|

市場調查報告書

商品編碼

1871077

生物基化學品市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Biobased Chemical Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

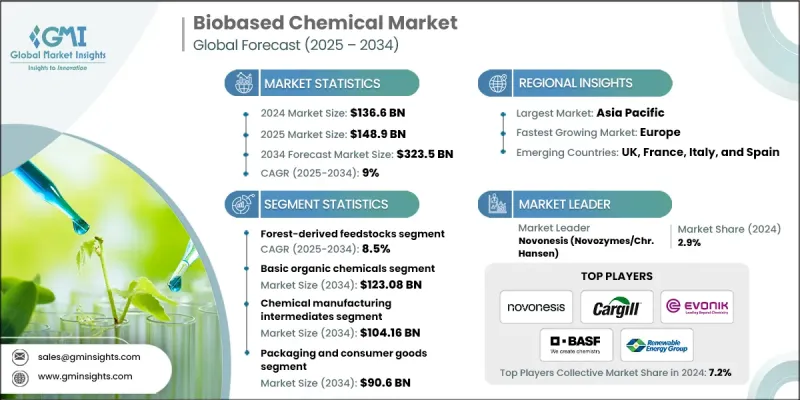

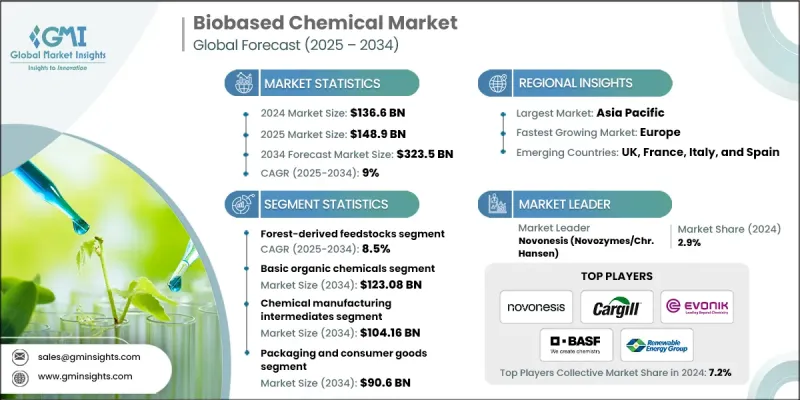

2024年全球生物基化學品市場價值為1,366億美元,預計到2034年將以9%的複合年成長率成長至3,235億美元。

全球範圍內向永續工業流程的轉型、政府對碳中和解決方案的激勵措施以及生物技術和綠色化學的突破,共同推動了市場的發展。生物基化學品由農業殘餘物、林業生質能和藻類等再生資源生產,正日益取代包裝、汽車、建築、紡織和農業等行業的化石基原料。日益嚴格的環境法規和消費者對環保產品的需求加速了可生物分解塑膠、生物基界面活性劑和再生溶劑的普及應用。在農業領域,生物農藥、肥料和土壤改良劑正被用於支持再生農業實踐並最大限度地減少對生態環境的影響。此外,市場還受益於技術創新,包括PLA升級回收和FDCA基聚合物的進步,這些技術提高了效率並減少了碳足跡,使生物基解決方案的性能能夠達到甚至超過石油基替代品,同時促進循環經濟原則的實施。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1366億美元 |

| 預測值 | 3235億美元 |

| 複合年成長率 | 9% |

農業衍生原料,包括傳統作物和專用能源作物,仍然是最大的細分市場,佔 52% 的佔有率,這得益於其豐富的儲量、成本效益以及與工業生物程序的兼容性,凸顯了它們在既有和新興生產途徑中的主導地位。

包裝和消費品行業是領先的終端用戶市場,涵蓋食品包裝和日常消費品。在永續生物基包裝材料使用量不斷成長的推動下,該細分市場預計將從2024年的382億美元成長到2034年的906億美元。

2024年北美生物基化學品市場規模達382億美元,預計2034年將以9%的複合年成長率成長。在美國和加拿大等國家,由於永續發展方面的監管要求、企業綠色環保措施以及可再生原料技術的進步,生物基化學品在包裝、汽車和農業等領域得到廣泛應用。市場對高性能生物塑膠、生物潤滑劑以及兼具環保效益和功能性的工業解決方案的需求仍然強勁。

全球生物基化學品市場的主要參與者包括帝斯曼-菲美意 (DSM-Firmenich)、布拉斯科 (Braskem)、Amyris、嘉吉 (Cargill)、諾維信 (Novozymes)、Green Biologics、贏創 (Evonik)、Gevo、Genomatica、Novamont、Ecovative、可再生能源集團 (Reablebable、Acovative Threads、LanzaTech、Corbion、巴斯夫 (BASF)、Modern Meadow 和 Zymergen。這些公司正優先考慮創新、策略合作和永續發展實踐,以擴大市場佔有率。他們大力投資研發,以開發高性能生物基聚合物、溶劑和特殊化學品。與原料供應商和技術提供者的合作確保了穩定的原料供應和製程最佳化。許多公司正在建立合資企業和許可協議,以進入新的地域市場並實現產品組合多元化。監管合規性和永續性認證是他們重視的方面,旨在提升信譽和客戶信任。此外,各公司也專注於強調環境效益、生物分解性和循環經濟概念的行銷策略。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 市場機遇

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 依產品類型

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依原料來源分類,2021-2034年

- 主要趨勢

- 森林來源原料

- 農業衍生原料

- 廢棄物衍生原料

- 海洋和藻類原料

第6章:市場估算與預測:依產品類型分類,2021-2034年

- 主要趨勢

- 基礎有機化學品

- 生物基乙烯及其衍生物

- 生物基丙烯及其衍生物

- 生物基芳烴(BTX)

- 有機酸(乳酸、琥珀酸)

- 乙醇與發酵

- 工業生物乙醇

- 胺基酸和蛋白質

- 維生素和營養保健品

- 特種生物基化學品

- 工業酵素

- 生物催化劑和生物表面活性劑

- 生物基溶劑

- 環狀及中間體化學品

- 生物基單體

- 可再生芳烴

- 特種中間體

- 生物聚合物前驅

- PLA前驅

- PHA前驅

- 生物基聚醯胺前驅

第7章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 化學製造中間體

- 聚合物生產

- 醫藥中間體

- 精細化學合成

- 塑膠材料及樹脂生產

- 可生物分解塑膠

- 生物基工程塑膠

- 複合材料

- 個人護理和清潔產品

- 生物基界面活性劑

- 天然防腐劑

- 化妝品成分

- 油漆、塗料和黏合劑應用

- 生物基塗料

- 天然黏合劑

- 木材處理化學品

- 農業化學品應用

- 生物基肥料

- 生物農藥與作物保護

- 土壤改良劑

第8章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 包裝及消費品

- 農業和食品加工

- 汽車與運輸

- 建築材料

- 紡織品和服裝

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- Amyris, Inc.

- BASF SE

- BioAmber Inc.

- Bolt Threads, Inc.

- Braskem SA

- Cargill, Incorporated

- Corbion NV

- DSM-firmenich

- Ecovative Design LLC

- Evonik Industries AG

- Genomatica, Inc.

- Gevo, Inc.

- Green Biologics Ltd.

- LanzaTech, Inc.

- Modern Meadow, Inc.

- Novamont SpA

- Novozymes A/S

- Renewable Energy Group, Inc.

- Solugen, Inc.

- Zymergen Inc.

The Global Biobased Chemical Market was valued at USD 136.6 Billion in 2024 and is estimated to grow at a CAGR of 9% to reach USD 323.5 Billion by 2034.

The market is driven by the worldwide shift toward sustainable industrial processes, government incentives for carbon-neutral solutions, and breakthroughs in biotechnology and green chemistry. Biobased chemicals, produced from renewable resources such as agricultural residues, forestry biomass, and algae, are increasingly replacing fossil-derived raw materials across sectors like packaging, automotive, construction, textiles, and agriculture. Rising environmental regulations and consumer demand for eco-friendly products have accelerated the adoption of biodegradable plastics, bio-based surfactants, and renewable solvents. In agriculture, biopesticides, fertilizers, and soil-enhancing solutions are being used to support regenerative practices and minimize ecological impact. The market is also benefiting from technological innovations, including advances in PLA upcycling and FDCA-based polymers, which enhance efficiency and reduce carbon footprints, enabling bio-based solutions to meet or exceed the performance of petroleum-based alternatives while promoting circular economy principles.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $136.6 Billion |

| Forecast Value | $323.5 Billion |

| CAGR | 9% |

Agriculture-derived feedstocks, including conventional crops and dedicated energy crops, remain the largest segment, holding a 52% share due to their abundance, cost-effectiveness, and compatibility with industrial bioprocesses, highlighting their dominance in both established and emerging production pathways.

The packaging and consumer goods sector is the leading end-user market, encompassing food packaging and everyday consumer products. This segment is expected to grow from USD 38.2 Billion in 2024 to USD 90.6 Billion by 2034, driven by the increasing use of sustainable, bio-based packaging materials.

North America Biobased Chemical Market generated USD 38.2 Billion in 2024, growing at a CAGR of 9% through 2034. In countries like the U.S. and Canada, biobased chemicals are widely adopted in packaging, automotive, and agriculture due to regulatory mandates for sustainability, corporate green initiatives, and technological advancements in renewable feedstocks. Demand remains strong for high-performance bioplastics, bio-lubricants, and industrial solutions that provide environmental benefits without compromising functionality.

Key players in the Global Biobased Chemical Market include DSM-Firmenich, Braskem, Amyris, Cargill, Novozymes, Green Biologics, Evonik, Gevo, Genomatica, Novamont, Ecovative, Renewable Energy Group, BioAmber, Solugen, Bolt Threads, LanzaTech, Corbion, BASF, Modern Meadow, and Zymergen. Companies in the Global Biobased Chemical Market are prioritizing innovation, strategic partnerships, and sustainable practices to expand their market footprint. They invest heavily in research and development to create high-performance bio-based polymers, solvents, and specialty chemicals. Collaborations with feedstock suppliers and technology providers ensure a stable raw material supply and process optimization. Many firms are establishing joint ventures and licensing agreements to enter new geographies and diversify product portfolios. Regulatory compliance and sustainability certifications are emphasized to enhance credibility and customer trust. Companies are also focusing on marketing strategies that highlight environmental benefits, biodegradability, and circular economy alignment.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Feedstock Source

- 2.2.3 Product Type

- 2.2.4 Application

- 2.2.5 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Feedstock Source, 2021-2034 (USD Billion & Tons)

- 5.1 Key trends

- 5.2 Forest-derived feedstocks

- 5.3 Agriculture-derived feedstocks

- 5.4 Waste-derived feedstocks

- 5.5 Marine & algae-based feedstocks

Chapter 6 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Billion & Tons)

- 6.1 Key trends

- 6.2 Basic organic chemicals

- 6.2.1 Bio-based ethylene & derivatives

- 6.2.2 Bio-based propylene & derivatives

- 6.2.3 Bio-based aromatics (BTX)

- 6.2.4 Organic acids (lactic, succinic)

- 6.3 Ethyl alcohol & fermentation

- 6.3.1 Industrial bioethanol

- 6.3.2 Amino acids & proteins

- 6.3.3 Vitamins & nutraceuticals

- 6.4 Specialty biobased chemicals

- 6.4.1 Industrial enzymes

- 6.4.2 Biocatalysts & biosurfactants

- 6.4.3 Bio-based solvents

- 6.5 Cyclic & intermediate chemicals

- 6.5.1 Bio-based monomers

- 6.5.2 Renewable aromatics

- 6.5.3 Specialty intermediates

- 6.6 Biopolymer precursors

- 6.6.1 PLA precursors

- 6.6.2 PHA precursors

- 6.6.3 Bio-based polyamide precursors

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion & Tons)

- 7.1 Key trends

- 7.2 Chemical manufacturing intermediates

- 7.2.1 Polymer production

- 7.2.2 Pharmaceutical intermediates

- 7.2.3 Fine chemical synthesis

- 7.3 Plastic material & resin production

- 7.3.1 Biodegradable plastics

- 7.3.2 Bio-based engineering plastics

- 7.3.3 Composite materials

- 7.4 Personal care & cleaning products

- 7.4.1 Bio-based surfactants

- 7.4.2 Natural preservatives

- 7.4.3 Cosmetic ingredients

- 7.5 Paint, coating & adhesive applications

- 7.5.1 Bio-based paints & coatings

- 7.5.2 Natural adhesives

- 7.5.3 Wood treatment chemicals

- 7.6 Agricultural chemical applications

- 7.6.1 Bio-based fertilizers

- 7.6.2 Biopesticides & crop protection

- 7.6.3 Soil conditioners

Chapter 8 Market Estimates and Forecast, By End Use, 2021-2034 (USD Billion & Tons)

- 8.1 Key trends

- 8.2 Packaging & consumer goods

- 8.3 Agriculture & food processing

- 8.4 Automotive & transportation

- 8.5 Construction & building materials

- 8.6 Textiles & apparel

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion & Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Amyris, Inc.

- 10.2 BASF SE

- 10.3 BioAmber Inc.

- 10.4 Bolt Threads, Inc.

- 10.5 Braskem S.A.

- 10.6 Cargill, Incorporated

- 10.7 Corbion N.V.

- 10.8 DSM-firmenich

- 10.9 Ecovative Design LLC

- 10.10 Evonik Industries AG

- 10.11 Genomatica, Inc.

- 10.12 Gevo, Inc.

- 10.13 Green Biologics Ltd.

- 10.14 LanzaTech, Inc.

- 10.15 Modern Meadow, Inc.

- 10.16 Novamont S.p.A.

- 10.17 Novozymes A/S

- 10.18 Renewable Energy Group, Inc.

- 10.19 Solugen, Inc.

- 10.20 Zymergen Inc.