|

市場調查報告書

商品編碼

1844385

直接面對消費者的基因檢測市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Direct-to-Consumer Genetic Testing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

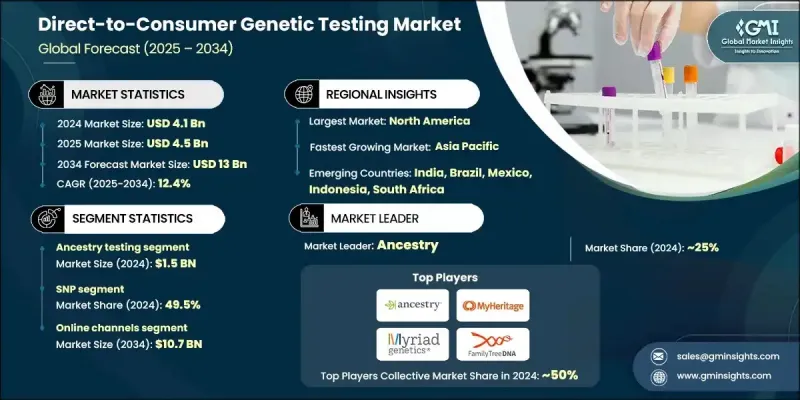

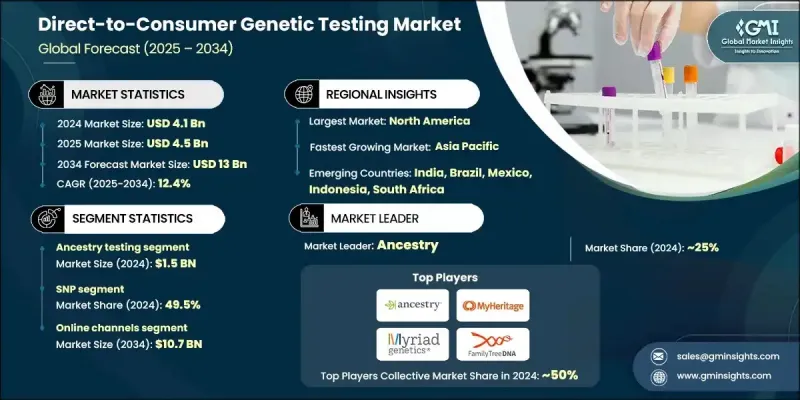

2024 年全球直接面對消費者的基因檢測市場價值為 41 億美元,預計到 2034 年將以 12.4% 的複合年成長率成長,達到 130 億美元。

消費者對個人化健康和保健解決方案日益成長的需求推動了這個市場的快速擴張。隨著越來越多的人,尤其是年輕人,尋求更深入地了解自身的健康狀況、血統和生活方式,對家用基因檢測的需求也日益成長。這些檢測無需醫療中介,只需唾液或頰拭子即可獲得便捷的結果。直接面對消費者的基因檢測涵蓋了廣泛的應用領域,包括預測性和攜帶者檢測、藥物基因組學、護膚、營養、血統和性狀分析。這些基因洞察日益融入數位健康工具和行動應用程式,也是市場的關鍵驅動力。穿戴式裝置和健康追蹤平台擴大與基因資料同步,以提供個人化的健身、營養和健康建議。基因檢測與日常健康技術的結合正在改善用戶體驗,並擴大消費者的吸引力。向主動健康管理的轉變,以及消費者對即時和客製化洞察不斷變化的期望,繼續支持市場在更廣泛人群中的滲透。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 41億美元 |

| 預測值 | 130億美元 |

| 複合年成長率 | 12.4% |

2024年,血統檢測細分市場產值達15億美元。消費者越來越被血統檢測價格實惠、易於理解以及滿足個人好奇心的特質所吸引。這些檢測提供了一種追溯血統、發現全球族裔背景和探索家庭聯繫的方式。推動這一細分市場的公司正在利用大規模DNA資料庫、用戶友善平台和積極的行銷策略來擴大覆蓋範圍。他們能夠以簡單易懂的方式提供全面且引人入勝的血統洞察,這大大提升了這個細分市場的受歡迎程度。

2024年,單核苷酸多態性 (SNP) 技術佔了49.5%的市場。其可擴展性以及在海量資料集中識別數千種基因變異的高效性使其成為面向消費者應用的理想選擇。 SNP晶片廣泛用於分析遺傳特徵、健康傾向和血統。該技術處理速度快、檢測成本低且可靠性高,這對於在大批量直接面對消費者的檢測中保持經濟實惠和快速響應至關重要。這種可擴展性使SNP技術成為當今眾多領先基因檢測產品的支柱。

2024年,北美直接面對消費者的基因檢測市場佔據了48.6%的市場。該地區受益於消費者認知度、先進的數位健康基礎設施以及早期採用的心態。個人化健康工具的廣泛使用、支持性的監管框架以及公眾對健康最佳化的濃厚興趣,進一步推動了美國和加拿大DTC檢測生態系統的發展。此外,關鍵產業參與者的積極參與以及基因檢測與數位健康平台之間日益增強的協同作用,正在加速市場成長並鞏固其區域領導地位。

影響全球直接面對消費者基因檢測市場的一些主要參與者包括 DNA Genotek、Dante Lab、The SkinDNA Company、Family Tree DNA (Gene By Gene)、Easy DNA、Tempus AI、MedGenome、Helix、MyHeritage、Nutrigenomix、HomeDNA、Veritas Intercontinental、Mapmygenome、BlueGenetics、Fulnostics、Fullatics) Complete、Myriad Genetics, Inc.、Living DNA、Ancestry、Quest Diagnostics、Genesis Healthcare 和 Identigene。 DTC 基因檢測市場的公司正致力於透過多語言平台和本地合作夥伴關係擴大其全球影響力。主要參與者正在投資方便用戶使用的行動應用程式,將即時健康資料與基因洞察相結合,以增強客戶參與度。定期更新檢測小組並推出皮膚護理和健康遺傳學等利基檢測類別,正在幫助公司觸及新的人群。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 基於基因洞察的個人化解決方案需求不斷成長

- 基因組定序技術不斷進步

- 提高對遺傳疾病的認知

- 透過線上管道擴大DTC的可近性

- 產業陷阱與挑戰

- 隱私和資料安全

- 嚴格的監管挑戰

- 市場機會

- 擴大網上分銷通路

- 策略聯盟和夥伴關係

- 新興市場的滲透率不斷提高

- 成長動力

- 成長潛力分析

- 監管格局

- 美國

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 拉丁美洲

- 多邊環境協定

- 基因檢測產業的投資與融資格局

- 技術格局

- 新興技術

- 現有技術

- 資料隱私問題

- 價值鏈分析

- 報銷場景

- 定價分析

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按測試類型,2021 - 2034 年

- 主要趨勢

- 攜帶者篩檢

- 預測測試

- 血統測試

- 營養基因組學測試

- 藥物基因組學檢測

- 保養品測試

- 其他測試類型

第6章:市場估計與預測:按技術,2021 - 2034 年

- 主要趨勢

- 基於微陣列的偵測

- 單核苷酸多態性(SNP)晶片

- 全基因組定序(WGS)

- 其他技術

第7章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 線上通路

- 場外交易(OTC)

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Ancestry

- Blueprint Genetics

- Counsyl

- Dante Lab

- DNA Complete

- DNA Genotek

- Easy DNA

- Family Tree DNA (Gene By Gene)

- Fulgent Genetics

- Genesis Healthcare

- Genova Diagnostics (GDX)

- Helix

- HomeDNA

- Identigene

- Living DNA

- Mapmygenome

- MedGenome

- MyHeritage

- Myriad Genetics, Inc.

- Nutrigenomix

- Pathway genomics

- Quest Diagnostics

- Tempus AI

- The SkinDNA Company

- Veritas Intercontinental

The Global Direct-to-Consumer Genetic Testing Market was valued at USD 4.1 billion in 2024 and is estimated to grow at a CAGR of 12.4% to reach USD 13 billion by 2034.

The rapid expansion is fueled by the rising consumer demand for personalized health and wellness solutions. As more individuals, especially younger demographics, seek deeper insights into their health, ancestry, and lifestyle, the demand for at-home genetic tests is accelerating. These tests eliminate the need for a healthcare intermediary, offering accessible results via simple saliva or cheek swabs. Direct-to-Consumer Genetic Testing covers a wide range of applications, including predictive and carrier testing, pharmacogenomics, skincare, nutrition, ancestry, and trait analysis. The growing integration of these genetic insights into digital health tools and mobile apps is also a key market driver. Wearables and health tracking platforms are increasingly syncing with genetic data to deliver personalized fitness, nutrition, and wellness recommendations. This alignment of genetic testing with everyday health technology is improving user experience and widening consumer appeal. The shift toward proactive health management, along with evolving consumer expectations for real-time and tailored insights, continues to support market penetration across a broader population base.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $13 Billion |

| CAGR | 12.4% |

The ancestry testing segment generated USD 1.5 billion in 2024. Consumers are increasingly drawn to the affordability, ease of understanding, and personal curiosity that ancestry testing satisfies. These tests offer a way to trace heritage, discover global ethnic backgrounds, and explore family connections. Companies driving this segment are leveraging large-scale DNA databases, consumer-friendly platforms, and aggressive marketing strategies to expand reach. Their ability to deliver comprehensive and engaging ancestry insights in an accessible format has significantly strengthened the popularity of this segment.

In 2024, the single-nucleotide polymorphism (SNP) technology held a 49.5% share. Its scalability and efficiency in identifying thousands of genetic variants across large datasets make it ideal for consumer-facing applications. SNP chips are extensively used for analyzing genetic traits, health predispositions, and ancestry. The technology offers fast processing, reduced testing costs, and high reliability, which are critical for maintaining affordability and speed in high-volume direct-to-consumer testing. This scalability has positioned SNP technology as the backbone of many leading genetic testing products available today.

North America Direct-to-Consumer Genetic Testing Market held a 48.6% share in 2024. The region benefits from a strong mix of consumer awareness, advanced digital health infrastructure, and an early adoption mindset. High engagement with personalized health tools, supportive regulatory frameworks, and strong public interest in health optimization are further boosting the DTC testing ecosystem in the U.S. and Canada. In addition, the active presence of key industry players and increasing alignment between genetic testing and digital wellness platforms are accelerating market growth and strengthening regional leadership.

Some of the major players shaping the Global Direct-to-Consumer Genetic Testing Market include DNA Genotek, Dante Lab, The SkinDNA Company, Family Tree DNA (Gene By Gene), Easy DNA, Tempus AI, MedGenome, Helix, MyHeritage, Nutrigenomix, HomeDNA, Veritas Intercontinental, Mapmygenome, Blueprint Genetics, Fulgent Genetics, Pathway Genomics, Genova Diagnostics (GDX), DNA Complete, Myriad Genetics, Inc., Living DNA, Ancestry, Quest Diagnostics, Genesis Healthcare, and Identigene. Companies in the DTC genetic testing market are focusing on expanding their global presence through multilingual platforms and local partnerships. Key players are investing in user-friendly mobile apps that integrate real-time health data with genetic insights to enhance customer engagement. Regular updates to testing panels and the introduction of niche test categories, such as skincare and wellness genetics, are helping companies reach new demographics.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Test type trends

- 2.2.3 Technology trends

- 2.2.4 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for personalized solutions based on genetic insights

- 3.2.1.2 Growing technology advancement in genomic sequencing

- 3.2.1.3 Increased awareness of genetic disorders

- 3.2.1.4 Expanding accessibility of DTC through online channels

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Privacy and data security

- 3.2.2.2 Stringent regulatory challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of online distribution channels

- 3.2.3.2 Strategic alliances and partnerships

- 3.2.3.3 Increasing penetration in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.4.2.1 Germany

- 3.4.2.2 UK

- 3.4.2.3 France

- 3.4.2.4 Spain

- 3.4.2.5 Italy

- 3.4.3 Asia Pacific

- 3.4.3.1 China

- 3.4.3.2 Japan

- 3.4.3.3 India

- 3.4.3.4 Australia

- 3.4.4 Latin America

- 3.4.5 MEA

- 3.5 Investment and funding landscape in the genetic testing industry

- 3.6 Technological landscape

- 3.6.1 Emerging technologies

- 3.6.2 Current technologies

- 3.7 Data privacy concerns

- 3.8 Value chain analysis

- 3.9 Reimbursement scenario

- 3.10 Pricing analysis

- 3.11 Future market trends

- 3.12 Porter’s analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Test Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Carrier screening

- 5.3 Predictive testing

- 5.4 Ancestry testing

- 5.5 Nutrigenomic testing

- 5.6 Pharmacogenomic testing

- 5.7 Skincare testing

- 5.8 Other test types

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Microarray-based testing

- 6.3 Single-nucleotide polymorphism (SNP) chips

- 6.4 Whole genome sequencing (WGS)

- 6.5 Other technologies

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Online channels

- 7.3 Over-the-counter (OTC)

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Ancestry

- 9.2 Blueprint Genetics

- 9.3 Counsyl

- 9.4 Dante Lab

- 9.5 DNA Complete

- 9.6 DNA Genotek

- 9.7 Easy DNA

- 9.8 Family Tree DNA (Gene By Gene)

- 9.9 Fulgent Genetics

- 9.10 Genesis Healthcare

- 9.11 Genova Diagnostics (GDX)

- 9.12 Helix

- 9.13 HomeDNA

- 9.14 Identigene

- 9.15 Living DNA

- 9.16 Mapmygenome

- 9.17 MedGenome

- 9.18 MyHeritage

- 9.19 Myriad Genetics, Inc.

- 9.20 Nutrigenomix

- 9.21 Pathway genomics

- 9.22 Quest Diagnostics

- 9.23 Tempus AI

- 9.24 The SkinDNA Company

- 9.25 Veritas Intercontinental