|

市場調查報告書

商品編碼

1858965

機器人割草機市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Robotic Lawn Mower Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

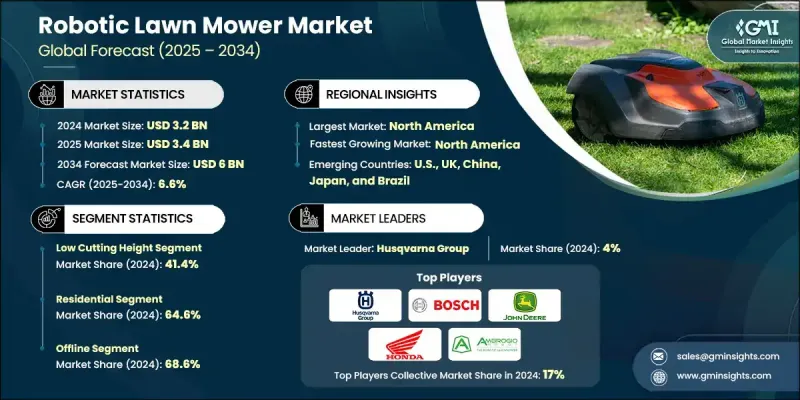

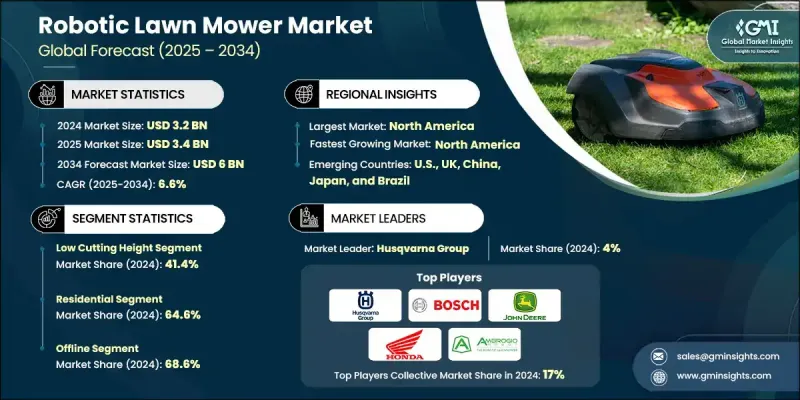

2024 年全球機器人割草機市場價值為 32 億美元,預計到 2034 年將以 6.6% 的複合年成長率成長至 60 億美元。

隨著自動化和環保意識的日益增強,消費者越來越傾向於選擇智慧割草機器人,將其作為傳統草坪維護方式的智慧便捷替代方案。這些割草機器人兼具便利性、節能性和低環境影響等優點,使其成為不斷發展的戶外動力設備領域的重要組成部分。人工智慧技術的進步、電池續航力的提升以及與智慧家庭生態系統的無縫整合,持續推動機器人割草機器人的普及。製造商們正致力於提升設備的安全性、運行時間和易用性,同時投資永續設計實踐。此外,數位化平台正透過產品教育、遠端診斷和服務支援等方式,幫助品牌為客戶創造更多價值。透過利用線上互動和品牌故事,許多公司正在打造鮮明的品牌形象,並在競爭日益激烈的市場中佔據優勢。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 32億美元 |

| 預測值 | 60億美元 |

| 複合年成長率 | 6.6% |

低割草高度割草機市佔率高達41.4%,預計到2034年將以6.8%的複合年成長率成長。這個市場主導地位源自於消費者對符合現代景觀美學的精準修剪草坪的偏好。大多數機器人割草機都針對較短的草坪進行了最佳化,使其在多功能性和性能方面更具優勢。使用者偏好低割草高度,以創造更整潔的住宅花園和小型商業地產景觀,這使得低割草高度成為最實用、應用最廣泛的選擇。

2024年,住宅市場佔據了64.6%的市場佔有率,預計2025年至2034年將以6.8%的複合年成長率成長。屋主對低維護成本和自動化草坪護理解決方案日益成長的需求持續推動市場成長。智慧家庭設備的普及以及可支配收入的增加,促使更多家庭投資購買機器人割草機。這些消費者優先考慮便利性、美觀效果和減少維護時間,這使得住宅市場的需求遠超商業應用領域,後者通常涉及更多變數和複雜性。

2024年,美國機器人割草機市佔率高達87.4%,預計到2034年,市場規模將達21億美元。其市場主導地位源自於消費者對機器人解決方案的廣泛認知以及對智慧家庭維護技術的強烈需求。廣泛的零售通路和完善的基礎設施為產品在全國範圍內的分銷提供了支援。精通技術的消費者、對電池驅動工具的早期接受度以及大量擁有中大型草坪的屋主,共同推動了市場的發展勢頭。此外,美國本土的創新也不斷突破性能、永續性和智慧整合的界線。

全球機器人割草機市場的主要參與者包括 Traqnology、Mammotion、Echo Robotics、Robomow、Ambrogio、Kress Robotics、Robert Bosch、Ecoflow、Worx Landroid、Honda Motor Company、Gardena、Husqvarna Group、Yarbo、John Deere、Dreame 和 Nextmow。為了鞏固市場地位,機器人割草機市場的企業正致力於人工智慧驅動的導航、更安靜的運作和節能的設計。多個品牌正在擴展產品線,以滿足不同面積和地形的草坪需求,同時瞄準預算有限的消費者和高階買家。先進的安全感測器、行動應用程式連接以及便於維護的模組化部件如今已成為標配。各公司也透過建立經銷商網路和提供售後服務來推動區域擴張。具有競爭力的價格、品牌專屬的設計元素以及環保的生產流程仍然是市場定位的關鍵。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 智慧家庭自動化需求不斷成長

- 勞動成本不斷上漲和人口老化

- 人們對永續景觀設計的認知不斷提高

- 科技進步(人工智慧、感測器、GPS)

- 產業陷阱與挑戰

- 初始投資成本高

- 在崎嶇或複雜地形上效果有限

- 電池限制和維護要求

- 機會

- 與物聯網和智慧助理整合

- 拓展至商業和市政景觀美化領域

- 訂閱模式和租賃方案

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監理框架

- 標準和合規要求

- 區域監理框架

- 認證標準

- 波特五力分析

- PESTEL 分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依類型分類,2021-2034年

- 主要趨勢

- 完全自主

- 半自主

第6章:市場估算與預測:依割草高度分類,2021-2034年

- 主要趨勢

- 低(0.5吋至1吋)

- 中等尺寸(1吋至1.5吋)

- 高(1.5吋至2吋)

第7章:市場估價與預測:依草坪面積分類,2021-2034年

- 主要趨勢

- 小型草坪(不超過0.25英畝)

- 中等大小的草坪(0.25 - 0.5 英畝)

- 大片草坪(0.5英畝以上)

第8章:市場估算與預測:依電池容量分類,2021-2034年

- 主要趨勢

- 最高20伏

- 20伏至30伏

- 高於30伏

第9章:市場估計與預測:依價格分類,2021-2034年

- 主要趨勢

- 低的

- 中等的

- 高的

第10章:市場估計與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 住宅

- 商業的

第11章:市場估價與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 線上

- 公司網站

- 電子商務

- 離線

- 專賣店

- 大型超市/超市

- 其他

第12章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第13章:公司簡介

- Ambrogio

- Dreame

- Echo Robotics

- Ecoflow

- Gardena

- Honda Motor Company

- Husqvarna Group

- John Deere

- Kress Robotics

- Mammotion

- Robert Bosch

- Robomow

- Traqnology

- Worx Landroid

- Yarbo

The Global Robotic Lawn Mower Market was valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 6 billion by 2034.

As automation and eco-consciousness gain traction, consumers are increasingly gravitating toward robotic lawn mowers as a smart, hands-free alternative to traditional lawn maintenance. These mowers offer a blend of convenience, energy efficiency, and low environmental impact, making them a key part of the evolving outdoor power equipment landscape. Advancements in artificial intelligence, improved battery life, and seamless integration with smart home ecosystems continue to propel adoption. Manufacturers are heavily focused on enhancing device safety, operational time, and usability while investing in sustainable design practices. Additionally, digital platforms are helping brands deliver added value to customers through product education, remote diagnostics, and service assistance. By leveraging online engagement and brand storytelling, many companies are carving out strong identities and gaining competitive ground in an increasingly saturated market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $6 Billion |

| CAGR | 6.6% |

The low cutting height segment held a 41.4% share and is expected to grow at a 6.8% CAGR through 2034. This dominance is linked to consumer preferences for precisely cut lawns that align with modern landscaping aesthetics. Most robotic mowers are optimized for shorter grass, giving this segment an edge in versatility and performance. Users favor low-height trimming for a cleaner appearance in both residential gardens and small commercial properties, making this configuration the most practical and widely adopted option.

The residential segment held a 64.6% share in 2024 and is projected to grow at a CAGR of 6.8% from 2025 to 2034. Rising homeowner interest in low-maintenance and automated lawn care solutions continues to drive growth. Increased comfort with smart home devices, paired with higher disposable incomes, is encouraging more households to invest in robotic mowers. These consumers prioritize convenience, aesthetic results, and reduced time spent on upkeep, fueling residential market demand far beyond that of commercial applications, which typically involve more variables and complexity.

U.S. Robotic Lawn Mower Market held 87.4% share in 2024, with projected revenues reaching USD 2.1 billion by 2034. The dominance stems from widespread awareness of robotic solutions and a strong inclination toward smart technologies in household maintenance. Broad retail availability and infrastructure support nationwide product distribution. The combination of tech-savvy consumers, early adoption of battery-powered tools, and significant numbers of homeowners with medium to large lawns contributes to the market's momentum. In addition, U.S.-based innovation continues to push the boundaries in terms of performance, sustainability, and smart integration.

Key players in the Global Robotic Lawn Mower Market include Traqnology, Mammotion, Echo Robotics, Robomow, Ambrogio, Kress Robotics, Robert Bosch, Ecoflow, Worx Landroid, Honda Motor Company, Gardena, Husqvarna Group, Yarbo, John Deere, Dreame, and Nextmow. To strengthen their foothold, companies in the robotic lawn mower market are focusing on AI-driven navigation, quieter operation, and energy-efficient design. Several brands are expanding their product lines to cater to varied lawn sizes and terrains, targeting both budget-conscious and premium buyers. Advanced safety sensors, mobile app connectivity, and modular parts for easier maintenance are now common features. Firms are also pushing for regional expansion by forming dealer networks and offering after-sales services. Competitive pricing, along with brand-specific design elements and eco-friendly manufacturing processes, remains central to market positioning efforts.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Cutting height

- 2.2.4 Lawn size

- 2.2.5 Battery capacity

- 2.2.6 Price

- 2.2.7 End Use

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for smart home automation

- 3.2.1.2 Growing labor costs and aging population

- 3.2.1.3 Rising awareness about sustainable landscaping

- 3.2.1.4 Technological advancements (AI, sensors, GPS)

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment cost

- 3.2.2.2 Limited effectiveness on uneven or complex terrains

- 3.2.2.3 Battery limitations and maintenance requirements

- 3.2.3 Opportunities

- 3.2.3.1 Integration with IoT and smart assistants

- 3.2.3.2 Expansion into commercial and municipal landscaping

- 3.2.3.3 Subscription-based models and leasing options

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory framework

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behaviour analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behaviour

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Fully autonomous

- 5.3 Semi-autonomous

Chapter 6 Market Estimates & Forecast, By Cutting Height, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Low (0.5 inch to 1 inch)

- 6.3 Medium (1 inch to 1.5 inch)

- 6.4 High (1.5 inches to 2 inches)

Chapter 7 Market Estimates & Forecast, By Lawn Size, 2021-2034 (USD Billion) (Units)

- 7.1 Key trends

- 7.2 Small lawns (up to 0.25 acres)

- 7.3 Medium lawns (0.25 - 0.5 acres)

- 7.4 Large lawns (0.5 acres and above)

Chapter 8 Market Estimates & Forecast, By Battery Capacity, 2021-2034 (USD Billion) (Units)

- 8.1 Key trends

- 8.2 Up to 20V

- 8.3 20V to 30V

- 8.4 Above 30V

Chapter 9 Market Estimates & Forecast, By Price, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Low

- 9.3 Medium

- 9.4 High

Chapter 10 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Residential

- 10.3 Commercial

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Online

- 11.2.1 Company websites

- 11.2.2 E-commerce

- 11.3 Offline

- 11.3.1 Specialty stores

- 11.3.2 Hypermarket/Supermarket

- 11.3.3 Others

Chapter 12 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Ambrogio

- 13.2 Dreame

- 13.3 Echo Robotics

- 13.4 Ecoflow

- 13.5 Gardena

- 13.6 Honda Motor Company

- 13.7 Husqvarna Group

- 13.8 John Deere

- 13.9 Kress Robotics

- 13.10 Mammotion

- 13.11 Robert Bosch

- 13.12 Robomow

- 13.13 Traqnology

- 13.14 Worx Landroid

- 13.15 Yarbo