|

市場調查報告書

商品編碼

1858870

連續製造市場機會、成長促進因素、產業趨勢分析及2025-2034年預測Continuous Manufacturing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

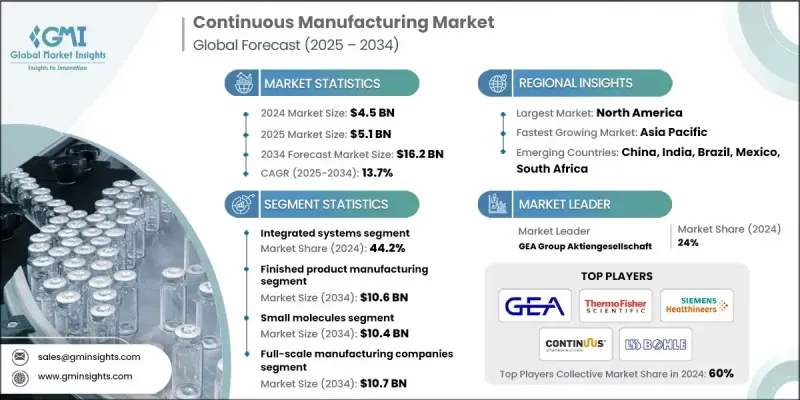

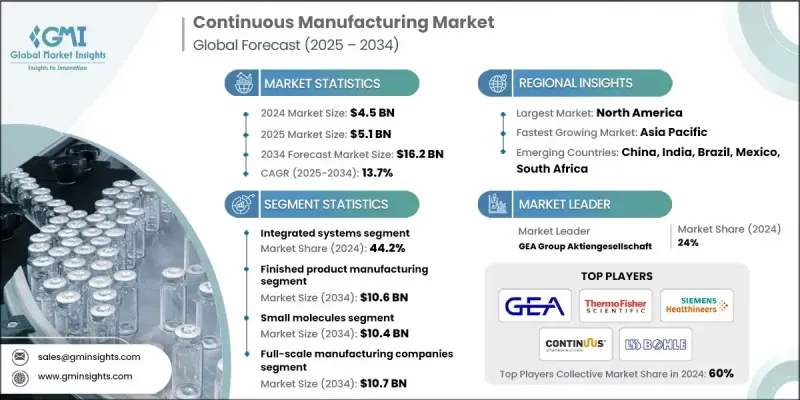

2024 年全球連續製造市場價值為 45 億美元,預計到 2034 年將以 13.7% 的複合年成長率成長至 162 億美元。

隨著製藥企業轉向更快、可擴展且更可靠的生產系統,市場正在擴張。連續生產在監管鼓勵和對更靈活的藥物生產流程需求不斷成長的背景下,正獲得強勁發展勢頭。企業正從傳統的間歇式生產系統轉向連續技術,以期獲得更佳的製程控制、更低的浪費和更短的生產週期。隨著個人化醫療和小批量治療藥物需求的成長,能夠快速適應並更有效率運作的生產模式變得至關重要。這項技術能夠實現即時監控、簡化操作流程並提高合規性,從而迅速改變藥物的生產方式。小分子藥物和生物製劑的生產都因這些創新而發生革命性變化,因為該行業越來越重視成本效益、速度和品質。隨著企業不斷優先考慮更快的市場交付速度和更嚴格的營運控制,連續生產正迅速成為整個製藥生產領域的新標準。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 45億美元 |

| 預測值 | 162億美元 |

| 複合年成長率 | 13.7% |

預計到2034年,成品藥生產領域市場規模將達106億美元。該領域的成長主要得益於連續生產技術在最終藥品生產中的日益普及,這些技術有助於製造商縮短生產週期並減少營運瓶頸。連續生產平台能夠提高產品一致性,實現自動化、高通量生產,大幅減少人為干預,並透過線上控制增強品質保證。這些整合系統在口服製劑和注射的生產中正變得至關重要,能夠顯著提高成本效益和製程可靠性。

預計到2034年,小分子藥物市場規模將達到104億美元。其市場主導地位源自於腫瘤、傳染病和慢性病等治療領域對小分子藥物的廣泛需求。由於生產方法成熟、結構簡單且生產規模龐大,這些化合物與連續生產過程高度契合。隨著製藥公司尋求最佳化生產線,小分子藥物在連續生產應用方面處於領先地位,因為它們能夠在不犧牲品質或可擴展性的前提下實現高效生產。

2024年,美國連續生產市場規模預計將達18億美元。該市場正受益於監管支持的更新、對彈性生產模式的日益重視以及對數位製造技術的巨額投資而蓬勃發展。美國在全球藥品生產中扮演著至關重要的角色,而連續生產作為一種增強供應鏈穩健性和維持高生產標準的策略,其吸引力與日俱增。隨著美國本土製造商尋求簡化工作流程和降低營運風險,連續生產流程的應用也不斷普及。

推動全球連續製造市場轉型的主要企業包括:Munson Machinery、Thermo Fisher Scientific、Syntegon Technology、Siemens Healthineers、STEER World、Gericke、FREUND CORPORATION、LB Bohle Maschinen und Verfahren、KORSCH、Continuus Pharmaceuticals、Scott Equip Company、und Verfahren、KORSCH、Continuus Pharmaceuticals、Scott Equip Companym. GmbH、Glatt 和 Gebruder Lodige Maschinenbau。全球連續製造市場的企業正透過多種針對性策略提升其市場地位。其中一個重點是開發模組化和可擴展的系統,以靈活應用於各種製藥領域。製造商正在投資自動化和即時資料整合,以加強生產控制並滿足嚴格的監管標準。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 連續生產監理支持

- 營運效率和成本降低

- 即時品質控制和過程監控

- 對個人化和小批量療法的需求不斷成長

- 產業陷阱與挑戰

- 高初始資本投入

- 熟練勞動力有限

- 市場機遇

- 生物製劑和大分子藥物生產領域的擴張

- 合約製造服務成長

- 成長促進因素

- 成長潛力分析

- 監管環境

- 技術格局

- 當前技術趨勢

- 新興技術

- 未來市場趨勢

- 專利分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品類型分類,2021-2034年

- 主要趨勢

- 整合系統

- 半連續系統

- 連續式造粒機

- 連續塗佈機

- 連續式攪拌機

- 連續式乾燥機

- 連續式壓縮機

- 其他半連續系統

- 軟體

第6章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 成品製造

- 固體劑量

- 半固體劑型

- 液體劑量

- API生產

第7章:市場估計與預測:依治療類型分類,2021-2034年

- 主要趨勢

- 小分子

- 大分子

第8章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 研發部門

- 研究機構

- 合約研究組織(CRO)

- 全規模製造業

- 合約生產組織(CMO)

- 製藥和生物技術公司

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Continuus Pharmaceuticals

- Coperion GmbH

- FREUND CORPORATION

- GEA Group Aktiengesellschaft

- Gebruder Lodige Maschinenbau

- Gericke

- Glatt

- KORSCH

- LB Bohle Maschinen und Verfahren

- Munson Machinery

- Scott Equipment company

- Siemens Healthineers

- STEER World

- Sturtevant Inc

- Syntegon Technology

- Thermo Fisher Scientific

The Global Continuous Manufacturing Market was valued at USD 4.5 billion in 2024 and is estimated to grow at a CAGR of 13.7% to reach USD 16.2 billion by 2034.

The market is undergoing expansion as pharmaceutical manufacturers pivot toward faster, scalable, and more reliable production systems. Continuous manufacturing is gaining strong momentum with growing regulatory encouragement and rising demand for more agile drug manufacturing processes. Companies are transitioning away from conventional batch-based systems in favor of continuous technologies that provide improved process control, lower waste, and reduced lead times. As personalized medicine and small-batch therapeutics grow in demand, the need for production models that can adapt quickly and operate more efficiently has become critical. This technology enables real-time monitoring, streamlined operations, and better compliance factors that are rapidly transforming how drugs are produced. Both small molecule and biologics manufacturing are being revolutionized through these innovations, as the industry places greater emphasis on cost-efficiency, speed, and quality. As companies continue to prioritize faster market delivery and tighter operational control, continuous manufacturing is quickly becoming the new standard across the pharmaceutical production landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.5 Billion |

| Forecast Value | $16.2 Billion |

| CAGR | 13.7% |

The finished product manufacturing segment is projected to reach USD 10.6 billion by 2034. This segment's expansion is fueled by the growing implementation of continuous technologies in the production of final drug products, helping manufacturers achieve quicker production timelines and reduced operational bottlenecks. Continuous platforms improve consistency and enable automated, high-throughput processes, significantly minimizing human intervention while enhancing quality assurance through in-line controls. These integrated systems are becoming essential in manufacturing oral dosage forms and injectable products with greater cost-effectiveness and process reliability.

The small molecules segment is forecasted to hit USD 10.4 billion by 2034. Its dominance stems from the widespread demand for small-molecule drugs across therapeutic areas like oncology, infectious diseases, and chronic illnesses. These compounds are highly compatible with continuous processes due to their well-established production methods, structural simplicity, and volume-driven manufacturing needs. As pharma companies look to optimize production lines, small molecules are at the forefront of continuous manufacturing adoption because they support high-efficiency production without compromising quality or scalability.

United States Continuous Manufacturing Market was valued at USD 1.8 billion in 2024. The market is advancing due to updated regulatory support, increased focus on resilient production models, and heavy investments in digitalized manufacturing technologies. The US plays a critical role in global pharmaceutical output, with continuous manufacturing becoming increasingly attractive as a strategy for enhancing supply chain robustness and maintaining high production standards. As domestic manufacturers seek to streamline workflows and reduce operational risks, adoption of continuous processes continues to gain ground.

Key players driving this transformation in the Global Continuous Manufacturing Market include Munson Machinery, Thermo Fisher Scientific, Syntegon Technology, Siemens Healthineers, STEER World, Gericke, FREUND CORPORATION, L.B. Bohle Maschinen und Verfahren, KORSCH, Continuus Pharmaceuticals, Scott Equipment Company, Sturtevant Inc., GEA Group Aktiengesellschaft, Coperion GmbH, Glatt, and Gebruder Lodige Maschinenbau. Companies in the Global Continuous Manufacturing Market are enhancing their market position through several targeted strategies. A key focus is on developing modular and scalable systems that offer flexibility across a range of pharmaceutical applications. Manufacturers are investing in automation and real-time data integration to boost production control and meet stringent regulatory standards.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Application trends

- 2.2.4 Therapeutic type trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Regulatory support for continuous manufacturing

- 3.2.1.2 Operational efficiency and cost reduction

- 3.2.1.3 Real-time quality control and process monitoring

- 3.2.1.4 Rising demand for personalized and small-batch therapies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial capital investment

- 3.2.2.2 Limited skilled workforce

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in biologics and large molecule manufacturing

- 3.2.3.2 Growth in contract manufacturing services

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Patent analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Integrated systems

- 5.3 Semi-continuous systems

- 5.3.1 Continuous granulators

- 5.3.2 Continuous coaters

- 5.3.3 Continuous blenders

- 5.3.4 Continuous dryers

- 5.3.5 Continuous compressors

- 5.3.6 Other semi-continuous systems

- 5.4 Software

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Finished product manufacturing

- 6.2.1 Solid dosage

- 6.2.2 Semi solid dosage

- 6.2.3 Liquid dosage

- 6.3 API manufacturing

Chapter 7 Market Estimates and Forecast, By Therapeutic Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Small molecule

- 7.3 Large molecules

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 R&D departments

- 8.2.1 Research institutes

- 8.2.2 Contract research organizations (CROs)

- 8.3 Full-scale manufacturing companies

- 8.3.1 Contract manufacturing organizations (CMOs)

- 8.3.2 Pharmaceutical and biotechnological companies

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Continuus Pharmaceuticals

- 10.2 Coperion GmbH

- 10.3 FREUND CORPORATION

- 10.4 GEA Group Aktiengesellschaft

- 10.5 Gebruder Lodige Maschinenbau

- 10.6 Gericke

- 10.7 Glatt

- 10.8 KORSCH

- 10.9 L.B. Bohle Maschinen und Verfahren

- 10.10 Munson Machinery

- 10.11 Scott Equipment company

- 10.12 Siemens Healthineers

- 10.13 STEER World

- 10.14 Sturtevant Inc

- 10.15 Syntegon Technology

- 10.16 Thermo Fisher Scientific