|

市場調查報告書

商品編碼

1858829

汽車交流發電機及起動馬達市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Automotive Alternator and Starter Motor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

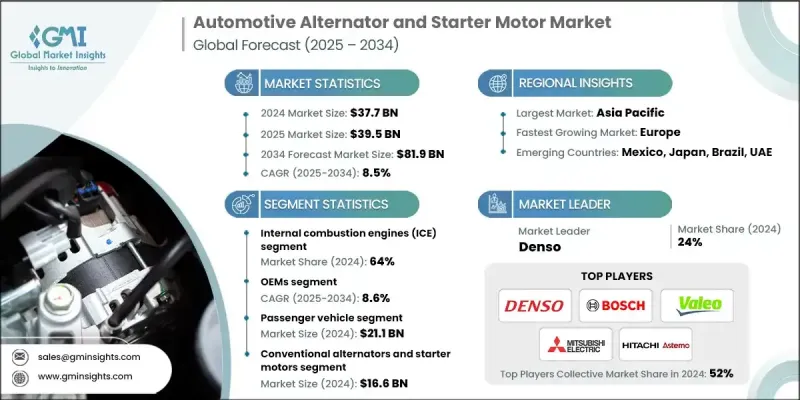

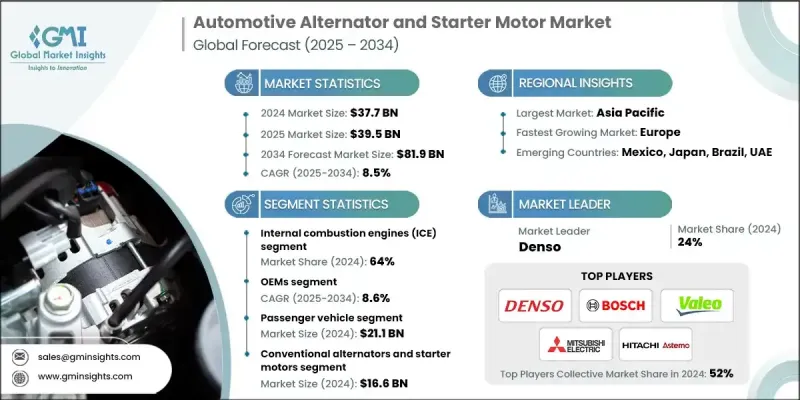

2024 年全球汽車交流發電機和起動馬達市場價值為 377 億美元,預計到 2034 年將以 8.5% 的複合年成長率成長至 819 億美元。

隨著汽車製造商積極應對日益成長的車輛電氣化趨勢、混合動力和電動車需求的不斷攀升以及日益嚴格的全球排放標準,市場成長正在加速。隨著電池技術的不斷發展和能源效率在車輛設計中日益凸顯,汽車製造商正優先考慮能夠提升動力系統性能並降低排放和油耗的電氣元件。整合式車輛系統對交流發電機和起動馬達提出了更高的要求,促使供應商不斷創新,提供符合現代出行趨勢的解決方案。技術進步和智慧車輛架構也推動了這一發展勢頭。高效、輕量化和智慧化的系統正在取代老舊零件,以確保符合全球標準、提高可靠性並延長使用壽命。汽車製造商和供應商都在大力投資於能夠支援複雜電子功能、最佳化引擎運作並增強現代車輛能源管理的零件,尤其是在業界向永續出行轉型之際。隨著這些趨勢的不斷發展,交流發電機和起動馬達技術在車輛整體性能中的重要性日益凸顯。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 377億美元 |

| 預測值 | 819億美元 |

| 複合年成長率 | 8.5% |

2024年,內燃機(ICE)汽車市佔率仍高達64%。儘管電動車發展迅猛,但內燃機汽車在全球汽車生產和銷售中仍佔據主導地位。汽車製造商和車隊營運商繼續依賴成熟的內燃機技術,因此需要高性能的交流發電機和起動電機,以支援高效的能源利用、引擎的可靠性以及與日益電子化的動力系統的兼容性。製造商正積極響應,提供耐用且成本最佳化的解決方案,旨在與傳統車輛系統無縫整合。

原始設備製造商(OEM)市佔率佔比高達 71%,預計到 2034 年將以 8.6% 的複合年成長率成長。由於汽車製造商優先考慮原廠安裝的高性能交流發電機和起動電機,以滿足嚴格的監管和能源效率標準,因此來自原始設備製造商的需求仍然強勁。重點仍然是提供符合不斷變化的排放標準、支援車輛電氣化並具有長期耐用性的堅固可靠的零件。原始設備製造商繼續與零件供應商合作,以確保下一代車輛的品質整合、系統相容性和持續性能。

預計到2024年,北美汽車交流發電機和起動馬達市場將佔據81.1%的市場佔有率,市場規模達82億美元。北美汽車產業規模龐大,乘用車和商用車普及率高,混合動力和電動車型的採用率不斷提高,這些因素使其在北美市場中脫穎而出。圍繞排放和能源效率的嚴格監管框架為製造商創造了新的機遇,因為先進的交流發電機和智慧起動馬達對於滿足消費者期望和政府要求至關重要。

全球汽車交流發電機和起動馬達市場的主要企業包括德爾福科技、羅伯特博世、現代摩比斯、日立阿斯泰莫、三葉、三菱電機、盧卡斯TVS、電裝、法雷奧和博格華納。這些領先企業致力於將創新、效率和與汽車製造OEM)需求的策略契合相結合,以鞏固其全球市場地位。許多企業正在開發輕量化、緊湊型和高效率的零件,以滿足混合動力、內燃機和輕度混合動力汽車的需求。與汽車製造商的策略合作能夠實現先進系統的客製化和無縫整合。此外,智慧功能,例如自動啟動/停止系統、能量回收系統和預測性診斷,也備受關注。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 汽車產量和銷售量不斷成長

- 電氣化和混合動力趨勢

- 老舊車隊的售後市場需求

- 技術進步

- 產業陷阱與挑戰

- 向純電動車轉型導致傳統需求下降

- 高昂的研發與轉型成本

- 市場機遇

- 更嚴格的全球排放法規

- 激烈的價格競爭

- 供應鏈限制

- OEM整合及對整合解決方案的偏好

- 成長促進因素

- 成長潛力分析

- 監管環境

- 汽車電氣系統的SAE標準

- 美國環保署排放標準對電力負荷的影響

- 美國國家公路交通安全管理局 (NHTSA) 電氣元件安全標準

- 國際標準協調(ISO、IEC)

- 連網車輛的網路安全法規

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 智慧交流發電機開發與可變輸出控制

- 48伏輕混系統整合

- 無刷技術進步

- 整合式起動發電機演變

- 能源管理與電池整合

- 預測性維護與物聯網整合

- 價格趨勢

- 按地區

- 依產品

- 生產統計

- 生產中心

- 消費中心

- 進出口

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 風險評估框架

- 最佳情況情景

- 客戶分析與購買行為

- OEM採購標準與決策框架

- 售後市場消費者偏好與痛點

- 品牌忠誠度模式

- 按客戶群進行價格敏感度分析

- 貿易動態與關稅分析

- 進出口趨勢和貿易流量

- 各地區關稅影響

- 貿易政策變化及其影響

- 本地內容需求

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:依引擎類型分類,2021-2034年

- 主要趨勢

- 內燃機(ICE)

- 油電混合引擎

- 電動車(EV)動力系統

第6章:市場估價與預測:依車輛類型分類,2021-2034年

- 主要趨勢

- 搭乘用車

- SUV

- 轎車

- 掀背車

- 商用車輛

- 輕型商用車(LCV)

- 中型商用車(MCV)

- 重型商用車輛(HCV)

- 二輪車

- 越野車

第7章:市場估計與預測:依技術分類,2021-2034年

- 主要趨勢

- 傳統交流發電機和起動電機

- 智慧交流發電機和起動電機

- 再生煞車系統

第8章:市場估算與預測:依銷售管道分類,2021-2034年

- 主要趨勢

- 原始設備製造商

- 售後市場

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 比利時

- 荷蘭

- 瑞典

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 新加坡

- 韓國

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- 全球參與者

- BorgWarner

- Continental

- Delphi Technologies

- Denso

- Hitachi Astemo

- Lucas Electrical

- Mitsuba

- Mitsubishi Electric

- Robert Bosch

- Valeo

- 區域玩家

- ADVICS

- ASIMCO Technologies

- Cummins

- DB Electrical

- Guangzhou Sivco

- Hella

- Hyundai Mobis

- Lucas TVS

- Prestolite Electric

- 新興玩家

- Broad-Ocean Technologies

- Controlled Power Technologies

- Ningbo Zhongwang AUTO Fittings

- PHINIA

- Unipoint

The Global Automotive Alternator and Starter Motor Market was valued at USD 37.7 billion in 2024 and is estimated to grow at a CAGR of 8.5% to reach USD 81.9 billion by 2034.

Market growth is accelerating as automakers respond to increasing vehicle electrification, rising demand for hybrid and electric vehicles, and tougher global emission norms. As battery technology continues to evolve and energy efficiency becomes central to vehicle design, automotive manufacturers are prioritizing electrical components that enhance powertrain performance while reducing emissions and fuel consumption. Integrated vehicle systems are placing greater demands on alternators and starter motors, pushing suppliers to innovate and deliver solutions that align with modern mobility trends. Technological enhancements and smart vehicle architectures are also contributing to this momentum. High-efficiency, lightweight, and intelligent systems are replacing older components to ensure compliance with global standards, improve reliability, and extend operational lifespan. Both automakers and suppliers are investing heavily in components that support complex electronic functions, optimize engine operations, and enhance energy management in modern vehicles, particularly as the industry transitions toward sustainable mobility. As these trends continue to evolve, alternator and starter motor technologies are becoming more central to overall vehicle performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $37.7 Billion |

| Forecast Value | $81.9 Billion |

| CAGR | 8.5% |

In 2024, the internal combustion engine (ICE) segment held a 64% share. Despite the rise of electric vehicles, ICE-powered vehicles still dominate global production and sales. Automotive OEMs and fleet operators continue to rely on proven ICE technologies, requiring high-performance alternators and starter motors that support efficient energy use, engine reliability, and compatibility with increasingly electronic powertrains. Manufacturers are responding with durable and cost-optimized solutions engineered for seamless integration with traditional vehicle systems.

The OEM segment held a 71% share and is projected to grow at a CAGR of 8.6% through 2034. Demand from original equipment manufacturers remains strong, as automakers prioritize factory-installed, high-performance alternators and starter motors that meet stringent regulatory and efficiency standards. The focus remains on delivering robust, reliable components that comply with evolving emission norms, support vehicle electrification, and offer long-term durability. OEMs continue to partner with component suppliers to ensure quality integration, system compatibility, and sustained performance in next-generation vehicles.

North America Automotive Alternator and Starter Motor Market held 81.1% share in 2024, generating USD 8.2 billion. The country stands out due to its expansive automotive industry, widespread use of passenger and commercial vehicles, and increasing adoption of hybrid and electrified models. Strong regulatory frameworks around emissions and energy efficiency are creating new opportunities for manufacturers, as advanced alternators and smart starter motors become essential to meet both consumer expectations and government mandates.

Noteworthy companies in the Global Automotive Alternator and Starter Motor Market include Delphi Technologies, Robert Bosch, Hyundai Mobis, Hitachi Astemo, Mitsuba, Mitsubishi Electric, Lucas TVS, Denso, Valeo, and BorgWarner. Leading companies in the Global Automotive Alternator and Starter Motor Market are focusing on a blend of innovation, efficiency, and strategic alignment with OEM needs to strengthen their global footprint. Many are developing lightweight, compact, and high-efficiency components tailored for hybrid, ICE, and mild-hybrid vehicles. Strategic collaborations with automakers enable customization and seamless integration of advanced systems. Emphasis is also placed on smart features such as stop-start systems, regenerative energy capabilities, and predictive diagnostics.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Engine

- 2.2.3 Vehicle

- 2.2.4 Technology

- 2.2.5 Sales Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factors affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising vehicle production & sales

- 3.2.1.2 Electrification & hybridization trends

- 3.2.1.3 Aftermarket demand from aging fleets

- 3.2.1.4 Technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Shifts toward full EVs reducing traditional demand

- 3.2.2.2 High R&D and transition costs

- 3.2.3 Market opportunities

- 3.2.3.1 Stricter global emission regulations

- 3.2.3.2 Intense price competition

- 3.2.3.3 Supply chain constraints

- 3.2.3.4 OEM consolidation and preference for integrated solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 SAE standards for automotive electrical systems

- 3.4.2 EPA emissions standards impact on electrical load

- 3.4.3 NHTSA safety standards for electrical components

- 3.4.4 International standards harmonization (ISO, IEC)

- 3.4.5 Cybersecurity regulations for connected vehicles

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Smart alternator development & variable output control

- 3.7.2 48v mild hybrid system integration

- 3.7.3 Brushless technology advancement

- 3.7.4 Integrated starter-alternator evolution

- 3.7.5 Energy management & battery integration

- 3.7.6 Predictive maintenance & IOT integration

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Risk Assessment Framework

- 3.14 Best Case Scenarios

- 3.15 Customer Analysis & Buying Behavior

- 3.15.1 OEM procurement criteria and decision frameworks

- 3.15.2 Aftermarket consumer preferences and pain points

- 3.15.3 Brand loyalty patterns

- 3.15.4 Price sensitivity analysis by customer segment

- 3.16 Trade Dynamics & Tariff Analysis

- 3.16.1 Import/export trends and trade flows

- 3.16.2 Tariff impacts by region

- 3.16.3 Trade policy changes and implications

- 3.16.4 Local content requirements

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Engine, 2021 - 2034 ($ Bn & Units)

- 5.1 Key trends

- 5.2 Internal Combustion Engine (ICE)

- 5.3 Hybrid Engines

- 5.4 Electric Vehicle (EV) Powertrains

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($ Bn & Units)

- 6.1 Key trends

- 6.2 Passenger Vehicles

- 6.2.1 SUV

- 6.2.2 Sedan

- 6.2.3 Hatchback

- 6.3 Commercial Vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Medium Commercial Vehicles (MCV)

- 6.3.3 Heavy Commercial Vehicles (HCV)

- 6.4 Two-Wheelers

- 6.5 Off-Road Vehicles

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($ Bn & Units)

- 7.1 Key trends

- 7.2 Conventional Alternators and Starter Motors

- 7.3 Smart Alternators and Starter Motors

- 7.4 Regenerative Braking Systems

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($ Bn & Units)

- 8.1 Key trends

- 8.2 OEMs

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($ Bn & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Belgium

- 9.3.7 Netherlands

- 9.3.8 Sweden

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 Singapore

- 9.4.6 South Korea

- 9.4.7 Vietnam

- 9.4.8 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Global players

- 10.1.1 BorgWarner

- 10.1.2 Continental

- 10.1.3 Delphi Technologies

- 10.1.4 Denso

- 10.1.5 Hitachi Astemo

- 10.1.6 Lucas Electrical

- 10.1.7 Mitsuba

- 10.1.8 Mitsubishi Electric

- 10.1.9 Robert Bosch

- 10.1.10 Valeo

- 10.2 Regional players

- 10.2.1 ADVICS

- 10.2.2 ASIMCO Technologies

- 10.2.3 Cummins

- 10.2.4 DB Electrical

- 10.2.5 Guangzhou Sivco

- 10.2.6 Hella

- 10.2.7 Hyundai Mobis

- 10.2.8 Lucas TVS

- 10.2.9 Prestolite Electric

- 10.3 Emerging players

- 10.3.1 Broad-Ocean Technologies

- 10.3.2 Controlled Power Technologies

- 10.3.3 Ningbo Zhongwang AUTO Fittings

- 10.3.4 PHINIA

- 10.3.5 Unipoint