|

市場調查報告書

商品編碼

1871076

小型堆高機市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Small Forklift Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

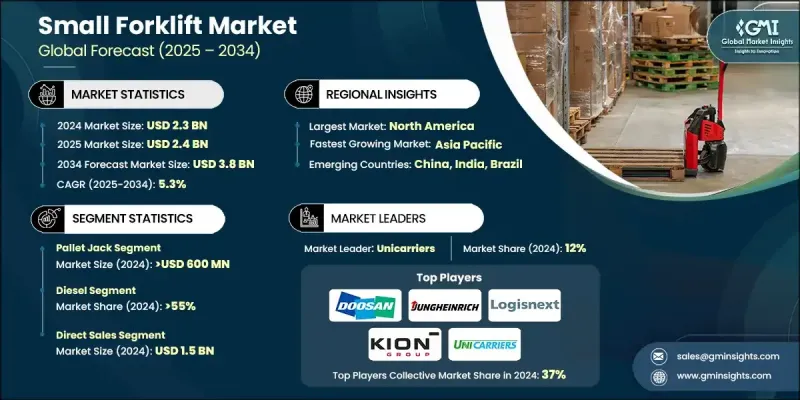

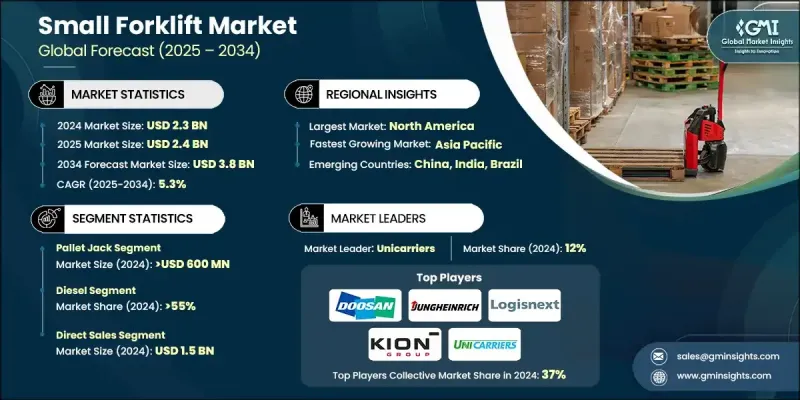

2024 年全球小型堆高機市場價值為 23 億美元,預計到 2034 年將以 5.3% 的複合年成長率成長至 38 億美元。

市場成長的驅動力在於,空間有限的場所對緊湊、靈活、高效的物料搬運設備的需求日益成長。小型堆高機因其能夠在狹窄通道內作業並提供可靠的起重性能,正成為倉庫、零售中心和小型製造工廠的必備設備。對空間最佳化和成本效益日益成長的需求提升了小型堆高機的市場吸引力,尤其是在那些尋求低維護成本和節能替代方案的企業中。對於物流預算有限或搬運需求適中的企業而言,小型堆高機提供了一種經濟高效的解決方案。電動小型堆高機的日益普及正在改變整個產業,這得益於其運作安靜、排放低廉和環境效益。注重永續發展的企業正在轉向使用電池驅動的堆高機,以滿足監管要求並改善室內空氣品質。製造商也不斷推進產品創新,例如提升電池壽命、改進人體工學設計以及增加安全系統,如自動警報和直覺的控制系統。此外,租賃市場也蓬勃發展,為企業提供無需大量資本投入即可靈活使用設備的方案,這對於短期專案和季節性營運來說極具吸引力。過去十年間,小型堆高機已從小眾解決方案發展成為多個行業廣泛採用的工業標準。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 23億美元 |

| 預測值 | 38億美元 |

| 複合年成長率 | 5.3% |

預計到2024年,托盤搬運車市場規模將達到6億美元,佔據最大的市場佔有率。托盤搬運車憑藉其經濟實惠、用途廣泛以及在地面物料搬運方面的高效性,已成為倉儲和配送營運中不可或缺的設備。電子商務物流中心的擴張持續推動對電動托盤搬運車的需求成長,電動托盤搬運車在快節奏的工作環境中具有更佳的人體工學設計、更低的操作員疲勞度和更高的安全性。其易用性和低營運成本使其成為物流和零售營運的首選。

2024年,柴油堆高機市佔率達55%。柴油堆高機憑藉其續航里程長、經久耐用以及相比電動堆高機更低的初始成本,繼續保持市場主導地位。在持續的替換需求以及電動堆高機續航里程和性能受限的戶外物料搬運應用的推動下,柴油堆高機市場持續穩定成長。然而,日益嚴格的排放法規和環境標準正在逐步影響柴油堆高機的普及率,尤其是在城市和室內環境中,促使市場緩慢但穩定地向更清潔的能源轉型。

美國小型堆高機市場佔80.4%的市場佔有率,預計2024年市場規模將達5億美元。北美地區憑藉其強大的物流網路和較高的技術普及率,仍然是全球需求的重要貢獻者。該地區電動堆高機的使用量正在快速成長,這得益於強勁的出口表現和推動零排放營運的監管政策。美國一些擁有嚴格環保法規的州正在加速向電動物料搬運設備的轉型,從而在倉庫、工廠和零售設施中創造更清潔、更永續的營運環境。

全球小型堆高機市場的主要參與者包括三菱Logisnext Americas Inc.、豐田產業株式會社、永恆力股份公司、斗山博貓、Crown Equipment Corporation、Manitou Group、Hyster-Yale, Inc.、EP Equipment、Combilift、凱傲Specialists和Godrej & Boyce。這些企業正積極採取策略性舉措,以鞏固其競爭地位並擴大全球商業版圖。他們大力投資電動和混合動力堆高機技術,以滿足日益成長的永續發展要求和監管標準。製造商專注於先進的鋰離子電池系統和快速充電解決方案,以提高效率並減少停機時間。與物流供應商和租賃公司的策略合作有助於提高市場准入度,同時為客戶提供靈活的擁有選擇。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 電子商務和物流基礎設施的擴展

- 向電氣化和永續營運轉型

- 智慧技術與自動化的融合

- 產業陷阱與挑戰

- 先進堆高機系統需要高資本投入

- 技術工人短缺和培訓差距

- 機會

- 新興經濟體的成長與基礎建設發展

- 微型配送和城市倉儲模式的興起

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依類型分類,2021-2034年

- 主要趨勢

- 前移式堆高機

- 揀貨員

- 砲塔卡車

- 托盤搬運車

- 托盤堆疊機

- 牽引車

- 步行式托盤搬運車

- 騎乘式托盤搬運車

第6章:市場估算與預測:依燃料類型分類,2021-2034年

- 主要趨勢

- 柴油引擎

- 電的

- 汽油和液化石油氣/壓縮天然氣

第7章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 倉儲與物流

- 零售與電子商務物流中心

- 製造業(輕工業、電子產品、食品飲料)

- 建築材料

- 汽車零件處理

- 港口和配送終端

第8章:市場估算與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 直銷

- 間接銷售

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Toyota Industries Corporation

- KION Group AG

- Jungheinrich AG

- Crown Equipment Corporation

- Mitsubishi Logisnext Americas Inc.

- Hyster-Yale, Inc.

- Anhui Heli Co., Ltd.

- Hangcha Group Co., Ltd.

- Doosan Bobcat

- Clark Material Handling

- Godrej & Boyce

- Manitou Group

- EP Equipment

- Combilift

- Unicarriers

The Global Small Forklift Market was valued at USD 2.3 Billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 3.8 Billion by 2034.

Market growth is being driven by the growing need for compact, maneuverable, and efficient material-handling equipment across facilities with limited floor space. Small forklifts are becoming essential for warehouses, retail centers, and small manufacturing units due to their ability to operate in confined aisles while providing reliable lifting performance. The rising demand for space optimization and cost efficiency is enhancing their market appeal, particularly among businesses seeking low-maintenance and fuel-efficient alternatives. Small forklifts provide a cost-effective solution for operations with limited logistics budgets or moderate handling requirements. The increasing adoption of electric small forklifts is transforming the industry, supported by their quiet operation, reduced emissions, and environmental benefits. Companies focused on sustainability are shifting toward battery-powered forklifts to meet regulatory goals and improve indoor air quality. Manufacturers are also advancing product innovation by enhancing battery life, ergonomic design, and safety systems such as automated alerts and intuitive controls. Additionally, the market is seeing growth in rental and leasing programs, offering businesses flexible access to equipment without major capital expenditure, an attractive model for short-term projects and seasonal operations. Over the past decade, the small forklift has evolved from a niche solution to a widely adopted industrial standard across multiple sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $3.8 Billion |

| CAGR | 5.3% |

The pallet jack segment reached USD 600 million in 2024, holding the largest market share. Pallet jacks have become integral to warehouse and distribution operations due to their affordability, versatility, and efficiency in ground-level material handling. The expansion of e-commerce fulfillment centers continues to accelerate demand for electric pallet jacks, which offer improved ergonomics, reduced operator fatigue, and enhanced safety in fast-paced environments. Their ease of use and low operating costs make them a preferred choice in logistics and retail operations.

The diesel segment accounted for a 55% share in 2024. Diesel-powered forklifts maintain their dominance because of their long operating range, durability, and lower upfront costs compared to electric alternatives. This segment continues to grow steadily, supported by consistent replacement demand and outdoor material-handling applications where electric options remain limited in range and performance. However, tightening emission regulations and stricter environmental standards are gradually influencing the adoption rate of diesel units, particularly in urban and indoor environments, prompting a slow but steady shift toward cleaner energy options.

U.S. Small Forklift Market held 80.4% share and generated USD 500 million in 2024. North America remains a significant contributor to global demand, underpinned by a robust logistics network and a high rate of technological adoption. The region is witnessing rapid growth in electric forklift utilization, supported by strong export performance and regulatory mandates promoting zero-emission operations. U.S. states with strict environmental laws are accelerating the transition toward electric material-handling equipment, fostering a cleaner and more sustainable operational landscape across warehouses, factories, and retail facilities.

Prominent players active in the Global Small Forklift Market include Mitsubishi Logisnext Americas Inc., Toyota Industries Corporation, Jungheinrich AG, Doosan Bobcat, Crown Equipment Corporation, Manitou Group, Hyster-Yale, Inc., EP Equipment, Combilift, KION Group AG, Unicarriers, Clark Material Handling, Anhui Heli Co., Ltd., Regional Champions, Hangcha Group Co., Ltd., Niche Specialists, and Godrej & Boyce. Companies operating in the Global Small Forklift Market are employing strategic initiatives to strengthen their competitive position and expand their global footprint. They are heavily investing in electric and hybrid forklift technologies to meet growing sustainability requirements and regulatory standards. Manufacturers are focusing on advanced lithium-ion battery systems and fast-charging solutions to enhance efficiency and reduce downtime. Strategic collaborations with logistics providers and rental firms help increase market accessibility while providing customers with flexible ownership options.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Fuel

- 2.2.4 End use

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of e-commerce and fulfillment infrastructure

- 3.2.1.2 Transition toward electrification and sustainable operations

- 3.2.1.3 Integration of smart technologies and automation

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High capital investment for advanced forklift systems

- 3.2.2.2 Skilled labor shortage and training gaps

- 3.2.3 Opportunities

- 3.2.3.1 Growth in emerging economies and infrastructure development

- 3.2.3.2 Rise of micro-fulfillment and urban warehousing models

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Reach truck

- 5.3 Order picker

- 5.4 Turret truck

- 5.5 Pallet jack

- 5.6 Pallet stacker

- 5.7 Tow tractor

- 5.8 Walkie pallet truck

- 5.9 Rider pallet truck

Chapter 6 Market Estimates and Forecast, By Fuel, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Diesel

- 6.3 Electric

- 6.4 Gasoline & LPG/CNG

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Warehousing & logistics

- 7.3 Retail & e-commerce fulfillment centers

- 7.4 Manufacturing (light industry, electronics, food & beverage)

- 7.5 Construction & building materials

- 7.6 Automotive components handling

- 7.7 Ports & distribution terminals

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Toyota Industries Corporation

- 10.2 KION Group AG

- 10.3 Jungheinrich AG

- 10.4 Crown Equipment Corporation

- 10.5 Mitsubishi Logisnext Americas Inc.

- 10.6 Hyster-Yale, Inc.

- 10.7 Anhui Heli Co., Ltd.

- 10.8 Hangcha Group Co., Ltd.

- 10.9 Doosan Bobcat

- 10.10 Clark Material Handling

- 10.11 Godrej & Boyce

- 10.12 Manitou Group

- 10.13 EP Equipment

- 10.14 Combilift

- 10.15 Unicarriers