|

市場調查報告書

商品編碼

1858809

未烘焙穀物片市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Unroasted Cereal Flakes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

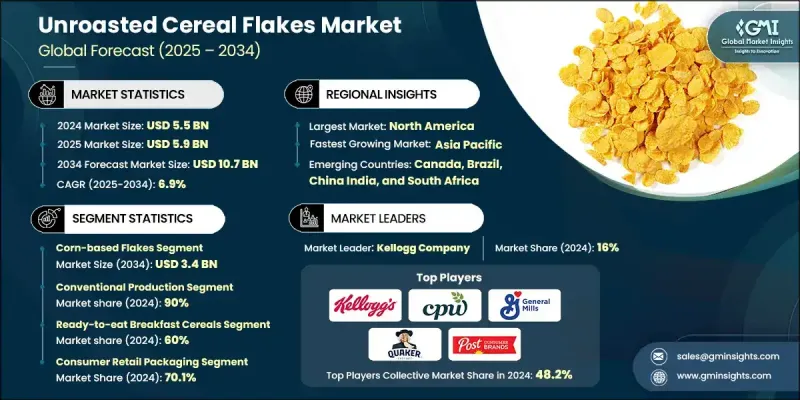

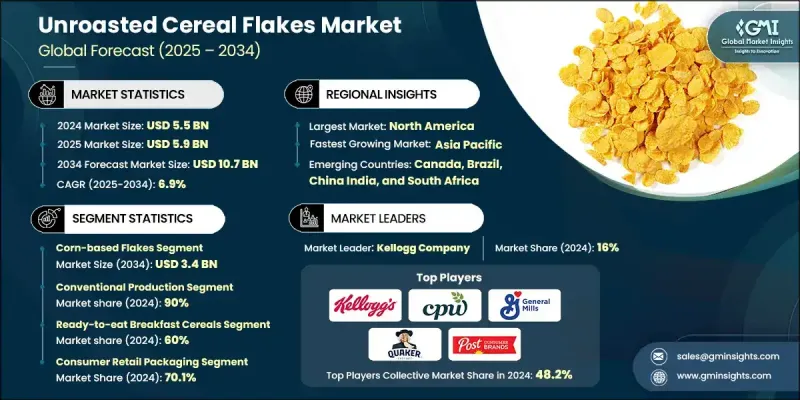

2024 年全球未烘焙穀物片市場價值為 55 億美元,預計到 2034 年將以 6.9% 的複合年成長率成長至 107 億美元。

該市場強勁的成長前景得益於消費者對加工最少、全穀物早餐產品的需求激增,這些產品符合不斷發展的清潔標籤和營養透明度標準。美國食品藥物管理局 (FDA) 的新規更新了「健康」的定義,納入了特定的全穀物最低含量標準,同時限制了添加糖、飽和脂肪和鈉的含量,這有力地支持了未烘焙穀物片的市場定位。全球穀物年產量持續超過 30 億噸,穩定的原料供應鏈和規模化生產能力使該行業受益匪淺,生產商能夠優先考慮全穀物的採購和透明度。受膳食意識轉變和政府更新的營養建議(強調膳食纖維和全穀物)的推動,消費者更傾向於選擇配料清晰、成分簡單、加工程度低的穀物產品。這促使產品創新不斷增加,包括功能性增強和營養強化,以吸引那些既注重便利又注重營養的健康消費者。隨著膳食標準的不斷演變,製造商正與衛生機構更加緊密地合作,以確保其產品符合消費者對更清潔、更簡單、更健康食品選擇的期望。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 55億美元 |

| 預測值 | 107億美元 |

| 複合年成長率 | 6.9% |

有機未烘焙穀物片市場預計到2034年將以8.9%的複合年成長率成長,這主要得益於簡化的認證流程以及與大規模穀物生產的緊密聯繫。再生農業也正在興起,預計複合年成長率將達到11%,這得益於品牌與計劃團體合作,建立農場層面的轉型路徑和可靠的驗證體系。這些再生農業的宣傳在專業零售領域越來越受歡迎,由於投入品可追溯性和永續性文件的完善,供應商能夠獲得更長期的合作協議。

即食未烘焙穀片市場佔有率高達60%,預計2034年將以6.9%的複合年成長率成長。這類穀物之所以廣受歡迎,是因為它們方便快捷,符合消費者的既定習慣,並且不斷推陳出新,以滿足不斷變化的消費者偏好。它們迎合了忙碌的消費者群體,滿足他們對營養豐富、易於烹飪食品的需求,並通常以“清潔標籤”和“功能性”等宣傳語瞄準高階市場,旨在吸引注重健康的消費者。

北美未烘焙穀片市場佔33%的佔有率,預計2024年市場規模將達39億美元。該地區的成長得益於消費者對全穀物益處的廣泛認知以及成熟的零售體系。美國更新的標籤法規以及機構膳食計劃中降低糖分的要求,為成分更健康的穀物產品創造了有利條件。在加拿大,儘管來自加工穀物和能量棒的競爭仍然激烈,但由於高階貨架空間的擴大和認證流程的簡化,有機品牌正獲得更高的認可。各品牌更重視永續包裝和可驗證的標籤聲明,以贏得消費者信任並在競爭激烈的市場中脫穎而出。

未烘焙穀物片市場的主要企業包括:Nature's Path Foods、Post Consumer Brands、Food For Life Baking、Maselis NV、雀巢(Cereal Partners Worldwide)、Small Valley Milling、Bob's Red Mill、百事可樂/桂格燕麥、Hearthside Food、Organic Milling Solutions、Organicicing、Hykia, Globaler Grains、家樂氏公司以及bio-familia(瑞士)。領先企業正致力於拓展產品組合,推出符合現代健康標準和膳食法規的清潔標章、有機和全穀物穀物產品。各公司紛紛採用美國農業部有機認證,並利用聯邦補貼抵銷成本,加速進軍高階市場。許多企業正在提高供應鏈的透明度,以支持再生農業聲明和可追溯性,這有助於建立長期的零售合作夥伴關係。各品牌在功能性成分(如纖維、蛋白質和益生菌)方面不斷創新,同時減少添加劑的使用。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 促進要素

- 健康意識和全穀物飲食指南提升了市場需求。

- 更新後的「健康」標準更傾向於加工最少的穀物。

- 電子商務和現代貿易擴大了准入範圍

- 擴大有機和再生農業

- 陷阱與挑戰

- 保存期限限制推動包裝和物流創新

- 來自加工食品和替代早餐選擇的競爭壓力

- 與傳統穀物相比,生產成本更高

- 機會:

- 有機認證和永續性高階化

- 在清晰的框架內提出強化和功能性主張

- 功能性食品強化

- 促進要素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 按產品規格

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品類型分類,2021-2034年

- 主要趨勢

- 玉米片

- 小麥片

- 燕麥片

- 米片

- 大麥片

- 古代穀物片

- 多穀物混合

第6章:市場估計與預測:依農業實務分類,2021-2034年

- 主要趨勢

- 傳統生產方式

- 有機生產

- 再生農業

- 專業認證

第7章:市場估價與預測:依包裝形式分類,2021-2034年

- 主要趨勢

- 消費者零售包裝

- 散裝/餐飲包裝

- 工業包裝

- 永續包裝

第8章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 即食早餐穀物

- 熱麥片/粥底

- 餐飲服務/大宗應用

- 工業/原料用途

- 格蘭諾拉麥片/什錦麥片成分

- 特殊膳食應用

第9章:市場估算與預測:依配銷通路分類,2021-2034年

- 主要趨勢

- 現代貿易

- 超市

- 大型超市

- 其他

- 傳統貿易

- 獨立雜貨店

- 其他

- 電子商務

- 線上市場(例如亞馬遜、Flipkart)

- 生鮮配送應用程式(例如,bigbasket)

- 其他

第10章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第11章:公司簡介

- Kellogg Company

- Nestle (Cereal Partners Worldwide)

- General Mills

- PepsiCo/Quaker Oats

- Post Consumer Brands

- Nature's Path Foods

- Maselis NV

- Bob's Red Mill

- bio-familia (Swiss)

- King Arthur Baking

- Hearthside Food Solutions

- Organic Milling

- Small Valley Milling

- Ritika's Global Grains

- Food For Life Baking

The Global Unroasted Cereal Flakes Market was valued at USD 5.5 billion in 2024 and is estimated to grow at a CAGR of 6.9% to reach USD 10.7 billion by 2034.

This market's strong growth outlook is supported by a surge in consumer demand for minimally processed, whole-grain breakfast products that align with evolving clean-label and nutrition transparency standards. New FDA regulations have updated the definition of "healthy" to include specific whole-grain minimums while capping added sugars, saturated fats, and sodium, which strongly supports the positioning of unroasted cereal flakes. With global cereal grain output consistently exceeding 3 billion metric tons annually, the industry benefits from stable input supply chains and scalability, allowing producers to prioritize whole grain sourcing and transparency. Consumers are favoring cereals with recognizable, limited ingredients and reduced processing, driven by shifting dietary awareness and updated government nutrition recommendations that emphasize fiber and whole grains. This has led to increased product innovation that includes functional enhancements and nutrient fortification, appealing to health-conscious shoppers seeking both convenience and nutrition. As dietary standards evolve, manufacturers are aligning more closely with health agencies to ensure their offerings meet expectations for cleaner, simpler, and more wholesome food choices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.5 Billion |

| Forecast Value | $10.7 Billion |

| CAGR | 6.9% |

The organic unroasted cereal flakes segment will grow at a CAGR of 8.9% through 2034, propelled by streamlined certification processes and strong links to large-scale cereal production. Regenerative agriculture is also emerging with an 11% CAGR, as brands work with advocacy groups to establish farm-level transition pathways and reliable verification systems. These regenerative claims are gaining traction in specialty retail settings, helping suppliers secure longer-term agreements due to improved input traceability and sustainability documentation.

The ready-to-eat unroasted flakes segment held 60% share and is expected to grow at a CAGR of 6.9% through 2034. These cereals are popular due to their convenience, well-established consumer habits, and continuous product innovations that address evolving preferences. They cater to a busy consumer base looking for nutritious and easy-to-prepare options, often targeting premium segments with clean-label and functional claims aimed at wellness-driven individuals.

North America Unroasted Cereal Flakes Market held a 33% share and generated USD 3.9 billion in 2024. Growth in this region is fueled by broad consumer awareness of whole grain benefits and a mature retail infrastructure. Updated U.S. labeling rules and reduced sugar mandates within institutional meal programs have created favorable conditions for cereals with cleaner profiles. In Canada, while competition from processed cereals and snack bars remains high, organic brands are seeing greater acceptance due to expanded premium shelf space and more accessible certification processes. Brands are placing greater focus on sustainable packaging and verifiable label claims to gain consumer trust and stand out in a competitive market.

Key companies in the Unroasted Cereal Flakes Market are Nature's Path Foods, Post Consumer Brands, Food For Life Baking, Maselis N.V., Nestle (Cereal Partners Worldwide), Small Valley Milling, Bob's Red Mill, PepsiCo/Quaker Oats, Hearthside Food Solutions, Organic Milling, King Arthur Baking, General Mills, Ritika's Global Grains, Kellogg Company, and bio-familia (Swiss). Leading players are focusing on expanding their product portfolios to include clean-label, organic, and whole-grain cereals to align with modern health standards and dietary regulations. Companies are adopting USDA organic certification and leveraging federal reimbursements to offset costs, accelerating entry into premium segments. Many are increasing transparency across their supply chains to support regenerative agriculture claims and traceability, which helps build long-term retail partnerships. Brands are innovative with functional ingredients like fiber, protein, and probiotics while using fewer additives.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product type trends

- 2.2.2 Agricultural practice trends

- 2.2.3 Application trends

- 2.2.4 Packaging format trends

- 2.2.5 Distribution channel trends

- 2.2.6 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Drivers

- 3.2.1.1 Health awareness and whole-grain guidance elevate demand

- 3.2.1.2 Updated "healthy" criteria favor minimally processed cereals

- 3.2.1.3 E-commerce and modern trade broaden access

- 3.2.1.4 Expansion of organic and regenerative agriculture

- 3.2.2 Pitfalls & Challenges

- 3.2.2.1 Shelf-life constraints push packaging and logistics innovation

- 3.2.2.2 Competitive pressure from processed and alt breakfast options

- 3.2.2.3 Higher production costs vs conventional cereals

- 3.2.3 Opportunities:

- 3.2.3.1 Organic certification and sustainability premiumization

- 3.2.3.2 Fortification and functional claims within clear frameworks

- 3.2.3.3 Functional food fortification

- 3.2.1 Drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product format

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Corn-based flakes

- 5.3 Wheat-based flakes

- 5.4 Oat-based flakes

- 5.5 Rice-based flakes

- 5.6 Barley-based flakes

- 5.7 Ancient grain flakes

- 5.8 Multigrain blends

Chapter 6 Market Estimates and Forecast, By Agricultural Practices, 2021-2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Conventional production

- 6.3 Organic production

- 6.4 Regenerative agriculture

- 6.5 Specialty certifications

Chapter 7 Market Estimates and Forecast, By Packaging Format, 2021-2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Consumer retail packaging

- 7.3 Bulk/foodservice packaging

- 7.4 Industrial packaging

- 7.5 Sustainable packaging

Chapter 8 Market Estimates and Forecast, By Application, 2021-2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 Ready-to-eat breakfast cereals

- 8.3 Hot cereal/porridge base

- 8.4 Foodservice/bulk applications

- 8.5 Industrial/ingredient use

- 8.6 Granola/muesli components

- 8.7 Specialized dietary applications

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021-2034 (USD Million & Kilo Tons)

- 9.1 Key trends

- 9.2 Modern trade

- 9.2.1 Supermarkets

- 9.2.2 Hypermarkets

- 9.2.3 Others

- 9.3 Traditional trade

- 9.3.1 Independent grocery stores

- 9.3.2 Others

- 9.4 E-commerce

- 9.4.1 Online marketplaces (e.g., amazon, flipkart)

- 9.4.2 Grocery delivery apps (e.g., bigbasket)

- 9.4.3 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Kellogg Company

- 11.2 Nestle (Cereal Partners Worldwide)

- 11.3 General Mills

- 11.4 PepsiCo/Quaker Oats

- 11.5 Post Consumer Brands

- 11.6 Nature's Path Foods

- 11.7 Maselis N.V.

- 11.8 Bob's Red Mill

- 11.9 bio-familia (Swiss)

- 11.10 King Arthur Baking

- 11.11 Hearthside Food Solutions

- 11.12 Organic Milling

- 11.13 Small Valley Milling

- 11.14 Ritika's Global Grains

- 11.15 Food For Life Baking