|

市場調查報告書

商品編碼

1858991

瓦楞紙箱製造機市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Corrugated Box Making Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

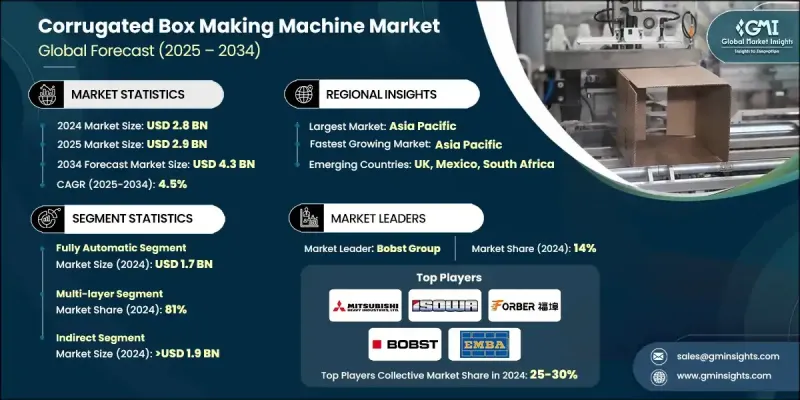

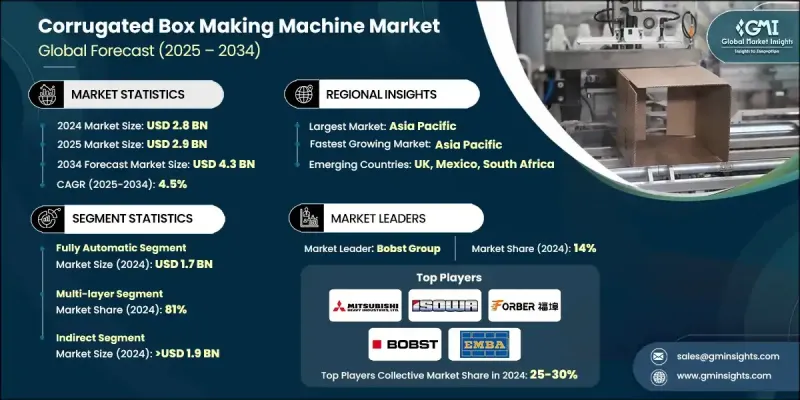

2024 年全球瓦楞紙箱製造機市場價值為 28 億美元,預計到 2034 年將以 4.5% 的複合年成長率成長至 43 億美元。

電子、食品飲料、個人護理和製藥等行業的強勁需求正顯著推動市場擴張。瓦楞紙箱憑藉其耐用性、輕盈性和可回收性,仍然是最受歡迎的包裝解決方案。隨著發展中經濟體推動城市化和工業發展,對能夠高速生產多種規格紙箱的包裝機械的需求日益成長。電子商務已成為一股關鍵力量,透過對客製化、防護性和品牌化紙箱解決方案的更高要求,改變了包裝需求。個人化包裝的興起促使企業加大對能夠進行多層生產、客製化模切和先進印刷的機器的投資。製造商正積極回應,開發採用更智慧、更節能設計的模組化機器,以提高紙箱質量,同時提升產量和營運效率。這種發展趨勢為瓦楞紙箱機械領域的自動化和創新創造了新的機會。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 28億美元 |

| 預測值 | 43億美元 |

| 複合年成長率 | 4.5% |

全自動包裝機市場預計在2024年將創造17億美元的收入,憑藉其每分鐘可精準穩定地生產數百個包裝盒的能力,佔據市場主導地位。這些系統對於物流和食品服務等高產量行業至關重要,因為在這些行業中,性能和降低缺陷率是關鍵。全自動包裝機在黏合、折疊和尺寸控制方面的精準性提高了產品質量,並確保了在高要求的生產週期中穩定輸出。

2024年,多層紙箱包裝機佔了81%的市場。這類機器專為生產兩層或多層瓦楞紙包裝而設計,具有更高的結構強度和更佳的產品保護性能。多層包裝在處理易碎或重型物品的行業中備受青睞,例如汽車、電子產品和重型工業工具。在那些重視運輸安全和長途運輸包裝的行業中,對這類系統的需求正在不斷成長。

2024年,美國瓦楞紙箱製造機械市場規模達5.5億美元,市佔率高達88.7%。其領先地位得益於強大的製造基礎設施和統一的包裝標準。自動化程度的不斷提高以及節能智慧技術的應用,使得生產速度更快、營運成本更低,並更容易整合到高速生產線中。電子商務和高科技製造等行業的需求持續推動著美國市場的成長。

瓦楞紙箱製造機市場的主要參與者包括EMBA Machinery、ISOWA、Bobst Group、Packsize International、三菱重工、Shrink Machine、Serpa Packaging Solutions、ACME Machinery、Zemat Technology Group、河北勝利紙箱設備有限公司、KOLBUS、Saro Packaging Machine Industries、Fosber、溫州中科包裝機械工業有限公司。為了鞏固市場地位,瓦楞紙箱製造機產業的企業正優先考慮產品創新、模組化系統開發和數位化整合。領先的製造商正在推出具備遠端監控、物聯網連接和人工智慧診斷功能的機器,以提高效率。對研發和節能系統的策略性投資有助於滿足客戶對自動化、減少停機時間和永續性的不斷變化的需求。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 增加消費品產量

- 電子商務擴張

- 自動化與智慧製造

- 產業陷阱與挑戰

- 高昂的初始投資成本

- 維護和維修成本

- 機會

- 工業4.0整合

- 永續性與環保包裝

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依類型分類,2021-2034年

- 主要趨勢

- 半自動

- 全自動

第6章:市場估價與預測:依包裝盒類型分類,2021-2034年

- 主要趨勢

- 單層

- 多層

第7章:市場估計與預測:依產能分類,2021-2034年

- 主要趨勢

- 低噸位(1-3噸)

- 中型(3-5噸)

- 高(超過5噸)

第8章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 餐飲

- 電子產品和消費品

- 居家及個人用品

- 紡織品

- 其他

第9章:市場估算與預測:依配銷通路,2021-2034年

- 主要趨勢

- 直接的

- 間接

第10章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第11章:公司簡介

- ACME Machinery

- Bobst Group

- EMBA Machinery

- Fosber

- ISOWA

- KOLBUS

- Mitsubishi Heavy Industries

- Packsize International

- Saro Packaging Machine Industries.

- Serpa packaging Solutions

- Shanghai Printyoung International Industry

- Hebei Shengli Carton Equipment

- Shrink Machine

- Wenzhou Zhongke Packaging Machinery

- Zemat Technology Group

The Global Corrugated Box Making Machine Market was valued at USD 2.8 billion in 2024 and is estimated to grow at a CAGR of 4.5% to reach USD 4.3 billion by 2034.

The surge in demand across industries like electronics, food & beverage, personal care, and pharmaceuticals is significantly driving market expansion. Corrugated boxes continue to be the most favored packaging solution, thanks to their durability, lightweight structure, and recyclability. As developing economies push forward with urbanization and industrial growth, demand for packaging machinery that delivers high-speed, multi-format box production has intensified. E-commerce has become a pivotal force, transforming packaging needs through increased requirements for custom, protective, and brandable box solutions. The shift toward personalized packaging has led to more investment in machines capable of multi-layer production, custom die-cutting, and advanced printing. Manufacturers are responding by developing modular machines with smarter, energy-efficient designs to improve box quality while boosting throughput and operational efficiency. This evolution is creating new opportunities for automation and innovation within the corrugated box machinery space.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $4.3 Billion |

| CAGR | 4.5% |

The fully automatic machines segment generated USD 1.7 billion in 2024, dominating demand due to their ability to produce hundreds of boxes per minute with precision and consistency. These systems are critical to high-volume sectors like logistics and food services, where performance and reduced defect rates are key. Their precision in gluing, folding, and size control improves product quality and ensures reliable output in demanding production cycles.

The multi-layer box machine category held an 81% share in 2024. Designed to produce packaging with two or more fluted layers, these machines offer higher structural strength and greater product protection. Multi-layer packaging is highly valued in sectors handling fragile or heavyweight items, such as automotive, electronics, and heavy industrial tools. Demand for these systems is rising in industries that prioritize transportation safety and secure long-haul packaging.

U.S. Corrugated Box Making Machine Market generated USD 550 million and held 88.7% share in 2024. Its leadership is backed by a robust manufacturing infrastructure and consistent packaging standards. The growing influence of automation and the adoption of energy-efficient and smart technologies are enabling faster production, lower operational costs, and easier integration into high-speed production lines. Demand from sectors like e-commerce and high-tech manufacturing continues to drive growth in the U.S. market.

Key players in the Corrugated Box Making Machine Market include EMBA Machinery, ISOWA, Bobst Group, Packsize International, Mitsubishi Heavy Industries, Shrink Machine, Serpa Packaging Solutions, ACME Machinery, Zemat Technology Group, Hebei Shengli Carton Equipment, KOLBUS, Saro Packaging Machine Industries, Fosber, Wenzhou Zhongke Packaging Machinery, and Shanghai Printyoung International Industry. To strengthen their market position, companies in the corrugated box making machine industry are prioritizing product innovation, modular system development, and digital integration. Leading manufacturers are introducing machines with remote monitoring, IoT connectivity, and AI-based diagnostics to boost efficiency. Strategic investments in R&D and energy-efficient systems help meet evolving customer expectations for automation, reduced downtime, and sustainability.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Box type

- 2.2.4 Capacity

- 2.2.5 End use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing consumer goods production

- 3.2.1.2 E-commerce expansion

- 3.2.1.3 Automation & smart manufacturing

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Maintenance and repair costs

- 3.2.3 Opportunities

- 3.2.3.1 Industry 4.0 integration

- 3.2.3.2 Sustainability and ecofriendly packaging

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Semi-automatic

- 5.3 Fully-automatic

Chapter 6 Market Estimates and Forecast, By Box Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Single-layer

- 6.3 Multi-layer

Chapter 7 Market Estimates and Forecast, By Capacity, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Low (1-3 tons)

- 7.3 Mid (3-5 tons)

- 7.4 High (above 5 tons)

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Food & beverage

- 8.3 Electronics & consumer goods

- 8.4 Home & personal goods

- 8.5 Textile goods

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 ACME Machinery

- 11.2 Bobst Group

- 11.3 EMBA Machinery

- 11.4 Fosber

- 11.5 ISOWA

- 11.6 KOLBUS

- 11.7 Mitsubishi Heavy Industries

- 11.8 Packsize International

- 11.9 Saro Packaging Machine Industries.

- 11.10 Serpa packaging Solutions

- 11.11 Shanghai Printyoung International Industry

- 11.12 Hebei Shengli Carton Equipment

- 11.13 Shrink Machine

- 11.14 Wenzhou Zhongke Packaging Machinery

- 11.15 Zemat Technology Group