|

市場調查報告書

商品編碼

1858968

肺動脈高壓市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Pulmonary Arterial Hypertension Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

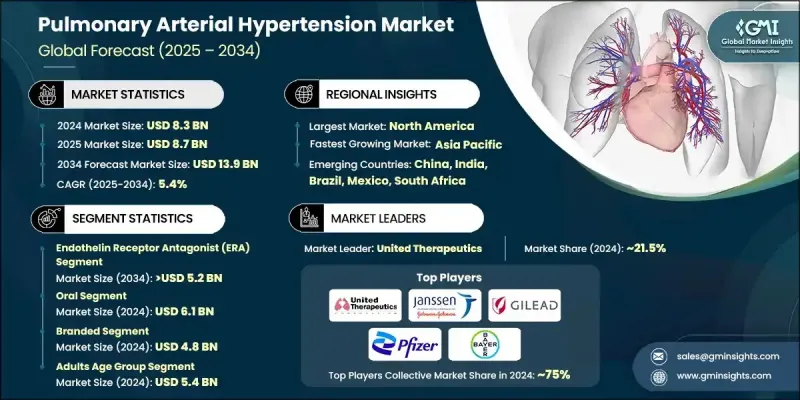

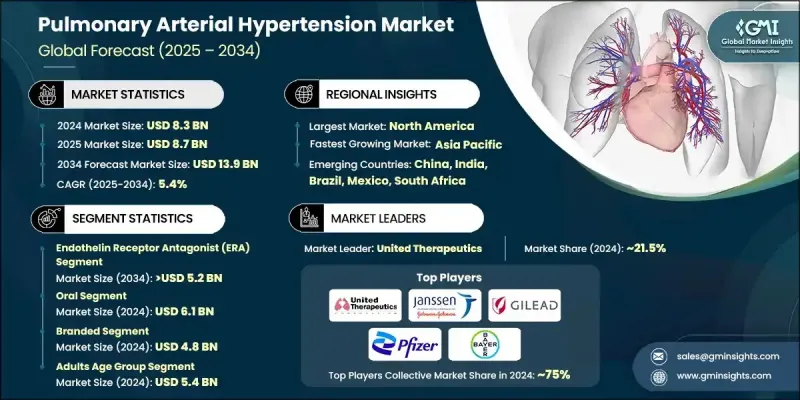

2024 年全球肺動脈高壓市場價值為 83 億美元,預計到 2034 年將以 5.4% 的複合年成長率成長至 139 億美元。

市場需求的成長歸因於全球肺動脈高壓(PAH)病例數的增加、藥物療法的進步,以及美國食品藥物管理局(FDA)和歐洲藥品管理局(EMA)等監管機構為支持新型PAH療法研發而持續做出的努力。隨著診斷技術和生物標記篩檢方法的改進,PAH的早期檢測變得更加有效,有助於更好地管理疾病。醫療基礎設施投資的不斷成長,尤其是在亞太和拉丁美洲等新興地區,也對擴大PAH療法的可近性發揮了關鍵作用。由於醫療體系的改善和政府主導的宣傳活動,中國、印度和巴西等國的療法供應量有所提高。生物相似藥的上市有助於降低治療費用,進一步提高發展中地區的可近性。製藥公司也正在利用策略性併購和合作來豐富其產品組合,並加速PAH藥物研發的創新。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 83億美元 |

| 預測值 | 139億美元 |

| 複合年成長率 | 5.4% |

內皮素受體拮抗劑(ERA)在2024年佔據了37.3%的市場佔有率,預計到2034年將達到52億美元,年複合成長率為5.4%。 ERA,例如波生坦、安立生坦和馬西替坦,能夠阻斷內皮素-1,內皮素-1是一種參與肺動脈高壓(PAH)發展的關鍵血管收縮劑。這些藥物有助於降低肺血管阻力並提高運動能力,因此是長期疾病管理的常用選擇。

2024年,口服藥物市場規模達到61億美元,因其服用方便,減少了頻繁就醫和使用複雜醫療設備的需求,深受眾多患者的青睞。口服療法副作用較少,且安全性較高,因此較適合長期服用,特別適用於合併其他疾病的患者。

2024年,美國肺動脈高壓市場規模預計將達到40億美元,主要受該疾病盛行率上升的推動,尤其是在老年族群和合併慢性阻塞性肺病(COPD)等其他疾病的患者中。先進的診斷方法,包括超音波心動圖和生物標記檢測,使得早期發現成為可能,從而增加了尋求治療的患者群體,進而推動了對肺動脈高壓治療藥物的需求。美國企業在肺動脈高壓研究領域處於領先地位,引領治療領域的創新。

活躍於全球肺動脈高壓市場的主要公司包括默克集團(Merck KGaA)、拜耳(Bayer)、吉利德科學(Gilead Sciences)、葛蘭素史克(GlaxoSmithKline,簡稱GSK)、輝瑞(Pfizer)、強生楊森製藥(Janssen Pharmaceuticals)、 Technologies、Gossamer Bio、Galectin Therapeutics和諾華(Novartis)。為了鞏固其在肺動脈高壓市場的地位,各公司正致力於透過研發新療法和改善患者獲得治療的途徑來拓展產品組合。許多公司正透過合作、併購等方式進行投資,通常與規模較小的生技公司合作,以獲取創新和後期研發資產。此外,各公司還優先考慮在新興市場進行策略性區域投資,以降低治療成本並提高治療的可及性,特別是透過建立本地生產設施。這種做法不僅降低了成本,也符合生物相似藥日益成長的趨勢,有助於降低發展中市場的定價障礙。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 肺動脈高壓及相關疾病盛行率不斷上升

- 藥物治療的進展

- 個人化治療的趨勢日益增強

- 發展中國家醫療衛生基礎設施的改善

- 產業陷阱與挑戰

- 高昂的治療費用

- 專家資源有限

- 監管挑戰

- 市場機遇

- 聯合療法的應用日益廣泛

- 基因療法與再生醫學的融合日益加深

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 美國

- 加拿大

- 歐洲

- 亞太地區

- 北美洲

- 技術格局

- 當前技術趨勢

- 新興技術

- 未來市場趨勢

- 定價分析

- 臨床試驗分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依藥物類別分類,2021-2034年

- 主要趨勢

- 前列環素和前列環素類似物

- 可溶性鳥苷酸環化酶(SGC)促效劑

- 內皮素受體拮抗劑(ERA)

- 磷酸二酯酶 5 (PDE-5)

- 血管擴張劑

- 其他藥物類別

第6章:市場估計與預測:依給藥途徑分類,2021-2034年

- 主要趨勢

- 口服

- 靜脈

- 吸入

第7章:市場估算與預測:依類型分類,2021-2034年

- 主要趨勢

- 品牌

- 學名藥

第8章:市場估算與預測:依年齡層別分類,2021-2034年

- 主要趨勢

- 兒科

- 成人

- 老年醫學

第9章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 醫院

- 專科診所

- 其他最終用途

第10章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第11章:公司簡介

- Bayer

- F. Hoffmann La Roche

- GlaxoSmithKline (GSK)

- Gilead Sciences

- Gmax Biopharm

- Gossamer Bio

- Galectin Therapeutics

- Janssen Pharmaceuticals (Johnson & Johnson)

- Liquidia Technologies

- Merck KGaA

- Novartis

- Pfizer

- Resverlogix

- United Therapeutics

The Global Pulmonary Arterial Hypertension Market was valued at USD 8.3 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 13.9 billion by 2034.

The rise in market demand is attributed to the increasing number of PAH cases worldwide, advancements in drug therapies, and ongoing efforts by regulatory agencies such as the FDA and EMA to support the development of new PAH treatments. As diagnostic technologies and biomarker screening methods improve, early detection of PAH has become more effective, contributing to better management of the disease. The growing investments in healthcare infrastructure, particularly in emerging regions like Asia-Pacific and Latin America, have also played a key role in expanding access to PAH treatments. Countries such as China, India, and Brazil are seeing enhanced availability of therapies due to improvements in healthcare systems and government-driven awareness initiatives. Biosimilars entering the market are helping to make treatments more affordable, further boosting accessibility in developing regions. Pharmaceutical companies are also leveraging strategic mergers, acquisitions, and partnerships to diversify their portfolios and accelerate innovation in PAH drug development.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.3 Billion |

| Forecast Value | $13.9 Billion |

| CAGR | 5.4% |

The endothelin receptor antagonist (ERA) segment held a 37.3% share in 2024, and it is projected to reach USD 5.2 billion by 2034, growing at a CAGR of 5.4%. ERAs, such as bosentan, ambrisentan, and macitentan, block endothelin-1, a key vasoconstrictor involved in the development of PAH. These drugs help reduce pulmonary vascular resistance and improve exercise capacity, making them a common choice for long-term disease management.

In 2024, the oral drug segment generated USD 6.1 billion, and it is preferred by many patients due to the convenience of administration, reducing the need for frequent hospital visits and complex medical equipment. Oral therapies are associated with fewer side effects and better safety profiles, which make them suitable for long-term use, especially among patients with other health conditions.

U.S. Pulmonary Arterial Hypertension Market was valued at USD 4 billion in 2024, driven by the rising prevalence of the disease, particularly among older populations and individuals with other comorbidities such as COPD. Early detection facilitated by advanced diagnostic methods, including echocardiography and biomarker testing, is contributing to a larger pool of patients seeking treatment, fueling demand for PAH therapies. U.S.-based companies are at the forefront of PAH research, driving innovation in the treatment space.

Prominent companies active in the Global Pulmonary Arterial Hypertension Market include Merck KGaA, Bayer, Gilead Sciences, GlaxoSmithKline (GSK), Pfizer, Janssen Pharmaceuticals (Johnson & Johnson), United Therapeutics, Gmax Biopharm, Resverlogix, Liquidia Technologies, Gossamer Bio, Galectin Therapeutics, and Novartis. To strengthen their position in the Pulmonary Arterial Hypertension Market, companies are focusing on expanding their product portfolios through research and development of new therapies and improving patient access to treatments. Many are investing in partnerships, mergers, and acquisitions, often with smaller biotech firms, to acquire innovative and late-stage assets. Companies are also prioritizing strategic regional investments in emerging markets to make treatments more affordable and available, especially by establishing local production facilities. This approach not only reduces costs but also aligns with the growing trend of biosimilars, which help lower pricing barriers in developing markets.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Drug class trends

- 2.2.3 Route of administration trends

- 2.2.4 Type trends

- 2.2.5 Age group trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of PAH and related conditions

- 3.2.1.2 Advancement in drug therapies

- 3.2.1.3 Increasing shift toward personalized treatment

- 3.2.1.4 Improved healthcare infrastructure in developing countries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High treatment cost

- 3.2.2.2 Limited access to specialists

- 3.2.2.3 Regulatory challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Growing usage of combination therapy

- 3.2.3.2 Rising integration of gene therapy and regenerative medicine

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Clinical trial analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Prostacyclin and prostacyclin analogs

- 5.3 Soluble guanylate cyclase (SGC) stimulators

- 5.4 Endothelin receptor antagonist (ERA)

- 5.5 Phosphodiesterase 5 (PDE-5)

- 5.6 Vasodilators

- 5.7 Other drug classes

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oral

- 6.3 Intravenous

- 6.4 Inhalation

Chapter 7 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Branded

- 7.3 Generics

Chapter 8 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pediatrics

- 8.3 Adult

- 8.4 Geriatrics

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Specialty clinics

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Bayer

- 11.2 F. Hoffmann La Roche

- 11.3 GlaxoSmithKline (GSK)

- 11.4 Gilead Sciences

- 11.5 Gmax Biopharm

- 11.6 Gossamer Bio

- 11.7 Galectin Therapeutics

- 11.8 Janssen Pharmaceuticals (Johnson & Johnson)

- 11.9 Liquidia Technologies

- 11.10 Merck KGaA

- 11.11 Novartis

- 11.12 Pfizer

- 11.13 Resverlogix

- 11.14 United Therapeutics