|

市場調查報告書

商品編碼

1858832

空間電源市場機會、成長促進因素、產業趨勢分析及預測Space Power Supply Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast |

||||||

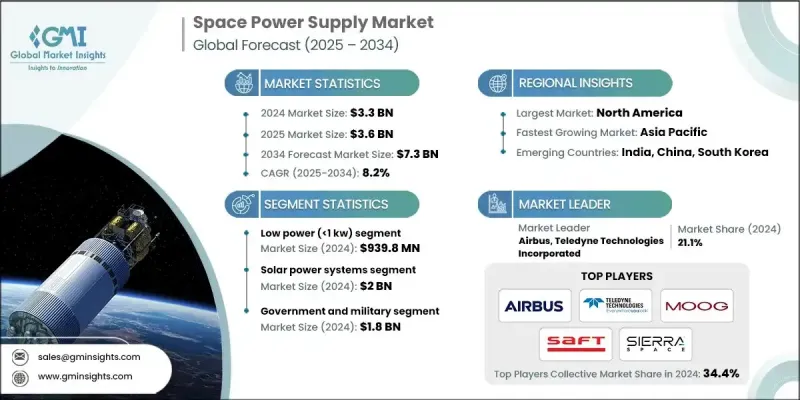

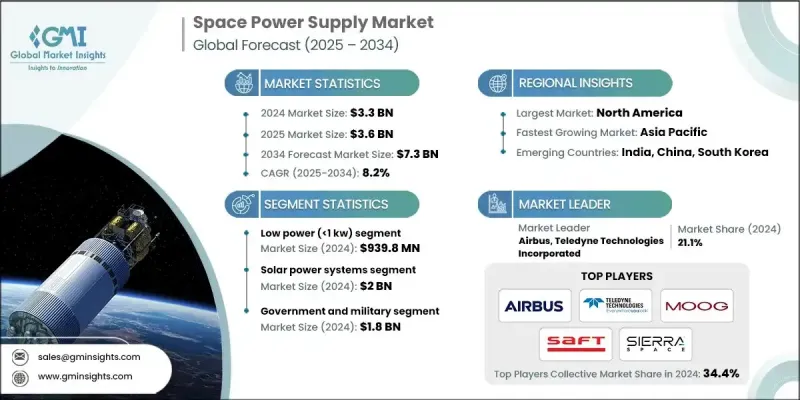

2024 年全球空間電源市場價值為 33 億美元,預計到 2034 年將以 8.2% 的複合年成長率成長至 73 億美元。

衛星發射數量的增加、光伏技術的進步、對立方體衛星和小衛星需求的成長以及對永續發展的日益重視,共同推動了市場成長。商業任務的加速推進以及為支援各類衛星運作而對高效電力系統的需求,持續創造著長期的市場機會。衛星的快速部署,特別是用於通訊、地球監測和導航等應用的大型星座,進一步刺激了市場需求。北美憑藉其先進的航太生態系統、雄厚的資金支持、前沿的研究投資以及在國防基礎設施中率先採用人工智慧技術,在全球市場中處於領先地位。公共機構與私人航太技術開發商之間的策略合作也為市場帶來了正面影響。政府對人工智慧整合,尤其是在國防和情報系統中的投資,鞏固了該地區在下一代航太技術和未來航太資產保障方面的領先地位。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 33億美元 |

| 預測值 | 73億美元 |

| 複合年成長率 | 8.2% |

2024年,低功率(1度)電源市場規模達9.398億美元。由於其與小型衛星和短期任務的兼容性,該類別持續蓬勃發展。它提供了一種輕巧且經濟高效的電源解決方案,使其成為資源受限的商業和科學任務的理想選擇。製造商正致力於提高功率密度和效率,同時控制系統成本。對於面向立方體衛星和學術應用的開發人員而言,設計可靠、緊湊的系統仍然是重中之重。

到2024年,太陽能發電系統市場規模將達20億美元。這一成長與清潔能源的日益普及、光伏技術的日趨成熟以及太空持續不斷的太陽能照射優勢密切相關。這些系統正擴大應用於通訊、國防和科研任務。各公司正致力於提高太陽能板的效率、減輕重量並增強系統耐久性,以應對嚴苛的太空環境。這些進步對於延長任務壽命和降低整體部署成本至關重要。

2024年,美國太空電源市場規模達12億美元。這一成長得益於太空基礎設施的快速升級、對電池回收日益重視、太空法規的不斷完善以及對在軌服務(例如燃料補給)需求的增加。製造商正透過專注於永續、模組化和先進的電源技術來調整其設計,以滿足不斷變化的需求。這些發展旨在支持長期任務,簡化監管過渡,並創造一個面向未來的太空環境,同時高度重視任務靈活性和環境保護。

推動全球空間電源市場創新和成長的領導企業包括:L3Harris Technologies, Inc.、瑞薩電子株式會社、GomSpace、Moog Inc.、Rocket Lab USA、空中巴士公司、NanoAvionics、EnerSys、VPT, Inc.、DHVcorp Technology、Modular Devices Inc.、ET SPACE POWER, 材. Defence GmbH、GSYuasa Lithium Power、EaglePicher Technologies、AAC Clyde Space、Spectrolab 和 AZUR SPACE Solar Power GmbH。這些企業正透過創新、永續發展以及與全球太空任務的策略合作不斷取得進步。許多企業正大力投資研發,以開發適用於小型和大型太空船的高效輕量化電源系統。研發重點在於提升光伏性能、延長電池壽命、降低高輻射環境下的熱負荷。模組化系統設計正被廣泛採用,以支援在軌維修和可重複使用性。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 增加衛星部署

- 太陽能板技術的進步

- 小型衛星和立方體衛星的成長

- 對永續能源解決方案的需求日益成長

- 商業航太任務的擴展

- 產業陷阱與挑戰

- 高昂的開發和部署成本

- 技術挑戰和可靠性問題

- 市場機遇

- 電池技術的進步

- 電力系統小型化

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品

- 定價策略

- 新興商業模式

- 合規要求

- 國防預算分析

- 全球國防開支趨勢

- 區域國防預算分配

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 關鍵國防現代化項目

- 預算預測(2025-2034 年)

- 對產業成長的影響

- 各國國防預算

- 供應鏈韌性

- 地緣政治分析

- 勞動力分析

- 數位轉型

- 併購和策略合作格局

- 風險評估與管理

- 主要合約授予情況(2021-2024 年)

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 市場集中度分析

- 按地區

- 對主要參與者進行競爭基準分析

- 財務績效比較

- 收入

- 利潤率

- 研發

- 產品組合比較

- 產品範圍廣度

- 科技

- 創新

- 地理位置比較

- 全球足跡分析

- 服務網路覆蓋

- 按地區分類的市場滲透率

- 競爭定位矩陣

- 領導人

- 挑戰者

- 追蹤者

- 小眾玩家

- 戰略展望矩陣

- 財務績效比較

- 2021-2024 年主要發展動態

- 併購

- 夥伴關係與合作

- 技術進步

- 擴張和投資策略

- 永續發展舉措

- 數位轉型計劃

- 新興/新創企業競爭對手格局

第5章:市場估算與預測:依電源類型分類,2021-2034年

- 主要趨勢

- 太陽能發電系統

- 核電系統

- 電池系統

- 燃料電池

- 混合系統

第6章:市場估算與預測:依電力容量分類,2021-2034年

- 主要趨勢

- 低功率(<1千瓦)

- 中等功率(1-20千瓦)

- 高功率(20-100千瓦)

- 功率極高(>100千瓦)

第7章:市場估計與預測:依平台分類,2021-2034年

- 主要趨勢

- 低地球軌道 (LEO)

- 中地球軌道 (MEO)

- 地球同步軌道(GEO)

- 深空

第8章:市場估算與預測:依應用領域分類,2021-2034年

- 衛星

- 溝通

- 地球觀測

- 導航(GNSS)

- 科學與氣象監測

- 其他

- 太空站/居住艙

- 國際太空站和計劃中的商業太空站

- 月球門戶

- 其他

- 太空船/深空探測器

- 行星際探測器

- 流浪者隊

- 運載火箭

- 其他

第9章:市場估算與預測:依最終用途分類,2021-2034年

- 政府和軍隊

- 商業營運商

- 研究機構

第10章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第11章:公司簡介

- 全球關鍵參與者

- Airbus

- L3 Harris Technologies, Inc.

- Moog Inc.

- EnerSys

- Rocket Lab USA

- 區域關鍵參與者

- 北美洲

- Teledyne Technologies Incorporated

- GSYuasa Lithium Power

- EaglePicher Technologies

- VPT, Inc.

- 歐洲

- AAC Clyde Space

- AZUR SPACE Solar Power GmbH

- Apcon AeroSpace & Defence GmbH

- DHV Technology

- Saft

- NanoAvionics

- Modular Devices Inc.

- 8 XP Semiconductor

- Asia-Pacific

- Renesas Electronics Corporation

- GomSpace

- 北美洲

- 顛覆者/小眾玩家

- Sierra Space Corporation

- Spectrolab

- ET SPACE POWER, INC.

The Global Space Power Supply Market was valued at USD 3.3 billion in 2024 and is estimated to grow at a CAGR of 8.2% to reach USD 7.3 billion by 2034.

The market growth is propelled by increasing satellite launches, improvements in photovoltaic technologies, rising demand for CubeSats and small satellites, and the growing push toward sustainability. The acceleration of commercial missions and the demand for efficient power systems to support various types of satellite operations continue to create long-term opportunities. Rapid satellite deployment, especially in the form of large constellations for applications in communication, earth monitoring, and navigation, further fuels demand. North America leads the global landscape, owing to its advanced aerospace ecosystem, substantial funding support, cutting-edge research investments, and early adoption of AI in national defense infrastructure. The market is also gaining from strategic collaborations between public agencies and private space technology developers. Government investment in AI integration, especially in defense and intelligence systems, reinforces the region's leadership in next-generation space technologies and futureproofing of space assets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 Billion |

| Forecast Value | $7.3 Billion |

| CAGR | 8.2% |

The low power (1 kW) segment accounted for USD 939.8 million in 2024. This category continues to thrive due to its compatibility with compact satellites and short-term missions. It offers a lightweight and cost-efficient power solution, making it ideal for commercial and scientific missions operating under constrained resources. Manufacturers are focusing on enhancing power density and efficiency while keeping system costs under control. The design of reliable, compact systems remains a critical priority for developers targeting CubeSats and academic applications.

The solar power systems segment reached USD 2 billion in 2024. This growth is linked to the rising use of clean energy sources, maturing photovoltaic technologies, and the advantage of uninterrupted solar exposure in space. These systems are increasingly integrated into communication, defense, and research missions. Companies are focusing efforts on improving solar panel efficiency, reducing mass, and boosting system durability to handle harsh space conditions. These advances are key to extending mission lifespans and lowering overall deployment costs.

United States Space Power Supply Market generated USD 1.2 billion in 2024. This growth is supported by rapid upgrades in space infrastructure, rising emphasis on battery recycling, progressive space regulations, and increased demand for in-orbit services such as refueling. Manufacturers are aligning their designs to meet evolving needs by focusing on sustainable, modular, and advanced power technologies. These developments aim to support long-duration missions, ease regulatory transitions, and enable a future-ready space environment with a strong emphasis on mission flexibility and environmental stewardship.

Leading players driving innovation and growth in the Global Space Power Supply Market include L3Harris Technologies, Inc., Renesas Electronics Corporation, GomSpace, Moog Inc., Rocket Lab USA, Airbus, NanoAvionics, EnerSys, VPT, Inc., DHV Technology, Modular Devices Inc., ET SPACE POWER, INC., Teledyne Technologies Incorporated, Saft, Sierra Space Corporation, Apcon AeroSpace & Defence GmbH, GSYuasa Lithium Power, EaglePicher Technologies, AAC Clyde Space, Spectrolab, and AZUR SPACE Solar Power GmbH. Companies operating in the Space Power Supply Market are advancing through innovation, sustainability, and strategic alignment with global space missions. Many are investing heavily in R&D to develop high-efficiency, lightweight power systems suitable for both small and large spacecraft. A strong focus is placed on enhancing photovoltaic performance, increasing battery life, and reducing thermal loads in high-radiation environments. Modular system design is being embraced to support in-orbit servicing and reusability.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry snapshot

- 2.2 Key market trends

- 2.2.1 Power source trends

- 2.2.2 Power capacity trends

- 2.2.3 Platform trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.2.6 Regional

- 2.3 TAM Analysis, 2025-2034 (USD Million)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing Satellite Deployments

- 3.2.1.2 Advancements in Solar Panel Technology

- 3.2.1.3 Growth of Small Satellites and CubeSats

- 3.2.1.4 Rising Demand for Sustainable Energy Solutions

- 3.2.1.5 Expansion of Commercial Space Missions

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High Development and Deployment Costs

- 3.2.2.2 Technical Challenges and Reliability Issues

- 3.2.3 Market opportunities

- 3.2.3.1 Advancements in Battery Technologies

- 3.2.3.2 Miniaturization of Power Systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Defense Budget Analysis

- 3.13 Global Defense Spending Trends

- 3.14 Regional Defense Budget Allocation

- 3.14.1 North America

- 3.14.2 Europe

- 3.14.3 Asia Pacific

- 3.14.4 Middle East and Africa

- 3.14.5 Latin America

- 3.15 Key Defense Modernization Programs

- 3.16 Budget Forecast (2025-2034)

- 3.16.1 Impact on Industry Growth

- 3.16.2 Defense Budgets by Country

- 3.17 Supply Chain Resilience

- 3.18 Geopolitical Analysis

- 3.19 Workforce Analysis

- 3.20 Digital Transformation

- 3.21 Mergers, Acquisitions, and Strategic Partnerships Landscape

- 3.22 Risk Assessment and Management

- 3.23 Major Contract Awards (2021-2024)

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Power Source, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Solar power systems

- 5.3 Nuclear power systems

- 5.4 Battery systems

- 5.5 Fuel cells

- 5.6 Hybrid systems

Chapter 6 Market Estimates and Forecast, By Power Capacity, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Low power (<1 kw)

- 6.3 Medium power (1-20 kw)

- 6.4 High power (20-100 kw)

- 6.5 Very high power (>100 kw)

Chapter 7 Market Estimates and Forecast, By Platform, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 LEO (low earth orbit)

- 7.3 MEO (medium earth orbit)

- 7.4 GEO (geostationary orbit)

- 7.5 Deep space

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million)

- 8.1 Satellites

- 8.1.1 Communication

- 8.1.2 Earth observation

- 8.1.3 Navigation (GNSS)

- 8.1.4 Scientific & weather monitoring

- 8.1.5 Others

- 8.2 Space stations / habitats

- 8.2.1 ISS and planned commercial stations

- 8.2.2 Lunar gateway

- 8.2.3 Others

- 8.3 Spacecraft / deep-space probes

- 8.3.1 Interplanetary probes

- 8.3.2 Rovers

- 8.4 Launch vehicles

- 8.5 Others

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million)

- 9.1 Government and military

- 9.2 Commercial operators

- 9.3 Research institutions

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company profiles

- 11.1 Global Key Players

- 11.1.1 Airbus

- 11.1.2. L3 Harris Technologies, Inc.

- 11.1.3 Moog Inc.

- 11.1.4 EnerSys

- 11.1.5 Rocket Lab USA

- 11.2 Regional Key Players

- 11.2.1 North America

- 11.2.1.1 Teledyne Technologies Incorporated

- 11.2.1.2 GSYuasa Lithium Power

- 11.2.1.3 EaglePicher Technologies

- 11.2.1.4 VPT, Inc.

- 11.2.2 Europe

- 11.2.2.1 AAC Clyde Space

- 11.2.2.2 AZUR SPACE Solar Power GmbH

- 11.2.2.3 Apcon AeroSpace & Defence GmbH

- 11.2.2.4 DHV Technology

- 11.2.2.5 Saft

- 11.2.2.6 NanoAvionics

- 11.2.2.7 Modular Devices Inc.

- 11.2.2. 8 XP Semiconductor

- 11.2.3 Asia-Pacific

- 11.2.3.1 Renesas Electronics Corporation

- 11.2.3.2 GomSpace

- 11.2.1 North America

- 11.3 Disruptors / Niche Players

- 11.3.1 Sierra Space Corporation

- 11.3.2 Spectrolab

- 11.3.3 ET SPACE POWER, INC.