|

市場調查報告書

商品編碼

1858966

自癒混凝土市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Self-Healing Concrete Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

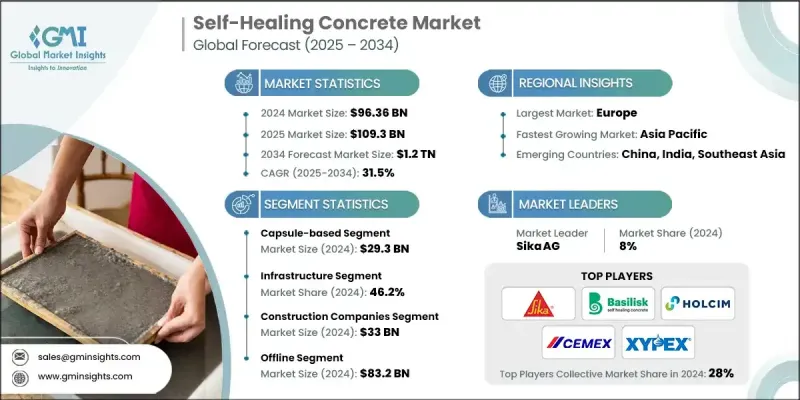

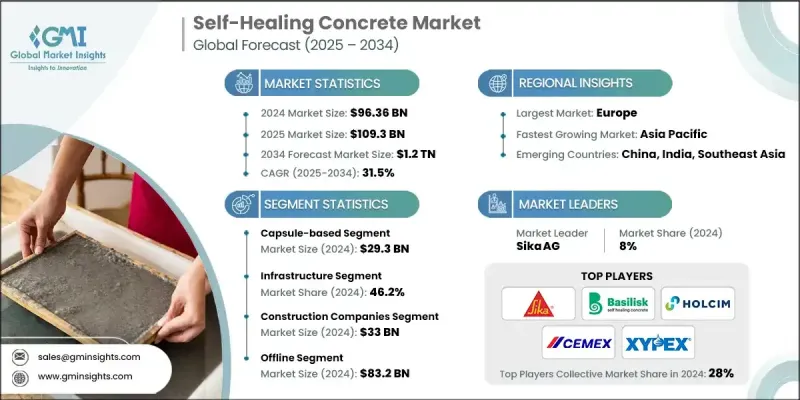

2024 年全球自癒混凝土市場價值為 963.6 億美元,預計到 2034 年將以 31.5% 的複合年成長率成長至 1.2 兆美元。

這一非凡的成長軌跡得益於全球對更智慧、更環保、更永續的建築解決方案日益成長的需求。儘管新冠疫情初期因勞動力短缺、供應鏈受阻、預算限制和工地臨時關閉等原因,導致建築項目普遍中斷,但市場此後已強勁反彈。在復甦階段,許多利害關係人優先考慮緊急基礎設施需求而非創新,導致技術應用暫時放緩。然而,向永續材料的長期轉型始終是強勁的推動力。各國政府和企業都在積極鼓勵使用永續的替代方案,以降低生命週期維護成本和環境影響。自癒混凝土已成為極具前景的解決方案,它無需頻繁維修即可延長使用壽命。北美和歐洲目前在全球市場佔據主導地位,這得益於其完善的監管框架、強大的研發生態系統和高度的認知度。美國、荷蘭和德國等國家在將這項技術應用於橋樑、隧道和水處理系統等關鍵公共基礎設施方面處於領先地位。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 963.6億美元 |

| 預測值 | 1.2兆美元 |

| 複合年成長率 | 31.5% |

2024年,基礎設施領域佔據46.2%的市場佔有率,這主要得益於隧道、水壩和道路等工程中混凝土的廣泛應用,這些過程往往面臨較高的環境壓力。自癒技術為延長此類工程的使用壽命提供了可靠且經濟高效的解決方案,從而提升安全性和性能。該技術能夠自動修復微裂紋,防止其進一步惡化,顯著降低維修成本和停機時間,因此非常適合高價值資產。

2024年,基於膠囊的自修復混凝土市場規模達到438億美元,預計2025年至2034年將以31.9%的複合年成長率成長。此方法是將填充有修復化合物的微膠囊嵌入混凝土混合物中。當裂縫形成時,這些膠囊會破裂並釋放修復劑,從而有效地密封裂縫。這種方法具有諸多優勢,包括可控釋放機制、保護活性物質免受環境影響以及能夠密封較大的裂縫。其可擴展性和易於整合到傳統施工流程中的特點,推動了該方法的廣泛應用,尤其是在商業和住宅建築領域。

2024年美國自癒混凝土市場規模達212億美元,預計2025年至2034年將以32.3%的複合年成長率成長。該地區在2024年佔據了25%的市場佔有率,並受益於聯邦基礎設施項目和經濟刺激計劃的顯著推動。這些措施正在加速新一代建築材料在公共工程中的應用,尤其是在道路、公共建築和橋樑等領域,因為這些領域的耐久性和低維護成本是關鍵考量。

引領全球自癒混凝土產業發展的領導企業包括 Kryton International Inc.、Heidelberg Materials、Green-Basilisk BV、BASF SE、Holcim、Buzzi Unicem USA、Acciona、Wacker Chemie AG、Sika AG、Xypex Chemical Corporation、Devan、CEMEX SABAB、Masterk Builder 、Azo Builders、At、Ak、CEMEX SAB。為了確保在全球自癒混凝土市場中保持競爭優勢,主要企業正採取多管齊下的策略。許多企業正大力投資研發,以開發可無縫整合到各種建築環境中的先進自癒技術。與建築公司和政府機構建立策略合作夥伴關係,有助於提升產品知名度並加速現場部署。此外,各企業也正在擴大生產能力並最佳化產品組合,以滿足高階基礎設施和對成本敏感的商業應用需求。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預測模型

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 市場機遇

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 依產品

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測,產品類型,2021-2034年

- 主要趨勢

- 基於膠囊的

- 血管性

- 基於細菌

- 化學

- 其他(混合型、酵素基型等)

第6章:市場估算與預測:依形式分類,2021-2034年

- 主要趨勢

- 內在的

- 膠囊型

- 血管性

第7章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 住宅

- 商業及機構建築

- 工業建築

- 基礎設施

第8章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 建築公司

- 政府和公共機構

- 基礎設施開發商

- 房地產開發商

- 研究機構和大學

第9章:市場估算與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 離線

- 線上

第10章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第11章:公司簡介

- Acciona

- Akzo Nobel NV

- BASF SE

- Buzzi Unicem USA

- CEMEX SAB de CV

- Devan

- Fescon

- Green-Basilisk BV (Basilisk Self-Healing Concrete)

- Kryton International Inc.

- HEIDELBERG CEMENT

- Holcim

- Master Builders Solutions

- Sika AG

- Wacker Chemie AG

- Xypex Chemical Corporation

The Global Self-Healing Concrete Market was valued at USD 96.36 billion in 2024 and is estimated to grow at a CAGR of 31.5% to reach USD 1.2 trillion by 2034.

This exceptional growth trajectory is shaped by the increasing global push toward smarter, greener, and more sustainable construction solutions. Although the COVID-19 pandemic initially created widespread disruptions across construction projects due to labor shortages, supply chain setbacks, budgetary constraints, and temporary site closures, the market has since rebounded strongly. During the recovery phase, many stakeholders prioritized urgent infrastructure needs over innovation, slowing adoption temporarily. However, the long-term shift toward sustainable materials has remained a strong catalyst. Governments and corporations are actively encouraging the use of sustainable alternatives that reduce lifecycle maintenance costs and environmental impact. Self-healing concrete has emerged as a promising solution, offering extended durability without the need for frequent repairs. North America and Europe currently dominate the global landscape, supported by strong regulatory frameworks, robust R&D ecosystems, and high levels of awareness. Countries like the U.S., the Netherlands, and Germany are front-runners in applying this technology to critical public infrastructure such as bridges, tunnels, and water treatment systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $96.36 Billion |

| Forecast Value | $1.2 Trillion |

| CAGR | 31.5% |

The infrastructure segment held a 46.2% share in 2024, driven by the extensive use of concrete in applications like tunnels, dams, and roadways, which often face high environmental stress. Self-healing technology offers a reliable, cost-efficient solution to extend service life in such conditions, supporting both safety and performance. By automatically addressing micro-cracks before they worsen, the technology significantly cuts down on repair costs and downtime, making it highly suitable for high-value assets.

The capsule-based self-healing concrete segment was valued at USD 43.8 billion in 2024 and is forecasted to grow at a CAGR of 31.9% from 2025 to 2034. This method involves embedding microcapsules filled with healing compounds within the concrete mixture. When a crack forms, these capsules rupture and release the healing agent, effectively sealing the damage. This approach offers several advantages, including a controlled release mechanism, protection of active materials from environmental exposure, and the ability to seal larger cracks. The scalability and ease of integration into traditional construction workflows have fueled the widespread adoption of this method, particularly for commercial and residential structures.

U.S. Self-Healing Concrete Market was valued at USD 21.2 billion in 2024 and is projected to grow at a 32.3% CAGR from 2025 to 2034. The region, which accounted for a 25% share in 2024, is seeing significant tailwinds from federal infrastructure programs and stimulus packages. These initiatives are accelerating the adoption of next-generation building materials across public projects, particularly in roads, public buildings, and bridges, where durability and reduced maintenance are key priorities.

Leading companies shaping the Global Self-Healing Concrete Industry include Kryton International Inc., Heidelberg Materials, Green-Basilisk BV, BASF SE, Holcim, Buzzi Unicem USA, Acciona, Wacker Chemie AG, Sika AG, Xypex Chemical Corporation, Devan, CEMEX S.A.B. de C.V., Master Builders Solutions, Akzo Nobel N.V., and Fescon. To secure their competitive edge in the Global Self-Healing Concrete Market, key players are adopting a multi-pronged strategy. Many are heavily investing in R&D to develop advanced healing technologies that can be integrated seamlessly into various construction environments. Strategic partnerships with construction firms and government bodies are enhancing product visibility and accelerating field deployment. Companies are also expanding manufacturing capabilities and refining product portfolios to address both high-end infrastructure and cost-sensitive commercial applications.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Form

- 2.2.4 Application

- 2.2.5 End use

- 2.2.6 Distribution channel

- 2.3 TAM Analysis, 2021-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Capsule-based

- 5.3 Vascular based

- 5.4 Bacteria-based

- 5.5 Chemical-based

- 5.6 Others (hybrid, enzyme-based, etc.)

Chapter 6 Market Estimates & Forecast, By Form, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Intrinsic based

- 6.3 Capsule based

- 6.4 Vascular based

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial & institutional buildings

- 7.4 Industrial construction

- 7.5 Infrastructure

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Construction companies

- 8.3 Government & public authorities

- 8.4 Infrastructure developers

- 8.5 Real estate developers

- 8.6 Research institutes & universities

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Offline

- 9.3 Online

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East & Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East & Africa

Chapter 11 Company Profiles

- 11.1 Acciona

- 11.2 Akzo Nobel N.V.

- 11.3 BASF SE

- 11.4 Buzzi Unicem USA

- 11.5 CEMEX S.A.B. de C.V.

- 11.6 Devan

- 11.7 Fescon

- 11.8 Green-Basilisk BV (Basilisk Self-Healing Concrete)

- 11.9 Kryton International Inc.

- 11.10 HEIDELBERG CEMENT

- 11.11 Holcim

- 11.12 Master Builders Solutions

- 11.13 Sika AG

- 11.14 Wacker Chemie AG

- 11.15 Xypex Chemical Corporation