|

市場調查報告書

商品編碼

1858820

微電網控制器市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Microgrid Controller Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

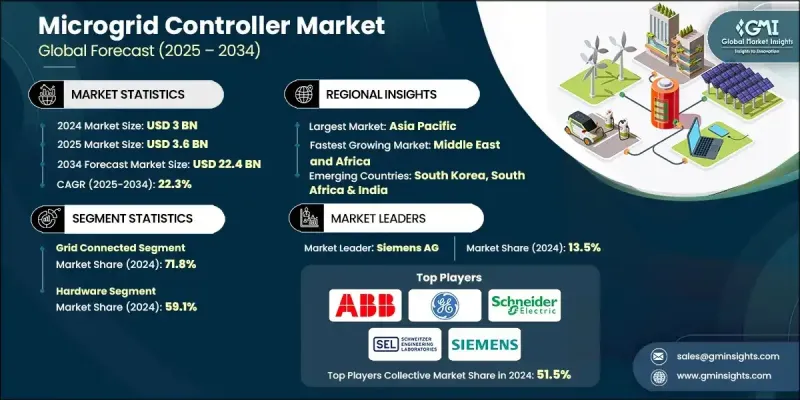

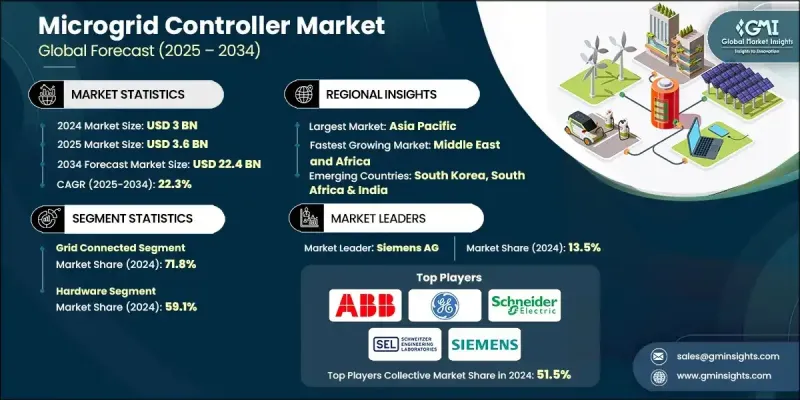

2024 年全球微電網控制器市場價值為 30 億美元,預計到 2034 年將以 22.3% 的複合年成長率成長至 224 億美元。

隨著再生能源併網進程的加快,尤其是太陽能和風能(眾所周知,這兩種能源具有間歇性),市場發展勢頭強勁。微電網控制器在管理這些波動性資源方面發揮著至關重要的作用,它們透過最佳化能量流動、維持供需平衡和確保系統穩定性來實現這一目標。微電網控制器能夠即時切換各種能源、儲能單元和負載,這使得它們對於可靠且自主的微電網運作變得日益重要。隨著全球議程轉向碳減排,微電網正成為一種靈活的在地化解決方案,以最大限度地利用再生能源,而控制器則是釋放這一潛力的關鍵。這些智慧系統能夠進行即時預測、動態調整電力運作並提高能源效率,使其成為支援永續發展目標不可或缺的一部分。作為管理、協調和監控能源使用的智慧設備,微電網控制器正迅速成為面向未來的能源基礎設施的基礎,尤其是在需要能夠抵禦停電和中斷的彈性分散式電力系統的地區。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 30億美元 |

| 預測值 | 224億美元 |

| 複合年成長率 | 22.3% |

2024年,併網型微電網市佔率達到71.8%,預計到2034年將以21.9%的複合年成長率成長。由於這些控制器有助於分散式能源高效運作、降低尖峰用電量並允許將多餘的能源輸送回主電網,因此市場對這些控制器的需求持續成長。它們還支援積極參與需量反應計劃,並簡化監管合規流程。隨著全球各地的公用事業公司致力於能源基礎設施現代化,微電網控制器因其與智慧電網系統的兼容性而得到更廣泛的應用,這些智慧電網系統能夠提高能源分配的可靠性和靈活性。

2024年,硬體部分佔據59.1%的市場佔有率,預計到2034年將以21.9%的複合年成長率成長。隨著微電網日益複雜,對耐用、高性能控制硬體的需求也隨之成長。這些組件包括通訊設備、電力電子設備、感測器和處理器,它們對於即時監控和快速切換功能至關重要。再生能源裝置和電池系統的擴展進一步推動了對能夠管理可變負載並幫助維持系統穩定性的精密硬體的需求,尤其是在併網和孤島運行模式之間切換時。

2024年,美國微電網控制器市佔率高達81.5%,預計到2034年將達到16億美元。這一市場主導地位得益於國家和區域政府為微電網發展提供的財政支持,這些支持減輕了資本負擔並加快了部署速度。同時,集中式能源網路日益脆弱,容易受到氣候變遷帶來的干擾,加速了向分散式解決方案的轉變。在這些系統中,微電網控制器變得至關重要,它透過實現無縫孤島運作、故障偵測和智慧負載管理,確保電力供應不間斷。

推動全球微電網控制器市場創新和競爭的關鍵企業包括:Power Analytics Corporation、Caterpillar Inn、Heila Technologies、Pxise Energy Solutions、AutoGrid Systems Inc、通用電氣 (GE)、霍尼韋爾國際公司、特斯拉能源、伊頓公司、西門子公司、Enchanted Rock、Encorp Inc.、ABB Ltd、施耐德電氣、HOt. Laboratories、日立能源有限公司和艾默生電氣公司。全球微電網控制器市場的領導者正透過研發投資、技術創新和策略合作等多種方式擴大市場佔有率。各公司正在開發先進的人工智慧控制演算法,以增強即時效能、預測分析和自適應負載平衡。重點正轉向模組化、即插即用的硬體系統,以便輕鬆整合到現有基礎設施中。許多企業正在與公用事業公司、政府機構和私人能源供應商建立合作關係,以加速微電網的部署。此外,雲端平台和邊緣運算解決方案也被廣泛採用,以實現遠端監控和可擴展的控制功能。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 原物料供應及採購分析

- 製造能力評估

- 供應鏈韌性與風險因素

- 配電網路分析

- 成本結構分析

- 監管環境

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 按地區分類的公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 戰略儀錶板

- 策略舉措

- 公司標竿分析

- 創新與技術格局

第5章:市場規模及預測:以連結方式分類,2021-2034年

- 主要趨勢

- 並網

- 離網

第6章:市場規模及預測:依產品類型分類,2021-2034年

- 主要趨勢

- 硬體

- 軟體與服務

第7章:市場規模及預測:依最終用途分類,2021-2034年

- 主要趨勢

- 衛生保健

- 教育機構

- 軍隊

- 公用事業

- 工業/商業

- 偏僻的

- 其他

第8章:市場規模及預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 英國

- 俄羅斯

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第9章:公司簡介

- ABB Ltd

- AutoGrid Systems Inc

- Caterpillar Inn

- Cummins Inc

- Eaton Corporation

- Emerson Electric Co.

- Enchanted Rock

- Encorp Inc.

- General Electric (GE)

- Heila Technologies

- Hitachi Energy Ltd

- HOMER Energy

- Honeywell International Inc

- Power Analytics Corporation

- Pxise Energy Solutions

- S&C Electric Company

- Schneider Electric

- Schweitzer Engineering Laboratories

- Siemens AG

- Tesla Energy

The Global Microgrid Controller Market was valued at USD 3 billion in 2024 and is estimated to grow at a CAGR of 22.3% to reach USD 22.4 billion by 2034.

The market is gaining momentum as the shift toward integrating renewables intensifies, particularly solar and wind, which are known for their intermittency. Microgrid controllers play a vital role in managing these fluctuating resources by optimizing energy flow, maintaining supply-demand equilibrium, and ensuring system stability. Their ability to enable real-time switching between various sources, energy storage units, and loads is making them increasingly critical for reliable and autonomous microgrid operations. As the global agenda shifts toward carbon reduction, microgrids are emerging as a flexible, localized solution to maximize renewable energy use, and controllers are key to unlocking this potential. These smart systems allow real-time forecasting, adjust power operations dynamically, and boost energy efficiency making them indispensable for supporting sustainability targets. As intelligent devices that manage, coordinate, and monitor energy usage, microgrid controllers are rapidly becoming foundational in future-ready energy infrastructure, especially for areas needing resilient, decentralized power systems capable of withstanding outages and disruptions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3 Billion |

| Forecast Value | $22.4 Billion |

| CAGR | 22.3% |

In 2024, the grid-connected segment held 71.8% share, and is expected to grow at a CAGR of 21.9% through 2034. Demand for these controllers continues to rise as they help distributed energy resources operate efficiently, reduce peak power consumption, and allow energy exports back to the main grid. They also support active participation in demand response initiatives and streamline regulatory compliance. With utilities around the world working to modernize energy infrastructure, microgrid controllers are seeing stronger uptake thanks to their compatibility with smart grid systems that improve energy distribution reliability and flexibility.

The hardware segment held 59.1% share in 2024 and is expected to grow at a 21.9% CAGR through 2034. As microgrids become more complex, the need for durable, high-performance control hardware rises. These components include communication devices, power electronics, sensors, and processors essential for real-time monitoring and fast-switching functionality. The expansion of renewable installations and battery systems has further fueled the need for sophisticated hardware that can manage variable loads and help maintain system stability, particularly when switching between grid-connected and islanded operating modes.

United States Microgrid Controller Market held an 81.5% share in 2024 and is projected to generate USD 1.6 billion by 2034. This dominance is supported by national and regional incentives offering financial support for microgrid development, which reduces capital burdens and speeds up deployment. At the same time, the growing vulnerability of centralized energy networks to climate-driven disruptions is accelerating the shift toward decentralized solutions. Microgrid controllers have become critical in these setups, ensuring uninterrupted power by enabling seamless islanding, fault detection, and intelligent load management.

Key companies driving innovation and competition in the Global Microgrid Controller Market include Power Analytics Corporation, Caterpillar Inn, Heila Technologies, Pxise Energy Solutions, AutoGrid Systems Inc, General Electric (GE), Honeywell International Inc, Tesla Energy, Eaton Corporation, Siemens AG, Enchanted Rock, Encorp Inc., ABB Ltd, Schneider Electric, HOMER Energy, Cummins Inc, S&C Electric Company, Schweitzer Engineering Laboratories, Hitachi Energy Ltd, and Emerson Electric Co. Leading players in the Global Microgrid Controller Market are expanding their presence through a mix of R&D investment, technology innovation, and strategic partnerships. Companies are developing advanced AI-powered control algorithms to enhance real-time performance, predictive analytics, and adaptive load balancing. Focus is shifting toward modular, plug-and-play hardware systems that integrate easily with existing infrastructure. Many are entering partnerships with utilities, government bodies, and private energy providers to accelerate microgrid deployments. Cloud-based platforms and edge computing solutions are also being adopted to enable remote monitoring and scalable control capabilities.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Connectivity trends

- 2.4 Offering trends

- 2.5 End use trends

- 2.6 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Cost structure analysis

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

- 3.7.1 Political factors

- 3.7.2 Economic factors

- 3.7.3 Social factors

- 3.7.4 Technological factors

- 3.7.5 Legal factors

- 3.7.6 Environmental factors

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Connectivity, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Grid connected

- 5.3 Off grid

Chapter 6 Market Size and Forecast, By Offering, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Hardware

- 6.3 Software & service

Chapter 7 Market Size and Forecast, By End Use, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Healthcare

- 7.3 Educational institutes

- 7.4 Military

- 7.5 Utility

- 7.6 Industrial/ commercial

- 7.7 Remote

- 7.8 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 France

- 8.3.3 UK

- 8.3.4 Russia

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 ABB Ltd

- 9.2 AutoGrid Systems Inc

- 9.3 Caterpillar Inn

- 9.4 Cummins Inc

- 9.5 Eaton Corporation

- 9.6 Emerson Electric Co.

- 9.7 Enchanted Rock

- 9.8 Encorp Inc.

- 9.9 General Electric (GE)

- 9.10 Heila Technologies

- 9.11 Hitachi Energy Ltd

- 9.12 HOMER Energy

- 9.13 Honeywell International Inc

- 9.14 Power Analytics Corporation

- 9.15 Pxise Energy Solutions

- 9.16 S&C Electric Company

- 9.17 Schneider Electric

- 9.18 Schweitzer Engineering Laboratories

- 9.19 Siemens AG

- 9.20 Tesla Energy