|

市場調查報告書

商品編碼

1859018

呼吸防護設備市場機會、成長促進因素、產業趨勢分析及預測(2024-2032年)Respiratory Protective Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2024 - 2032 |

||||||

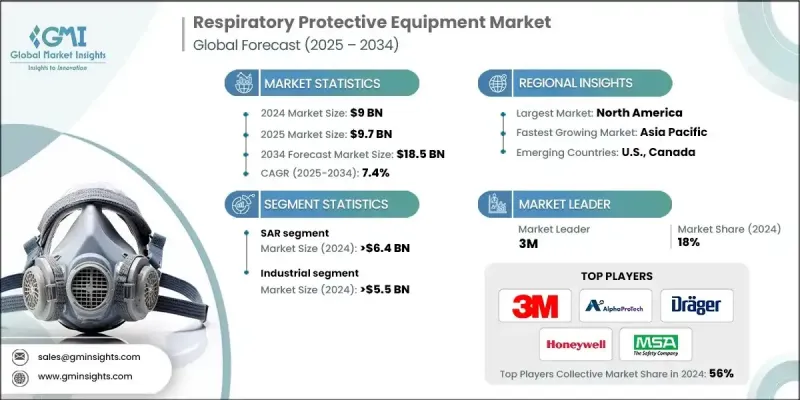

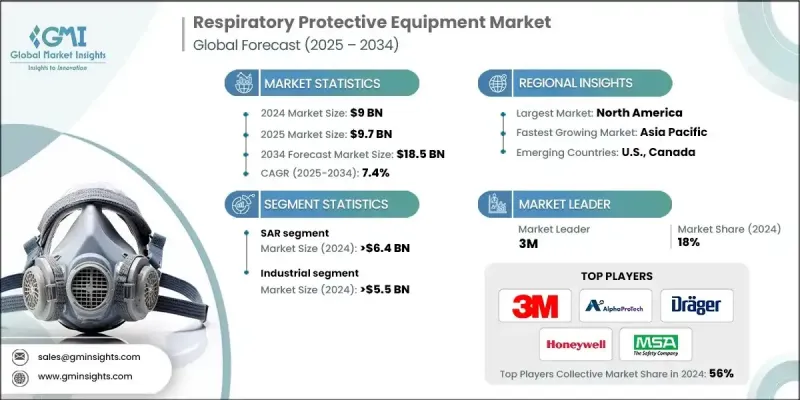

2024 年全球呼吸防護設備市場價值為 90 億美元,預計到 2034 年將以 7.4% 的複合年成長率成長至 185 億美元。

呼吸防護設備市場的成長主要源自於人們對空氣污染物相關健康風險的日益關注,以及呼吸系統疾病患者人數的不斷增加。此外,越來越多的產業和環境中的工人會接觸到有害粉塵、煙霧、蒸氣和傳染性病原體,這也推動了呼吸防護設備需求的持續成長。醫療保健、製造業、建築業和緊急服務等行業都是該市場的主要驅動力。隨著全球工作場所安全法規的日益嚴格,各行業都在大力投資高品質的呼吸防護設備,進一步促進了市場擴張。呼吸防護設備對於維護職業健康至關重要,尤其是在有害物質普遍存在的行業。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 90億美元 |

| 預測值 | 185億美元 |

| 複合年成長率 | 7.4% |

2024年,供氣式呼吸器(SAR)市場規模達到64億美元,預計2025年至2034年將以7.6%的複合年成長率成長。供氣式呼吸器通常用於密閉空間、危險化學品處理和消防等特殊應用領域。儘管供氣式呼吸器提供卓越的防護性能,但與其他類型的呼吸器相比,其維護和操作的複雜性使其不太適合日常工業用途。

2024 年,工業領域的市場規模達到 55 億美元。該領域的各行業正在加大對可重複使用空氣淨化呼吸器的投資,這種呼吸器經濟實惠且靈活,適用於經常接觸粉塵和化學品的環境。

2024年,美國呼吸防護設備市場佔86.5%的市場佔有率,市場規模達27億美元。憑藉其先進的工業體系和嚴格的安全法規,美國市場仍然是呼吸防護設備的主要驅動力。石油天然氣、航太和化學製造等行業都依賴高品質的呼吸器來保護員工安全。美國職業安全與健康管理局(OSHA)和國家職業安全與健康研究所(NIOSH)等監管機構透過制定嚴格的呼吸防護標準發揮著至關重要的作用,這促使了更先進的設備(例如具有即時監測功能的智慧型呼吸器)的研發。

全球呼吸防護設備產業的主要參與者包括霍尼韋爾國際公司 (Honeywell International Inc.)、桑德斯特羅姆安全公司 (Sundstrom Safety AB)、萊克蘭工業公司 (Lakeland Industries, Inc.)、德爾格公司 (Dragerwerk AG & Co. KGaA)、RPB Safety LLC、Bullard (Bullard)、Ataak、礦山安全公司 (Mta Plus)、Bull Plus公司 (Bull,公司Group)、阿爾法普羅科技公司 (Alpha Pro Tech)、雅芳防護系統公司 (Avon Protection Systems)、格森公司 (The Gerson Company) 和3B醫療公司 (3B Medical, Inc.)。為了鞏固市場地位,呼吸防護設備產業的公司正致力於持續創新,尤其是在智慧技術和改良材料的應用方面。許多公司優先開發即時監控、無線連接和增強過濾系統等先進功能,以滿足消費者對更安全、更有效率呼吸器日益成長的需求。此外,他們還在拓展全球分銷網路,並與醫療保健和危險環境等需要特殊防護的行業建立戰略合作夥伴關係。各公司也在投資永續材料,以吸引具有環保意識的消費者,從而進一步提升其在競爭激烈的市場中的佔有率。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預測模型

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 健康意識日益增強

- 轉向可重複使用的呼吸器

- 智慧科技的融合

- 注重舒適性和人體工學

- 產業陷阱與挑戰

- 供應鏈中斷

- 高昂的設備成本

- 市場機遇

- 醫療保健產業現代化

- 環保產品開發

- 新興經濟體的擴張

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:依產品分類,2021-2034年

- 主要趨勢

- 年利率

- 無動力

- 一次性過濾半面罩

- 可重複使用的半面罩

- 全臉面罩

- 動力

- 半臉面罩

- 全臉面罩

- 頭盔、兜帽和麵罩

- 無動力

- SAR

- 自給式呼吸器

- 航空呼吸器

- 其他

- 年利率

第6章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 工業的

- 醫療保健

- 軍事與航空

- 公共服務

- 消費者

第7章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 中東其他地區

第8章:公司簡介

- 3B Medical, Inc.

- 3M

- Alpha Pro Tech

- Avon Protection Systems

- Bullard

- Delta Plus Group

- Dragerwerk AG & Co. KGaA

- Honeywell International Inc.

- Lakeland Industries, Inc.

- Mine Safety Appliances (MSA)

- RPB Safety LLC

- Sundstrom Safety AB

- The Gerson Company

The Global Respiratory Protective Equipment Market was valued at USD 9 billion in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 18.5 billion by 2034.

The growth is driven by heightened awareness of health risks associated with airborne contaminants and the increasing number of individuals suffering from respiratory diseases. Moreover, the demand for RPE continues to rise due to the growing number of industries and environments where workers are exposed to harmful dust, fumes, vapors, and infectious agents. Sectors such as healthcare, manufacturing, construction, and emergency services are all key drivers of this market. As workplace safety regulations tighten globally, industries are investing heavily in high-quality respiratory protection, further fueling market expansion. Respiratory protective equipment is critical for maintaining occupational health, especially in industries where hazardous substances are prevalent.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9 Billion |

| Forecast Value | $18.5 Billion |

| CAGR | 7.4% |

The supplied-air respirators (SAR) segment reached USD 6.4 billion in 2024 and is expected to grow at a CAGR of 7.6% from 2025 to 2034. SARs are typically used in specialized applications such as confined spaces, hazardous chemical handling, and firefighting. Though SARs offer superior protection, their maintenance and operational complexity make them less suited for everyday industrial use compared to other types of respirators.

The industrial segment accounted for USD 5.5 billion in 2024. Industries in this segment are increasingly investing in reusable air-purifying respirators, which are cost-effective and flexible for environments where exposure to dust and chemicals is common.

U.S. Respiratory Protective Equipment Market held 86.5% share and generated USD 2.7 billion in 2024. The U.S. market remains a key driver for respiratory protective equipment due to its advanced industrial sectors and stringent safety regulations. Industries like oil and gas, aerospace, and chemical manufacturing rely on high-quality respirators to safeguard their workforce. Regulatory bodies such as OSHA and NIOSH play a crucial role by setting strict standards for respiratory protection, which has led to the development of more advanced devices, such as smart respirators with real-time monitoring capabilities.

Prominent players in the Global Respiratory Protective Equipment Industry include Honeywell International Inc., Sundstrom Safety AB, Lakeland Industries, Inc., Dragerwerk AG & Co. KGaA, RPB Safety LLC, Bullard, Mine Safety Appliances (MSA), 3M, Delta Plus Group, Alpha Pro Tech, Avon Protection Systems, The Gerson Company, and 3B Medical, Inc. To strengthen their presence, companies in the respiratory protective equipment sector are focusing on continuous innovation, especially through the integration of smart technologies and improved materials. Many firms are prioritizing the development of advanced features such as real-time monitoring, wireless connectivity, and enhanced filtration systems to meet the growing demand for safer and more efficient respirators. Additionally, they are expanding their global distribution networks and forging strategic partnerships with industries that require specialized protection, such as healthcare and hazardous environments. Companies are also investing in sustainable materials to appeal to eco-conscious consumers, further enhancing their market share in the competitive landscape.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising health awareness

- 3.2.1.2 Shift toward reusable respirators

- 3.2.1.3 Integration of smart technologies

- 3.2.1.4 Focus on comfort and ergonomics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Supply chain disruptions

- 3.2.2.2 High equipment costs

- 3.2.3 Market opportunities

- 3.2.3.1 Healthcare sector modernization

- 3.2.3.2 Eco-friendly product development

- 3.2.3.3 Expansion in emerging economies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.12 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 (USD Billion, Units)

- 5.1 Key trends

- 5.1.1 APR

- 5.1.1.1 Unpowered

- 5.1.1.1.1 Disposable filtering half mask

- 5.1.1.1.2 Reusable half mask

- 5.1.1.1.3 Full-face mask

- 5.1.1.2 Powered

- 5.1.1.2.1 Half face mask

- 5.1.1.2.2 Full-face mask

- 5.1.1.2.3 Helmets, hoods & visors

- 5.1.1.1 Unpowered

- 5.1.2 SAR

- 5.1.2.1 SCBA

- 5.1.2.2 Airline respirator

- 5.1.3 Others

- 5.1.1 APR

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion, Units)

- 6.1 Key trends

- 6.2 Industrial

- 6.3 Medical & healthcare

- 6.4 Military & aviation

- 6.5 Public service

- 6.6 Consumer

Chapter 7 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion, Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

- 7.6.4 Rest of Middle East Asia

Chapter 8 Company Profiles

- 8.1 3B Medical, Inc.

- 8.2 3M

- 8.3 Alpha Pro Tech

- 8.4 Avon Protection Systems

- 8.5 Bullard

- 8.6 Delta Plus Group

- 8.7 Dragerwerk AG & Co. KGaA

- 8.8 Honeywell International Inc.

- 8.9 Lakeland Industries, Inc.

- 8.10 Mine Safety Appliances (MSA)

- 8.11 RPB Safety LLC

- 8.12 Sundstrom Safety AB

- 8.13 The Gerson Company