|

市場調查報告書

商品編碼

1858804

政府及公共服務領域人工智慧市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)AI in Government and Public Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

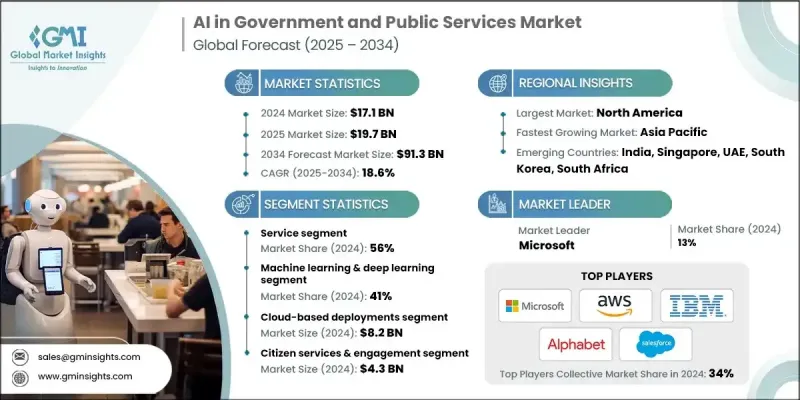

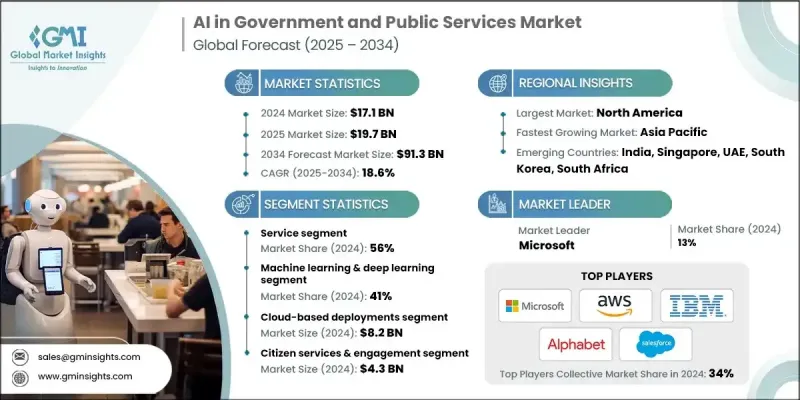

2024 年全球政府和公共服務領域人工智慧市場價值為 171 億美元,預計到 2034 年將以 18.6% 的複合年成長率成長至 913 億美元。

人工智慧的快速發展,以及數位化治理的日益普及,正在推動這一成長。世界各國政府都在利用人工智慧來提高營運效率、實現公共服務現代化,並更有效地與公民互動。人工智慧技術透過自動化資料輸入、文件處理和公眾諮詢等重複性行政工作,正在改變傳統的官僚體系。這使得政府機構能夠加快工作流程、減少錯誤,並將人力資源重新分配到更具戰略意義的任務上。利用人工智慧來增強即時決策、預測分析和服務自動化,正成為數位轉型議程的核心要素。此外,對更敏捷、反應迅速和數據驅動的治理模式的重視,也促使公共部門機構加快採用人工智慧的步伐。各國政府意識到人工智慧在提高透明度、最佳化資源配置以及為公民提供更個人化服務方面的益處,同時還能在公共管理中維護嚴格的隱私和道德標準。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 171億美元 |

| 預測值 | 913億美元 |

| 複合年成長率 | 18.6% |

2024年,服務板塊佔據56%的市場佔有率,預計2025年至2034年將以16%的複合年成長率成長。該板塊涵蓋系統整合、實施諮詢、員工培訓和技術支持,每一項都在政府生態系統中順利部署人工智慧解決方案方面發揮著至關重要的作用。公共部門機構通常依賴專家諮詢來確定可行的人工智慧應用案例、設計可擴展的實施計劃並確保符合監管要求。由於前期投資需求高,且傳統系統整合面臨許多挑戰,對專業服務的需求持續成長,凸顯了其在人工智慧長期成功中的關鍵作用。

機器學習和深度學習領域在2024年佔據了41%的市場佔有率,預計到2034年將以17%的複合年成長率成長。這些核心人工智慧技術透過實現模式識別、預測分析和智慧自動化,為政府的眾多應用提供了支撐。政府機構正在部署機器學習模型,以支援詐欺偵測、績效分析、風險評估和資源規劃。這些工具能夠處理大量結構化和非結構化資料,使其成為現代公共部門運作的關鍵。

2024年,亞太地區政府和公共服務領域的人工智慧市場佔有率達到24%,預計2025年至2034年間將以21%的複合年成長率成長。該地區以人口眾多、都市化快速進程的國家為主導,正大力投資人工智慧以滿足現代治理的需求。在亞太地區最具發展潛力的市場中,有一個國家因其大規模人工智慧計畫而脫穎而出,這些計畫旨在實現智慧城市管理、以公民為中心的服務和數位化行政。強而有力的政府支持和戰略規劃正在推動人工智慧在政府各個職能部門的廣泛應用。

推動政府和公共服務市場人工智慧創新和部署的關鍵企業包括Alphabet、IBM、Salesforce、NVIDIA、微軟、亞馬遜網路服務(AWS)、Oracle、Cognizant、OpenAI和埃森哲。為了鞏固自身地位,這些主要企業正致力於與政府機構進行策略合作,共同開發滿足公共服務需求的AI驅動平台。各公司正大力投資研發,以創造符合政府合規標準的、可擴展、安全且符合倫理規範的AI解決方案。許多公司正在加強其專業服務部門,以支援系統整合、監管諮詢和AI培訓。與地方政府的合作使得企業能夠根據區域需求進行客製化,同時,基於雲端的AI產品也在不斷擴展,以支援遠端和可擴展的部署。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 雲端服務供應商

- 人工智慧平台提供商

- 系統整合商

- 硬體和基礎設施供應商

- 安全與治理解決方案提供商

- 成本結構

- 利潤率

- 每個階段的價值增加

- 影響供應鏈的因素

- 顛覆者

- 供應商格局

- 對力的影響

- 成長促進因素

- 對營運效率和成本降低的需求

- 公民對數位服務的期望日益提高

- 需要數據驅動的政策和決策

- 加強公共安全保障

- 產業陷阱與挑戰

- 資料隱私、安全和倫理問題

- 高額初始投資和遺留系統整合

- 市場機遇

- 主動和預測性的公共服務

- 改善城市規劃和智慧城市發展

- 成長促進因素

- 技術趨勢與創新生態系統

- 目前技術

- 大型語言模型演化

- 多模態人工智慧整合

- 強化學習進展

- 神經架構搜尋

- 新興技術

- 面向智慧體的聯邦學習

- 邊緣人工智慧與分散式運算

- 量子計算整合

- 腦機介面開發

- 目前技術

- 成長潛力分析

- 監管環境

- 監理合規與治理框架

- 聯邦人工智慧行政命令實施

- OMB人工智慧治理準則合規性

- NIST人工智慧風險管理框架的採用

- 國際人工智慧治理標準一致性

- 安全與隱私管理

- FedRAMP授權要求

- 網路安全框架整合

- 資料隱私和保護協議

- 跨境資料傳輸合規性

- 監理合規與治理框架

- 波特的分析

- PESTEL 分析

- 專利分析

- 成本細分分析

- 價格趨勢

- 按地區

- 依產品

- 永續性和環境方面

- 環境影響評估與生命週期分析

- 社會影響力與社區關係

- 公司治理與企業責任

- 永續技術發展

- 用例

- 遺留系統整合與現代化

- 傳統基礎設施相容性挑戰

- 系統整合架構策略

- 資料遷移和互通性解決方案

- 分階段現代化方法

- 勞動力轉型與技能發展

- 人工智慧技能差距評估和培訓需求

- 變革管理與使用者採納策略

- 公共部門人才招募挑戰

- 跨機構知識共享計劃

- 採購與供應商選擇框架

- 政府採購流程的複雜性

- 供應商資格和安全許可要求

- 合約管理及績效指標

- 多供應商整合策略

- 倫理人工智慧與偏見緩解

- 演算法公平性和透明度要求

- 偏見檢測與緩解框架

- 可解釋人工智慧實施標準

- 公共問責與審計機制

- 互通性和標準化

- 跨機構資料共享協議

- API標準化與整合

- 通用平台開發計劃

- 聯邦企業架構調整

- 預算最佳化和投資報酬率演示

- 政府預算策略

- 成本效益分析框架

- 績效衡量與關鍵績效指標制定

- 價值實現與影響評估

- 公眾信任與透明度

- 公民參與和溝通策略

- 透明度和可解釋性要求

- 公眾回饋與問責機制

- 媒體與利害關係人關係管理

- 跨機構協作與協調

- 機構間夥伴關係模式

- 共享服務和平台策略

- 聯邦-州-地方協調框架

- 公私合作發展

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:依產品類型分類,2021-2034年

- 主要趨勢

- 解決方案/軟體

- 服務

- 諮詢顧問

- 系統整合與部署

- 培訓與教育

- 支援與維護

第6章:市場估計與預測:依技術分類,2021-2034年

- 主要趨勢

- 機器學習與深度學習

- 自然語言處理(NLP)

- 圖片和影片

- 機器人流程自動化 (RPA)

- 其他

第7章:市場估算與預測:依部署模式分類,2021-2034年

- 主要趨勢

- 本地部署

- 基於雲端的

- 混合

第8章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 公民服務與參與

- 用於公共查詢的數位助理和聊天機器人

- 公共傳播多語種翻譯

- 個人化政府入口網站

- 公共安全與保全

- 監視與監控

- 犯罪預測與分析

- 緊急應變系統

- 醫療保健和社會服務

- 疾病預測與疫情控制

- 智慧資源分配

- 福利和救濟金分配監督

- 國防與國家安全

- 威脅偵測與分析

- 人工智慧驅動的網路安全系統

- 軍事決策支援系統

- 行政效率

- 智慧城市與城市管理

- 其他

第9章:市場估算與預測:依最終用途分類,2021-2034年

- 主要趨勢

- 聯邦/國家政府

- 州/省政府

- 地方/市政府

- 其他

第10章:市場估計與預測:依地區分類,2021-2034年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 比利時

- 荷蘭

- 瑞典

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 新加坡

- 韓國

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第11章:公司簡介

- 全球參與者

- Accenture

- Alphabet

- Amazon Web Services

- Cognizant

- IBM

- Microsoft

- NVIDIA

- Open AI

- Oracle

- Salesforce

- SAP

- 區域玩家

- Booz Allen Hamilton

- CACI International

- General Dynamics Information Technology

- Leidos

- Lockheed Martin

- Palantir Technologies

- Raytheon Technologies

- SAIC (Science Applications International)

- 新興玩家

- Appian

- Automation Anywhere

- Blue Prism

- C3.ai

- DataRobot

- H2 O.ai

- UiPath

- Verint Systems

The Global AI in Government and Public Services Market was valued at USD 17.1 billion in 2024 and is estimated to grow at a CAGR of 18.6% to reach USD 91.3 billion by 2034.

Rapid advancements in artificial intelligence, combined with the increasing shift toward digital governance, are fueling this growth. Governments worldwide are leveraging AI to enhance operational efficiency, modernize public services, and engage citizens more effectively. AI technologies are transforming traditional bureaucratic systems by automating repetitive administrative duties such as data entry, document processing, and public inquiries. This allows government agencies to accelerate workflows, reduce errors, and redirect human resources to more strategic tasks. The use of AI to enhance real-time decision-making, predictive analytics, and service automation is becoming a core element of digital transformation agendas. Additionally, the focus on more agile, responsive, and data-driven governance models has pushed public sector organizations to adopt AI at a faster pace. Governments are recognizing the benefits of AI in enhancing transparency, optimizing resource allocation, and providing more personalized services to citizens, all while maintaining strong privacy and ethical standards in public administration.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $17.1 Billion |

| Forecast Value | $91.3 Billion |

| CAGR | 18.6% |

In 2024, the services segment held a 56% share and is anticipated to grow at a CAGR of 16% from 2025 to 2034. This segment includes system integration, implementation consulting, staff training, and technical support, each playing a vital role in enabling the smooth deployment of AI solutions within government ecosystems. Public sector organizations often rely on expert consulting to identify viable AI use cases, design scalable implementation plans, and ensure regulatory compliance. With high upfront investment needs and challenges around legacy system integration, the demand for specialized services continues to increase, underscoring their critical role in long-term AI success.

The machine learning and deep learning segment held a 41% share in 2024 and is projected to grow at a CAGR of 17% through 2034. These core AI technologies underpin a wide range of government applications by enabling pattern recognition, predictive analytics, and intelligent automation. Government bodies are deploying machine learning models to support fraud detection, performance analysis, risk evaluation, and resource planning. The ability of these tools to process large volumes of structured and unstructured data makes them essential for modern public sector operations.

Asia-Pacific AI in Government and Public Services Market held 24% share in 2024 and will grow at a CAGR of 21% during 2025-2034. The region, led by countries with large populations and rapid urbanization, is investing heavily in AI to meet the demands of modern governance. Among the most promising markets in the region, one country stands out due to its large-scale AI initiatives targeting smart city management, citizen-centric services, and digital administration. Strong governmental support and strategic planning are enabling widespread AI adoption across various government functions.

Key companies driving innovation and deployment of AI in the Government and Public Services Market include Alphabet, IBM, Salesforce, NVIDIA, Microsoft, Amazon Web Services, Oracle, Cognizant, OpenAI, and Accenture. To strengthen their presence, key players are focusing on strategic collaborations with government agencies to co-develop AI-driven platforms tailored for public service needs. Companies are investing heavily in R&D to create scalable, secure, and ethical AI solutions aligned with government compliance standards. Many firms are enhancing their professional services divisions to support system integration, regulatory consulting, and AI training. Partnerships with local governments are enabling customization for regional needs, while cloud-based AI offerings are being expanded to support remote and scalable deployments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast

- 1.4 Primary research and validation

- 1.5 Some of the primary sources

- 1.6 Data mining sources

- 1.6.1 Secondary

- 1.6.1.1 Paid Sources

- 1.6.1.2 Public Sources

- 1.6.1.3 Sources, by region

- 1.6.1 Secondary

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Offering

- 2.2.3 Technology

- 2.2.4 Deployment mode

- 2.2.5 Application

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Cloud service providers

- 3.1.1.2 AI platform providers

- 3.1.1.3 System integrators

- 3.1.1.4 Hardware & infrastructure providers

- 3.1.1.5 Security & governance solution providers

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Factors impacting the supply chain

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 Demand for operational efficiency & cost reduction

- 3.2.1.2 Rising citizen expectations for digital services

- 3.2.1.3 Need for data-driven policy and decision-making

- 3.2.1.4 Enhanced public safety and security

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Data privacy, security, and ethical concerns

- 3.2.2.2 High initial investment and legacy system integration

- 3.2.3 Market opportunities

- 3.2.3.1 Proactive and predictive public services

- 3.2.3.2 Improved urban planning and smart city development

- 3.2.1 Growth drivers

- 3.3 Technology trends & innovation ecosystem

- 3.3.1 Current technologies

- 3.3.1.1 Large language model evolution

- 3.3.1.2 Multi-modal AI integration

- 3.3.1.3 Reinforcement learning advances

- 3.3.1.4 Neural architecture search

- 3.3.2 Emerging technologies

- 3.3.2.1 Federated learning for agents

- 3.3.2.2 Edge AI & distributed computing

- 3.3.2.3 Quantum computing integration

- 3.3.2.4 Brain-computer interface development

- 3.3.1 Current technologies

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 Regulatory compliance & governance framework

- 3.5.1.1 Federal AI executive order implementation

- 3.5.1.2 OMB AI governance guidelines compliance

- 3.5.1.3 NIST AI risk management framework adoption

- 3.5.1.4 International AI governance standards alignment

- 3.5.2 Security & privacy management

- 3.5.2.1 FedRAMP authorization requirements

- 3.5.2.2 Cybersecurity framework integration

- 3.5.2.3 Data privacy & protection protocols

- 3.5.2.4 Cross-border data transfer compliance

- 3.5.1 Regulatory compliance & governance framework

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Patent analysis

- 3.9 Cost breakdown analysis

- 3.10 Price trends

- 3.10.1 By region

- 3.10.2 By product

- 3.11 Sustainability and environmental aspects

- 3.11.1 Environmental impact assessment & lifecycle analysis

- 3.11.2 Social impact & community relations

- 3.11.3 Governance & corporate responsibility

- 3.11.4 Sustainable technological development

- 3.12 Use cases

- 3.13 Legacy system integration & modernization

- 3.13.1 Legacy infrastructure compatibility challenges

- 3.13.2 System integration architecture strategies

- 3.13.3 Data migration & interoperability solutions

- 3.13.4 Phased modernization approaches

- 3.14 Workforce transformation & skills development

- 3.14.1 AI skills gap assessment & training needs

- 3.14.2 Change management & user adoption strategies

- 3.14.3 Public sector talent acquisition challenges

- 3.14.4 Cross-agency knowledge sharing programs

- 3.15 Procurement & vendor selection framework

- 3.15.1 Government procurement process complexity

- 3.15.2 Vendor qualification & security clearance requirements

- 3.15.3 Contract management & performance metrics

- 3.15.4 Multi-vendor integration strategies

- 3.16 Ethical AI & bias mitigation

- 3.16.1 Algorithmic fairness & transparency requirements

- 3.16.2 Bias detection & mitigation frameworks

- 3.16.3 Explainable AI implementation standards

- 3.16.4 Public accountability & audit mechanisms

- 3.17 Interoperability & standardization

- 3.17.1 Cross-agency data sharing protocols

- 3.17.2 API standardization & integration

- 3.17.3 Common platform development initiatives

- 3.17.4 Federal enterprise architecture alignment

- 3.18 Budget optimization & ROI demonstration

- 3.18.1 Government budget allocation strategies

- 3.18.2 Cost-benefit analysis frameworks

- 3.18.3 Performance measurement & KPI development

- 3.18.4 Value realization & impact assessment

- 3.19 Public trust & transparency

- 3.19.1 Citizen engagement & communication strategies

- 3.19.2 Transparency & explainability requirements

- 3.19.3 Public feedback & accountability mechanisms

- 3.19.4 Media & stakeholder relations management

- 3.20 Cross-agency collaboration & coordination

- 3.20.1 Inter-agency partnership models

- 3.20.2 Shared services & platform strategies

- 3.20.3 Federal-state-local coordination frameworks

- 3.20.4 Public-private partnership development

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New product launches

- 4.5.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Offering, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Solutions/software

- 5.3 Services

- 5.3.1 Consulting & advisory

- 5.3.2 System integration & deployment

- 5.3.3 Training & education

- 5.3.4 Support & maintenance

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Machine learning & deep learning

- 6.3 Natural Language Processing (NLP)

- 6.4 Image & video

- 6.5 Robotic Process Automation (RPA)

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Deployment mode, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 On-Premises

- 7.3 Cloud-Based

- 7.4 Hybrid

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Citizen services & engagement

- 8.2.1 Digital assistants & chatbots for public queries

- 8.2.2 Multilingual Translation for Public Communication

- 8.2.3 Personalized government portals

- 8.3 Public safety & security

- 8.3.1 Surveillance & monitoring

- 8.3.2 Crime prediction & analysis

- 8.3.3 Emergency response systems

- 8.4 Healthcare & social services

- 8.4.1 Disease prediction & outbreak control

- 8.4.2 Smart resource allocation

- 8.4.3 Benefits & welfare distribution monitoring

- 8.5 Defense & national security

- 8.5.1 Threat detection & analysis

- 8.5.2 AI-driven cybersecurity systems

- 8.5.3 Military decision support systems

- 8.6 Administrative efficiency

- 8.7 Smart cities & urban management

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By End use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Federal/National government

- 9.3 State/Provincial government

- 9.4 Local/Municipal government

- 9.5 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 North America

- 10.1.1 US

- 10.1.2 Canada

- 10.2 Europe

- 10.2.1 UK

- 10.2.2 Germany

- 10.2.3 France

- 10.2.4 Italy

- 10.2.5 Spain

- 10.2.6 Belgium

- 10.2.7 Netherlands

- 10.2.8 Sweden

- 10.3 Asia Pacific

- 10.3.1 China

- 10.3.2 India

- 10.3.3 Japan

- 10.3.4 Australia

- 10.3.5 Singapore

- 10.3.6 South Korea

- 10.3.7 Vietnam

- 10.3.8 Indonesia

- 10.4 Latin America

- 10.4.1 Brazil

- 10.4.2 Mexico

- 10.4.3 Argentina

- 10.5 MEA

- 10.5.1 South Africa

- 10.5.2 Saudi Arabia

- 10.5.3 UAE

Chapter 11 Company Profiles

- 11.1 Global players

- 11.1.1 Accenture

- 11.1.2 Alphabet

- 11.1.3 Amazon Web Services

- 11.1.4 Cognizant

- 11.1.5 IBM

- 11.1.6 Microsoft

- 11.1.7 NVIDIA

- 11.1.8 Open AI

- 11.1.9 Oracle

- 11.1.10 Salesforce

- 11.1.11 SAP

- 11.2 Regional players

- 11.2.1 Booz Allen Hamilton

- 11.2.2 CACI International

- 11.2.3 General Dynamics Information Technology

- 11.2.4 Leidos

- 11.2.5 Lockheed Martin

- 11.2.6 Palantir Technologies

- 11.2.7 Raytheon Technologies

- 11.2.8 SAIC (Science Applications International)

- 11.3 Emerging players

- 11.3.1 Appian

- 11.3.2 Automation Anywhere

- 11.3.3 Blue Prism

- 11.3.4 C3.ai

- 11.3.5 DataRobot

- 11.3.6. H2 O.ai

- 11.3.7 UiPath

- 11.3.8 Verint Systems