|

市場調查報告書

商品編碼

1844384

雷射加工設備市場機會、成長動力、產業趨勢分析及2025-2034年預測Laser Processing Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

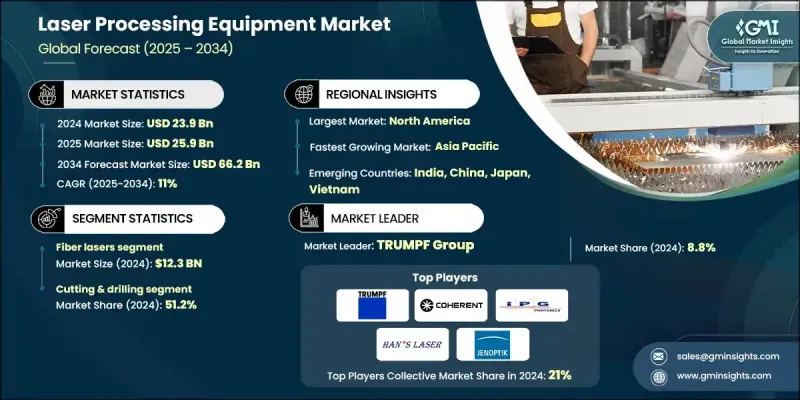

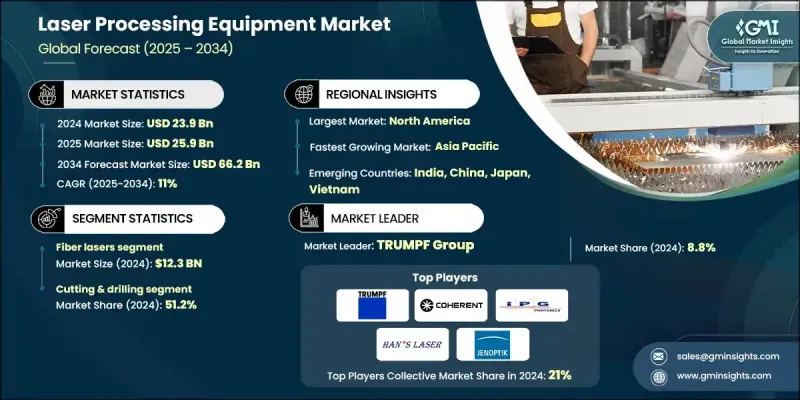

2024 年全球雷射加工設備市場價值為 239 億美元,預計到 2034 年將以 11% 的複合年成長率成長至 662 億美元。

工業4.0創新(包括人工智慧、物聯網和全面自動化)的快速融合正在重塑工業製造,並加速先進雷射加工解決方案的普及。光纖雷射器憑藉其高能源效率、低營運成本以及在嚴苛環境下的高可靠性,持續獲得發展動能。隨著各行各業尋求更快的原型設計和更大的設計靈活性,基於雷射的積層製造技術的應用日益廣泛,進一步推動了市場成長。超快和高功率雷射在航太和醫療等關鍵領域也變得至關重要,因為這些領域對精度和客製化至關重要。人們對精度的期望不斷提高,以及對永續製造實踐的需求不斷成長,正在推動持續的研發。該行業的擴張得益於可擴展的應用,例如微加工、雕刻、鑽孔和結構切割,所有這些應用都受益於精確的非接觸式加工。這些不斷發展的應用案例,加上良好的性價比和不斷擴大的工業基礎,將在未來幾年繼續塑造全球市場動態。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 239億美元 |

| 預測值 | 662億美元 |

| 複合年成長率 | 11% |

光纖雷射類別在2024年創造了123億美元的市場規模,這得益於其卓越的能量轉換效率和低維護要求。其穩定的光束品質可實現精細加工,這對於多種先進製造環境中的高公差操作至關重要。降低能耗意味著降低營運成本,這使得光纖雷射成為注重成本的行業的首選。其極低的材料浪費和精準的性能與全球製造業正在推行的更嚴格的生產和永續標準相契合。光纖雷射可靠性和使用壽命的持續改進進一步提高了其應用率。

2024年,切割和鑽孔細分市場佔據了51.2%的市場佔有率,這得益於對複雜成型和精確材料去除的需求。雷射加工因其能夠最大限度地減少材料浪費、支持精益生產模式以及提高成本效益而廣受認可。它在處理金屬、塑膠、陶瓷和複合材料方面的適應性使其成為多個垂直行業的關鍵工具。從汽車裝配線到醫療器械製造,雷射切割和鑽孔憑藉其精確執行複雜操作的能力,已成為現代工業工作流程中的標準工藝。

美國雷射加工設備市場佔65%的市場佔有率,2024年市場規模達35億美元。該國以創新為中心的生態系統,結合其先進的製造業基礎設施,持續支持產品開發和廣泛應用。航太、電子、汽車和醫療保健等產業的多元化發展,正在推動對下一代雷射技術的持續投資。強大的國內研發計畫和全球製造業領導企業的存在,進一步鞏固了美國在該地區的主導地位。

影響全球雷射加工設備市場的知名公司包括 IPG Photonics、TRUMPF、Hans Group、Control Micro Systems、Vermont、Newport、Coherent、Rofin-Sinar Technologies、Lumibird、Universal Laser Systems、Eurolaser、Laser Systems、Concept Laser、Jenoptik 和 Hgtech。雷射加工設備市場的公司正透過專注於創新、效率和特定行業的解決方案來加強其全球影響力。許多公司都在研發方面投入巨資,以開發專為精密工業設計的緊湊型高功率雷射系統。客製化和模組化設備設計正在幫助製造商滿足醫療、航太和電子領域的利基應用。與 OEM 和工業自動化供應商的策略合作正在擴大其技術的覆蓋範圍。企業也在擴大生產能力,同時強調環保營運,以滿足日益成長的永續製造需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 雷射技術的進步

- 對高品質和精密製造的需求不斷成長

- 積層製造(3D列印)的採用率不斷上升

- 產業陷阱與挑戰

- 初期投資高

- 營運成本增加

- 機會

- (電動車)和電池製造

- 半導體和微電子製造

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依技術類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 貿易統計(HS 編碼 - 84561000)

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依技術類型,2021-2034

- 主要趨勢

- 光纖雷射

- 二氧化碳

- 固態

- 其他

第6章:市場估計與預測:依製程類型,2021-2034

- 主要趨勢

- 切割和鑽孔

- 焊接

- 標記和雕刻

- 沖壓和微加工

- 其他

第7章:市場估計與預測:依材料類型,2021-2034

- 主要趨勢

- 鋼

- 鋁

- 銅

- 塑膠和聚合物

- 陶瓷

- 其他(玻璃、複合材料、半導體等)

第8章:市場估計與預測:依功能類型,2021-2034

- 主要趨勢

- 半自動

- 自動的

第9章:市場估計與預測:依整合度,2021-2034

- 主要趨勢

- 獨立系統

- 整合生產線

- 模組化系統

- 攜帶式/桌上型設備

第 10 章:市場估計與預測:按雷射源類型,2021-2034 年

- 主要趨勢

- 二極體雷射

- 盤片雷射

- 準分子雷射

- 其他(超快雷射、铥)

第 11 章:市場估計與預測:按冷卻機制,2021-2034 年

- 主要趨勢

- 風冷

- 水冷

- 混合冷卻

第 12 章:市場估計與預測:按最終用途,2021-2034 年

- 主要趨勢

- 汽車

- 金屬及製造

- 電子產品

- 能源與電力

- 其他

第 13 章:市場估計與預測:按地區,2021-2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 14 章:公司簡介

- Coherent

- Concept Laser

- Control Micro Systems

- Eurolaser

- Hans Group

- Hgtech

- IPG Photonics

- Jenoptik

- Laser Systems

- Lumibird

- Newport

- Rofin-Sinar Technologies

- TRUMPF

- Universal Laser Systems

- Vermont

The Global Laser Processing Equipment Market was valued at USD 23.9 billion in 2024 and is estimated to grow at a CAGR of 11% to reach USD 66.2 billion by 2034.

The rapid integration of Industry 4.0 innovations, including AI, IoT, and full-scale automation, is reshaping industrial manufacturing and accelerating the adoption of advanced laser processing solutions. Fiber lasers continue gaining momentum due to their energy efficiency, reduced operating costs, and high reliability in demanding environments. Increasing use of laser-based additive manufacturing techniques has further propelled market growth as industries seek faster prototyping and greater design flexibility. Ultrafast and high-power lasers are also becoming essential across critical sectors like aerospace and medical, where accuracy and customization are vital. Rising expectations for precision, along with growing demand for sustainable manufacturing practices, are fostering continuous R&D. The industry's expansion is supported by scalable applications, such as micromachining, engraving, drilling, and structural cutting, all benefiting from precise, non-contact processing. These evolving use cases, coupled with favorable cost-to-performance ratios and an expanding industrial base, will continue to shape global market dynamics in the years to come.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23.9 Billion |

| Forecast Value | $66.2 Billion |

| CAGR | 11% |

The fiber lasers category segment generated USD 12.3 billion in 2024, driven by their superior energy conversion efficiency and low maintenance requirements. Their consistent beam quality allows for detailed processing, which has become essential for high-tolerance operations across several advanced manufacturing environments. Reduced energy consumption translates into lower operational costs, making fiber lasers a preferred choice among cost-conscious industries. Their minimal material waste output and precision-focused performance align well with stricter production and sustainability standards being introduced across global manufacturing landscapes. Continuous improvements in fiber laser reliability and lifespan further enhance their adoption rate.

The cutting and drilling segment held a 51.2% share in 2024, driven by the need for intricate shaping and precise material removal. Laser processing is recognized for minimizing material wastage, supporting lean manufacturing models, and improving cost-efficiency. Its adaptability in handling metals, plastics, ceramics, and composite materials makes it a key tool across multiple verticals. From automotive assembly lines to medical device fabrication, the ability to perform complex operations with accuracy has cemented laser cutting and drilling as standard processes in modern industrial workflows.

U.S. Laser Processing Equipment Market held 65% and generated USD 3.5 billion in 2024. The country's innovation-focused ecosystem, combined with its advanced manufacturing infrastructure, continues to support product development and widespread adoption. The diversity of industries such as aerospace, electronics, automotive, and healthcare is driving consistent investment in next-generation laser technologies. Strong domestic R&D initiatives and the presence of global manufacturing leaders further reinforce the country's dominant position within the region.

Prominent companies shaping the Global Laser Processing Equipment Market include IPG Photonics, TRUMPF, Hans Group, Control Micro Systems, Vermont, Newport, Coherent, Rofin-Sinar Technologies, Lumibird, Universal Laser Systems, Eurolaser, Laser Systems, Concept Laser, Jenoptik, and Hgtech. Companies in the laser processing equipment market are strengthening their global footprint by focusing on innovation, efficiency, and sector-specific solutions. Many are investing heavily in R&D to develop compact, high-power laser systems tailored for precision industries. Customization and modular equipment designs are helping manufacturers cater to niche applications across the medical, aerospace, and electronics sectors. Strategic collaborations with OEMs and industrial automation providers are expanding the reach of their technologies. Firms are also scaling up production capabilities while emphasizing eco-friendly operations to meet the rising demand for sustainable manufacturing.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology type

- 2.2.3 Process level

- 2.2.4 Material type

- 2.2.5 Function type

- 2.2.6 Integration type

- 2.2.7 Laser source type

- 2.2.8 Cooling mechanism type

- 2.2.9 End use industry

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Advancements in laser technology

- 3.2.1.2 Growing demand for high-quality and precision manufacturing

- 3.2.1.3 Rising adoption of additive manufacturing (3D printing)

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investments

- 3.2.2.2 Increased operating costs

- 3.2.3 Opportunities

- 3.2.3.1 (EVs) and Battery Manufacturing

- 3.2.3.2 Semiconductor and Microelectronics Fabrication

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By technology type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code- 84561000)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Technology Type, 2021-2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Fiber lasers

- 5.3 CO2

- 5.4 Solid state

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Process Type, 2021-2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Cutting & drilling

- 6.3 Welding

- 6.4 Marking & engraving

- 6.5 Punching & micromachining

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Material Type, 2021-2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Steel

- 7.3 Aluminium

- 7.4 Copper

- 7.5 Plastics and polymers

- 7.6 Ceramics

- 7.7 Others (Glass, composites, semiconductors etc.)

Chapter 8 Market Estimates & Forecast, By Function Type, 2021-2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Semi-automatic

- 8.3 Automatic

Chapter 9 Market Estimates & Forecast, By Integration Level, 2021-2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Standalone systems

- 9.3 Integrated production lines

- 9.4 Modular systems

- 9.5 Portable/desktop units

Chapter 10 Market Estimates & Forecast, By Laser Source Type, 2021-2034, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Diode lasers

- 10.3 Disk lasers

- 10.4 Excimer lasers

- 10.5 Others (Ultrafast lasers, thulium)

Chapter 11 Market Estimates & Forecast, By Cooling Mechanism, 2021-2034, (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Air-cooled

- 11.3 Water-cooled

- 11.4 Hybrid cooling

Chapter 12 Market Estimates & Forecast, By End Use, 2021-2034, (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 Automotive

- 12.3 Metal & fabrication

- 12.4 Electronics

- 12.5 Energy & power

- 12.6 Others

Chapter 13 Market Estimates & Forecast, By Region, 2021-2034, (USD Billion) (Thousand Units)

- 13.1 Key trends

- 13.2 North America

- 13.2.1 U.S.

- 13.2.2 Canada

- 13.3 Europe

- 13.3.1 Germany

- 13.3.2 UK

- 13.3.3 France

- 13.3.4 Spain

- 13.3.5 Italy

- 13.4 Asia Pacific

- 13.4.1 China

- 13.4.2 Japan

- 13.4.3 India

- 13.4.4 Australia

- 13.4.5 South Korea

- 13.5 Latin America

- 13.5.1 Brazil

- 13.5.2 Mexico

- 13.5.3 Argentina

- 13.6 Middle East and Africa

- 13.6.1 South Africa

- 13.6.2 Saudi Arabia

- 13.6.3 UAE

Chapter 14 Company Profiles

- 14.1 Coherent

- 14.2 Concept Laser

- 14.3 Control Micro Systems

- 14.4 Eurolaser

- 14.5 Hans Group

- 14.6 Hgtech

- 14.7 IPG Photonics

- 14.8 Jenoptik

- 14.9 Laser Systems

- 14.10 Lumibird

- 14.11 Newport

- 14.12 Rofin-Sinar Technologies

- 14.13 TRUMPF

- 14.14 Universal Laser Systems

- 14.15 Vermont