|

市場調查報告書

商品編碼

1858964

電梯市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Elevators Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

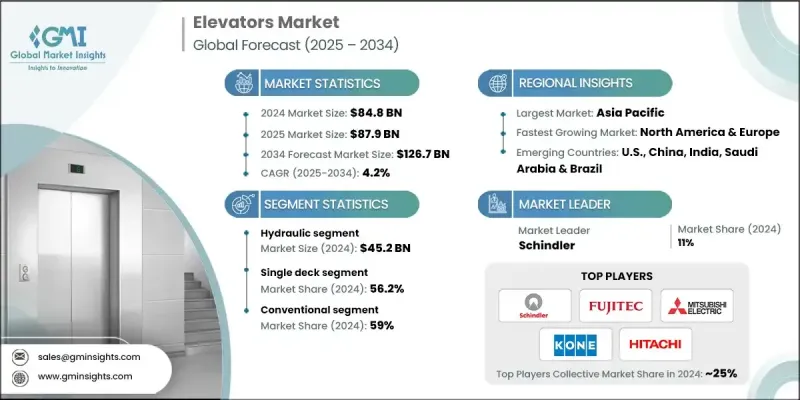

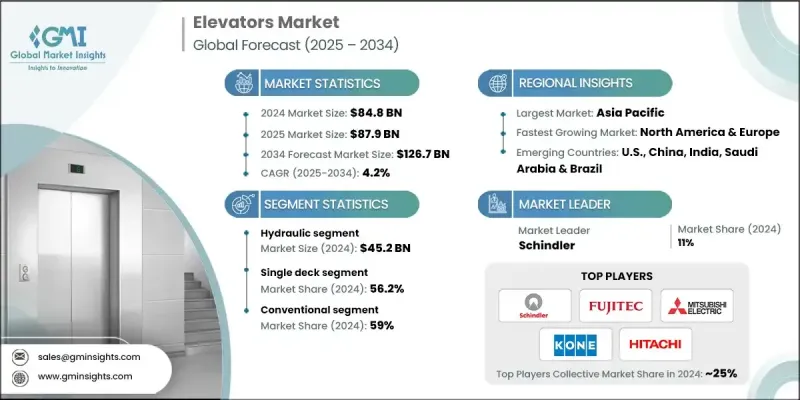

2024年全球電梯市場價值為848億美元,預計到2034年將以4.2%的複合年成長率成長至1267億美元。

全球基礎建設和城市現代化進程的持續推進,是推動垂直交通市場成長的主要動力。商業和住宅高層建築對高效垂直交通解決方案的需求日益成長,加速了市場發展。城市發展部門正大力投資智慧城市計畫和大型基礎設施項目,這些項目通常需要先進的電梯系統。建築翻新也發揮著重要作用,業主們正在用更新、更智慧的技術升級老舊系統,以符合最新的建築規範並提升營運效率。整合物聯網、人工智慧預測性維護和目的地調度系統的智慧電梯正在塑造垂直交通的未來。這些系統透過自適應演算法、即時監控和現代化介面,提高了安全性、能源效率和使用者舒適度。此外,改造項目也持續推動市場需求,現有建築正在配備先進的電梯技術,以提升功能並延長使用壽命。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 848億美元 |

| 預測值 | 1267億美元 |

| 複合年成長率 | 4.2% |

2024年,液壓電梯市場規模達到452億美元,預計2025年至2034年將以3.4%的複合年成長率成長。其持續受歡迎的原因在於其在中低層建築的實用性。與曳引式電梯相比,液壓電梯系統具有前期成本低、易於整合到緊湊空間以及維護需求更少等優點。近年來,永續液壓技術的創新,包括環保液壓油和更有效率的機械裝置,正在提升其環保性能和運作效率,使其成為太空和預算敏感型專案的首選。

2024年,單層電梯市佔率達到56.2%,預計到2034年將以3.9%的複合年成長率成長。其市場主導地位主要歸功於單層電梯在住宅、中高層商業建築和現代化改造項目中的廣泛應用。單層電梯設計更簡單、價格更實惠、維護更便捷,因此能夠很好地適應各種建築佈局。其簡便的安裝流程和較低的結構要求使其成為新建項目和建築改造的首選方案。

2024年美國電梯市場規模達130億美元,預計2025年至2034年將以2.9%的複合年成長率成長。美國市場的主導地位得益於強勁的商業和住宅建設項目,以及旨在實現基礎設施現代化改造的翻新項目。綠建築、智慧城市規劃和高樓的持續推進,也帶動了對新一代電梯系統的需求。三菱電機、日立、TK電梯、通力電梯和迅達等行業領導企業的存在,以及注重安全和能源效率的有利法規,進一步鞏固了美國市場的領先地位。

全球電梯市場的主要參與者包括東芝、現代電梯、TK電梯、三菱電機、富士達、日立、Electra電梯、迅達、Canny電梯、Sigma電梯、Aritco、ESCON電梯、舒馬赫電梯、通力(KONE)和EMAK。這些企業透過持續投資研發和整合人工智慧、物聯網以及節能組件等先進技術,不斷鞏固其市場地位。許多製造商正將重心轉向開發配備預測性維護系統和數位控制介面的智慧電梯,以提高效能並減少停機時間。與參與基礎設施項目的建築公司、房地產開發商和政府機構建立策略合作夥伴關係,也是擴大市場佔有率的關鍵。領導品牌正日益關注改造機會,提供針對現有建築量身訂製的升級解決方案。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 智慧城市與基礎建設發展

- 老舊基礎設施的現代化

- 創新技術的發展和對智慧電梯日益成長的需求

- 產業陷阱與挑戰

- 高昂的初始投資成本

- 嚴格的安全法規

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 貿易統計

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品分類,2021-2034年

- 主要趨勢

- 油壓

- 牽引力

- 無機房牽引

第6章:市場估算與預測:依甲板類型分類,2021-2034年

- 主要趨勢

- 單層甲板

- 雙層甲板

第7章:市場估算與預測:依建築高度分類,2021-2034年

- 主要趨勢

- 低層

- 中層

- 高層建築

第8章:市場估算與預測:依速度分類,2021-2034年

- 主要趨勢

- 小於1米/秒

- 速度介於 1 公尺/秒至 3 公尺/秒之間

- 速度介於 4 公尺/秒至 6 公尺/秒之間

- 速度介於 7 公尺/秒至 10 公尺/秒之間

- 速度高於 10 公尺/秒

第9章:市場估算與預測:依目的地控制,2021-2034年

- 主要趨勢

- 聰明的

- 傳統的

第10章:市場估計與預測:依產業分類,2021-2034年

- 主要趨勢

- 新設備

- 維護

- 現代化

第11章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 乘客

- 貨運

第12章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 住宅

- 家用電梯

- 其他

- 工業的

- 商業的

- 辦公室

- 飯店

- 衛生保健

- 其他(購物中心)

第13章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 印尼

- 馬來西亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第14章:公司簡介

- Aritco

- Canny Elevator

- Electra Elevators

- EMAK

- ESCON Elevators

- Fujitec

- Hitachi

- Hyundai Elevator

- KONE

- Mitsubishi Electric

- Schindler

- Schumacher Elevator

- Sigma Elevator

- TK Elevator

- Toshiba

The Global Elevators Market was valued at USD 84.8 billion in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 126.7 billion by 2034.

This growth is driven by the expanding development of infrastructure and urban modernization worldwide. The rising demand for efficient vertical mobility solutions in both commercial and residential high-rise buildings is accelerating market growth. Urban development authorities are investing in smart city initiatives and large-scale infrastructure projects, which often require sophisticated elevator systems. Building refurbishments are also contributing significantly, as property owners are upgrading aging systems with newer, smarter technologies to align with updated building codes and improve operational performance. The emergence of smart elevators integrated with IoT, AI-enabled predictive maintenance, and destination dispatch systems is shaping the future of vertical transportation. These systems offer improved safety, energy efficiency, and user comfort through adaptive algorithms, real-time monitoring, and modernized interfaces. The market is also seeing sustained demand from retrofit projects, where existing buildings are being equipped with advanced elevator technologies to boost functionality and extend service life.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $84.8 Billion |

| Forecast Value | $126.7 Billion |

| CAGR | 4.2% |

The hydraulic elevators segment generated USD 45.2 billion in 2024 and is projected to grow at a CAGR of 3.4% from 2025 to 2034. Their continued popularity stems from their practicality in low- to mid-rise buildings. These systems are recognized for their lower upfront costs, ease of integration into compact spaces, and reduced maintenance needs compared to traction elevators. Recent innovations in sustainable hydraulic technology, including eco-friendly fluids and more efficient mechanisms, are improving environmental compliance and operational performance, making them a preferred choice in space-conscious and budget-sensitive projects.

The single-deck segment held a 56.2% share in 2024 and is anticipated to grow at a CAGR of 3.9% through 2034. This dominance is attributed to its widespread use in residential, mid-rise commercial buildings, and modernization projects. Single-deck elevators are simpler in design, more affordable, and easier to maintain, making them highly compatible with a broad range of architectural layouts. Their uncomplicated installation process and lower structural requirements have made them a preferred solution for both new developments and building retrofits.

United States Elevators Market generated USD 13 billion in 2024 and is forecasted to grow at a CAGR of 2.9% from 2025 to 2034. The country's dominance is fueled by a strong pipeline of commercial and residential construction, along with renovation projects aimed at modernizing outdated infrastructure. Ongoing efforts in green building, smart urban planning, and high-rise expansion are increasing the demand for next-generation elevator systems. The presence of industry leaders such as Mitsubishi Electric, Hitachi, TK Elevator, KONE, and Schindler, coupled with favorable regulations focused on safety and energy efficiency, reinforces the U.S. market's leadership position.

Key players in the Global Elevators Market include Toshiba, Hyundai Elevator, TK Elevator, Mitsubishi Electric, Fujitec, Hitachi, Electra Elevators, Schindler, Canny Elevator, Sigma Elevator, Aritco, ESCON Elevators, Schumacher Elevator, KONE, and EMAK. Companies operating in the global elevators market are strengthening their position through continuous investment in R&D and integration of advanced technologies like AI, IoT, and energy-efficient components. Many manufacturers are shifting focus toward developing smart elevators equipped with predictive maintenance systems and digital control interfaces to enhance performance and reduce downtime. Strategic partnerships with construction firms, real estate developers, and government agencies involved in infrastructure projects are also key to expanding market share. Leading brands are increasingly focusing on retrofit opportunities, offering upgrade solutions tailored to existing buildings.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Deck type

- 2.2.4 Building height

- 2.2.5 Speed

- 2.2.6 Destination control

- 2.2.7 Business

- 2.2.8 Application

- 2.2.9 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Smart cities & infrastructure development

- 3.2.1.2 Modernization of aging infrastructure

- 3.2.1.3 Development of innovative technologies and rising demand for smart elevators

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Stringent safety regulations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Hydraulic

- 5.3 Traction

- 5.4 Machine room-less traction

Chapter 6 Market Estimates & Forecast, By Deck Type, 2021 - 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Single deck

- 6.3 Double deck

Chapter 7 Market Estimates & Forecast, By Building Height, 2021 - 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Low-rise

- 7.3 Mid-rise

- 7.4 High-rise

Chapter 8 Market Estimates & Forecast, By Speed, 2021 - 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Less than 1m/s

- 8.3 Between 1 m/s to 3 m/s

- 8.4 Between 4 m/s to 6 m/s

- 8.5 Between 7 m/s to 10 m/s

- 8.6 Above 10 m/s

Chapter 9 Market Estimates & Forecast, By Destination Control, 2021 - 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Smart

- 9.3 Conventional

Chapter 10 Market Estimates & Forecast, By Business, 2021 - 2034, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 New equipment

- 10.3 Maintenance

- 10.4 Modernization

Chapter 11 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Passenger

- 11.3 Freight

Chapter 12 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 Residential

- 12.2.1 Home lifts

- 12.2.2 Others

- 12.3 Industrial

- 12.4 Commercial

- 12.4.1 Office

- 12.4.2 Hotels

- 12.4.3 Healthcare

- 12.4.4 Others (Shopping malls)

Chapter 13 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Thousand Units)

- 13.1 Key trends

- 13.2 North America

- 13.2.1 U.S.

- 13.2.2 Canada

- 13.3 Europe

- 13.3.1 Germany

- 13.3.2 UK

- 13.3.3 France

- 13.3.4 Italy

- 13.3.5 Spain

- 13.4 Asia Pacific

- 13.4.1 China

- 13.4.2 India

- 13.4.3 Japan

- 13.4.4 South Korea

- 13.4.5 Australia

- 13.4.6 Indonesia

- 13.4.7 Malaysia

- 13.5 Latin America

- 13.5.1 Brazil

- 13.5.2 Mexico

- 13.5.3 Argentina

- 13.6 MEA

- 13.6.1 Saudi Arabia

- 13.6.2 UAE

- 13.6.3 South Africa

Chapter 14 Company Profiles

- 14.1 Aritco

- 14.2 Canny Elevator

- 14.3 Electra Elevators

- 14.4 EMAK

- 14.5 ESCON Elevators

- 14.6 Fujitec

- 14.7 Hitachi

- 14.8 Hyundai Elevator

- 14.9 KONE

- 14.10 Mitsubishi Electric

- 14.11 Schindler

- 14.12 Schumacher Elevator

- 14.13 Sigma Elevator

- 14.14 TK Elevator

- 14.15 Toshiba