|

市場調查報告書

商品編碼

1858834

汽車石墨烯增強組件市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Automotive Graphene-Enhanced Components Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

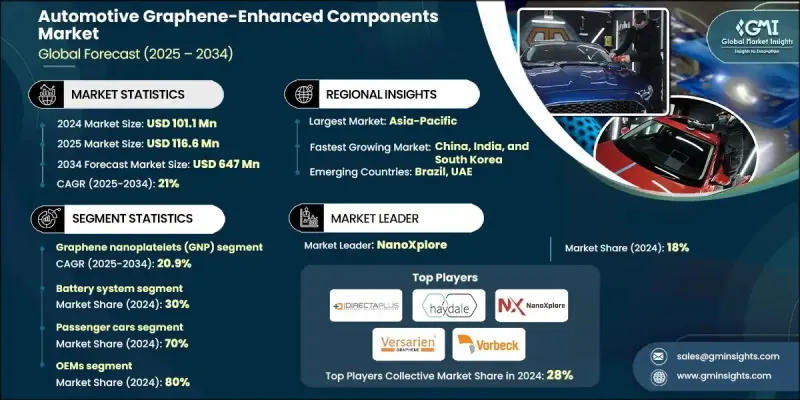

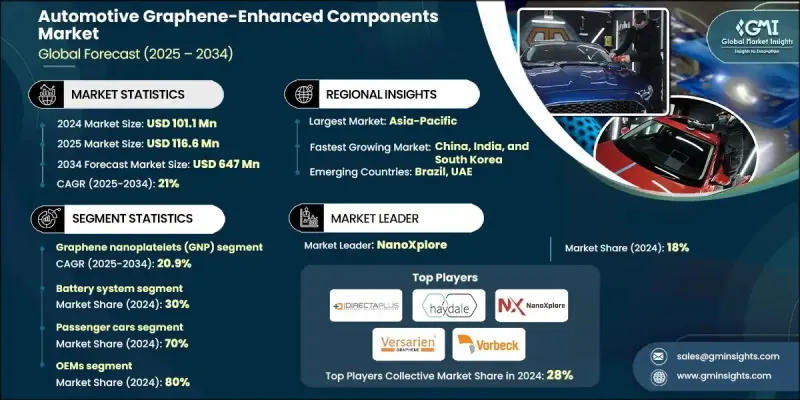

2024 年全球汽車石墨烯增強組件市場價值為 1.011 億美元,預計到 2034 年將以 21% 的複合年成長率成長至 6.47 億美元。

這種快速成長的動力源自於市場對兼具強度、輕量化和卓越能源性能的材料日益成長的需求。石墨烯優異的導電性、熱調節性和機械耐久性使其成為汽車製造商提高效率和降低排放的首選材料。隨著原始設備製造商 (OEM) 和一級供應商加大投資,整個產業正經歷著從實驗性應用向大規模部署的轉變。亞太、北美和歐洲等主要市場的電氣化進程是關鍵的催化劑,推動了石墨烯增強型電池、熱系統和結構部件的普及應用。汽車製造商正積極與材料開發商和研究機構進行研發合作,以獲得競爭優勢。輕質石墨烯增強複合材料正逐步取代傳統的金屬零件,直接有助於提高燃油經濟性和延長電動車的續航里程。這些趨勢與旨在促進永續汽車生產和減少全球碳排放的嚴格監管目標相契合,進一步鞏固了石墨烯在下一代汽車製造領域的長期潛力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1.011億美元 |

| 預測值 | 6.47億美元 |

| 複合年成長率 | 21% |

預計到2024年,電池系統市佔率將達到30%。電動車的日益普及推動了對石墨烯電池解決方案的需求,因為石墨烯電池具有卓越的導電性和能量密度。這些優勢有助於實現超快速充電、延長電池壽命和提高熱安全性等功能。因此,汽車製造商和供應商持續積極致力於提升電池性能,並對該領域保持高度關注。

2025年至2034年間,石墨烯奈米片(GNP)市場預計將以20.9%的複合年成長率成長。 GNP因其價格低廉、易於規模化生產以及均衡的機械和熱性能而備受青睞。它們在包括結構複合材料、電池電極和功能塗層在內的眾多應用領域正日益受到關注。其成本效益和多功能性使其成為大規模汽車整合應用的理想選擇。

預計到2024年,美國汽車石墨烯增強零件市場規模將達2,330萬美元,成為汽車石墨烯增強零件的關鍵市場。電動車的強勁普及以及日益嚴格的排放和燃油效率法規推動了該市場的成長。美國製造商正在快速部署石墨烯基電池組、電子元件和熱管理系統,以滿足商用車和乘用車領域的性能標準。

在全球汽車石墨烯增強零件市場中,Vorbeck Materials、First Graphene、Graphene Nanochem、NanoXplore、Graphenea、Directa Plus、Applied Graphene Materials (AGM)、Nanotech Energy、Versarien 和 Haydale Graphene Industries 等公司佔據著舉足輕重的地位。為了鞏固其在汽車石墨烯增強零件市場的地位,領導企業正採取以創新、規模化和合作為核心的關鍵策略。許多企業優先開發針對特定汽車功能的客製化石墨烯配方,例如提升電池效率、熱調節和結構強度。此外,各公司也正在投資先進製造技術以支援大規模生產,同時最佳化成本效益。與汽車原始設備製造商 (OEM)、研究型大學和材料供應商的策略合作,有助於加速產品測試和商業化推廣。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預報

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 電動車產量增加和電池普及

- 輕量化和燃油效率目標

- 高性能電子產品的興起

- 奈米材料研發的大力投資

- 產業陷阱與挑戰

- 石墨烯材料的生產成本很高

- 規模有限的大型供應鏈

- 市場機遇

- 下一代電動車電池和超級電容器

- 熱管理系統中的應用

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 用例和應用

- 最佳情況

- 成本效益分析與投資報酬率最佳化

- 材料成本與性能之間的權衡

- 製造成本影響評估

- 總擁有成本模型

- 價值工程策略

- 知識產權與技術許可

- 專利格局分析

- 技術授權模式

- 保護策略

- 自由實施評估

- 市場接受度與客戶接受度

- OEM製造商決策標準

- 消費者認知與接受度

- 市場教育與意識提升計劃

- 競爭差異化策略

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:依組件分類,2021-2034年

- 主要趨勢

- 引擎室內部件

- 泡棉墊

- 燃油導軌蓋

- 泵浦蓋

- 結構複合材料

- 電池系統組件

- 熱管理系統

- 電子元件

第6章:市場估計與預測:依石墨烯材料分類,2021-2034年

- 主要趨勢

- 石墨烯奈米片(GNP)

- 氧化石墨烯(GO)

- 還原氧化石墨烯(RGO)

- 化學氣相沉積石墨烯薄膜

第7章:市場估價與預測:依車輛類型分類,2021-2034年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- SUV

- 商用車輛

- 輕型商用車(LCV)

- 中型商用車(MCV)

- 重型商用車(HCV)

第8章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 原始設備製造商

- 售後市場及服務提供者

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- 全球參與者

- Applied Graphene Materials

- Directa Plus

- First Graphene

- Graphenea

- Haydale Graphene Industries

- Nanotech Energy

- NanoXplore

- Versarien

- Vorbeck Materials

- XG Sciences

- 區域玩家

- Angstron Materials

- Black Swan Graphene

- Graphene NanoChem

- Graphene 3D Lab

- Global Graphene Group

- Nanocyl

- Skeleton Technologies

- Talga Resources

- Graphmatech

- 新興參與者/顛覆者

- Archer Materials

- Avancis Graphene

- Cnano Technology

- Elcora Advanced Materials

- Garmor Graphene

- Grolltex

- NanoGraphene

- Zap & Go

- 2 D Carbon Tech

The Global Automotive Graphene-Enhanced Components Market was valued at USD 101.1 million in 2024 and is estimated to grow at a CAGR of 21% to reach USD 647 million by 2034.

This rapid growth is fueled by the increasing demand for materials that deliver strength, lightweight design, and superior energy performance. Graphene's exceptional conductivity, thermal regulation, and mechanical durability make it a preferred choice for automakers aiming to enhance efficiency and lower emissions. The industry is witnessing a shift from experimental usage to large-scale implementation as OEMs and Tier-1 suppliers ramp up investments. Electrification across major markets in Asia Pacific, North America, and Europe is a key catalyst, pushing the adoption of graphene-enhanced batteries, thermal systems, and structural components. Automotive manufacturers are actively engaging in R&D collaborations with material developers and research institutions to gain a competitive edge. Lightweight graphene-reinforced composites are gradually replacing traditional metal parts, directly contributing to better fuel economy and longer EV driving range. These trends align with stringent regulatory goals that promote sustainable automotive production and reduction in carbon emissions globally, reinforcing the long-term potential of graphene in next-generation vehicle manufacturing.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $101.1 Million |

| Forecast Value | $647 Million |

| CAGR | 21% |

The battery system segment held a 30% share in 2024. The rising penetration of electric vehicles is fueling demand for graphene-enabled battery solutions, as they offer superior conductivity and energy density. These advancements support features such as ultra-fast charging, enhanced battery life, and improved thermal safety. As a result, the segment continues to see strong engagement from automakers and suppliers focused on performance improvement.

The graphene nanoplatelets (GNP) segment will grow at a CAGR of 20.9% between 2025 and 2034. GNPs are used for their affordability, scalability, and balanced mechanical and thermal performance. They are gaining traction in a broad array of applications, including structural composites, battery electrodes, and functional coatings. Their cost-effective profile and multi-functional performance make them a preferred choice for large-scale automotive integration.

United States Automotive Graphene-Enhanced Components Market reached USD 23.3 million in 2024, emerging as a key market for automotive graphene-enhanced components. Growth is supported by strong EV adoption and strict emissions and fuel efficiency regulations. American manufacturers are rapidly deploying graphene-based battery packs, electronics, and thermal systems to meet performance benchmarks in both commercial and passenger vehicle segments.

Prominent companies shaping the Global Automotive Graphene-Enhanced Components Market include Vorbeck Materials, First Graphene, Graphene Nanochem, NanoXplore, Graphenea, Directa Plus, Applied Graphene Materials (AGM), Nanotech Energy, Versarien, and Haydale Graphene Industries. To solidify their position in the Automotive Graphene-Enhanced Components Market, leading companies are adopting key strategies focused on innovation, scalability, and partnerships. Many are prioritizing the development of tailored graphene formulations for specific automotive functions such as battery efficiency, thermal regulation, and structural strength. Firms are also investing in advanced manufacturing technologies to support mass production, while optimizing the cost-performance balance. Strategic collaborations with automotive OEMs, research universities, and materials suppliers are helping accelerate product testing and commercial rollout.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Graphene material

- 2.2.4 Vehicle

- 2.2.5 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing EV production and battery adoption

- 3.2.1.2 Lightweighting and fuel efficiency targets

- 3.2.1.3 Rise in high-performance electronics

- 3.2.1.4 Strong investments in nanomaterials R&D

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production cost of graphene materials

- 3.2.2.2 Limited large-scale supply chain

- 3.2.3 Market opportunities

- 3.2.3.1 Next-gen EV batteries and supercapacitors

- 3.2.3.2 Adoption in thermal management systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 Pestel analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Sustainability & environmental aspects

- 3.9.1 Sustainable practices

- 3.9.2 Waste reduction strategies

- 3.9.3 Energy efficiency in production

- 3.9.4 Eco-friendly Initiatives

- 3.9.5 Carbon footprint considerations

- 3.10 Use cases and applications

- 3.11 Best-case scenario

- 3.12 Cost-benefit analysis & roi optimization

- 3.12.1 Material cost vs performance trade-offs

- 3.12.2 Manufacturing cost impact assessment

- 3.12.3 Total cost of ownership models

- 3.12.4 Value engineering strategies

- 3.13 Intellectual property & technology licensing

- 3.13.1 Patent landscape analysis

- 3.13.2 Technology licensing models

- 3.13.3 Protection strategies

- 3.13.4 Freedom-to-operate assessments

- 3.14 Market adoption & customer acceptance

- 3.14.1 OEM decision-making criteria

- 3.14.2 Consumer perception & acceptance

- 3.14.3 Market education & awareness programs

- 3.14.4 Competitive differentiation strategies

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Under-hood components

- 5.2.1 Foam covers

- 5.2.2 Fuel rail covers

- 5.2.3 Pump covers

- 5.3 Structural composites

- 5.4 Battery system components

- 5.5 Thermal management systems

- 5.6 Electronic components

Chapter 6 Market Estimates & Forecast, By Graphene Material, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Graphene nanoplatelets (GNP)

- 6.3 Graphene oxide (GO)

- 6.4 Reduced graphene oxide (RGO)

- 6.5 CVD graphene films

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light commercial vehicles (LCV)

- 7.3.2 Medium commercial vehicles (MCV)

- 7.3.3 Heavy commercial vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEMs

- 8.3 Aftermarket & Service Providers

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Applied Graphene Materials

- 10.1.2 Directa Plus

- 10.1.3 First Graphene

- 10.1.4 Graphenea

- 10.1.5 Haydale Graphene Industries

- 10.1.6 Nanotech Energy

- 10.1.7 NanoXplore

- 10.1.8 Versarien

- 10.1.9 Vorbeck Materials

- 10.1.10 XG Sciences

- 10.2 Regional Players

- 10.2.1 Angstron Materials

- 10.2.2 Black Swan Graphene

- 10.2.3 Graphene NanoChem

- 10.2.4. Graphene 3D Lab

- 10.2.5 Global Graphene Group

- 10.2.6 Nanocyl

- 10.2.7 Skeleton Technologies

- 10.2.8 Talga Resources

- 10.2.9 Graphmatech

- 10.3 Emerging Players / Disruptors

- 10.3.1 Archer Materials

- 10.3.2 Avancis Graphene

- 10.3.3 Cnano Technology

- 10.3.4 Elcora Advanced Materials

- 10.3.5 Garmor Graphene

- 10.3.6 Grolltex

- 10.3.7 NanoGraphene

- 10.3.8 Zap & Go

- 10.3.9. 2 D Carbon Tech