|

市場調查報告書

商品編碼

1859023

牙科CAD/CAM市場機會、成長促進因素、產業趨勢分析及2025-2034年預測Dental CAD/CAM Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

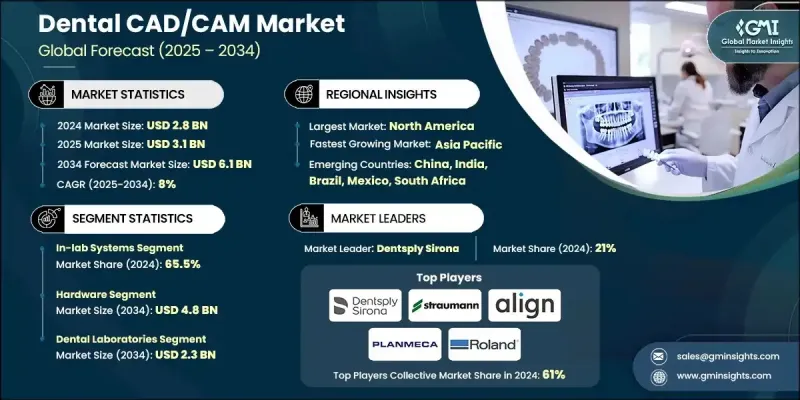

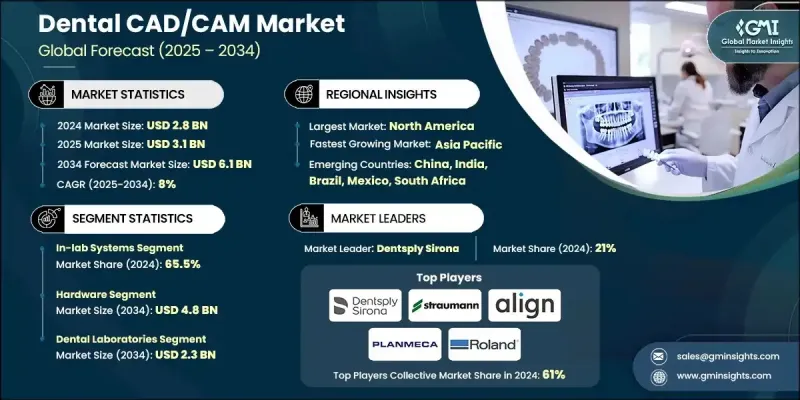

2024 年全球牙科 CAD/CAM 市場價值為 28 億美元,預計到 2034 年將以 8% 的複合年成長率成長至 61 億美元。

強勁的成長動力源自於牙科手術數量的增加、牙科疾病盛行率的上升以及數位化牙科技術的日益普及。隨著越來越多的人,特別是老年人群體,意識到口腔健康的重要性,牙科專業人員正擴大採用CAD/CAM技術,以提供更快、更精準、更人性化的治療。這些先進的系統顯著改善了牙冠、牙橋、貼面和義齒等牙科修復體的設計和製造,從而實現高度精準、高效且美觀的治療效果。 CAD/CAM解決方案透過最大限度地減少人為誤差和縮短治療時間,提高了患者滿意度和臨床療效。隨著對優質牙科修復體的需求不斷成長,牙科診所和技工室正逐步摒棄傳統的手工方法,轉而採用數位化工作流程。 CAD/CAM系統已成為修復和義齒治療的重要組成部分,為傳統方法提供了一種高效的替代方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 28億美元 |

| 預測值 | 61億美元 |

| 複合年成長率 | 8% |

2024年,由於其先進的處理複雜修復的能力、更高的精度、可擴展性和材料多樣性,實驗室內修復系統佔據了65.5%的市場。這些優勢使實驗室內修復系統成為大型牙科實驗室和綜合診所的首選。此細分市場的主導地位源於其高效處理大量病例並確保高品質修復效果的能力。

預計到2034年,牙科硬體市場規模將達到48億美元。這個市場主導地位主要得益於牙科硬體的創新,例如口內掃描器、銑床和3D列印機,這些創新正在徹底改變牙科印模和修復體的製作方式。例如,口內掃描儀正在取代傳統的實體印模,為患者提供更舒適、更有效率的體驗。

北美牙科CAD/CAM市場仍然是全球最大的牙科CAD/CAM系統區域市場,這得益於數位化牙科的廣泛應用、龐大的牙科專業人員群體以及對先進修復技術的巨額投資。該地區對精準度、美觀性和高效工作流程的重視,持續推動一般診所和專科診所對椅旁CAD/CAM系統的需求。這一成長趨勢在牙科服務機構、私人診所和學術機構中尤為明顯,它們都在利用這些技術來縮短治療時間並改善患者療效。

全球牙科CAD/CAM市場的主要參與者包括Roland DGA、Planmeca Oy、Ivoclar Vivadent、Align Technologies、3Shape、Dentsply Sirona、Zirkonzahn、Straumann AG、Jensen Dental、Dental Wings Inc.、Schagon Dental Group、Amann Girrbach、Datron AG、Entra Holdings.牙科CAD/CAM市場的企業正在採取多種策略來鞏固其市場地位。這些策略包括持續投入研發,旨在提高系統的精確度、速度和易用性。許多企業也與牙科診所、實驗室和研究機構建立策略合作夥伴關係,以增強產品供應並擴大市場覆蓋範圍。另一個關鍵策略是專注於人工智慧和機器學習技術的整合,以提高牙科修復體設計和製造流程的自動化程度。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 牙科手術數量不斷增加

- 牙科疾病發生率不斷上升

- 牙科領域CAD/CAM技術的應用日益廣泛

- 老年人口不斷增加

- CAD/CAM修復體相對於傳統修復體的優勢

- 產業陷阱與挑戰

- 牙科CAD/CAM設備的擁有成本高昂

- 低度開發地區意識較弱且購買力低下

- 市場機遇

- 與數位化牙科平台整合

- 開發緊湊且方便用戶使用的系統

- 成長促進因素

- 成長潛力分析

- 監管環境

- 技術格局

- 當前技術趨勢

- 新興技術

- 未來市場趨勢

- 2024年定價分析

- 專利分析

- 報銷方案

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依類型分類,2021-2034年

- 主要趨勢

- 實驗室內系統

- 辦公室系統

第6章:市場估算與預測:依組件分類,2021-2034年

- 主要趨勢

- 硬體

- 銑床

- 牙科3D印表機

- 掃描儀

- 軟體

- 基於雲端/Web

- 現場

第7章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 牙醫診所

- 牙科實驗室

- 牙科銑削中心

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- 3Shape

- Align Technologies

- Amann Girrbach

- Datron AG

- Dental Wings Inc.

- Dentsply Sirona

- Envista Holdings Corporation

- Hexagon AB

- imes-icore GmbH

- Ivoclar Vivadent

- Jensen Dental

- Planmeca Oy

- Roland DGA

- Schutz Dental Group

- Straumann AG

- Zirkonzahn

The Global Dental CAD/CAM Market was valued at USD 2.8 billion in 2024 and is estimated to grow at a CAGR of 8% to reach USD 6.1 billion by 2034.

The robust growth is driven by the rising number of dental procedures, the growing prevalence of dental diseases, and the increasing shift toward digital dentistry. As more people become aware of the importance of oral health, particularly among the aging population, dental professionals are increasingly adopting CAD/CAM technologies to provide faster, more accurate, and more patient-friendly treatments. These advanced systems significantly improve the design and manufacturing of dental restorations such as crowns, bridges, veneers, and dentures, enabling highly precise, efficient, and aesthetically pleasing outcomes. By minimizing human error and reducing treatment time, CAD/CAM solutions enhance patient satisfaction and clinical results. As the demand for superior dental restorations continues to rise, dental clinics and laboratories are moving away from traditional manual methods and adopting digital workflows. CAD/CAM systems have become a vital part of restorative and prosthetic dental care, offering an efficient alternative to conventional methods.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $6.1 Billion |

| CAGR | 8% |

The in-lab systems segment held a 65.5% share in 2024, due to their advanced capabilities to handle complex restorations with greater precision, scalability, and material versatility. These features make in-lab systems the preferred choice for large dental laboratories and multi-specialty clinics. The segment's dominance stems from its capacity to manage high-volume cases efficiently while ensuring top-quality results.

The hardware segment is expected to reach USD 4.8 billion by 2034. This dominance is driven by innovations in dental hardware, such as intraoral scanners, milling machines, and 3D printers, which are revolutionizing the production of dental impressions and restorations. Intraoral scanners, for instance, are replacing traditional physical impressions, offering a more comfortable and efficient experience for patients.

North America Dental CAD/CAM Market remains the largest regional market for dental CAD/CAM systems, supported by the widespread adoption of digital dentistry, a large pool of dental professionals, and substantial investments in advanced restorative technologies. The region's emphasis on precision, aesthetics, and efficient workflows continues to drive the demand for chairside CAD/CAM systems in both general and specialized practices. This growing trend is especially evident in dental service organizations, private clinics, and academic institutions, all of which are leveraging these technologies to reduce treatment times and enhance patient outcomes.

Leading players in the Global Dental CAD/CAM Market include Roland DGA, Planmeca Oy, Ivoclar Vivadent, Align Technologies, 3Shape, Dentsply Sirona, Zirkonzahn, Straumann AG, Jensen Dental, Dental Wings Inc., Schutz Dental Group, Amann Girrbach, Datron AG, Envista Holdings Corporation, Hexagon AB, and imes-icore GmbH. Companies in the Dental CAD/CAM Market are adopting a variety of strategies to strengthen their presence. These include continuous research and development efforts aimed at improving system precision, speed, and ease of use. Many are also forging strategic partnerships with dental clinics, laboratories, and research institutions to enhance product offerings and extend their market reach. Another key strategy is focusing on the integration of AI and machine learning technologies to improve the automation of dental restoration design and manufacturing processes.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Type trends

- 2.2.3 Component trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising number of dental procedures

- 3.2.1.2 Increasing prevalence of dental diseases

- 3.2.1.3 Growing adoption of CAD/CAM technology in dentistry

- 3.2.1.4 Rising geriatric population

- 3.2.1.5 Advantages of CAD/CAM restorations over conventional restorations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of ownership of dental CAD/CAM devices

- 3.2.2.2 Less awareness and low affordability in underdeveloped regions

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with digital dentistry platforms

- 3.2.3.2 Development of compact and user-friendly systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis, 2024

- 3.8 Patent analysis

- 3.9 Reimbursement scenario

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 In-lab systems

- 5.3 In-office systems

Chapter 6 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hardware

- 6.2.1 Milling machines

- 6.2.2 Dental 3D printers

- 6.2.3 Scanners

- 6.3 Software

- 6.3.1 Cloud/Web-based

- 6.3.2 On premise

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Dental clinics

- 7.3 Dental laboratories

- 7.4 Dental milling centres

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 3Shape

- 9.2 Align Technologies

- 9.3 Amann Girrbach

- 9.4 Datron AG

- 9.5 Dental Wings Inc.

- 9.6 Dentsply Sirona

- 9.7 Envista Holdings Corporation

- 9.8 Hexagon AB

- 9.9 imes-icore GmbH

- 9.10 Ivoclar Vivadent

- 9.11 Jensen Dental

- 9.12 Planmeca Oy

- 9.13 Roland DGA

- 9.14 Schutz Dental Group

- 9.15 Straumann AG

- 9.16 Zirkonzahn