|

市場調查報告書

商品編碼

1858871

特種油料作物市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Specialty Oil Crops Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

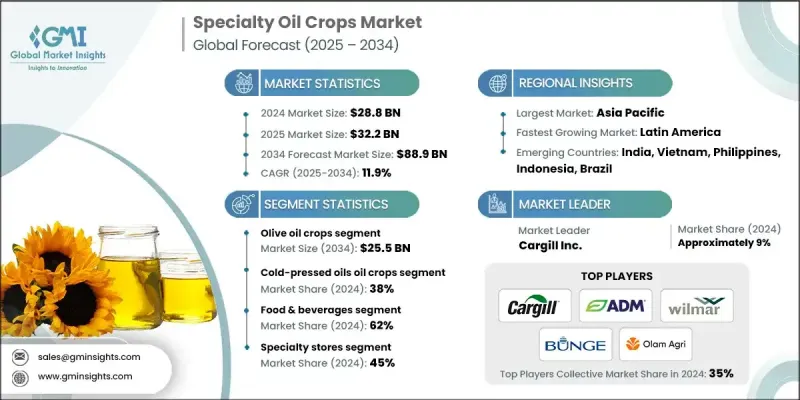

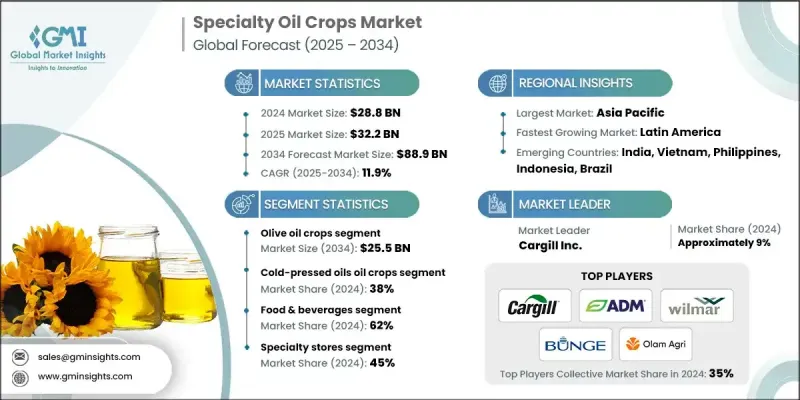

2024 年全球特種油料作物市場價值為 288 億美元,預計到 2034 年將以 11.9% 的複合年成長率成長至 889 億美元。

強勁的市場表現主要得益於消費者對更健康食用油的需求不斷成長,以及對植物性替代品營養優勢的日益關注。此外,消費者對健康和生活方式相關問題的日益重視,例如心血管疾病和肥胖症,也推動了市場成長,促使他們選擇富含omega-3和omega-6脂肪酸的食用油。隨著消費者積極尋求具有額外健康益處和天然成分的產品,特種油在注重健康的家庭和功能性食品領域越來越受歡迎。這些食用油在食品飲料行業的廣泛應用,也使其在化妝品和個人護理領域日益受到青睞,其潤膚和治療特性使其成為護膚、芳香療法和護髮應用的理想之選。對透明度和道德採購日益成長的需求,也促使生產商大力投資永續農業、清潔萃取技術和環保包裝。全球特種油作物產業正受到農業實踐創新和消費者對清潔標籤產品偏好的雙重影響,確保其在食品和非食品領域持續保持成長勢頭。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 288億美元 |

| 預測值 | 889億美元 |

| 複合年成長率 | 11.9% |

2024年,橄欖油產業產值達91億美元,預計到2034年將成長至255億美元,複合年成長率達11.7%。由於消費者普遍認知到橄欖油的健康益處,該產業仍保持市場領先地位。橄欖油富含抗氧化劑、單元不飽和脂肪和抗發炎成分,因此深受注重心臟健康和整體健康的消費者的青睞。其穩固的全球市場地位以及營養專家的積極推薦,進一步鞏固了其市場主導地位。

2024年,冷壓油作物市佔率達到38%,反映出消費者對保留天然營養成分、香氣和風味的食用油日益成長的需求。冷壓製程加工工序極少,因此能保留高濃度的維生素和抗氧化劑。這與「清潔標籤」趨勢以及消費者對健康、未精煉食用油的需求不謀而合,尤其是在高階食品品牌和注重健康的消費者群體中。

2024年,美國特種油料作物市場規模達到58億美元,預計2034年將以10.9%的複合年成長率成長。政府大力支持永續油籽研究,包括扶持有機和非基因改造作物,推動了國內市場的發展。消費者青睞壓榨油和冷壓油,因為它們純淨且有益健康,促進了烹飪領域的穩定成長。持續的創新和對更清潔、更健康替代品的追求,使美國在特種油品潮流中處於領先地位。

塑造全球特種油料作物市場格局的關鍵企業包括豐益國際(Wilmar International)、奧蘭農業(Olam Agri,現為奧蘭國際集團旗下公司)、嘉吉公司(Cargill Inc.)、ADM(Archer Daniels Midland,現為邦吉有限公司)和邦吉有限公司(Bunge Limited)。這些市場領導者正利用創新、永續發展和消費者互動相結合的方式來鞏固其市場地位。各公司正大力投資先進的冷壓和有機油萃取技術,以在滿足清潔標示標準的同時,保留產品的營養成分。與農民進行策略合作,確保非基因改造和可追溯的採購,從而保障透明度並加強供應鏈。許多品牌正在推出高階小批量產品,以滿足特定消費族群的需求,包括那些專注於純素食、功能性和治療用途的消費者。採用環保材料的包裝創新也是核心策略,因為品牌正在迎合消費者對永續發展的需求。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 市場機遇

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 按作物類型

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計

- 主要進口國

- 主要出口國(註:僅提供重點國家的貿易統計)

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依作物類型分類,2021-2034年

- 主要趨勢

- 橄欖油作物

- 椰子油作物

- 芝麻油作物

- 亞麻仁油作物

- 紅花油料作物

- 亞麻薺油作物

- 大麻籽油作物

- 其他特種油料作物

第6章:市場估算與預測:依加工方式分類,2021-2034年

- 主要趨勢

- 冷壓油

- 溶劑萃取

- 超臨界二氧化碳萃取

- 酵素輔助萃取

- 其他加工方法

第7章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 食品和飲料

- 食用油

- 功能性食品及營養保健品

- 烘焙食品和糖果

- 沙拉醬和調味汁

- 化妝品及個人護理

- 護膚應用

- 護髮應用

- 高階美容產品

- 藥品和營養保健品

- 藥物輸送系統

- 膳食補充劑

- 治療應用

- 生物燃料與能源

- 永續航空燃料

- 生質柴油應用

- 工業應用

- 油脂化學品

- 潤滑劑和塗料

- 其他工業用途

第8章:市場估算與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 大型超市和超市

- 線上零售

- 專賣店

- 健康食品店

- 美食及高階商店

- 餐飲服務

- 餐飲及飯店連鎖

- 機構銷售

- 其他分銷管道

- 農夫市集

- 直銷

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- ADM

- Agropur

- Borges International Group

- Bunge Limited

- California Olive Ranch

- Cargill Inc.

- Chosen Foods

- COFCO International

- Deoleo

- FreshMill Oils

- Golden Agri-Resources

- Gramiyum

- IOI Group

- La Tourangelle

- Louis Dreyfus Company

- Marico Limited

- Musim Mas

- Naissance

- Nutiva

- Olam Agri

- Olivado

- Spectrum Organic Products

- Statfold Seed Oils Ltd.

- Tata Consumer Products

- Wilmar International

The Global Specialty Oil Crops Market was valued at USD 28.8 billion in 2024 and is estimated to grow at a CAGR of 11.9% to reach USD 88.9 billion by 2034.

The strong market performance is being driven by rising demand for healthier cooking oils and growing awareness of the nutritional advantages of plant-based alternatives. A major contributor to growth is the increasing focus on wellness and lifestyle-related conditions, including cardiovascular issues and obesity, pushing consumers toward oils rich in omega-3 and omega-6 fatty acids. Specialty oils are gaining popularity in health-conscious households and functional food segments as consumers actively seek out products with added health benefits and natural ingredient profiles. The expanding use of these oils in the food and beverage industry is being matched by their rising appeal in cosmetics and personal care sectors, where their emollient and therapeutic properties are ideal for skincare, aromatherapy, and hair care applications. Growing demand for transparency and ethical sourcing has also led producers to invest heavily in sustainable agriculture, clean extraction technologies, and environmentally responsible packaging. The global specialty oil crops sector is being shaped by innovation in farming practices and consumer preference for clean-label products, ensuring continued momentum across both food and non-food segments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $28.8 Billion |

| Forecast Value | $88.9 Billion |

| CAGR | 11.9% |

In 2024, the olive oil crops segment generated USD 9.1 billion and is expected to grow to USD 25.5 billion by 2034, at a CAGR of 11.7%. This segment remains the market leader due to widespread awareness of its health-enhancing benefits. Olive oil is rich in antioxidants, monounsaturated fats, and anti-inflammatory components, making it a highly preferred choice for consumers prioritizing heart health and overall wellness. Its established global presence and positive endorsement by nutrition professionals further reinforce its dominant market share.

The cold-pressed oil crops segment held a 38% share in 2024, reflecting growing consumer interest in oils that retain natural nutrients, aroma, and flavor. The minimal processing involved in cold pressing results in high concentrations of vitamins and antioxidants. This aligns well with the clean-label trend and the demand for wholesome, unrefined oils, particularly among premium food brands and health-conscious buyers.

United States Specialty Oil Crops Market generated USD 5.8 billion in 2024 and is forecasted to grow at a CAGR of 10.9% through 2034. Strong government backing for sustainable oilseed research, including support for organic and non-GMO crops, is advancing the domestic market. Consumers are embracing expeller-press and cold-press oils for their purity and health benefits, fueling steady growth in the culinary space. Continued innovation and commitment to cleaner, healthier alternatives have placed the U.S. at the forefront of specialty oil trends.

Key companies shaping the Global Specialty Oil Crops Market include Wilmar International, Olam Agri (Olam International), Cargill Inc., Archer Daniels Midland (ADM), and Bunge Limited. Leading players in the specialty oil crops market are leveraging a mix of innovation, sustainability, and consumer engagement to strengthen their foothold. Companies are heavily investing in advanced cold-press and organic oil extraction technologies to retain nutritional integrity while meeting clean-label standards. Strategic collaborations with farmers for non-GMO and traceable sourcing ensure transparency and strengthen supply chains. Many brands are launching premium, small-batch products that cater to niche consumer segments, including those focused on vegan, functional, and therapeutic uses. Packaging innovation using eco-friendly materials is also a core strategy, as brands align with consumer demand for sustainability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Crop type

- 2.2.3 processing method

- 2.2.4 Application

- 2.2.5 Distribution channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By crop type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries( Note: the trade statistics will be provided for key countries only)

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.7 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Crop Type, 2021 - 2034 (USD Billion) (Tons)

- 5.1 Key trends

- 5.2 Olive oil crops

- 5.3 Coconut oil crops

- 5.4 Sesame oil crops

- 5.5 Flax/linseed oil crops

- 5.6 Safflower oil crops

- 5.7 Camelina oil crops

- 5.8 Hemp seed oil crops

- 5.9 Other specialty oil crops

Chapter 6 Market Estimates and Forecast, By Processing Method, 2021 - 2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Cold-pressed oils

- 6.3 Solvent extraction

- 6.4 Supercritical co2 extraction

- 6.5 Enzyme-assisted extraction

- 6.6 Other processing methods

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.2.1 Culinary oils

- 7.2.2 Functional foods & nutraceuticals

- 7.2.3 Bakery & confectionery

- 7.2.4 Salad dressings & sauces

- 7.3 Cosmetics & personal care

- 7.3.1 Skincare applications

- 7.3.2 Hair care applications

- 7.3.3 Premium beauty products

- 7.4 Pharmaceuticals & nutraceuticals

- 7.4.1 Drug delivery systems

- 7.4.2 Dietary supplements

- 7.4.3 Therapeutic applications

- 7.5 Biofuels & energy

- 7.5.1 Sustainable aviation fuel

- 7.5.2 Biodiesel applications

- 7.6 Industrial applications

- 7.6.1 Oleochemicals

- 7.6.2 Lubricants & coatings

- 7.6.3 Other industrial uses

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Tons)

- 8.1 Key trends

- 8.2 Hypermarkets & supermarkets

- 8.3 Online retail

- 8.4 Specialty stores

- 8.4.1 Health food stores

- 8.4.2 Gourmet & premium outlets

- 8.5 Food service

- 8.5.1 Restaurant & hotel chains

- 8.5.2 Institutional sales

- 8.6 Other distribution channels

- 8.6.1 Farmers markets

- 8.6.2 Direct sales

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 ADM

- 10.2 Agropur

- 10.3 Borges International Group

- 10.4 Bunge Limited

- 10.5 California Olive Ranch

- 10.6 Cargill Inc.

- 10.7 Chosen Foods

- 10.8 COFCO International

- 10.9 Deoleo

- 10.10 FreshMill Oils

- 10.11 Golden Agri-Resources

- 10.12 Gramiyum

- 10.13 IOI Group

- 10.14 La Tourangelle

- 10.15 Louis Dreyfus Company

- 10.16 Marico Limited

- 10.17 Musim Mas

- 10.18 Naissance

- 10.19 Nutiva

- 10.20 Olam Agri

- 10.21 Olivado

- 10.22 Spectrum Organic Products

- 10.23 Statfold Seed Oils Ltd.

- 10.24 Tata Consumer Products

- 10.25 Wilmar International