|

市場調查報告書

商品編碼

1858846

用於光計算的光子晶體市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Photonic Crystals for Optical Computing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

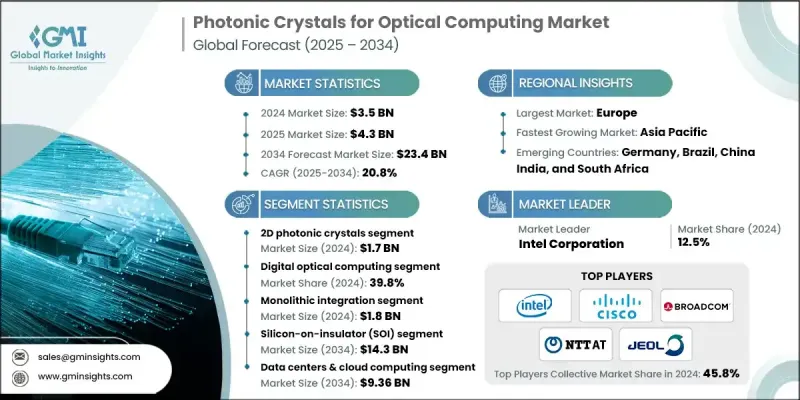

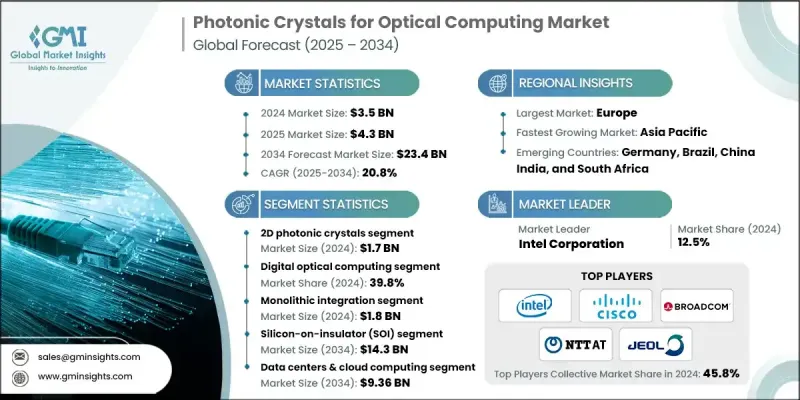

2024 年全球光子晶體光運算市場價值為 35 億美元,預計到 2034 年將以 20.8% 的複合年成長率成長至 234 億美元。

這一成長反映了光子晶體技術,特別是高效能運算系統中光子晶體技術的日益融合。推動這一成長的關鍵因素包括對指數級資料處理需求的不斷成長、矽光子學的演進以及新型光計算架構的出現。政府資助和國防現代化計畫對節能運算基礎設施的推動也是重要因素。這些技術的潛在應用十分廣泛,包括資料中心、電信、量子運算以及人工智慧/機器學習加速等,所有這些都持續推動市場成長。此外,旨在提升基於光子晶體的光計算系統性能和可擴展性的研發投入不斷增加,也加速了其應用。隨著製造流程的改進和成本的降低,預計這些技術將在全球各行各業和各個地區中廣泛應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 35億美元 |

| 預測值 | 234億美元 |

| 複合年成長率 | 20.8% |

預計2024年,2D光子晶體市場規模將達17億美元,複合年成長率(CAGR)為20.7%。先進光運算領域對2D光子晶體的需求主要源自於其能夠與波導和光子晶體平板結構高效整合。製造技術和加工流程的進步也推動了這一趨勢,降低了傳統上與這些系統相關的嚴格性能要求。

預計到2024年,數位光運算領域將佔據39.8%的市場佔有率,高速資料處理的需求是推動這一領域發展的主要動力。先進的全光交換系統、二元邏輯運算以及速度更快的數位訊號處理等創新技術將進一步促進成長。此外,計算領域的能源效率最佳化以及政府對增強型運算基礎設施的投資也是重要的市場促進因素。

2024年,歐洲光子晶體光運算市場規模達12億美元。預計到2034年,歐洲市場將顯著成長,達到81億美元,複合年成長率(CAGR)為20.8%。推動這一成長的因素包括:對節能運算解決方案的需求不斷成長、對光子學研發的大量投資,以及光計算技術在資料中心和電信領域的日益普及。

全球光子晶體光運算市場的主要參與者包括英特爾公司、Lightmatter公司、NTT先進技術公司、Xanadu Quantum Technologies公司、G&H Photonics有限公司、思科系統公司、PsiQuantum公司、Ayar Labs公司、日本電子株式會社和博通公司。為了維持和擴大市場佔有率,該領域的公司正致力於提升產品性能並實現產品組合多元化。對研發的策略性投資是推出先進光子晶體解決方案、提高可擴展性和功能性的關鍵。各公司也與學術機構、研究組織和其他行業領導者合作,以推動創新並提高光計算系統的效率。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 促進要素:

- 對速度更快、能效更高的運算能力的需求

- 奈米技術和製造方法的進步

- 不斷成長的資料流量和人工智慧/機器學習處理需求

- 量子和光學運算領域的研發投入不斷成長

- 陷阱與挑戰:

- 生產流程複雜且成本高

- 與現有半導體系統的整合

- 機會:

- 人工智慧、5G 和資料中心基礎設施的擴展

- 新興量子運算架構

- 學術界與科技公司之間的合作

- 政府和國防部在先進計算領域的投資

- 促進要素:

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 按產品規格

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)

(註:貿易統計僅針對重點國家提供)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品類型分類,2021-2034年

- 主要趨勢

- 一維光子晶體

- 2D光子晶體

- 3D光子晶體

第6章:市場估算與預測:依整合類型分類,2021-2034年

- 主要趨勢

- 整體整合

- 混合整合

- 總消耗量

第7章:市場估計與預測:依材料平台分類,2021-2034年

- 主要趨勢

- 絕緣體上矽(SOI)

- III-V族半導體

- 相變材料

第8章:市場估算與預測:依計算功能分類,2021-2034年

- 主要趨勢

- 數位光學計算

- 類比光計算

- 量子光學計算

- 神經形態光學計算

第9章:市場估算與預測:依最終用途產業分類,2021-2034年

- 主要趨勢

- 資料中心和雲端運算

- 電信

- 國防與航太

- 研究機構

- 高效能運算

第10章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第11章:公司簡介

- Intel Corporation

- Cisco Systems Inc.

- Broadcom Inc.

- NTT Advanced Technology

- JEOL Ltd.

- G&H Photonics Ltd.

- Xanadu Quantum Technologies

- PsiQuantum Corp.

- Ayar Labs Inc.

- Lightmatter Inc.

The Global Photonic Crystals for Optical Computing Market was valued at USD 3.5 billion in 2024 and is estimated to grow at a CAGR of 20.8% to reach USD 23.4 billion by 2034.

This expansion reflects the growing integration of photonic crystal technologies, particularly in high-performance computing systems. Key factors fueling this growth include the increasing demand for exponential data processing, the evolution of silicon photonics, and new architecture for optical computing. The push for energy-efficient computing infrastructures, backed by government funding and defense modernization programs, is also a major contributor. The potential applications for these technologies are vast, including data centers, telecommunications, quantum computing, and AI/ML acceleration, all of which continue to drive market growth. Furthermore, rising investments in research and development aimed at enhancing the performance and scalability of photonic crystal-based optical computing systems are accelerating adoption. As manufacturing processes improve and costs decrease, the widespread adoption of these technologies is anticipated across various global industries and regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.5 Billion |

| Forecast Value | $23.4 Billion |

| CAGR | 20.8% |

The 2D photonic crystal segment is expected to reach USD 1.7 billion in 2024, with a CAGR of 20.7%. The demand for 2D photonic crystals in advanced optical computing is attributed to their ability to integrate efficiently with waveguides and photonic crystal slab architectures. This trend is also facilitated by advancements in manufacturing techniques and processing technologies, which are easing the strict performance criteria traditionally associated with these systems.

The digital optical computing segment held a 39.8% share in 2024 as high-speed data processing is driving demand. Innovations such as advanced all-optical switching systems, binary logic operations, and digital signal processing with faster capabilities further contribute to growth. Additionally, energy efficiency optimization in computing and government investments in enhanced computing infrastructure are major market drivers.

Europe Photonic Crystals for Optical Computing Market generated USD 1.2 billion in 2024. The European market is expected to grow significantly, reaching USD 8.1 billion by 2034, at a CAGR of 20.8%. This growth is propelled by the increasing demand for energy-efficient computing solutions, significant investments in photonics research and development, and the growing implementation of optical computing technologies in data centers and telecommunications.

Key players in the Global Photonic Crystals for Optical Computing Market include Intel Corporation, Lightmatter Inc., NTT Advanced Technology, Xanadu Quantum Technologies, G&H Photonics Ltd., Cisco Systems Inc., PsiQuantum Corp., Ayar Labs Inc., JEOL Ltd., and Broadcom Inc. To maintain and expand their market presence, companies in this space are focusing on enhancing product performance and diversifying their portfolios. Strategic investments in research and development are key to the introduction of advanced photonic crystal solutions, improving scalability and functionality. Firms are also collaborating with academic institutions, research organizations, and other industry leaders to drive innovation and improve the efficiency of optical computing systems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Integration type

- 2.2.4 Material platform

- 2.2.5 Computing function

- 2.2.6 End use industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Drivers:

- 3.2.1.1 Demand for faster, energy-efficient computing

- 3.2.1.2 Advancements in nanotechnology and fabrication methods

- 3.2.1.3 Rising data traffic and AI/ML processing needs

- 3.2.1.4 Growing R&D investment in quantum and optical computing

- 3.2.2 Pitfalls & Challenges:

- 3.2.2.1 High production complexity and cost

- 3.2.2.2 Integration with existing semiconductor systems

- 3.2.3 Opportunities:

- 3.2.3.1 Expansion of AI, 5G, and data center infrastructure

- 3.2.3.2 Emerging quantum computing architectures

- 3.2.3.3 Collaborations between academia and tech firms

- 3.2.3.4 Government and defense investments in advanced computing

- 3.2.1 Drivers:

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product format

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 1D photonic crystals

- 5.3 2D photonic crystals

- 5.4 3D photonic crystals

Chapter 6 Market Estimates and Forecast, By Integration Type, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Monolithic integration

- 6.3 Hybrid integration

- 6.4 Total consumption

Chapter 7 Market Estimates and Forecast, By Material Platform, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Silicon-on-insulator (SOI)

- 7.3 III-V semiconductors

- 7.4 Phase-change materials

Chapter 8 Market Estimates and Forecast, By Computing Function, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Digital optical computing

- 8.3 Analog optical computing

- 8.4 Quantum optical computing

- 8.5 Neuromorphic optical computing

Chapter 9 Market Estimates and Forecast, By End Use Industry, 2021-2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 Data centers & cloud computing

- 9.3 Telecommunications

- 9.4 Defense & aerospace

- 9.5 Research institutions

- 9.6 High-performance computing

Chapter 10 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Intel Corporation

- 11.2 Cisco Systems Inc.

- 11.3 Broadcom Inc.

- 11.4 NTT Advanced Technology

- 11.5 JEOL Ltd.

- 11.6 G&H Photonics Ltd.

- 11.7 Xanadu Quantum Technologies

- 11.8 PsiQuantum Corp.

- 11.9 Ayar Labs Inc.

- 11.10 Lightmatter Inc.