|

市場調查報告書

商品編碼

1859026

嬰兒汽車安全座椅市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Baby Car Seat Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

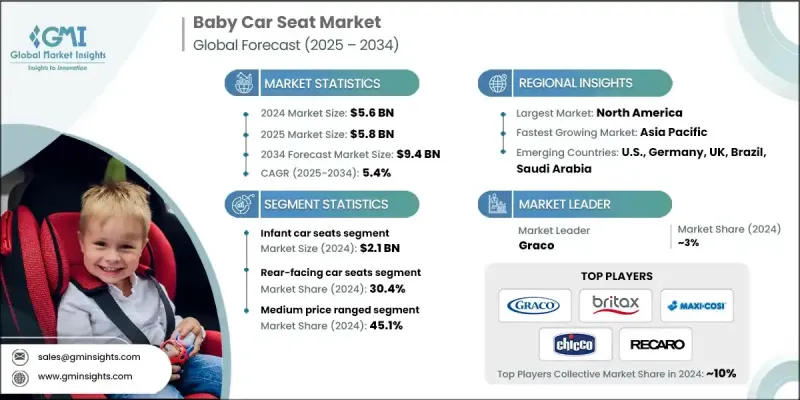

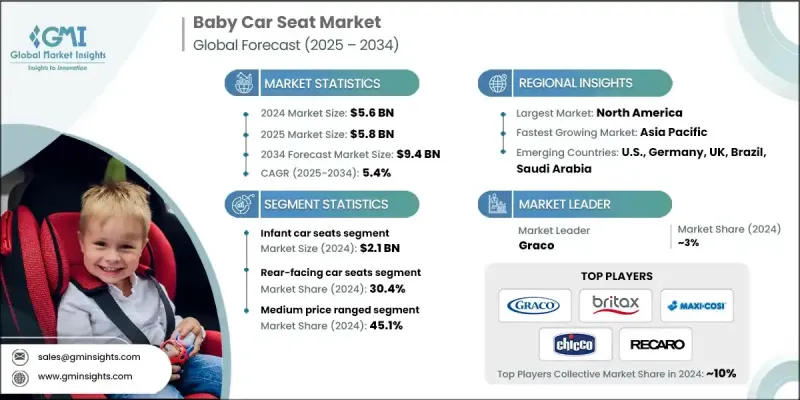

2024 年全球嬰兒汽車座椅市場價值為 56 億美元,預計到 2034 年將以 5.4% 的複合年成長率成長至 94 億美元。

政府法規仍是影響產業發展的關鍵因素。各國法律均要求使用適合兒童年齡的汽車安全座椅,違者將受到處罰。包括北美和歐洲標準在內的監管框架,強制執行嚴格的安全措施、碰撞測試和材料品質基準。因此,製造商必須在不斷改進產品線的同時,保持合規性。這些法規的不斷更新(通常會根據兒童安全方面的科學研究進行調整)確保了產品的持續開發和市場響應。技術進步正在推動高階細分市場的成長,尤其是在安全設計創新方面。現代嬰兒汽車安全座椅配備了先進的功能,例如側面碰撞保護系統、能量吸收材料以及透過 ISOFIX 介面實現的安全安裝。可轉換式安全座椅的需求也在不斷成長,這種座椅可以隨著兒童的成長而變化,提供後向和前向兩種安裝方式。防反彈桿、可調式底座、溫度調節布料以及符合人體工學的加長型設計等附加功能,越來越受到注重安全的消費者的青睞。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 56億美元 |

| 預測值 | 94億美元 |

| 複合年成長率 | 5.4% |

2024年,嬰兒汽車安全座椅市場規模達到21億美元,預計2025年至2034年將以5.4%的複合年成長率成長。這一成長主要得益於全球出生率的上升以及新手父母對嬰兒安全意識的增強。在醫療保健機構的指導和國家安全宣傳活動的推動下,許多照顧者現在優先考慮在嬰兒出生後的頭幾個月使用專門設計的汽車安全座椅。此外,醫院和兒科機構的鼓勵也進一步促進了早期使用,他們強調從嬰兒出院起就應該使用汽車安全座椅。

2024年,後向式兒童安全座椅市場佔有率達到30.4%,預計2034年將以5.6%的複合年成長率成長。由於其對嬰幼兒具有極佳的安全性,該類座椅持續受到歡迎。後向式設計能夠最大限度地減少脊椎、頭部和頸部的壓力,從而在碰撞事故中提供更佳的保護。隨著兒科專家和公共安全機構的日益認可,許多家長選擇使用後向安全座椅,即使超過法定最低使用期限,也能獲得更好的長期安全保障。

2024年,美國嬰兒汽車安全座椅市場規模預計將達15億美元。完善的兒童汽車安全法規以及消費者較高的安全意識,共同推動了美國市場對汽車安全座椅的穩定需求。美國消費者尤其青睞安全性能卓越、舒適度更高的高階車款。這些產品在電商平台和傳統零售通路的廣泛銷售,以及領先品牌不斷推陳出新,持續推動美國國內市場的擴張。

嬰兒汽車安全座椅市場的主要製造商包括Stokke、Goodbaby、BeSafe、Graco、Concord、Chicco、Britax、Maxi-Cosi、Aprica、Kiddy、Combi Corporation、Joyson Safety Systems、Jane Group、Recaro和Ailebebe。這些市場領導者正致力於透過產品創新、安全認證和策略性市場定位來鞏固其全球地位。許多品牌都在加大研發投入,以整合先進的安全功能、永續材料和模組化設計,從而提升產品的長期耐用性。與醫院、政府安全計畫和兒科機構的合作有助於提高品牌信任度和知名度。此外,各公司也正在拓展電商通路,並開發符合當地法規和消費者偏好的區域性產品線。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 提高對兒童乘車安全的認知

- 嚴格的政府法規

- 安全功能的技術進步

- 對高階和多功能座椅的需求日益成長

- 產業陷阱與挑戰

- 監理複雜性和合規成本

- 新興市場的價格敏感性

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL 分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品類型分類,2021-2034年

- 主要趨勢

- 嬰兒汽車座椅

- 可轉換式汽車座椅

- 組合式汽車座椅

- 增高座椅

- 高靠背增高座椅

- 無靠背增高座椅

第6章:市場估算與預測:依安裝類型分類,2021-2034年

- 主要趨勢

- 後向式汽車座椅

- 前向式汽車座椅

- 組合式汽車座椅

- 安全帶定位增高座椅

第7章:市場估算與預測:以重量計,2021-2034年

- 主要趨勢

- 低於50磅

- 50磅-100磅

- 超過100磅

第8章:市場估算與預測:依價格分類,2021-2034年

- 主要趨勢

- 低的

- 中等的

- 高的

第9章:市場估計與預測:依年齡層別分類,2021-2034年

- 主要趨勢

- 新生兒(0-6個月)

- 嬰兒(6個月-2歲)

- 幼兒(2-5歲)

- 其他(5歲以上)

第10章:市場估計與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 個人消費者

- 醫院和診所

- 托兒設施

- 汽車租賃公司

第11章:市場估價與預測:依配銷通路,2021-2034年

- 主要趨勢

- 線上

- 電子商務網站

- 公司自有網站

- 離線

- 超市/大型超市

- 百貨公司

- 其他

第12章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 印尼

- 馬來西亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第13章:公司簡介

- Ailebebe

- Aprica

- BeSafe

- Britax

- Chicco

- Combi Corporation

- Concord

- Goodbaby

- Graco

- Jane Group

- Joyson Safety Systems

- Kiddy

- Maxi-Cosi

- Recaro

- Stokke

The Global Baby Car Seat Market was valued at USD 5.6 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 9.4 billion by 2034.

Government regulations remain a key factor shaping the industry. Legal mandates across various countries require the use of car seats tailored to a child's age, and failure to comply can result in penalties. Regulatory frameworks, including North American and European standards, enforce rigorous safety measures, crash tests, and material quality benchmarks. As a result, manufacturers are compelled to maintain compliance while continuously improving their product lines. The evolving nature of these regulations, which are often updated in response to scientific research on child safety, ensures ongoing product development and market responsiveness. Technological advancements are fueling growth in premium segments, especially where innovation in safety design takes precedence. Modern baby car seats are equipped with advanced features such as side-impact protection systems, energy-absorbing materials, and secure mounting through ISOFIX compatibility. Demand is also rising for convertible seats that evolve with a child's growth, offering both rear-facing and forward-facing options. Added functionalities like anti-rebound bars, adjustable bases, temperature-regulating fabrics, and ergonomic designs for extended use are increasingly appealing to safety-conscious consumers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.6 Billion |

| Forecast Value | $9.4 Billion |

| CAGR | 5.4% |

The infant car seat segment generated USD 2.1 billion in 2024 and is expected to grow at a CAGR of 5.4% from 2025 to 2034. This growth is driven by a rising global birth rate and the growing awareness among new parents about infant safety. Many caregivers now prioritize using specially designed car seats during a baby's early months, prompted by guidance from healthcare providers and national safety awareness campaigns. Early adoption is further supported by institutional encouragement from hospitals and pediatric services that emphasize infant car seat usage from the moment of hospital discharge.

The rear-facing car seats segment held a 30.4% share in 2024 and is forecasted to grow at a CAGR of 5.6% through 2034. This category continues to gain popularity due to its strong safety profile for infants and toddlers. Rear-facing designs offer enhanced protection in collisions by minimizing stress on the spine, head, and neck. With growing endorsement from pediatric health professionals and public safety organizations, many parents are choosing to use rear-facing models beyond the legal minimum, extending use for better long-term safety outcomes.

U.S. Baby Car Seat Market was valued at USD 1.5 billion in 2024. The presence of established safety regulations requiring car seats for children, along with a high level of consumer awareness, contributes to stable demand in the country. U.S. consumers show a strong preference for high-end models with superior safety features and enhanced comfort. The broad availability of these products across both e-commerce platforms and traditional retail outlets, combined with constant updates and innovations from leading brands, continues to fuel domestic market expansion.

Key manufacturers active in the Baby Car Seat Market include Stokke, Goodbaby, BeSafe, Graco, Concord, Chicco, Britax, Maxi-Cosi, Aprica, Kiddy, Combi Corporation, Joyson Safety Systems, Jane Group, Recaro, and Ailebebe. Leading players in the Baby Car Seat Market are focusing on a mix of product innovation, safety certifications, and strategic market positioning to reinforce their global presence. Many brands are investing in R&D to integrate advanced safety features, sustainable materials, and modular designs that cater to long-term usability. Collaborations with hospitals, government safety programs, and pediatric institutions help improve trust and visibility. Companies are also expanding their e-commerce channels and developing region-specific product lines tailored to local regulations and preferences.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Installation type

- 2.2.4 Weight

- 2.2.5 Price

- 2.2.6 Age group

- 2.2.7 End use

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Heightened awareness of child passenger safety

- 3.2.1.2 Stringent government regulations

- 3.2.1.3 Technological advancements in safety features

- 3.2.1.4 Growing demand for premium and multi-functional seats

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Regulatory complexity and compliance costs

- 3.2.2.2 Price sensitivity in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behavior analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behavior

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product type, 2021 - 2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Infant car seats

- 5.3 Convertible car seats

- 5.4 Combination car seats

- 5.5 Booster car seats

- 5.5.1 High back booster seats

- 5.5.2 Backless booster seats

Chapter 6 Market Estimates & Forecast, By Installation Type, 2021 - 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Rear-facing car seats

- 6.3 Forward-facing car seats

- 6.4 Combination car seats

- 6.5 Belt-positioning booster seats

Chapter 7 Market Estimates & Forecast, By Weight, 2021 - 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Below 50 LB

- 7.3 50 LB- 100 LB

- 7.4 Above 100 LB

Chapter 8 Market Estimates & Forecast, By Price, 2021 - 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates & Forecast, By Age Group, 2021 - 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Newborn (0-6 months)

- 9.3 Infants (6 months- 2 years)

- 9.4 Toddlers (2-5 years)

- 9.5 others (above 5 years)

Chapter 10 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Individual consumers

- 10.3 Hospitals & clinics

- 10.4 Childcare facilities

- 10.5 Car rental companies

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Online

- 11.2.1 E-commerce websites

- 11.2.2 Company-owned websites

- 11.3 Offline

- 11.3.1 Supermarket/hypermarket

- 11.3.2 Departmental stores

- 11.3.3 Others

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.4.6 Indonesia

- 12.4.7 Malaysia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 Saudi Arabia

- 12.6.2 UAE

- 12.6.3 South Africa

Chapter 13 Company Profiles

- 13.1 Ailebebe

- 13.2 Aprica

- 13.3 BeSafe

- 13.4 Britax

- 13.5 Chicco

- 13.6 Combi Corporation

- 13.7 Concord

- 13.8 Goodbaby

- 13.9 Graco

- 13.10 Jane Group

- 13.11 Joyson Safety Systems

- 13.12 Kiddy

- 13.13 Maxi-Cosi

- 13.14 Recaro

- 13.15 Stokke