|

市場調查報告書

商品編碼

1859003

光纖連接器市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Fiber Optic Connector Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

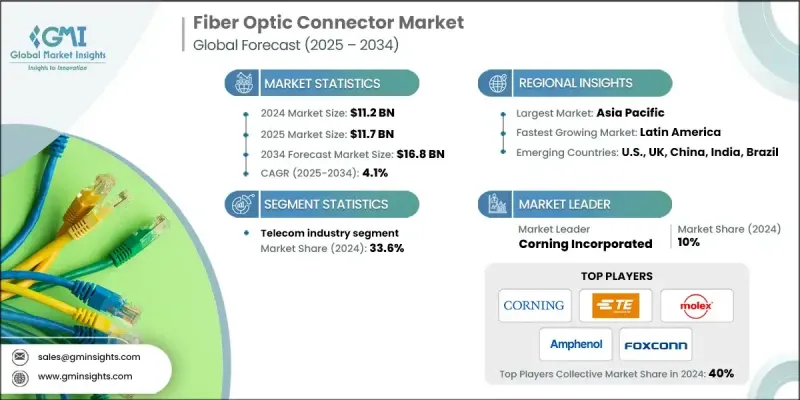

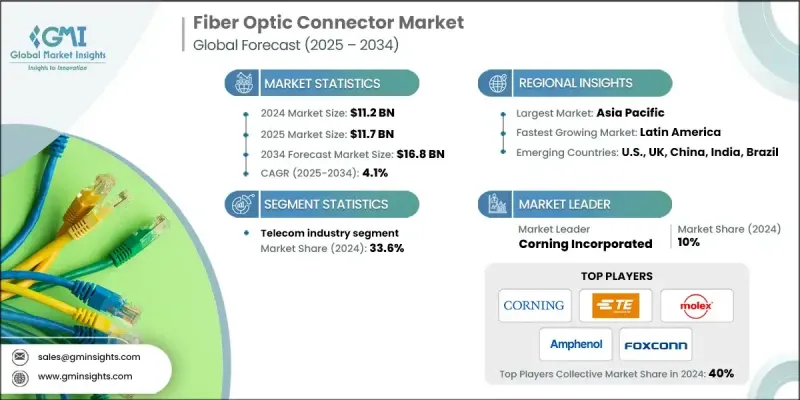

2024 年全球光纖連接器市值為 112 億美元,預計到 2034 年將以 4.1% 的複合年成長率成長至 168 億美元。

全球對快速穩定網路連線的需求日益成長,加之各國政府大力推動寬頻基礎建設,持續推動市場成長。隨著電信業者加強光纖到府部署並推動5G部署,對高效率光纖連接器的需求也日益迫切。對即時串流媒體和線上遊戲等高頻寬服務的日益依賴,要求資料傳輸系統具備強大的彈性,這使得光纖連接器成為至關重要的基礎設施組件。此外,在農村地區擴建計畫中,模組化、可擴展的網路至關重要,光纖連接器的需求也隨之成長。同時,智慧交通、連網汽車和物聯網整合交通系統的進步也促進了耐用型高頻連接器的應用。城市網路密集化策略和數位化公共交通系統的日益普及進一步推動了緊湊型光纖連接器的使用。公共和私營部門對高速鐵路和數位物流基礎設施的持續投資,正在強化市場格局,因為光纖在為不斷擴展的智慧城市網路提供低延遲連接和即時通訊方面發揮著核心作用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 112億美元 |

| 預測值 | 168億美元 |

| 複合年成長率 | 4.1% |

2024年,電信業佔據33.6%的市場佔有率,預計到2034年將以4.3%的複合年成長率成長。電信業的發展與人工智慧賦能的網路以及最後一公里光纖系統的加速部署日益緊密相關。光纖連接器在確保人工智慧應用和數位包容性所需的低延遲、高速資料基礎設施方面發揮著至關重要的作用。眾多政府主導的措施正加速最後一公里光纖的部署,使電信業成為光纖需求的重要來源。

2024年,交通運輸業預計將創造5.6億美元的收入,這主要得益於技術現代化、物流自動化以及全球電動車(EV)網路的不斷擴展。交通運輸和物流營運的數位轉型正在推動對光纖連接器的需求,以實現即時資料通訊、預測分析和基於感測器的系統。在公共和私人戰略資金的支持下,電動車充電基礎設施的快速擴張進一步增強了該行業對光纖連接的依賴,以最佳化車輛和電網之間的通訊。

預計到2024年,北美光纖連接器市場將佔據79%的佔有率,市場規模將達到17億美元。美國市場持續蓬勃發展,主要得益於國內光纖生產和數位基礎建設投資的不斷成長。工業連接的擴展以及國家寬頻建設的強勁目標,都對區域市場的表現做出了顯著貢獻。

全球光纖連接器市場的主要參與者包括 Molex、Aptiv、Phoenix Contact、AVX、立訊精密、Amphenol、3M、矢崎、TE Connectivity、康寧、Glenair、Fischer Connectors、GTK、廣瀨電機、Douglas Electrical Components、Lappi.光纖連接器市場的領導者正投資於先進的連接器小型化技術,以支援緊湊型設備和更高的資料速度。為了滿足電信和智慧基礎設施領域日益成長的需求,多家企業正專注於產品創新,致力於開發堅固耐用、高密度和高頻連接器。與電信營運商和智慧交通整合商的合作有助於企業獲得長期供應契約,並在 5G 和互聯交通等新興技術領域保持領先地位。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 監管環境

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

- 新興機會與趨勢

- 數位化和物聯網整合

- 新興市場滲透

第4章:競爭格局

- 介紹

- 按地區分類的公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 策略舉措

- 競爭性標竿分析

- 戰略儀錶板

- 創新與技術格局

第5章:市場規模及預測:依最終用途分類,2021-2034年

- 主要趨勢

- 電信

- 運輸

- 汽車

- 工業的

- 電腦及周邊設備

- 其他

第6章:市場規模及預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第7章:公司簡介

- 3M

- Ametek

- Amphenol

- Aptiv

- AVX

- Corning Incorporated

- Douglas Electrical Components

- Fischer Connectors

- Foxconn

- Glenair

- GTK

- Hirose Electric

- Lapp Group

- Luxshare Precision

- Mencom

- Molex

- Phoenix Contact

- Rosenberger

- TE Connectivity

- Thermalogic Corporation

- Yazaki

The Global Fiber Optic Connector Market was valued at USD 11.2 billion in 2024 and is estimated to grow at a CAGR of 4.1% to reach USD 16.8 billion by 2034.

The increasing global demand for fast and stable internet connectivity, paired with strong governmental initiatives focused on broadband infrastructure development, continues to elevate market growth. As telecommunications providers enhance fiber-to-the-home rollouts and advance 5G deployments, the need for high-efficiency fiber optic connectors has intensified. Growing reliance on bandwidth-intensive services, such as real-time streaming and online gaming, demands resilient data transmission systems-positioning fiber connectors as essential infrastructure components. Additionally, fiber optic connector demand is gaining traction across rural expansion projects where modular, scalable networking is critical. In parallel, advancements in smart mobility, connected vehicles, and IoT-integrated transport systems are also spurring the adoption of durable, high-frequency connectors. Urban network densification strategies and rising adoption of digital public transit systems further support the use of compact fiber connectors. Continued public and private sector investments in high-speed rail and digital logistics infrastructure are strengthening the market landscape, as fiber optics plays a central role in delivering low-latency connectivity and real-time communication across expanding smart city grids.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.2 Billion |

| Forecast Value | $16.8 Billion |

| CAGR | 4.1% |

In 2024, the telecom sector held a 33.6% share and is expected to grow at a CAGR of 4.3% through 2034. The telecom industry's evolution is increasingly tied to AI-enabled networks and the accelerated rollout of last-mile fiber systems. Fiber optic connectors play a critical role in ensuring the low-latency, high-speed data infrastructure needed for artificial intelligence applications and digital inclusivity. Numerous government-led initiatives are intensifying last-mile fiber deployments, positioning telecom as a stronghold for fiber optic demand.

The transportation sector generated USD 560 million in 2024, driven by technological modernization, automation in logistics, and the expanding global electric vehicle (EV) network. Digital transformation across transportation and logistics operations is pushing demand for fiber connectors to enable real-time data communication, predictive analytics, and sensor-based systems. The rapid scaling of EV charging infrastructure supported by strategic public and private funding is further increasing the sector's reliance on fiber connectivity to optimize vehicle and grid communication.

North America Fiber Optic Connector Market held 79% share in 2024, generating USD 1.7 billion. The market in the U.S. continues to thrive due to rising investments in domestic fiber production and digital infrastructure buildout. Expanding industrial connectivity, coupled with robust national broadband goals, is contributing significantly to regional market performance.

Key players active in the Global Fiber Optic Connector Market include Molex, Aptiv, Phoenix Contact, AVX, Luxshare Precision, Amphenol, 3M, Yazaki, TE Connectivity, Corning Incorporated, Glenair, Fischer Connectors, GTK, Hirose Electric, Douglas Electrical Components, Lapp Group, Mencom, Rosenberger, Thermalogic Corporation, and Foxconn. Leading companies in the fiber optic connector market are investing in advanced connector miniaturization to support compact devices and higher data speeds. To align with rising demand from telecom and smart infrastructure sectors, several players are focusing on product innovation targeting ruggedized, high-density, and high-frequency connectors. Collaborations with telecom providers and smart mobility integrators help companies secure long-term supply contracts and stay ahead in evolving technologies like 5G and connected transportation.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East and Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By End use, 2021 - 2034 (USD Million, Million Units)

- 5.1 Key trends

- 5.2 Telecom

- 5.3 Transportation

- 5.4 Automotive

- 5.5 Industrial

- 5.6 Computer & peripherals

- 5.7 Others

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034 (USD Million, Million Units)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.2.3 Mexico

- 6.3 Europe

- 6.3.1 Germany

- 6.3.2 UK

- 6.3.3 France

- 6.3.4 Italy

- 6.3.5 Spain

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 Australia

- 6.4.3 India

- 6.4.4 Japan

- 6.4.5 South Korea

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 UAE

- 6.5.3 South Africa

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Argentina

Chapter 7 Company Profiles

- 7.1 3M

- 7.2 Ametek

- 7.3 Amphenol

- 7.4 Aptiv

- 7.5 AVX

- 7.6 Corning Incorporated

- 7.7 Douglas Electrical Components

- 7.8 Fischer Connectors

- 7.9 Foxconn

- 7.10 Glenair

- 7.11 GTK

- 7.12 Hirose Electric

- 7.13 Lapp Group

- 7.14 Luxshare Precision

- 7.15 Mencom

- 7.16 Molex

- 7.17 Phoenix Contact

- 7.18 Rosenberger

- 7.19 TE Connectivity

- 7.20 Thermalogic Corporation

- 7.21 Yazaki