|

市場調查報告書

商品編碼

1844376

埋弧爐市場機會、成長動力、產業趨勢分析及2025-2034年預測Submerged Arc Furnace Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

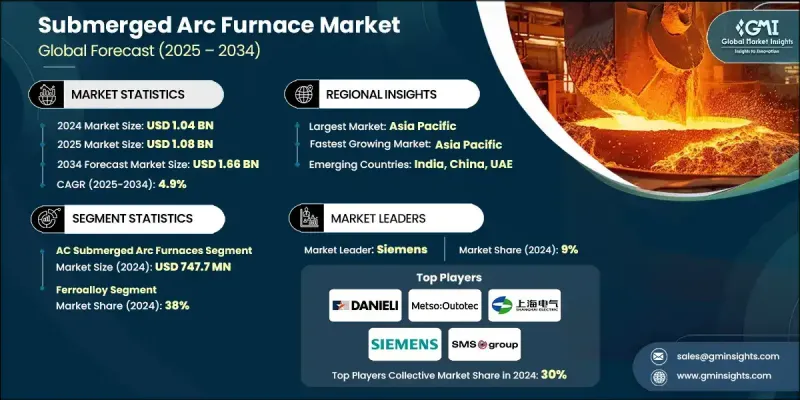

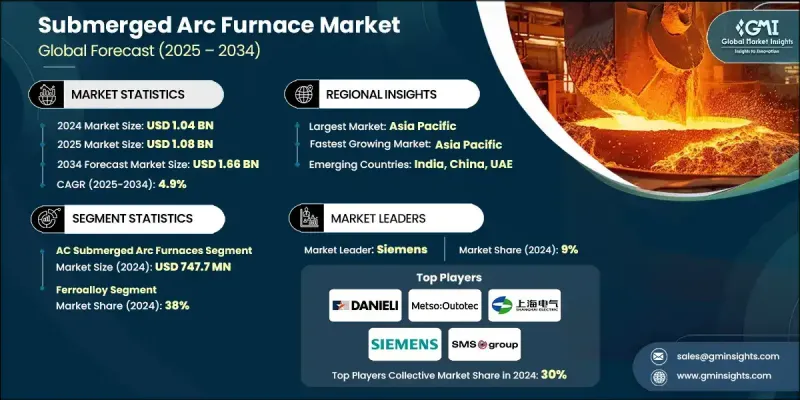

2024 年全球埋弧爐市場價值為 10.4 億美元,預計到 2034 年將以 4.9% 的複合年成長率成長至 16.6 億美元。

礦熱爐需求的激增與全球鋼鐵、鐵合金和金屬矽產量的成長密切相關。隨著新興市場工業化和城市化進程的加快,對高等級鋼材的需求持續成長。礦熱爐在鋼鐵製造業中發揮核心作用,尤其是在生產煉鋼過程中作為關鍵投入的鐵合金方面。日益成長的基礎設施建設、汽車製造業和建築業的擴張進一步加劇了這一需求。此外,再生能源的推動也刺激了太陽能板和電子產品對金屬矽的需求成長。由於金屬矽的生產屬於能源密集型產業,現代礦熱爐(SAF)設計在提高效率和生產力方面發揮著至關重要的作用。多個產業應用的不斷增加,加上爐型技術的創新,正在推動市場的成長軌跡。由於鋼鐵和矽仍然是全球經濟的基礎材料,礦熱爐的應用持續擴大,使其成為全球製造業營運的關鍵技術投資。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 10.4億美元 |

| 預測值 | 16.6億美元 |

| 複合年成長率 | 4.9% |

交流埋弧爐細分市場在2024年創造了7.477億美元的產值,預計到2034年將以5.1%的複合年成長率成長。這類爐子憑藉其成本效益、成熟的技術基礎以及在工業環境中的易用性,保持著領先地位。 AC-SAF系統因其運作可靠性和與高溫製程的兼容性,常用於金屬矽和鐵合金的生產。它們能夠提供一致的結果,同時保持資本成本的可控性,使其在大規模工業應用中極具吸引力。

鐵合金應用領域在2024年佔據38%的佔有率,預計2025年至2034年的複合年成長率為5%。在礦熱爐的所有用途中,鐵合金製造仍然是需求的主要驅動力。這些特殊合金,例如矽鐵、鉻鐵和錳鐵,在鋼鐵生產中至關重要,需要持續的高溫環境,而只有礦熱爐(SAF)才能可靠地提供這種環境。對優質鋼鐵產量和冶金精度的需求持續推動全球市場對此類應用的需求。

2024年,美國礦熱爐市場佔76%的市場佔有率,產值達2.088億美元。美國強大的鋼鐵和金屬生產基礎,以及不斷成長的設施升級和技術改進投資,共同支撐了其在市場中的領先地位。礦熱爐廣泛應用於生產基礎設施、交通運輸和製造業等核心產業所需的關鍵金屬。旨在提高產量和能源效率的持續現代化改造,進一步促進了礦熱爐的普及。

影響全球礦熱爐市場的關鍵參與者包括上海電氣、奧圖泰、Tenova、西安邦德斯電氣技術有限公司、西馬克集團、Thermtronix、保爾沃特、蒂森克虜伯工業、Electrotherm、西門子、哈奇、美卓奧圖泰、普銳特冶金技術、達涅利和多西科技。這些公司持續引領全球主要工業爐應用領域的創新和技術整合。為了維持並擴大其市場佔有率,礦熱爐領域的公司正優先進行研發,以提高能源效率、爐子自動化和數位監控。技術升級的重點是最大限度地減少停機時間並延長設備使用壽命,同時最佳化高溫性能。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 鋼鐵、鐵合金和金屬矽的需求不斷成長

- 環境永續與監管

- 產業陷阱與挑戰

- 資本和營運成本高

- 能源依賴和供應風險

- 機會

- 技術進步與數位融合

- 高純度金屬需求不斷成長

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 貿易統計

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034

- 主要趨勢

- 直流埋弧爐

- 交流埋弧爐

第6章:市場估計與預測:按應用,2021 - 2034

- 主要趨勢

- 鐵合金

- 金屬矽

- 熔融剛玉

- 碳化鈣

- 黃磷

第7章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第8章:公司簡介

- Danieli

- Doshi Technologies

- Electrotherm

- Hatch

- Metso Outotec

- Outotec Oyj

- Paul Wurth

- Primetals Technologies

- Shanghai Electric

- Siemens

- SMS Group

- Tenova

- Thermtronix

- Thyssenkrupp Industrial

- Xi'an Abundance Electric Technology

The Global Submerged Arc Furnace Market was valued at USD 1.04 billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 1.66 billion by 2034.

The surge in demand for submerged arc furnaces is closely tied to the global rise in steel, ferroalloy, and silicon metal production. As industrialization and urban development accelerate across emerging markets, the need for high-grade steel products continues to intensify. Submerged arc furnaces play a central role in steel manufacturing, especially in producing ferroalloys that serve as critical inputs during steelmaking processes. Growing infrastructure activity, automotive manufacturing, and the expansion of the construction sector further amplify this need. Additionally, the push for renewable energy has sparked greater demand for silicon metal used in solar panels and electronics. As silicon metal production is energy-intensive, modern SAF designs are proving vital in improving efficiency and productivity. Increasing applications across multiple sectors, coupled with innovation in furnace technologies, are fueling the market's upward trajectory. With steel and silicon remaining foundational materials in the global economy, submerged arc furnace adoption continues to expand, making it a key technology investment for manufacturing operations worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.04 Billion |

| Forecast Value | $1.66 Billion |

| CAGR | 4.9% |

The AC submerged arc furnaces segment generated USD 747.7 million in 2024 and is forecast to grow at a CAGR of 5.1% through 2034. These furnaces maintain the top spot due to their cost efficiency, mature technology base, and ease of use in industrial settings. AC-SAF systems are commonly chosen in silicon metal and ferroalloy production due to their operational reliability and compatibility with high-temperature processes. They provide consistent results while keeping capital costs manageable, making them highly attractive for large-scale industrial use.

The ferroalloy applications segment held a 38% share in 2024 and is projected to grow at a CAGR of 5% from 2025 to 2034. Among all uses of submerged arc furnaces, ferroalloy manufacturing remains the dominant driver of demand. These specialized alloys, such as ferrosilicon, ferrochrome, and ferromanganese, are essential in steel production, requiring consistent high-heat environments that only SAFs can reliably provide. The need for quality steel outputs and metallurgical precision continues to push the demand for this application across global markets.

U.S. Submerged Arc Furnace Market held a 76% share in 2024, generating USD 208.8 million. The country's leadership position is backed by its robust steel and metal production base, supported by growing investments in facility upgrades and technological improvements. SAFs are widely deployed in producing critical metals used in core industries like infrastructure, transportation, and manufacturing. Ongoing modernization efforts aimed at boosting output and energy efficiency further contribute to increased SAF adoption.

Key players shaping the Global Submerged Arc Furnace Market include Shanghai Electric, Outotec Oyj, Tenova, Xi'an Abundance Electric Technology, SMS Group, Thermtronix, Paul Wurth, Thyssenkrupp Industrial, Electrotherm, Siemens, Hatch, Metso Outotec, Primetals Technologies, Danieli, and Doshi Technologies. These companies continue to lead innovation and technological integration across major industrial furnace applications worldwide. To maintain and expand their footprint, companies in the submerged arc furnace space are prioritizing R&D to enhance energy efficiency, furnace automation, and digital monitoring. Technological upgrades are focused on minimizing downtime and extending equipment lifespan, while also optimizing high-temperature performance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for steel, ferroalloys, and silicon metal

- 3.2.1.2 Environmental sustainability & regulation

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High capital and operating costs

- 3.2.2.2 Energy dependency and supply risks

- 3.2.3 Opportunities

- 3.2.3.1 Technological advancements & digital integration

- 3.2.3.2 Rising demand for high-purity metals

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade Statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Billion, Thousand Units)

- 5.1 Key trends

- 5.2 DC submerged arc furnaces

- 5.3 AC submerged arc furnaces

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Billion, Thousand Units)

- 6.1 Key trends

- 6.2 Ferroalloy

- 6.3 Silicon Metal

- 6.4 Fused Alumina

- 6.5 Calcium Carbide

- 6.6 Yellow Phosphorus

Chapter 7 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Thousand Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Danieli

- 8.2 Doshi Technologies

- 8.3 Electrotherm

- 8.4 Hatch

- 8.5 Metso Outotec

- 8.6 Outotec Oyj

- 8.7 Paul Wurth

- 8.8 Primetals Technologies

- 8.9 Shanghai Electric

- 8.10 Siemens

- 8.11 SMS Group

- 8.12 Tenova

- 8.13 Thermtronix

- 8.14 Thyssenkrupp Industrial

- 8.15 Xi’an Abundance Electric Technology