|

市場調查報告書

商品編碼

1858977

氣體交換肺功能檢測市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Gas Exchange Pulmonary Function Testing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

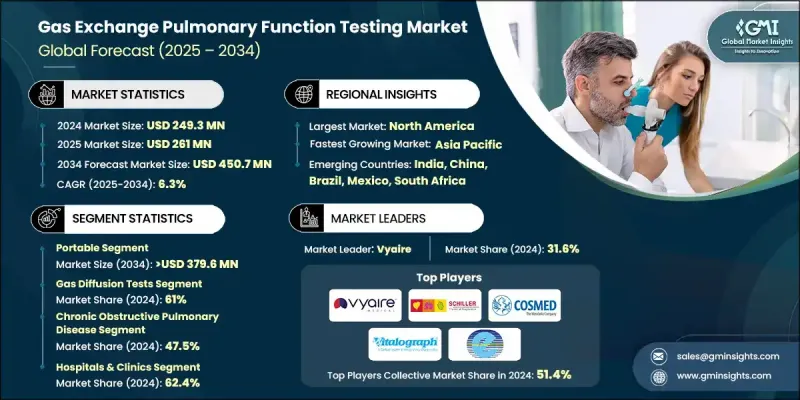

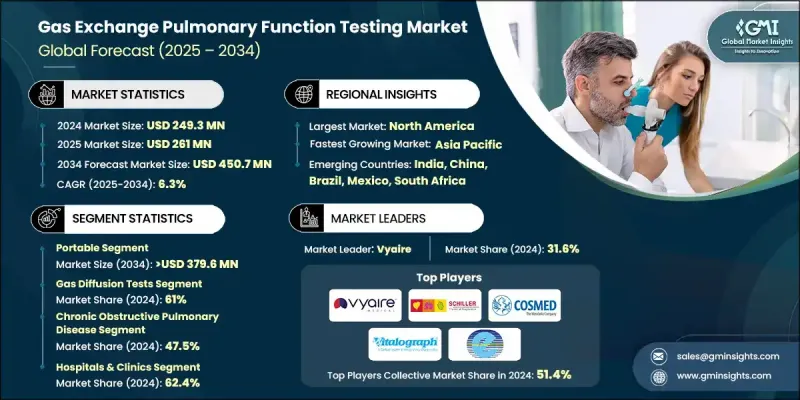

2024 年全球氣體交換肺功能測試市值為 2.493 億美元,預計到 2034 年將以 6.3% 的複合年成長率成長至 4.507 億美元。

慢性呼吸系統疾病病例的增加、DLCO和CPET等診斷工具的日益普及以及醫院診斷設施的擴張,共同推動了該市場的成長。該市場為醫療服務提供者、技術公司、支付方和生命科學公司提供先進的診斷技術,旨在改善臨床工作流程、確保合規性並提升患者護理水準。產品包括氣體擴散分析儀、CPET系統、肺功能儀以及整合人工智慧和遠距醫療功能的數位平台。這些創新正在重塑診斷路徑,實現更快、更準確、更遠端的檢測。隨著醫療基礎設施的快速發展,尤其是在發展中地區,以及攜帶式和方便用戶使用型檢測工具的日益普及,肺功能檢測的覆蓋範圍達到了前所未有的高度。持續的研發投入、策略聯盟和地理擴張正在推動市場競爭和產品創新。在已開發市場,有利的報銷機制和對預防性呼吸系統護理日益成長的重視,正在加速先進肺功能檢測系統的應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2.493億美元 |

| 預測值 | 4.507億美元 |

| 複合年成長率 | 6.3% |

2024年,攜帶式設備市佔率達到82.8%,這主要得益於人們對居家和床邊呼吸監測的日益青睞。患者和醫護人員正積極採用攜帶式肺功能檢測工具,以便在臨床環境之外管理氣喘、慢性阻塞性肺病和間質性肺病等疾病。這些設備得益於數位連接技術的進步、緊湊的設計和直覺的介面,已被證明是居家監測的理想之選,能夠在不影響準確性和性能的前提下,實現頻繁的檢測和遠端疾病管理。

2024年,氣體擴散測試市場佔據61%的市場佔有率,預計2034年將達到2.637億美元。這些測試,尤其是一氧化碳擴散量(DLCO)測試,對於評估肺部輸送氧氣和二氧化碳等氣體的效率仍然至關重要。隨著全球間質性肺病、肺纖維化和慢性阻塞性肺病病例的不斷增加,對精準擴散測試的需求持續攀升。醫院、診斷實驗室和專科診所越來越依賴這一領域來早期發現和管理複雜的肺部疾病。

2024年,北美氣體交換肺功能測試市場佔有率將達到40.2%,這主要得益於先進的診斷基礎設施、慢性呼吸系統疾病的高發生率以及尖端技術的快速普及。此外,老年人口的成長及其患有肺纖維化和慢性阻塞性肺病等疾病的風險增加,也進一步推動了該地區對精準氣體交換評估和心肺運動試驗(CPET)系統的需求。

全球氣體交換肺功能檢測市場的主要參與者包括Geratherm Respiratory、MGC Diagnostics Holdings、Sibelmed、Schiller、COSMED、ndd Medical Technologies、Vitalograph、Vyaire、Morgan Scientific、ECO MEDICS、CORTEX和CHEST MI。為了鞏固其在全球氣體交換肺功能檢測市場的地位,這些主要公司正大力投資於產品創新,重點關注數位化整合、基於人工智慧的分析和遠端監測功能。與醫院、診斷實驗室和遠距醫療服務提供者建立策略合作夥伴關係有助於擴大分銷管道和臨床應用。許多企業也透過區域生產、改善物流和為醫療專業人員提供培訓計劃,加大對新興市場的關注。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 產業影響因素

- 成長促進因素

- 呼吸系統疾病發生率上升

- 技術進步

- 對居家照護解決方案的需求日益成長

- 政府的支持性措施和報銷政策

- 產業陷阱與挑戰

- 設備成本高昂

- 市場機遇

- 與數位健康平台整合

- 攜帶式和手持設備的開發

- 成長促進因素

- 成長潛力分析

- 監管環境

- 報銷方案

- 技術格局

- 當前技術趨勢

- 配備數位介面的先進肺功能儀平台

- 心肺運動試驗(CPET)系統

- 氣體擴散分析儀(DLCO)

- 新興技術

- 人工智慧驅動的呼吸系統診斷預測分析

- 遠端監控和遠端肺功能測試解決方案

- 穿戴式肺功能監測設備

- 當前技術趨勢

- 差距分析

- 波特的分析

- PESTEL 分析

- 價值鏈分析

- 未來市場趨勢

- 居家肺功能測試的成長

- 攜帶式和以患者為中心的設備的擴展

- 將肺功能測試系統與數位健康平台整合

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 競爭定位矩陣

- 主要市場參與者的競爭分析

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新服務類型推出

- 擴張計劃

第5章:市場估算與預測:依系統類型分類,2021-2034年

- 主要趨勢

- 便攜的

- 文具

第6章:市場估算與預測:依測試方法分類,2021-2034年

- 主要趨勢

- 氣體擴散試驗

- 心肺運動試驗(CPET)

第7章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 慢性阻塞性肺臟疾病

- 氣喘

- 慢性呼吸困難

- 肺纖維化

- 其他應用

第8章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 醫院和診所

- 診斷中心

- 其他最終用途

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- CHEST MI

- CORTEX

- COSMED

- ECO MEDICS

- Geratherm Respiratory

- Morgan Scientific

- MGC Diagnostics Holdings

- ndd Medical Technologies

- Schiller

- Sibelmed

- Vitalograph

- Vyaire

The Global Gas Exchange Pulmonary Function Testing Market was valued at USD 249.3 million in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 450.7 million by 2034.

Growth in this market is being propelled by rising cases of chronic respiratory conditions, increasing adoption of diagnostic tools such as DLCO and CPET, and the expansion of hospital-based diagnostic facilities. This market supports healthcare providers, technology firms, payers, and life sciences companies with advanced diagnostic technologies designed to improve clinical workflows, ensure regulatory compliance, and enhance patient care. Product offerings include gas diffusion analyzers, CPET systems, spirometry devices, and digital platforms integrated with AI and telehealth capabilities. These innovations are reshaping diagnostic pathways by enabling quicker, more accurate, and remote testing capabilities. With rapid growth in healthcare infrastructure, particularly in developing regions, combined with a broader range of portable and user-friendly testing tools, access to pulmonary testing has never been more widespread. Continuous investment in R&D, along with strategic alliances and geographic expansion, is driving competition and product innovation. In developed markets, favorable reimbursement frameworks and a growing shift toward preventive respiratory care are accelerating the adoption of advanced pulmonary function testing systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $249.3 Million |

| Forecast Value | $450.7 Million |

| CAGR | 6.3% |

In 2024, the portable device segment held an 82.8% share owing to the increased preference for home-based and point-of-care respiratory monitoring. Patients and healthcare professionals are embracing portable pulmonary function tools to manage conditions such as asthma, COPD, and interstitial lung diseases outside clinical settings. These devices, supported by advancements in digital connectivity, compact designs, and intuitive interfaces, are proving to be ideal for home monitoring, enabling frequent testing and remote disease management without compromising accuracy or performance.

The gas diffusion tests segment held a 61% share in 2024 and is anticipated to reach USD 263.7 million by 2034. These tests, especially DLCO, remain vital in assessing how efficiently the lungs transfer gases like oxygen and carbon dioxide. With rising global cases of interstitial lung diseases, pulmonary fibrosis, and chronic obstructive pulmonary disease, the demand for accurate diffusion testing continues to climb. Hospitals, diagnostic labs, and specialty clinics are increasingly relying on this segment for early detection and management of complex pulmonary disorders.

North America Gas Exchange Pulmonary Function Testing Market held 40.2% share in 2024, driven by advanced diagnostic infrastructure, high prevalence of chronic respiratory conditions, and accelerated uptake of cutting-edge technologies. The growing elderly population and their increased vulnerability to conditions like pulmonary fibrosis and COPD further support the demand for precise gas exchange assessments and CPET systems in the region.

Leading players in the Global Gas Exchange Pulmonary Function Testing Market include Geratherm Respiratory, MGC Diagnostics Holdings, Sibelmed, Schiller, COSMED, ndd Medical Technologies, Vitalograph, Vyaire, Morgan Scientific, ECO MEDICS, CORTEX, and CHEST M.I. To boost their foothold in the Global Gas Exchange Pulmonary Function Testing Market, key companies are heavily investing in product innovation focused on digital integration, AI-based analytics, and remote monitoring capabilities. Strategic partnerships with hospitals, diagnostic labs, and telehealth providers help expand distribution and clinical adoption. Many players are also increasing their focus on emerging markets through regional manufacturing, improved logistics, and training programs for medical professionals.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 System type trends

- 2.2.3 Test method trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of respiratory diseases

- 3.2.1.2 Technological advancements

- 3.2.1.3 Growing demand for home care solutions

- 3.2.1.4 Supportive government initiatives and reimbursement policies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with equipment

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with digital health platforms

- 3.2.3.2 Development of portable and handheld device

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 MEA

- 3.5 Reimbursement scenario

- 3.6 Technology landscape

- 3.6.1 Current technological trends

- 3.6.1.1 Advanced spirometry platforms with digital interfaces

- 3.6.1.2 Cardiopulmonary exercise testing (CPET) systems

- 3.6.1.3 Gas diffusion analyzers (DLCO)

- 3.6.2 Emerging technologies

- 3.6.2.1 AI-driven predictive analytics for respiratory diagnostics

- 3.6.2.2 Remote monitoring and tele-PFT solutions

- 3.6.2.3 Wearable pulmonary function monitoring devices

- 3.6.1 Current technological trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Value chain analysis

- 3.11 Future market trends

- 3.11.1 Growth of home-based pulmonary function testing

- 3.11.2 Expansion of portable and patient-centric devices

- 3.11.3 Integration of PFT systems with digital health platforms

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New service type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By System Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Portable

- 5.3 Stationary

Chapter 6 Market Estimates and Forecast, By Test Method, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Gas diffusion tests

- 6.3 Cardiopulmonary exercise testing (CPET)

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Chronic obstructive pulmonary disease

- 7.3 Asthma

- 7.4 Chronic shortness of breath

- 7.5 Pulmonary fibrosis

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals & clinics

- 8.3 Diagnostic centers

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 CHEST M.I.

- 10.2 CORTEX

- 10.3 COSMED

- 10.4 ECO MEDICS

- 10.5 Geratherm Respiratory

- 10.6 Morgan Scientific

- 10.7 MGC Diagnostics Holdings

- 10.8 ndd Medical Technologies

- 10.9 Schiller

- 10.10 Sibelmed

- 10.11 Vitalograph

- 10.12 Vyaire