|

市場調查報告書

商品編碼

1858998

血管閉合裝置市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Vascular Closure Device Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

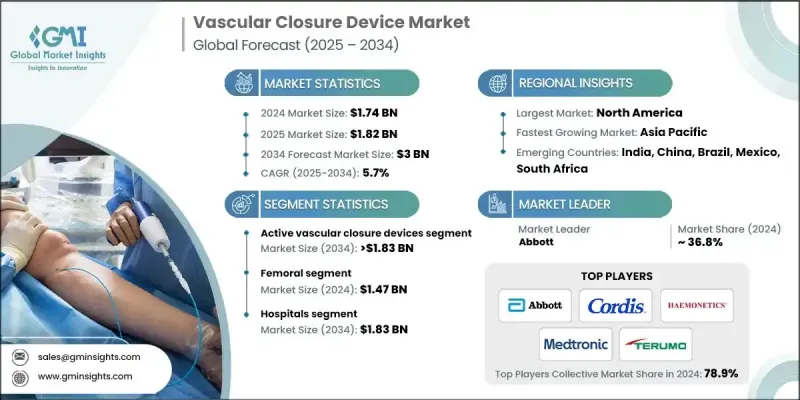

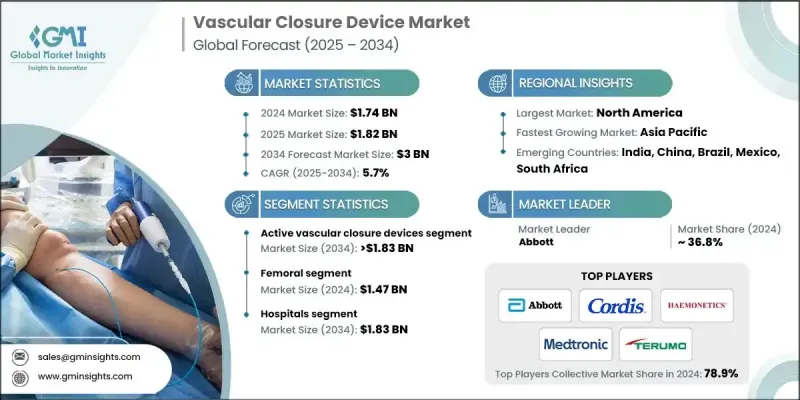

2024 年全球血管閉合裝置市值為 17.4 億美元,預計到 2034 年將以 5.7% 的複合年成長率成長至 30 億美元。

血管閉合裝置市場成長可歸因於多種因素,包括心血管疾病盛行率上升、介入性心臟病學和放射學手術發展,以及對門診和當日出院手術需求的增加。血管閉合裝置是重要的醫療器械,用於在導管插入術後封閉動脈穿刺口,其使用方式包括機械夾、縫線或膠原蛋白塞。與傳統的止血方法(如手動壓迫)相比,這些裝置能夠更快、更有效地止血,縮短止血時間,並最大限度地減少患者的恢復時間。隨著冠狀動脈疾病和心臟衰竭等心血管疾病在全球範圍內的發病率上升,血管造影和介入手術的數量也隨之增加,進一步推動了對血管閉合裝置的需求。此外,生物可吸收閉合裝置和血管外密封系統等創新技術的出現,透過解決出血和感染等併發症,擴大了血管閉合裝置的應用範圍,從而改善了患者預後,並加速了市場成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 17.4億美元 |

| 預測值 | 30億美元 |

| 複合年成長率 | 5.7% |

由於其卓越的療效、更快的止血速度和更低的併發症發生率,主動式血管閉合裝置在2024年佔據了59.3%的市場佔有率。包括縫線型和膠原蛋白型在內的主動式血管閉合裝置(VCD)因其能夠閉合血管通路部位,從而加快患者恢復並提高導管介入手術的效率,越來越受到醫生的青睞。預計該細分市場將繼續保持領先地位,因為它能夠提高導管室的效率並縮短手術時間。

2025年至2034年間,橈動脈段的複合年成長率將達4.4%。由於橈動脈入路出血併發症風險較低,且與股動脈入路相比恢復速度更快,因此正逐漸成為介入性心臟病學的首選入路。醫療機構中橈動脈手術數量的不斷增加,也推動了該領域專用血管閉合裝置的需求。

2024年,北美血管閉合裝置市佔率達44.9%。先進的醫療基礎設施、尖端的導管實驗室以及技術精湛的介入性心臟病專家,促進了縫合式和膠原蛋白式等先進血管閉合裝置的廣泛應用。微創心血管手術旨在縮短恢復時間、降低醫療成本,這一趨勢進一步推動了對這些裝置的需求。

全球血管閉合器材市場的主要參與者包括美敦力(Medtronic)、泰利福(Teleflex)、美瑞醫療(MERIT MEDICAL)、雅培(Abbott)、瑞克斯醫療(Rex Medical)、科迪斯(Cordis)、恩賽特血管(Ensite Vascular)、泰爾茂維爾(Terumrumo)、海蒙內特血管(ViHAa)(YEMFal特性)、醫學尼科) Technologies、Vasorum、Tricol Biomedical 和 Meril。為了鞏固市場地位,全球血管閉合器材市場的企業致力於提升產品創新能力並改善病患預後。許多公司正在投資研發先進的微創技術,以減少併發症並縮短恢復時間。與醫療機構和研究機構建立策略合作夥伴關係和開展合作也是擴大市場覆蓋範圍和獲得臨床驗證的常見做法。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 心血管疾病患者人數不斷增加

- 老年人口不斷增加

- 血管閉合裝置的技術進步

- 介入性心臟病學和放射學手術量不斷增加

- 產業陷阱與挑戰

- 術後併發症風險較高

- 嚴格的監管環境

- 市場機遇

- 拓展新興市場

- 生物可吸收和新一代閉合裝置的研發

- 成長促進因素

- 成長潛力分析

- 報銷方案

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 技術格局

- 當前技術趨勢

- 新興技術

- 差距分析

- 波特的分析

- PESTEL 分析

- 未來市場趨勢

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 競爭定位矩陣

- 主要市場參與者的競爭分析

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新設備類型發布

- 擴張計劃

第5章:市場估算與預測:依設備類型分類,2021-2034年

- 主要趨勢

- 主動血管閉合裝置

- 膠原蛋白塞介導裝置

- 縫合介導裝置

- 訂書釘/夾子介導的VCD

- 被動式血管閉合裝置

- 止血墊/貼片

- 壓縮裝置

第6章:市場估算與預測:依接取量分類,2021-2034年

- 主要趨勢

- 股骨

- 徑向

第7章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 醫院

- 門診手術中心

- 其他最終用途

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Abbott

- Cordis

- Ensite Vascular

- HAEMONETICS

- Medtronic

- Meril

- MERIT MEDICAL

- Rex Medical

- Teleflex

- TERUMO

- Transluminal Technologies

- Tricol Biomedical

- TZ Medical

- Vasorum

- Vivasure Medical

The Global Vascular Closure Device Market was valued at USD 1.74 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 3 billion by 2034.

This growth can be attributed to several factors, including the rising prevalence of cardiovascular diseases, the growth of interventional cardiology and radiology procedures, and the increasing demand for outpatient and same-day discharge procedures. Vascular closure devices are essential medical tools designed to seal arterial punctures after catheterization procedures, either using mechanical clips, sutures, or collagen plugs. These devices offer quicker and more efficient hemostasis compared to traditional methods like manual compression, reducing the time needed for bleeding cessation and minimizing patient downtime. As cardiovascular diseases like coronary artery disease and heart failure rise globally, more angiographies and interventional procedures are performed, further driving the demand for vascular closure devices. Additionally, innovations such as bioabsorbable closure devices and extravascular sealing systems have expanded the adoption of VCDs by addressing complications like bleeding and infection, which improves patient outcomes and accelerates market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.74 Billion |

| Forecast Value | $3 Billion |

| CAGR | 5.7% |

The active vascular closure devices segment held 59.3% share in 2024, owing to their superior efficacy, faster hemostasis times, and lower complication rates. Active VCDs, including suture-based and collagen-based devices, are increasingly preferred by physicians for their ability to close vascular access sites, enabling faster recovery and more efficient catheterization procedures. This segment is expected to maintain its leadership as it allows for improved cath lab performance and shorter operation times.

The radial artery segment will grow at a CAGR of 4.4% during 2025-2034. Radial access is becoming the preferred choice in interventional cardiology because it carries a lower risk of bleeding complications and allows for faster recovery compared to femoral access. The increasing number of radial artery procedures performed in healthcare settings is driving the demand for specialized closure devices in this area.

North America Vascular Closure Device Market held a 44.9% share in 2024. The presence of advanced healthcare infrastructure, cutting-edge catheterization labs, and highly skilled interventional cardiologists contributes to the widespread acceptance and use of advanced VCDs, such as suture-mediated and collagen-based devices. The trend towards minimally invasive cardiovascular procedures, designed to shorten recovery times and reduce healthcare costs, further boosts the demand for these devices.

Key players in the Global Vascular Closure Device Market include Medtronic, Teleflex, MERIT MEDICAL, Abbott, Rex Medical, Cordis, Ensite Vascular, Terumo, HAEMONETICS, Vivasure Medical, Transluminal Technologies, Vasorum, Tricol Biomedical, and Meril. To solidify their market position, companies in the Global Vascular Closure Device Market focus on enhancing product innovation and improving patient outcomes. Many companies are investing in the development of advanced, minimally invasive technologies that reduce complications and recovery times. Strategic partnerships and collaborations with healthcare providers and research institutions are also common to expand market reach and gain clinical validation.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Device type trends

- 2.2.3 Access trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing number of patients suffering from cardiovascular diseases

- 3.2.1.2 Growing geriatric population

- 3.2.1.3 Technological advancements in vascular closure devices

- 3.2.1.4 Rising volume of interventional cardiology and radiology procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High risk associated with post-procedural complications

- 3.2.2.2 Stringent regulatory scenario

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into emerging markets

- 3.2.3.2 Development of bioresorbable and next-generation closure devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Reimbursement scenario

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.6 Technology landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Vascular closure device market, 2021-2034 (Units)

- 3.7.1 North America

- 3.7.2 Europe

- 3.7.3 Asia Pacific

- 3.7.4 Latin America

- 3.7.5 Middle East and Africa

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New device type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Device Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Active vascular closure devices

- 5.2.1 Collagen plug mediated device

- 5.2.2 Suture-mediated devices

- 5.2.3 Staple/clip-mediated VCD

- 5.3 Passive vascular closure devices

- 5.3.1 Haemostasis pads/patches

- 5.3.2 Compression devices

Chapter 6 Market Estimates and Forecast, By Access, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Femoral

- 6.3 Radial

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott

- 9.2 Cordis

- 9.3 Ensite Vascular

- 9.4 HAEMONETICS

- 9.5 Medtronic

- 9.6 Meril

- 9.7 MERIT MEDICAL

- 9.8 Rex Medical

- 9.9 Teleflex

- 9.10 TERUMO

- 9.11 Transluminal Technologies

- 9.12 Tricol Biomedical

- 9.13 TZ Medical

- 9.14 Vasorum

- 9.15 Vivasure Medical