|

市場調查報告書

商品編碼

1858849

發酵衍生天然香料市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Fermentation-Derived Natural Flavors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

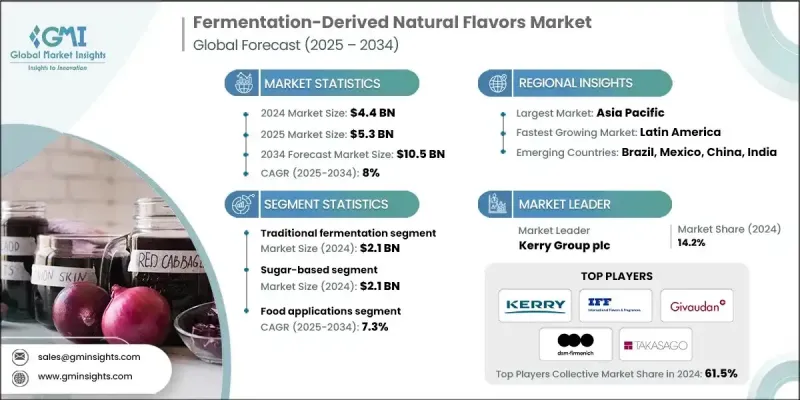

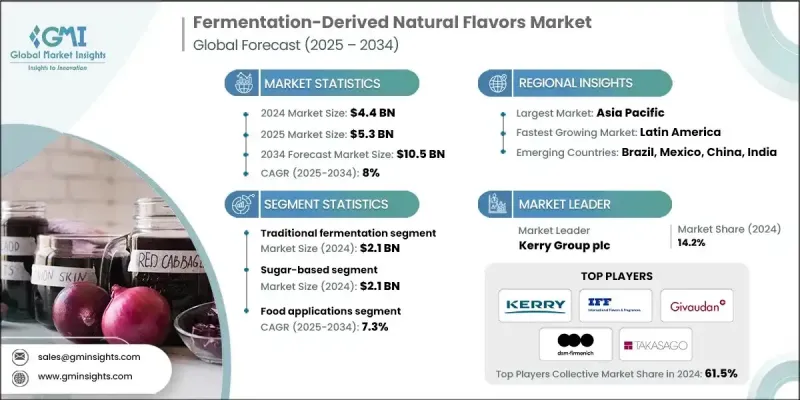

2024 年全球發酵衍生天然香料市場價值為 44 億美元,預計到 2034 年將以 8% 的複合年成長率成長至 105 億美元。

市場成長正迅速發展,主要受消費者對清潔標籤、永續配料日益成長的需求以及生物技術快速進步的推動。向環境友善生產方式的轉變正在重塑整個產業,人們越來越傾向於使用再生原料和循環經濟實踐。農產品價格的波動促使製造商採用替代原料,不僅穩定了成本,也減少了對環境的影響。同時,精準發酵正成為一項顛覆性的創新。透過基因工程微生物和合成生物學,企業現在能夠生產出以前傳統方法無法獲得的、具有高度針對性的風味分子。更高的純度、一致性和可擴展性吸引了大量投資用於微生物菌株工程和生物製程最佳化。這些進步正在改變天然香料在食品和飲料應用中的創造和整合方式。有利的監管框架以及消費者對生物技術食品配料日益成長的興趣,尤其是在已開發地區,進一步推動了市場成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 44億美元 |

| 預測值 | 105億美元 |

| 複合年成長率 | 8% |

預計到2024年,傳統發酵產業的市場規模將達到21億美元。這種方法之所以經久不衰,是因為其資本投入較低、消費者信任度高且監管簡便,特別是因為它通常使用符合GRAS(公認安全)標準的食品級微生物。這些技術尤其適用於那些對風味複雜性要求高於化合物純度的市場,例如傳統美食和手工食品領域。在這些應用中,傳統發酵既符合預算需求,又能滿足文化期望。

2024年,糖基原料市場規模達到21億美元,預計2034年將佔48%的市佔率。該市場以7%的適度成長,受益於成熟的供應鏈和最佳化完善的發酵技術。源自常見醣類的原料可提供易於發酵的碳源,這對於微生物風味化合物的生產至關重要。儘管成長速度較為穩定,但由於其可靠性和營運效率,該市場仍是許多大型發酵業務的支柱。

2024年,北美發酵衍生天然香料市佔率達到36%,預計2034年將以7%的複合年成長率成長。該地區的成長得益於先進的生物技術生態系統、消費者對天然和清潔標籤成分的強勁需求,以及有利於生物技術衍生食品成分商業化的監管框架。在該地區設有研發和生產設施的主要企業正在加速香料開發創新,以滿足不斷變化的消費者期望。

在全球發酵天然香料市場中,羅伯特集團(Robertet SA)、聖潔科技(Symrise AG)、帝斯曼-菲美尼(DSM-Firmenich)、奇華頓(Givaudan SA)、森馨科技(Sensient Technologies Corporation)、凱瑞集團(Kerry Group plc)、國際香料 Hanman(International Holding)控股公司(International F. A/S)、高砂國際株式會社(Takasago International Corporation)和銀杏生物工程控股公司(Ginkgo Bioworks Holdings Inc.)等領先企業正積極投資研發,以最佳化微生物菌株的性能並最大限度地提高風味物質的產量。許多企業正在採用精準發酵技術來生產高價值、具有獨特風味的化合物,這些化合物具有更高的純度和可擴展性。此外,各企業也致力於原料來源多元化,採用永續且經濟高效的原料,以減少對環境的影響和生產風險。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 消費者對天然成分的需求日益成長

- 生物技術應用監管支持

- 精準發酵技術進步

- 產業陷阱與挑戰

- 高初始資本投資要求

- 複雜的法規核准流程

- 供應鏈最佳化與原物料採購

- 市場機遇

- 拓展至植物性與功能性食品領域

- 利用當地原料開發區域特色風味

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 依原料類型

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依生產技術分類,2021-2034年

- 主要趨勢

- 精準發酵

- 傳統發酵

- 混合生物轉化

第6章:市場估算與預測:依原料類型分類,2021-2034年

- 主要趨勢

- 糖基原料

- 甘蔗

- 甜菜

- 葡萄糖

- 果糖

- 澱粉基原料

- 玉米

- 木薯

- 馬鈴薯

- 小麥澱粉

- 纖維素和廢棄原料

- 農業殘餘物

- 食物浪費

- 專用基質

- 蛋白質水解物

- 海洋生質能

- 新型底物

第7章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 食品應用

- 加工食品

- 烘焙食品

- 糖果

- 飲料應用

- 軟性飲料

- 酒精飲料

- 功能飲料

- 乳製品及植物性替代品

- 傳統乳製品

- 植物奶

- 起司替代品

- 化妝品及個人護理

- 化妝品成分

- 香水應用

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- Cargill Inc

- Archer Daniels Midland Company

- Bunge Limited

- COFCO Corporation

- Louis Dreyfus Company

- Verdesian Life Sciences

- Avani Seeds Ltd

- Lidea

- Buhler

- Nestle

- Agrovita Foods

The Global Fermentation-Derived Natural Flavors Market was valued at USD 4.4 billion in 2024 and is estimated to grow at a CAGR of 8% to reach USD 10.5 billion by 2034.

The market growth is rapidly evolving, driven by rising consumer demand for clean-label, sustainable ingredients and rapid advances in biotechnology. The shift toward environmentally responsible production methods is reshaping the industry, with a growing preference for renewable feedstocks and circular economy practices. Volatile agricultural commodity prices have pushed manufacturers to adopt alternative raw materials, which not only stabilize costs but also reduce environmental footprints. Meanwhile, precision fermentation is emerging as a game-changing innovation. Through engineered microbes and synthetic biology, companies are now capable of producing highly targeted flavor molecules that were previously inaccessible via conventional methods. Enhanced purity, consistency, and scalability are attracting massive investments in microbial strain engineering and bioprocess optimization. These advancements are transforming the creation and integration of natural flavors into food and beverage applications. Market growth is further supported by a favorable regulatory framework and growing consumer interest in biotechnology-based food ingredients, especially in developed regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.4 Billion |

| Forecast Value | $10.5 Billion |

| CAGR | 8% |

The traditional fermentation segment generated USD 2.1 billion in 2024. This method remains popular due to its lower capital requirements, consumer trust, and regulatory ease, especially since it typically uses food-safe microorganisms with GRAS classification. These techniques are particularly well-suited for markets where flavor complexity is more critical than compound purity, including heritage cuisines and artisanal food segments. In such applications, traditional fermentation aligns with both budgetary needs and cultural expectations.

The sugar-based feedstocks segment generated USD 2.1 billion in 2024, holding a 48% share projected through 2034. Growing at a moderate 7% rate, this segment benefits from long-established supply chains and well-optimized fermentation technologies. Feedstocks derived from common sugars offer readily fermentable carbon sources that are essential for microbial flavor compound production. While its growth rate is steady, the segment continues to serve as the backbone of many large-scale fermentation operations due to its reliability and operational efficiency.

North America Fermentation-Derived Natural Flavors Market held a 36% share in 2024 and is expected to grow at a 7% CAGR through 2034. The region's growth is powered by an advanced biotech ecosystem, robust consumer demand for natural and clean-label ingredients, and regulatory frameworks that facilitate the commercialization of biotech-derived food components. Major players operating R&D and production facilities in the region are accelerating innovation in flavor development to meet evolving consumer expectations.

Companies shaping the competitive landscape of the Global Fermentation-Derived Natural Flavors Market include Robertet SA, Symrise AG, DSM-Firmenich, Givaudan SA, Sensient Technologies Corporation, Kerry Group plc, International Flavors & Fragrances Inc., and Chr. Hansen Holding A/S, Takasago International Corporation, and Ginkgo Bioworks Holdings Inc., leading firms in the Fermentation-Derived Natural Flavors Market, are aggressively investing in R&D to refine microbial strain performance and maximize flavor yield. Many are adopting precision fermentation technologies to produce high-value, niche flavor compounds that offer superior purity and scalability. Companies are also focusing on diversifying raw material sourcing, embracing sustainable and cost-effective feedstocks to reduce environmental impact and production risks.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Admixtures

- 2.2.3 Application Methods

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing Consumer Demand for Natural Ingredients

- 3.2.1.2 Regulatory Support for Biotechnology Applications

- 3.2.1.3 Technological Advancements in Precision Fermentation

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High Initial Capital Investment Requirements

- 3.2.2.2 Complex Regulatory Approval Processes

- 3.2.2.3 Supply Chain Optimization & Raw Material Sourcing

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into Plant-Based and Functional Food Segments

- 3.2.3.2 Development of Region-Specific Flavor Profiles Using Local Feedstocks

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation Landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By feedstock type

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Production Technology, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Precision fermentation

- 5.3 Traditional fermentation

- 5.4 Hybrid biotransformation

Chapter 6 Market Estimates and Forecast, By Feedstock Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Sugar-Based Feedstocks

- 6.2.1 Sugarcane

- 6.2.2 Sugar Beet

- 6.2.3 Glucose

- 6.2.4 Fructose

- 6.3 Starch-Based Feedstocks

- 6.3.1 Corn

- 6.3.2 cassava

- 6.3.3 potato

- 6.3.4 wheat starch

- 6.4 Cellulosic & Waste Feedstocks

- 6.4.1 Agricultural residues

- 6.4.2 Food Waste

- 6.5 Specialized Substrates

- 6.5.1 Protein hydrolysates

- 6.5.2 Marine biomass

- 6.5.3 Novel substrates

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food Applications

- 7.2.1 Processed foods

- 7.2.2 Baked goods

- 7.2.3 Confectionery

- 7.3 Beverage Applications

- 7.3.1 Soft drinks

- 7.3.2 Alcoholic beverages,

- 7.3.3 Functional drinks

- 7.4 Dairy & Plant-Based Alternatives

- 7.4.1 Traditional dairy

- 7.4.2 Plant-based milk

- 7.4.3 Cheese alternatives

- 7.5 Cosmetics & Personal Care

- 7.5.1 Cosmetic ingredients

- 7.5.2 Fragrance applications

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Cargill Inc

- 9.2 Archer Daniels Midland Company

- 9.3 Bunge Limited

- 9.4 COFCO Corporation

- 9.5 Louis Dreyfus Company

- 9.6 Verdesian Life Sciences

- 9.7 Avani Seeds Ltd

- 9.8 Lidea

- 9.9 Buhler

- 9.10 Nestle

- 9.11 Agrovita Foods