|

市場調查報告書

商品編碼

1850617

乾式真空幫浦市場機會、成長動力、產業趨勢分析及2025-2034年預測Dry Vacuum Pump Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

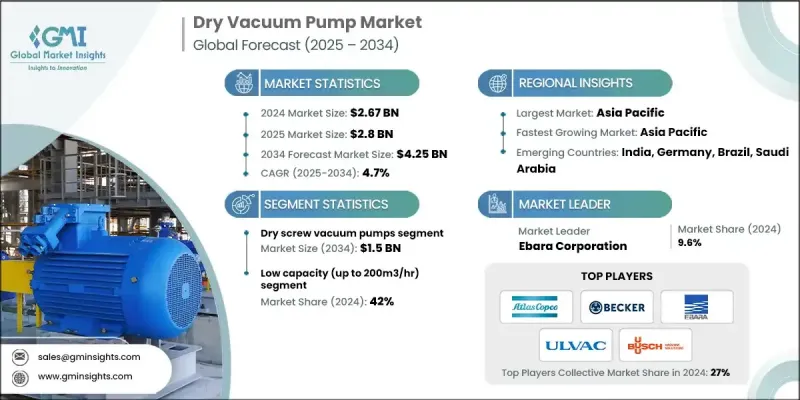

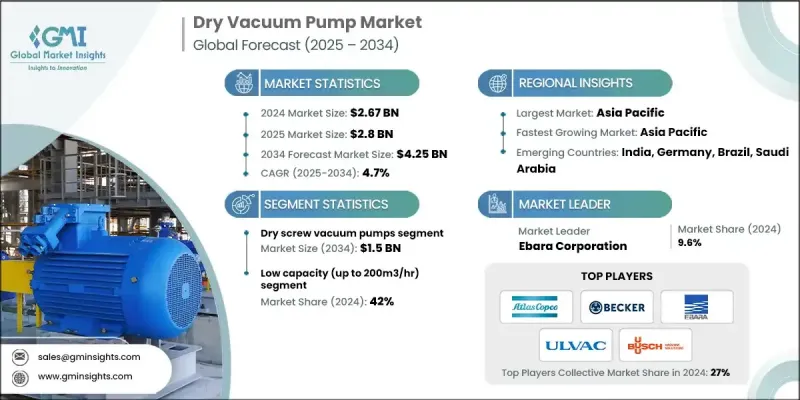

2024 年全球乾式真空幫浦市場價值為 26.7 億美元,預計到 2034 年將以 4.7% 的複合年成長率成長至 42.5 億美元。

電子、航太和汽車等工業製造領域的激增持續推動著乾式真空泵在成型、塗層和材料運輸等製程的需求。製藥和生物技術產業推動了市場成長,因為這些幫浦在滅菌、冷凍乾燥和溶劑回收操作中至關重要。食品和飲料行業也在推動採用,因為真空包裝和食品加工對清潔、無油系統的需求日益成長。同時,化學公司青睞乾式真空解決方案,因為它們易於維護的設計和無污染的操作。向自動化和數位化的轉變日益加劇,促使製造商在真空系統中整合智慧功能,提供即時監控、資料分析和預測性維護,以提高正常運行時間和效率。兩級系統在需要更深真空度的應用上越來越受歡迎。乾式真空幫浦因其節能、耐用和環保運作而在多種應用中取代了油基系統,使其成為尋求更清潔、更可靠真空技術的各行各業的有吸引力的選擇。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 26.7億美元 |

| 預測值 | 42.5億美元 |

| 複合年成長率 | 4.7% |

預計到2034年,乾式螺桿真空幫浦市場將實現15億美元的產值,這得益於半導體製造、冶金和化學生產領域的廣泛應用。這類幫浦可提供高真空度和快速抽速,且無污染。其節能運作是其關鍵優勢,尤其適用於那些致力於降低功耗和營運成本的工廠。其堅固耐用的設計和更長的維護間隔可減少維護需求並延長正常運行時間,使其成為大量、連續使用應用的理想選擇。此細分市場的成長反映出,在高需求環境中,人們對永續高效設備的偏好日益成長。

低流量(最高 200 立方公尺/小時)泵浦市場在 2024 年佔據了 42% 的佔有率,這得益於其應用領域對精確、緊湊和節能解決方案的需求。此領域廣泛應用於實驗室、小規模製藥生產、分析儀器和電子製造領域。其受歡迎程度源自於其在污染控制和可靠性至關重要的環境中能夠提供清潔、無油的性能。緊湊的設計、低維護成本和經濟高效的運行使這些泵浦非常適合有限空間的安裝和間歇性使用場景。

預計到2034年,北美乾式真空幫浦市場規模將達到10.7億美元。製藥和生物技術領域是推動該市場發展的主要動力,其中冷凍乾燥和無菌包裝等製程需要無污染的環境。嚴格的行業法規合規性以及該地區生物製劑生產的擴張,正在增強對這些系統的需求。高生產標準、不斷成長的研發投入以及對製程完整性的高度重視是支撐北美各工廠成長的關鍵因素。

影響乾式真空幫浦產業的關鍵製造商包括 Edwards Vacuum、Ebara Corporation、ULVAC、Becker Vacuum Pumps、Atlas Copco、Welch Vacuum、Agilent Technologies、Grundfos、Alfa Laval、Leybold GmbH、KNF Neuberger、Flowserve Corporation、Tuthill Corporation、DEKKER。為了鞏固其地位,領先的乾式真空幫浦製造商正專注於節能技術創新並擴展其產品線以滿足不斷變化的行業需求。許多公司正在投資具有自動化功能的智慧型幫浦系統,使用戶能夠存取即時性能資料和預測性維護工具。公司也正在建立策略聯盟和合作夥伴關係,以增強分銷網路,特別是在高成長地區。持續的研發努力正在開發具有更高真空度、運作更安靜和使用壽命更長的泵浦。

目錄

第1章:方法論與範圍

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按泵類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 貿易統計(HS 編碼-841410)

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按泵類型,2021-2034

- 主要趨勢

- 乾式螺桿真空泵

- 乾式渦旋真空泵

- 乾式隔膜泵

- 乾爪和鉤泵

- 其他

第6章:市場估計與預測:依產能,2021-2034

- 主要趨勢

- 低(最高 200m3/小時)

- 中(200-500 立方米/小時)

- 高(超過 500 立方米/小時)

第7章:市場估計與預測:依最終用途產業,2021-2034

- 主要趨勢

- 電子和半導體

- 製藥

- 化工和石化

- 石油和天然氣

- 食品和飲料

- 其他

第 8 章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 直銷

- 間接銷售

第9章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Agilent Technologies

- Atlas Copco

- Becker Vacuum Pumps

- Busch Vacuum Solutions

- Ebara Corporation

- Flowserve Corporation

- Graham Corporation

- Ingersoll Rand Inc

- Kashiyama Industries

- Orion Machinery

- Osaka Vacuum

- Schmalz Group

- Shinko Seiki

- ULVAC

- Unozawa

The Global Dry Vacuum Pumps Market was valued at USD 2.67 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 4.25 billion by 2034.

The surge in industrial manufacturing across electronics, aerospace, and automotive continues to fuel demand for dry vacuum pumps in processes such as molding, coating, and material transport. Pharmaceutical and biotech industries boost market growth, as these pumps are essential in sterilization, freeze-drying, and solvent recovery operations. The food and beverage sector is also driving adoption due to growing requirements for clean, oil-free systems in vacuum packaging and food processing. Meanwhile, chemical companies favor dry vacuum solutions for their maintenance-friendly designs and contamination-free operation. The increasing shift toward automation and digitalization pushes manufacturers to integrate smart features in vacuum systems, offering real-time monitoring, data analytics, and predictive maintenance to improve uptime and efficiency. Two-stage systems are gaining popularity in applications needing deeper vacuum levels. Dry vacuum pumps replace oil-based systems in several applications due to their energy efficiency, durability, and environmentally friendly operation, making them an attractive choice across industries seeking cleaner and more reliable vacuum technology.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.67 Billion |

| Forecast Value | $4.25 Billion |

| CAGR | 4.7% |

The dry screw vacuum pumps segment is expected to generate USD 1.5 billion by 2034, fueled by high adoption across semiconductor fabrication, metallurgy, and chemical production. These pumps deliver high vacuum levels and fast pumping speeds without contamination. Their energy-efficient operation is a key benefit, especially for facilities aiming to reduce power consumption and operational expenses. The robust design and extended service intervals lead to reduced maintenance needs and enhanced uptime, making them ideal for high-volume, continuous-use applications. This segment's growth reflects an increasing preference for sustainable and efficient equipment in high-demand environments.

The low (up to 200m3/hr) segment held a 42% share in 2024 owing to the applications requiring precise, compact, and energy-efficient solutions. This segment is widely adopted across laboratories, small-scale pharmaceutical production, analytical instrumentation, and electronics manufacturing. Its popularity stems from the pumps' ability to deliver clean, oil-free performance in environments where contamination control and reliability are critical. Compact design, low maintenance, and cost-effective operation make these pumps suitable for limited-space installations and intermittent-use scenarios.

North America Dry Vacuum Pumps Market is projected to reach USD 1.07 billion by 2034. The pharmaceutical and biotechnology landscape is a major driver, where processes like freeze-drying and aseptic packaging require contamination-free environments. Compliance with stringent industry regulations and the expansion of biologics manufacturing in the region are strengthening demand for these systems. High production standards, rising R&D investments, and a strong focus on process integrity are key factors supporting growth across North American facilities.

The key manufacturers shaping the Dry Vacuum Pumps Industry include Edwards Vacuum, Ebara Corporation, ULVAC, Becker Vacuum Pumps, Atlas Copco, Welch Vacuum, Agilent Technologies, Grundfos, Alfa Laval, Leybold GmbH, KNF Neuberger, Flowserve Corporation, Tuthill Corporation, DEKKER Vacuum Technologies, and Graham Corporation. To strengthen their position, leading dry vacuum pump manufacturers are focusing on innovation in energy-efficient technologies and expanding their product lines to meet evolving industry demands. Many are investing in smart pump systems with automation features, enabling users to access real-time performance data and predictive maintenance tools. Companies are also entering strategic alliances and partnerships to enhance distribution networks, particularly in high-growth regions. Continuous R&D efforts are developing pumps with improved vacuum levels, quieter operation, and longer service life.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Pump type

- 2.2.3 Capacity

- 2.2.4 End use industry

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By pump type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code-841410)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Pump Type, 2021-2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Dry screw vacuum pump

- 5.3 Dry scroll vacuum pump

- 5.4 Dry diaphragm pump

- 5.5 Dry claw and hook pumps

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Low (Up to 200m3/hr)

- 6.3 Mid (200-500 m3/hr)

- 6.4 High (More than 500 m3/hr)

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Electronics and semiconductors

- 7.3 Pharmaceutical

- 7.4 Chemical and petrochemical

- 7.5 Oil and gas

- 7.6 Food and beverages

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Agilent Technologies

- 10.2 Atlas Copco

- 10.3 Becker Vacuum Pumps

- 10.4 Busch Vacuum Solutions

- 10.5 Ebara Corporation

- 10.6 Flowserve Corporation

- 10.7 Graham Corporation

- 10.8 Ingersoll Rand Inc

- 10.9 Kashiyama Industries

- 10.10 Orion Machinery

- 10.11 Osaka Vacuum

- 10.12 Schmalz Group

- 10.13 Shinko Seiki

- 10.14 ULVAC

- 10.15 Unozawa