|

市場調查報告書

商品編碼

1858822

早餐香腸市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Breakfast Sausage Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

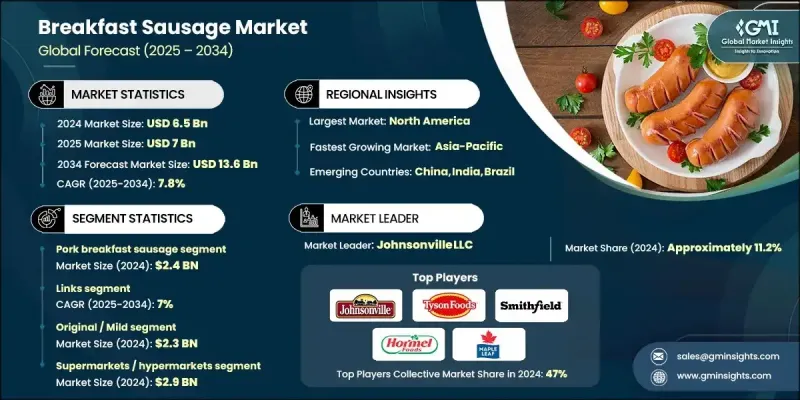

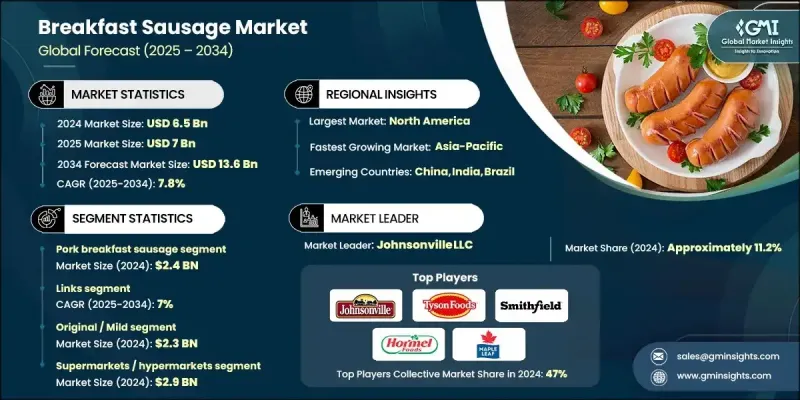

2024 年全球早餐香腸市場價值 65 億美元,預計到 2034 年將以 7.8% 的複合年成長率成長至 136 億美元。

隨著健康意識的增強和健身潮流的興起,不斷擴大的市場正在適應消費者偏好的變化。一個顯著的轉變正在發生:越來越多的人放棄高脂肪早餐肉,轉而選擇雞肉和火雞香腸等更精瘦的禽類替代品。這些產品因其高蛋白、低添加劑的特點而備受青睞,吸引了那些追求更健康、更營養食品的消費者。禽類香腸在新興市場和成熟市場都越來越受歡迎,因為它們提供了一種更輕盈的蛋白質選擇,同時又保留了傳統肉食愛好者所喜愛的濃郁口感。同時,豬肉和牛肉香腸仍然很受歡迎,這要歸功於它們根深蒂固的文化內涵和豐富的口味,尤其是在北美和歐洲。這些肉類產品不斷推陳出新,大膽的口味創新與令人懷舊的味覺體驗相結合,持續吸引消費者的目光。同時,植物性香腸市場也在蓬勃發展,便利性、美味和飲食彈性促使消費者嘗試各種素食早餐選擇。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 65億美元 |

| 預測值 | 136億美元 |

| 複合年成長率 | 7.8% |

2024年,豬肉早餐香腸市場規模達24億美元,預計2025年至2034年間將以7.1%的複合年成長率成長。雖然豬肉在幾個主要地區仍佔據主導地位,但由於人們出於健康考量(例如減少卡路里攝取和控制膽固醇),禽肉替代品正迅速流行起來。這些瘦肉在保留消費者熟悉的肉類特性的同時,也幫助他們重新定義了對早餐香腸的期望。整個早餐香腸市場正逐步在傳統肉類和現代替代品(尤其是越來越受到注重健康的消費者青睞的植物蛋白)之間尋求平衡。

2024年,香腸市場規模達到27億美元,預計到2034年將以7%的複合年成長率成長。消費者對易於烹飪和分量適中的香腸的需求,使得香腸條和香腸餅尤其受歡迎,尤其是在餐飲服務和快餐領域。它們便捷的特性,例如簡單的包裝、統一的尺寸和易於烹飪,能夠滿足繁忙的家庭和商業廚房的需求。同時,傳統的散裝香腸因其靈活性而仍然很受歡迎,因為它們可以根據不同的烹飪需求進行切片、調味和塑形。

2024年美國早餐香腸市場規模達21億美元,預計2025年至2034年將以7.5%的複合年成長率成長。美國市場的成熟推動了整個價值鏈的創新,尤其是在調味料和產品形式方面。領先品牌透過持續提供低脂、健康且便於快速烹飪和食用的香腸產品,保持了其市場主導地位。這些品牌成功地擴展了產品組合,以適應不斷變化的消費者行為,優先考慮便利性和營養價值。

塑造全球早餐香腸市場格局的關鍵企業包括肖特製藥股份公司 (SCHOTT Pharma AG)、斯蒂瓦納托集團 (Stevanato Group SpA)、格雷斯海默股份公司 (Gerresheimer AG)、西氏製藥服務公司 (West Pharmaceutical Services, Inc.) 和貝克頓迪金森公司 (BD)。早餐香腸市場的各企業正積極創新,以維持消費者興趣並鞏固市場地位。產品多元化是主要策略之一,各品牌紛紛推出更健康的品種,例如瘦肉禽肉香腸和低添加劑產品,以滿足注重健康的消費者的需求。風味香腸也融入了獨特的地理特色,既能喚起消費者的懷舊情懷,又能保持新鮮現代的口感。市場參與者也致力於產品形式的創新,例如預先包裝香腸和肉餅,以迎合快節奏的生活方式。與餐飲服務供應商和零售連鎖店建立策略合作夥伴關係,正在擴大產品的知名度和銷售管道。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預測模型!

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 市場機遇

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 未來市場趨勢

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依類型分類,2025-2034年

- 主要趨勢

- 豬肉早餐香腸

- 牛肉早餐香腸

- 雞肉早餐香腸

- 土耳其早餐香腸

- 植物性/素食早餐香腸

- 混合肉早餐香腸

第6章:市場估算與預測:依產品類型分類,2025-2034年

- 主要趨勢

- 連結

- 肉餅

- 卷/原木

- 碎屑

- 條狀/片狀

第7章:市場估計與預測:依口味類型分類,2025-2034年

- 主要趨勢

- 原味/淡味

- 辣/辣

- 楓糖味/甜味?

- 香草調味/鹹味品種

- 地方或特色口味

第8章:市場估算與預測:依配銷通路分類,2025-2034年

- 主要趨勢

- 超市/大型超市

- 便利商店

- 肉店

- 線上零售/電子商務

- 餐飲服務

第9章:市場估計與預測:依地區分類,2025-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- Johnsonville LLC

- Tyson Foods, Inc. (Jimmy Dean)

- Smithfield Foods, Inc.

- Hormel Foods Corporation

- Maple Leaf Foods Inc.

- Pilgrim's Pride Corporation

- Conagra Brands, Inc. (Banquet, Armour)

- Beyond Meat, Inc.

- Impossible Foods Inc.

- Applegate Farms LLC

- The Kraft Heinz Company

- Nestle SA (Sweet Earth, MorningStar Farms*)

- Al Fresco All Natural (Kayem Foods)

- Seaboard Corporation

- Vevan Foods / Other Regional & Local Brands

The Global Breakfast Sausage Market was valued at USD 6.5 billion in 2024 and is estimated to grow at a CAGR of 7.8% to reach USD 13.6 billion by 2034.

The expanding market is adapting to evolving consumer preferences shaped by increasing health awareness and fitness trends. A noticeable shift is occurring as more individuals move away from high-fat breakfast meats in favor of leaner poultry-based alternatives like chicken and turkey sausages. These products are gaining traction for being high in protein and lower in additives, appealing to consumers seeking cleaner, more nutritious options. The adoption of poultry sausages is on the rise in both emerging and mature markets, as they offer a lighter protein choice without sacrificing the dense, satisfying texture that traditional meat lovers prefer. Meanwhile, pork and beef sausages remain popular due to their deeply ingrained cultural relevance and flavor variety, especially in North America and Europe. These meats continue to evolve through bold flavor infusions that combine innovation with a nostalgic taste experience, maintaining strong consumer interest. Simultaneously, the plant-based sausage segment is gaining ground as convenience, taste, and dietary flexibility drive consumer experimentation with vegetarian breakfast options.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.5 Billion |

| Forecast Value | $13.6 Billion |

| CAGR | 7.8% |

The pork breakfast sausage segment was valued at USD 2.4 billion in 2024 and is forecasted to register a CAGR of 7.1% between 2025 and 2034. While pork continues to lead in several key regions, poultry-based alternatives are rapidly growing in popularity due to health considerations such as calorie reduction and cholesterol management. These lean meats are helping redefine consumer expectations while preserving the meaty characteristics they're familiar with. The overall breakfast sausage market is gradually striking a balance between longstanding traditional meats and modern alternatives, particularly plant-derived proteins that are increasingly favored by a health-conscious audience.

The sausage links segment was valued at USD 2.7 billion in 2024, with projections of a 7% CAGR through 2034. The demand for easy-to-prepare and portion-friendly options has made links and patties particularly desirable, especially in foodservice and fast-food applications. Their convenience factor, such as simple packaging, consistent sizing, and ease of cooking, caters to busy households and commercial kitchens alike. At the same time, traditional bulk sausages remain popular for their flexibility, as they can be sliced, seasoned, and shaped according to different culinary needs.

United States Breakfast Sausage Market was valued at USD 2.1 billion in 2024 and is expected to grow at a CAGR of 7.5% from 2025 to 2034. The US market's maturity is fueling innovation across the value chain, especially in terms of seasoning profiles and product formats. Leading brands have sustained dominance by consistently offering lean, health-conscious sausage variants suited for quick preparation and consumption. These brands have been successful in expanding their portfolio to align with evolving consumer behaviors, prioritizing convenience and nutritional value.

Key players shaping the Global Breakfast Sausage Market include SCHOTT Pharma AG, Stevanato Group S.p.A., Gerresheimer AG, West Pharmaceutical Services, Inc., and Becton, Dickinson and Company (BD). Companies operating in the breakfast sausage market are actively innovating to retain consumer interest and strengthen their market position. Product diversification is a leading strategy, with brands introducing healthier variants such as lean poultry sausages and low-additive options to cater to wellness-driven consumers. Flavored sausages are being enhanced with unique, regional-inspired profiles to stimulate nostalgic appeal while maintaining a fresh, modern twist. Market players are also focusing on format innovations like pre-portioned links and patties to appeal to fast-paced lifestyles. Strategic partnerships with foodservice providers and retail chains are expanding product visibility and access.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model!

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Form

- 2.2.4 Flavor Profile

- 2.2.5 Distribution Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Patent Landscape

- 3.10 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.10.1 Major importing countries

- 3.10.2 Major exporting countries

- 3.11 Sustainability and Environmental Aspects

- 3.11.1 Sustainable Practices

- 3.11.2 Waste Reduction Strategies

- 3.11.3 Energy Efficiency in Production

- 3.11.4 Eco-friendly Initiatives

- 3.12 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Type, 2025 - 2034 (USD Million, Kilo Tons)

- 5.1 Key trends

- 5.2 Pork breakfast sausage

- 5.3 Beef breakfast sausage

- 5.4 Chicken breakfast sausage

- 5.5 Turkey breakfast sausage

- 5.6 Plant?based / vegetarian breakfast sausage

- 5.7 Blended / mixed meat breakfast sausage

Chapter 6 Market Estimates and Forecast, By Form, 2025 - 2034 (USD Million, Kilo Tons)

- 6.1 Key trends

- 6.2 Links

- 6.3 Patties

- 6.4 Rolls / logs

- 6.5 Crumbles

- 6.6 Strips / slices

Chapter 7 Market Estimates and Forecast, By Flavor Profile, 2025 - 2034 (USD Million, Kilo Tons)

- 7.1 Key trends

- 7.2 Original / mild

- 7.3 Hot / spicy

- 7.4 Maple / sweet?flavored

- 7.5 Herb-seasoned / savory varieties

- 7.6 Regional or specialty flavors

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2025 - 2034 (USD Million, Kilo Tons)

- 8.1 Key trends

- 8.2 Supermarkets / hypermarkets

- 8.3 Convenience stores

- 8.4 Butcher shops

- 8.5 Online retail / e?commerce

- 8.6 Foodservice

Chapter 9 Market Estimates and Forecast, By Region, 2025 - 2034 (USD Million, Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East & Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 Johnsonville LLC

- 10.2 Tyson Foods, Inc. (Jimmy Dean)

- 10.3 Smithfield Foods, Inc.

- 10.4 Hormel Foods Corporation

- 10.5 Maple Leaf Foods Inc.

- 10.6 Pilgrim’s Pride Corporation

- 10.7 Conagra Brands, Inc. (Banquet, Armour)

- 10.8 Beyond Meat, Inc.

- 10.9 Impossible Foods Inc.

- 10.10 Applegate Farms LLC

- 10.11 The Kraft Heinz Company

- 10.12 Nestle S.A. (Sweet Earth, MorningStar Farms*)

- 10.13 Al Fresco All Natural (Kayem Foods)

- 10.14 Seaboard Corporation

- 10.15 Vevan Foods / Other Regional & Local Brands