|

市場調查報告書

商品編碼

1858995

血壓計市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Sphygmomanometer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

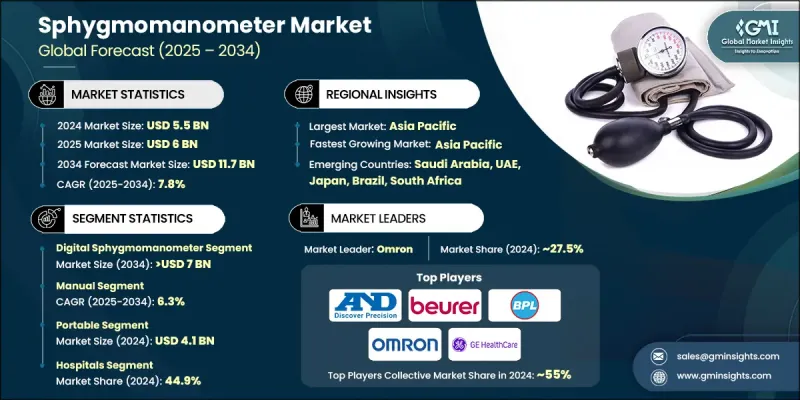

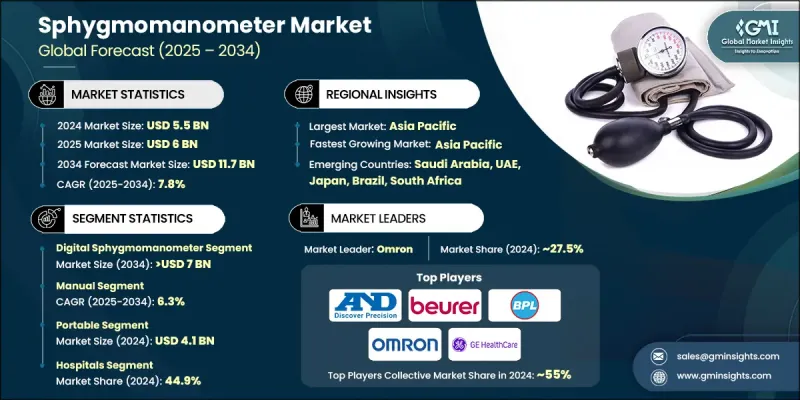

2024 年全球血壓計市場價值為 55 億美元,預計到 2034 年將以 7.8% 的複合年成長率成長至 117 億美元。

全球高血壓和心血管疾病發病率不斷上升、人口老化、健康意識增強以及各國政府大力推廣預防保健和早期診斷,共同推動了血壓監測市場的成長。其中一個主要因素是家庭醫療保健和遠端監測解決方案需求的激增。不良的營養、缺乏運動和高壓力等生活方式的改變加劇了高血壓的流行。隨著越來越多的人尋求可靠且便捷的健康追蹤方案,對易於使用的血壓監測儀的需求持續成長。血壓計是一種用於測量血壓的醫療設備,通常由袖帶、壓力表和充氣裝置組成,充氣裝置可以是手動的,也可以是自動的。人們越來越重視自我監測和早期檢測,這使得血壓計成為現代醫療保健趨勢的核心,既可用於臨床應用,也可用於個人健康追蹤。市場上的一個顯著變化是向數位化技術的轉變。自動血壓計憑藉其內建記憶體、進度追蹤和無線資料傳輸等先進功能,獲得了廣泛的認可。這些數位工具能夠與健康應用程式和雲端系統無縫整合,使用戶更容易管理自己的健康狀況並與醫療專業人員交流數據。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 55億美元 |

| 預測值 | 117億美元 |

| 複合年成長率 | 7.8% |

由於其用戶友善性、讀數精準以及在個人和臨床環境中的快速普及,預計到2024年,數位血壓計市場佔有率將達到56.7%。這些設備採用示波法測量,無需人工聽診,從而最大限度地減少人為誤差,並獲得更一致的讀數。此外,藍牙和應用程式的整合也使其在遠距醫療和虛擬醫療保健模式中得到更廣泛的應用。

預計到2034年,手動血壓計市場將以6.3%的複合年成長率成長。儘管數位血壓計廣受歡迎,手動血壓計因其無可比擬的精準度,在醫療領域仍備受推崇。它們在臨床評估中仍然發揮著重要作用,尤其是在需要透過聽診進行精確評估的情況下,例如高風險患者群體或臨床研究。此外,在那些優先考慮診斷可靠性而非便利性的醫療環境中,手動血壓計也備受青睞。

北美血壓計市場預計到2034年將以5.3%的複合年成長率成長,這主要得益於完善的醫療保健體系、人們對心血管健康的高度重視以及消費者對遠端患者監測技術的日益普及。此外,該地區還受益於有利的醫療報銷政策,提高了家用監測設備的可近性。美國食品藥物管理局(FDA)等監管機構確保產品的安全性和性能,增強了市場信心並推動了需求。包括聯邦醫療保險(Medicare)和私人保險在內的廣泛保險覆蓋進一步促進了家庭血壓計的成長。

全球血壓計市場的主要參與者包括GE醫療、博雅(Beurer)、歐姆龍(OMRON)、BPL、ADC、ACCOSON、Bosch(BOSCH + SOHN)、PRESTIGE MEDICAL、SUNTECH、Riester、microlife、Little Doctor、Rossmax、Spengler和AND。為了鞏固其在全球血壓計市場的地位,領先企業正致力於採取多項策略措施。這些舉措包括持續的產品創新、整合先進的數位功能(例如應用程式連接和基於人工智慧的分析)以及拓展其全球分銷網路。許多公司正在加大研發投入,以提高血壓計的準確性、舒適性和易用性,從而滿足專業醫療保健人員和家庭用戶的需求。與遠距醫療平台和醫療機構建立策略夥伴關係也對提高血壓計的普及率起著關鍵作用。此外,各公司正在根據不同的用戶需求客製化產品線,從便於攜帶的攜帶式設備到診所使用的專業級血壓計,從而確保在多個客戶群中佔據穩固的地位。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 高血壓和心血管疾病盛行率不斷上升

- 政府推行促進預防性醫療保健和早期診斷的舉措

- 技術進步

- 對家庭醫療保健和遠距病人監護的需求不斷成長。

- 產業陷阱與挑戰

- 嚴格的法規核准和合規性

- 市場機遇

- 新興經濟體醫療保健基礎設施的擴建

- 採用電子血壓計

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 技術格局

- 目前技術

- 新興技術

- 未來市場趨勢

- 消費者行為分析

- 2021-2024年各地區高血壓病例數

- 報銷方案

- 管道分析

- 投資環境

- 2024年定價分析

- 波特的分析

- PESTEL 分析

- 差距分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品分類,2021-2034年

- 主要趨勢

- 電子血壓計

- 臂式電子血壓計

- 腕式電子血壓計

- 無液體血壓計

- 水銀血壓計

第6章:市場估算與預測:依營運方式分類,2021-2034年

- 主要趨勢

- 手動的

- 自動的

- 半自動

第7章:市場估算與預測:依配置分類,2021-2034年

- 主要趨勢

- 便攜的

- 桌面安裝

- 落地式

- 壁掛式

第8章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 醫院

- 居家照護

- 門診手術中心

- 其他最終用途

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- ACCOSON

- ADC

- AND

- beurer

- BOSCH + SOHN

- BPL

- GE Healthcare

- Little Doctor

- microlife

- Omron

- PRESTIGE MEDICAL

- Riester

- rossmax

- Spengler

- SUNTECH

The Global Sphygmomanometer Market was valued at USD 5.5 billion in 2024 and is estimated to grow at a CAGR of 7.8% to reach USD 11.7 billion by 2034.

This growth is fueled by the increasing global incidence of hypertension and cardiovascular conditions, the aging population, growing health awareness, and strong initiatives by governments promoting preventive care and early diagnosis. A major contributing factor is the surge in demand for home healthcare and remote monitoring solutions. Lifestyle shifts characterized by poor nutrition, physical inactivity, and elevated stress levels have intensified the prevalence of high blood pressure. As more individuals seek reliable and simple solutions to track their health, demand for user-friendly blood pressure monitors continues to rise. A sphygmomanometer is a medical device used to measure blood pressure and typically consists of a cuff, a pressure gauge, and an inflation mechanism, which may be manual or automated. The growing focus on self-monitoring and early detection has placed these devices at the center of modern healthcare trends, supporting both clinical applications and personal wellness tracking. A notable transformation in the market is the shift toward digital technology. Automated sphygmomanometers have gained significant traction due to advanced features such as internal memory, progress tracking, and wireless data transmission. These digital tools enable seamless integration with health apps and cloud-based systems, making it easier for users to manage their health and communicate readings with medical professionals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.5 Billion |

| Forecast Value | $11.7 Billion |

| CAGR | 7.8% |

The digital segment held a 56.7% share in 2024, owing to its user-friendliness, precise readings, and rapid uptake in personal and clinical environments. These devices use oscillometric measurement methods, which eliminate the need for manual auscultation, minimizing human error and allowing for more consistent readings. Additionally, the integration of Bluetooth and app compatibility has allowed for wider adoption in telemedicine and virtual healthcare models.

The manual sphygmomanometers segment is expected to grow at a CAGR of 6.3% through 2034. Despite the popularity of digital devices, manual monitors remain highly regarded in medical settings for their unmatched accuracy. They continue to be relied upon in clinical assessments, especially where auscultation is preferred for precise evaluation, such as in high-risk patient populations or clinical studies. These devices are also favored in healthcare environments that prioritize diagnostic reliability over convenience.

North America Sphygmomanometer Market is projected to grow at a CAGR of 5.3% through 2034, supported by a well-established healthcare system, high awareness of cardiovascular health, and growing consumer adoption of remote patient monitoring technologies. The region also benefits from favorable healthcare reimbursement policies that improve access to home monitoring devices. Regulatory agencies such as the FDA ensure product safety and performance, which supports market confidence and drives demand. Widespread insurance coverage, including Medicare and private plans, further supports the growth of home-use blood pressure monitors.

Key industry players leading the Global Sphygmomanometer Market include GE Healthcare, beurer, OMRON, BPL, ADC, ACCOSON, BOSCH + SOHN, PRESTIGE MEDICAL, SUNTECH, Riester, microlife, Little Doctor, Rossmax, Spengler, and AND. To strengthen their presence in the Global Sphygmomanometer Market, leading companies are focusing on several strategic moves. These include continuous product innovation, integrating advanced digital features like app connectivity and AI-based analytics, and expanding their global distribution networks. Many firms are investing in R&D to enhance accuracy, comfort, and usability, catering to both professional healthcare providers and home users. Strategic partnerships with telehealth platforms and healthcare institutions also play a key role in increasing adoption. Additionally, companies are tailoring product lines for various user needs from compact devices for travel to professional-grade monitors for clinics ensuring a strong foothold across multiple customer segments.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Operation trends

- 2.2.4 Configuration trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of hypertension and cardiovascular diseases

- 3.2.1.2 Government initiatives promoting preventive healthcare and early diagnosis

- 3.2.1.3 Technological advancements

- 3.2.1.4 Increasing demand for home healthcare and remote patient monitoring.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory approvals and compliance

- 3.2.3 Market opportunities

- 3.2.3.1 Expanding healthcare infrastructure in emerging economies

- 3.2.3.2 Adoption of digital sphygmomanometer

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technological landscape

- 3.5.1 Current technologies

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Consumer behavior analysis

- 3.8 Number of cases of hypertension, by region, 2021 - 2024

- 3.8.1 North America

- 3.8.2 Europe

- 3.8.3 Asia Pacific

- 3.8.4 Latin America

- 3.8.5 MEA

- 3.9 Reimbursement scenario

- 3.10 Pipeline analysis

- 3.11 Investment landscape

- 3.12 Pricing analysis, 2024

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

- 3.15 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 North America

- 4.3.2 Europe

- 4.3.3 Asia Pacific

- 4.3.4 LAMEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn, Units)

- 5.1 Key trends

- 5.2 Digital sphygmomanometer

- 5.2.1 Arm electronic sphygmomanometer

- 5.2.2 Wrist electronic sphygmomanometer

- 5.3 Aneroid sphygmomanometer

- 5.4 Mercury sphygmomanometer

Chapter 6 Market Estimates and Forecast, By Operation, 2021 - 2034 ($ Mn, Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Automatic

- 6.4 Semi-automatic

Chapter 7 Market Estimates and Forecast, By Configuration, 2021 - 2034 ($ Mn, Units)

- 7.1 Key trends

- 7.2 Portable

- 7.3 Desk mounted

- 7.4 Floor standing

- 7.5 Wall mounted

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Homecare

- 8.4 Ambulatory surgical centers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ACCOSON

- 10.2 ADC

- 10.3 AND

- 10.4 beurer

- 10.5 BOSCH + SOHN

- 10.6 BPL

- 10.7 GE Healthcare

- 10.8 Little Doctor

- 10.9 microlife

- 10.10 Omron

- 10.11 PRESTIGE MEDICAL

- 10.12 Riester

- 10.13 rossmax

- 10.14 Spengler

- 10.15 SUNTECH