|

市場調查報告書

商品編碼

1858884

硼烯應用市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Borophene Applications Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

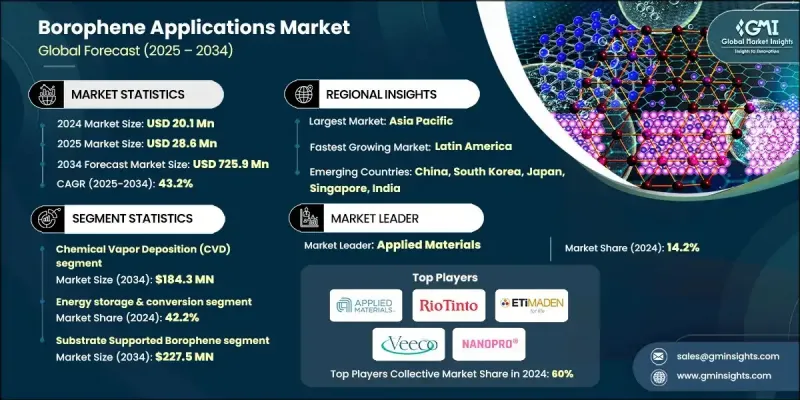

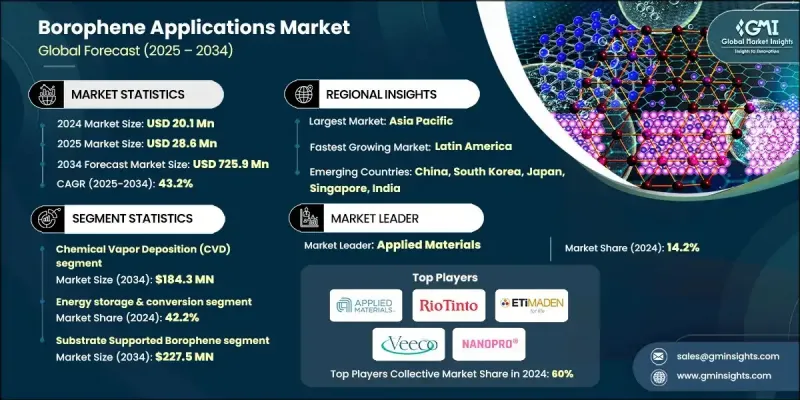

2024 年全球硼烯應用市場價值為 2,010 萬美元,預計到 2034 年將以 43.2% 的複合年成長率成長至 7.259 億美元。

硼烯的非凡成長源自於其獨特的導電性、柔韌性和定向性能,這些特性使其在先進領域超越了許多傳統材料。隨著全球再生能源和電動車的蓬勃發展,對下一代電池組件的需求日益成長。硼烯因其在鋰離子電池系統中極高的理論容量以及適用於超級電容器電極的特性,已成為極具潛力的候選材料。儘管由於其合成條件較為苛刻,硼烯的商業化規模化生產仍面臨挑戰,但近期的技術進步已顯著改善了生產流程。這些進步包括化學加工和剝離技術的創新,為更大規模的應用鋪平了道路。目前的研究表明,硼烯的鋰儲存潛力遠超傳統的石墨負極,使其成為未來能源解決方案的革命性選擇。其金屬特性以及可調控的電子行為,不僅在儲能系統領域,而且在電子、感測器和催化過程等領域都展現出變革性的潛力。市場的快速成長不僅反映了其卓越的性能,也反映了對材料創新的投入不斷增加。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2010萬美元 |

| 預測值 | 7.259億美元 |

| 複合年成長率 | 43.2% |

化學氣相沉積 (CVD) 技術在 2024 年創造了 520 萬美元的市場規模,預計到 2034 年將達到 1.843 億美元,這主要得益於其能夠製備厚度、結構一致且品質優異的硼烯薄膜。 CVD 技術具有高度可重複性和對合成變數的精確控制,這對於製造具有特定特性、適用於先進應用場景的硼烯至關重要。該工藝可與現有的半導體製造平台無縫整合,從而增強了其在電子領域的應用價值。此外,等離子體輔助 CVD 和低溫 CVD 方法的出現,在降低生產成本的同時,也提高了此製程的商業化規模,進一步推動了其應用。

到2024年,儲能和轉換領域將佔據42.2%的市場。該領域受益於硼烯優異的導電性、高理論能量容量和快速充放電響應特性,這些特性正被積極研究並應用於鋰離子電池、氫能系統和燃料電池組件。全球能源和電池技術巨頭正投入大量資金,加速研發工作,推動硼烯在清潔能源基礎設施的實際應用。

2024年北美硼烯應用市場規模為560萬美元,預計到2034年將達到1.877億美元,複合年成長率達42%。該地區受益於完善的學術機構、先進材料新創公司和創投支援體系。科學研究與產業發展之間的緊密聯繫正在推動創新,尤其是在電子和國防技術等領域,硼烯在這些領域正受到越來越多的關注。

在全球硼烯應用市場中,Nano Pro Ceramic、Veeco Instruments、Applied Materials、Eti Maden 和力拓集團 (Rio Tinto) 等關鍵企業正在引領市場發展。這些企業正採取多管齊下的策略來鞏固和擴大其市場地位。主要企業優先加大研發投入,以開發可擴展的生產方法並提升材料質量,從而滿足更高級的應用需求。技術提供者與學術機構之間的合作正在加速材料創新和商業化進程。此外,各企業也將硼烯生產能力與現有基礎設施結合,以降低成本並加快產品上市速度。策略聯盟、併購等手段也正被廣泛用於取得專有技術並強化智慧財產權組合。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 市場機遇

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場規模及預測:綜合法,2021-2034年

- 主要趨勢

- 分子束外延(MBE)

- 化學氣相沉積(CVD)

- 液相剝離法

- 電化學和機械剝離

- 其他

第6章:市場規模及預測:依產品形式分類,2021-2034年

- 主要趨勢

- 基底支撐的硼烯

- 獨立式和轉製式影片

- 功能化硼烯衍生物

- 複合材料和混合材料

- 硼烯-石墨烯異質結構

- 聚合物複合材料整合

- 陶瓷和金屬基複合材料

- 奈米結構形式

- 硼烯量子點

- 硼烯奈米管和奈米帶

- 3D硼烯結構

第7章:市場規模及預測:依應用領域分類,2021-2034年

- 主要趨勢

- 能量儲存與轉換

- 鋰離子電池負極

- 超級電容器電極

- 氫氣儲存

- 燃料電池催化劑

- 電子與光電子

- 軟性電子產品和穿戴式設備

- 光電探測器和感測器

- 儲存設備整合

- 透明導體

- 催化與化學加工

- 析氫反應(HER)催化劑

- 析氧反應(OER)

- 二氧化碳還原與環境催化

- 生物醫學與醫療保健

- 藥物輸送系統整合

- 生物影像與診斷

- 癌症診療與光熱療法

- 環境與感測器應用

- 氣體感測技術整合

- 水淨化與環境修復

- 生物感測器開發與醫療保健監測

第8章:市場規模及預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- Rio Tinto

- Eti Maden

- Applied Materials

- Veeco Instruments

- Nano Pro Ceramic

- Graphene Manufacturing Group

- American Elements Corporation

- Suzhou Graphene

The Global Borophene Applications Market was valued at USD 20.1 million in 2024 and is estimated to grow at a CAGR of 43.2% to reach USD 725.9 million by 2034.

This extraordinary growth is driven by borophene's unique combination of electrical conductivity, flexibility, and directional properties, which outperform many traditional materials in advanced sectors. With rising global momentum around renewable energy and electric mobility, the demand for next-generation battery components is gaining traction. Borophene has emerged as a high-potential candidate due to its extremely high theoretical capacity in lithium-ion battery systems and suitability for use in supercapacitor electrodes. Although the material's commercial scalability remains a challenge because of its sensitive synthesis requirements, recent technological advancements have significantly improved production techniques. These include innovations in chemical processing and exfoliation technologies, which are making way for larger-scale deployment. Current studies indicate that borophene offers lithium storage potential far exceeding traditional graphite anodes, positioning it as a revolutionary option in future energy solutions. Its metallic characteristics, combined with tunable electronic behavior, offer transformative potential not just in storage systems but across electronics, sensors, and catalytic processes. The market's rapid acceleration reflects not only its performance capabilities but also rising investments into material innovation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $20.1 Million |

| Forecast Value | $725.9 Million |

| CAGR | 43.2% |

The chemical vapor deposition (CVD) technology generated USD 5.2 million in 2024 to reach USD 184.3 million by 2034, driven by its ability to generate borophene films with consistent thickness, structure, and superior quality. CVD enables high reproducibility and precise control over synthesis variables, which is crucial for manufacturing borophene with specific traits suited for advanced use cases. This process seamlessly integrates with existing semiconductor fabrication platforms, enhancing its relevance for applications in the electronics space. Additionally, the emergence of plasma-assisted and low-temperature CVD approaches is making the process more commercially scalable while reducing production costs, further driving adoption.

The energy storage and conversion segment held a 42.2% share in 2024. This segment benefits greatly from borophene's superior conductivity, high theoretical energy capacity, and fast charge/discharge response attributes that are being actively researched for integration into lithium-ion batteries, hydrogen systems, and fuel cell components. Significant financial backing is being directed by global energy and battery technology players to accelerate R&D efforts that push borophene toward practical deployment in clean energy infrastructure.

North America Borophene Applications Market accounted for USD 5.6 million in 2024 and is expected to reach USD 187.7 million by 2034, growing at a CAGR of 42%. The region benefits from a well-established ecosystem of academic institutions, advanced materials startups, and supportive venture capital. Strong ties between scientific research and industrial development are propelling innovation, especially in fields like electronics and defense technologies, where borophene is gaining increased attention.

Key players shaping the Global Borophene Applications Market include Nano Pro Ceramic, Veeco Instruments, Applied Materials, Eti Maden, and Rio Tinto. Companies in the borophene applications market are deploying multi-pronged strategies to secure and expand their market positions. Major players are prioritizing heavy R&D investment to unlock scalable production methods and refine material quality for advanced use cases. Partnerships between technology providers and academic institutions are helping accelerate material innovation and commercialization. Firms are also integrating borophene production capabilities with existing infrastructure to lower costs and improve speed to market. Strategic alliances, mergers, and acquisitions are being leveraged to gain proprietary technologies and strengthen intellectual property portfolios.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Synthesis method

- 2.2.2 Product form

- 2.2.3 Application

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Synthesis Method, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Molecular beam epitaxy (MBE)

- 5.3 Chemical vapor deposition (CVD)

- 5.4 Liquid-phase exfoliation methods

- 5.5 Electrochemical & mechanical exfoliation

- 5.6 Others

Chapter 6 Market Size and Forecast, By Product Form, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Substrate-supported borophene

- 6.3 Free-standing & transferred films

- 6.4 Functionalized borophene derivatives

- 6.5 Composite & hybrid materials

- 6.5.1 Borophene-graphene heterostructures

- 6.5.2 Polymer composite integration

- 6.5.3 Ceramic & metal matrix composites

- 6.6 Nanostructured forms

- 6.6.1 Borophene quantum dots

- 6.6.2 Borophene nanotubes & nanoribbons

- 6.6.3 3D borophene structures

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Energy storage & conversion

- 7.2.1 Lithium-ion battery anodes

- 7.2.2 Supercapacitor electrode

- 7.2.3 Hydrogen storage

- 7.2.4 Fuel cell catalyst

- 7.3 Electronics & optoelectronics

- 7.3.1 Flexible electronics & wearable devices

- 7.3.2 Photodetector & sensor

- 7.3.3 Memory device integration

- 7.3.4 Transparent conductor

- 7.4 Catalysis & chemical processing

- 7.4.1 Hydrogen evolution reaction (HER) catalysts

- 7.4.2 Oxygen evolution reaction (OER)

- 7.4.3 Co2 reduction & environmental catalysis

- 7.5 Biomedical & healthcare

- 7.5.1 Drug delivery system integration

- 7.5.2 Bioimaging & diagnostic

- 7.5.3 Cancer theranostics & photothermal therapy

- 7.6 Environmental & sensor applications

- 7.6.1 Gas sensing technology integration

- 7.6.2 Water purification & environmental remediation

- 7.6.3 Biosensor development & healthcare monitoring

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 Rio Tinto

- 9.2 Eti Maden

- 9.3 Applied Materials

- 9.4 Veeco Instruments

- 9.5 Nano Pro Ceramic

- 9.6 Graphene Manufacturing Group

- 9.7 American Elements Corporation

- 9.8 Suzhou Graphene