry.

Key companies active in the Global Neuromorphic Chips for Autonomous Vehicles Market include Accenture, Applied Brain Research Inc., Aspinity Inc., BorgWarner Inc., BrainChip Holdings Ltd., Cadence Design Systems Inc., Figaro Engineering Inc., General Vision Inc., Grayscale AI, Gyrfalcon Technology Inc., Hewlett Packard Enterprise Development LP, IBM Corporation, Intel Corporation, MemryX Inc., Micron Technology Inc., Mythic Inc., NVIDIA Corporation, Polyn Technology, Prophesee SA, Qualcomm Technologies Inc., Samsung Electronics Co. Ltd., and Sony Corporation. To strengthen their position, leading companies in the Neuromorphic Chips for Autonomous Vehicles Market are prioritizing strategic collaborations, product innovation, and scalable manufacturing. Many are investing heavily in R&D to enhance chip efficiency, reduce power usage, and improve data processing accuracy. Partnerships between semiconductor firms and automotive manufacturers are accelerating integration and testing within next-generation vehicle systems. Several players are also focusing on expanding their geographic reach and forming alliances with AI software developers to align neuromorphic technology with emerging automotive standards.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Chip Architecture trends

- 2.2.2 Deployment trends

- 2.2.3 Vehicle Category trends

- 2.2.4 End use trends

- 2.2.5 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Advanced Autonomous Vehicle Adoption

- 3.2.1.2 Energy-Efficient Computing & Edge AI

- 3.2.1.3 Automotive Sensor Integration

- 3.2.1.4 Industry-Academia Collaborations & R&D

- 3.2.1.5 Advanced Autonomous Vehicle Adoption

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High Development and Implementation Costs

- 3.2.2.2 Complex System Integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Consumer sentiment analysis

- 3.11 Patent and IP analysis

- 3.12 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates & Forecast, By Chip Architecture, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Analog

- 5.3 Digital

- 5.4 Mixed-Signal

Chapter 6 Market Estimates & Forecast, By Deployment, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 On-Board (Edge) Processing

- 6.3 Cloud-Assisted Processing

- 6.4 Hybrid Processing

Chapter 7 Market Estimates & Forecast, By Vehicle Category, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 Passenger Cars

- 7.2.1 Commercial Vehicles

- 7.2.2 Trucks

- 7.2.3 Buses

- 7.3 Autonomous Shuttles & Robo-Taxis

- 7.4 Off-Road & Specialized Vehicles

- 7.4.1 Agriculture

- 7.4.2 Mining

- 7.4.3 Construction

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 Automotive OEMs

- 8.3 Tier-1 Suppliers

- 8.4 Aftermarket Solution Providers

- 8.5 Research & Development Entities

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Accenture

- 10.2 Applied Brain Research Inc.

- 10.3 Aspinity Inc.

- 10.4 BorgWarner Inc.

- 10.5 BrainChip Holdings Ltd.

- 10.6 Cadence Design Systems, Inc.

- 10.7 Figaro Engineering Inc.

- 10.8 General Vision Inc.

- 10.9 Grayscale AI

- 10.10 Gyrfalcon Technology Inc.

- 10.11 Hewlett Packard Enterprise Development LP

- 10.12 IBM Corporation

- 10.13 Innatera Nanosystems BV

- 10.14 Intel Corporation

- 10.15 MemryX Inc.

- 10.16 Micron Technology, Inc.

- 10.17 Mythic Inc.

- 10.18 NVIDIA Corporation

- 10.19 Polyn Technology

- 10.20 Prophesee SA

- 10.21 Qualcomm Technologies, Inc.

- 10.22 Samsung Electronics Co., Ltd.

- 10.23 Sony Corporation

- 10.24 SynSense AG

- 10.25 Syntiant Corp.

- 10.26 Vicarious Corp.

- 10.27 Vivum Computing