|

市場調查報告書

商品編碼

1844371

智慧烤箱市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Smart Ovens Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

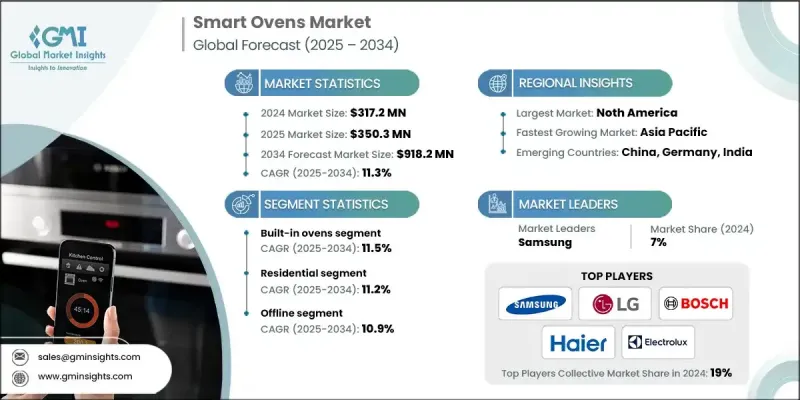

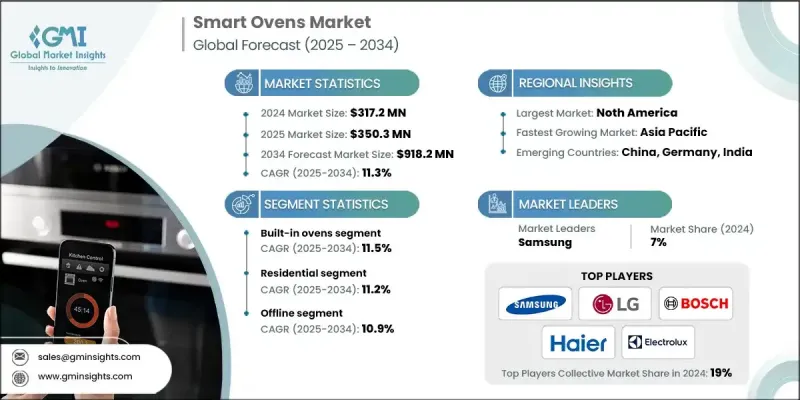

2024 年全球智慧烤箱市場價值為 3.172 億美元,預計將以 11.3% 的複合年成長率成長,到 2034 年達到 9.182 億美元。

智慧家庭技術的日益融合以及人們對自動化、省時的廚房解決方案日益成長的需求,推動了智慧烤箱的快速成長。消費者越來越青睞能夠連接Wi-Fi、與語音助理同步並提供遠端存取的電器——而這些正是當今智慧烤箱的關鍵功能。對能源效率和永續性的追求也促使消費者選擇能夠最佳化用電並最大程度減少食物浪費的烤箱。這些電器提供精準的控制和智慧功能,吸引了注重能源使用和便利性的消費者。這種需求也與不斷變化的消費習慣密切相關,尤其是在城市中心,快節奏的生活方式要求人們有效率地準備食物。人們開始青睞支持氣炸鍋、燒烤和蒸煮等健康烹飪技巧的多功能烤箱。線上零售平台的激增進一步擴大了產品的曝光度,使消費者能夠研究規格、比較價格並做出明智的決定。電子商務在推動已開發市場和新興市場的認知度和普及度方面發揮著重要作用,支持智慧烤箱產業的持續成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3.172億美元 |

| 預測值 | 9.182億美元 |

| 複合年成長率 | 11.3% |

2024年,嵌入式烤箱類別的市場規模達到2.079億美元,預計到2034年將以11.5%的複合年成長率成長。該細分市場受益於對無縫整合廚房設計日益成長的需求。嵌入式烤箱因其美觀和節省空間的特性而日益受到歡迎,尤其是在現代都市家庭中。它們通常配備智慧連接、節能功能和直覺的操控,這與當前消費者的期望相符。市場領導者正大力提升使用者介面、自動化程度和設計靈活性,使這些烤箱在現代廚房中更具吸引力。材料、觸控螢幕和模組化配置方面的創新正在幫助製造商滿足住宅買家不斷變化的需求。

2024年,家用電器市場佔據了85%的市場佔有率,預計2025年至2034年的複合年成長率將達到11.2%。這一主導地位的驅動力在於家庭對智慧多功能廚房電器的需求不斷成長。隨著可支配收入的增加和智慧生活的興起,消費者越來越重視便利性和性能。語音控制、智慧型手機連接和能源最佳化等功能對精通科技的屋主尤其有吸引力。此外,人們對家庭烹飪和烘焙的興趣日益濃厚,為兼具多功能性和易用性的烤箱創造了強勁的市場。隨著人們居家時間的增加以及希望在家庭環境中複製專業烹飪體驗的願望,這一趨勢更加明顯。

2024年,美國智慧烤箱市場規模達8,350萬美元,佔77%的市佔率。美國在智慧家庭普及方面的領先地位,加上對節能和互聯家電的需求不斷成長,在智慧烤箱銷售成長中發揮了關鍵作用。美國各地對智慧基礎設施和家庭自動化的投資不斷增加,進一步推動了消費者對高性能烹飪電器的需求。消費者擴大將智慧烤箱融入新房和廚房裝修中,使其成為許多智慧家庭生態系統的標準配備。

全球智慧烤箱市場的主要參與者包括惠而浦、通用電器、三星、夏普、UNOX、LG 電子、KitchenAid、June Oven、伊萊克斯、Breville、Alto-Shaam、BSH 家電、Nuwave、海爾和 Fagor Professional。為了鞏固其在全球智慧烤箱市場的地位,領先公司正專注於持續創新和增強連接功能。許多品牌正在推出具有應用程式整合、即時食譜指導和人工智慧驅動的烹飪自動化功能的先進型號,以提升用戶體驗。對節能技術和語音助理相容性的策略性投資也幫助品牌脫穎而出。與智慧家庭生態系統供應商和電子商務平台的合作正在擴大他們的數位足跡。此外,製造商透過產品差異化、直覺的介面和為現代城市生活量身定做的模組化廚房解決方案,瞄準高階和中端市場。

目錄

第1章:方法論與範圍

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監理框架

- 標準和認證

- 環境法規

- 進出口法規

- 貿易統計

- 主要進口國

- 主要出口國

- 波特五力分析

- PESTEL分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 嵌入式烤箱

- 檯面烤箱

- 獨立式烤箱

第6章:市場估計與預測:依配置類型,2021 - 2034 年

- 主要趨勢

- 單爐

- 雙爐

第7章:市場估計與預測:按烹飪技術,2021 - 2034 年

- 主要趨勢

- 對流

- 傳統的

- 蒸氣噴射

- 其他(Advantium等)

第8章:市場估計與預測:依價格區間,2021 - 2034 年

- 主要趨勢

- 低於1000美元

- 1000-2000美元

- 2000美元以上

第9章:市場估計與預測:依最終用途,2021 - 2034

- 主要趨勢

- 住宅

- 商業的

- HoReCa

- 辦公室

- 飯店業

- 衛生保健

- 其他(度假村和遊輪等)

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 線上

- 電子商務

- 公司網站

- 離線

- 超市/大賣場

- 專業零售店

- 其他(獨立零售商等)

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 12 章:公司簡介

- Alto-Shaam

- Breville

- BSH Home Appliances

- Electrolux

- Fagor Professional

- GE Appliances

- Haier

- June Oven

- KitchenAid

- LG Electronics

- Nuwave

- Samsung

- Sharp

- UNOX

- Whirlpool

The Global Smart Ovens Market was valued at USD 317.2 million in 2024 and is estimated to grow at a CAGR of 11.3% to reach USD 918.2 million by 2034.

The rapid growth is fueled by the rising integration of smart home technology and the growing desire for automated, time-saving kitchen solutions. Consumers are increasingly seeking appliances that can connect to Wi-Fi, sync with voice assistants, and provide remote access-all key features of today's smart ovens. The push toward energy efficiency and sustainability is also motivating buyers to opt for ovens that optimize power usage and minimize food waste. These appliances offer precise control and intelligent features that appeal to consumers who are conscious of energy use and convenience. The demand is also closely linked to evolving consumer habits, especially in urban centers where fast-paced lifestyles demand efficient meal preparation. People are turning to multifunctional ovens that support healthy cooking techniques like air frying, grilling, and steaming. The surge in online retail platforms has further expanded product visibility, enabling customers to research specifications, compare prices, and make informed decisions. E-commerce is playing a significant role in driving awareness and adoption across both developed and emerging markets, supporting the continued growth of the smart ovens industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $317.2 Million |

| Forecast Value | $918.2 Million |

| CAGR | 11.3% |

The built-in oven category segment generated USD 207.9 million in 2024 and is projected to grow at a CAGR of 11.5% throughout 2034. This segment benefits from the rising demand for seamless, integrated kitchen designs. Built-in ovens are gaining popularity for their aesthetic appeal and space-saving attributes, especially in modern urban homes. They are often equipped with smart connectivity, energy-saving features, and intuitive controls, which align well with current consumer expectations. Market leaders are focusing heavily on enhancing user interface, automation, and design flexibility, making these ovens even more attractive for contemporary kitchens. Innovations in materials, touchscreens, and modular configurations are helping manufacturers keep up with the evolving needs of residential buyers.

The residential segment held an 85% share in 2024 and is anticipated to grow at a CAGR of 11.2% from 2025 to 2034. This dominance is driven by rising household demand for intelligent, multifunctional kitchen appliances. As disposable incomes rise and smart living gains traction, consumers are prioritizing convenience and performance. Features such as voice control, smartphone connectivity, and energy optimization are particularly appealing to tech-savvy homeowners. In addition, the growing interest in home cooking and baking has created a strong market for ovens that offer both versatility and ease of use. The trend is amplified by the increased time spent at home and the desire to replicate professional cooking experiences in domestic settings.

United States Smart Ovens Market generated USD 83.5 million and held a 77% share in 2024. The country's leadership in smart home adoption, coupled with rising demand for energy-efficient and connected appliances, has played a key role in boosting smart oven sales. Increased investment in smart infrastructure and home automation across the U.S. is further driving consumer demand for high-performance cooking appliances. Consumers are increasingly incorporating smart ovens into new homes and kitchen renovations, making them a standard feature in many smart home ecosystems.

Key players in the Global Smart Ovens Market include Whirlpool, GE Appliances, Samsung, Sharp, UNOX, LG Electronics, KitchenAid, June Oven, Electrolux, Breville, Alto-Shaam, BSH Home Appliances, Nuwave, Haier, and Fagor Professional. To strengthen their position in the global smart ovens market, leading companies are focusing on continuous innovation and enhanced connectivity features. Many brands are introducing advanced models with app integration, real-time recipe guidance, and AI-driven cooking automation to elevate the user experience. Strategic investments in energy-efficient technologies and voice assistant compatibility are also helping brands stand out. Partnerships with smart home ecosystem providers and e-commerce platforms are expanding their digital footprint. Additionally, manufacturers are targeting premium and mid-range segments through product differentiation, intuitive interfaces, and modular kitchen solutions tailored for modern urban living.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Configuration type

- 2.2.4 Cooking technology

- 2.2.5 Price range

- 2.2.6 End use

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Million, Thousand Units)

- 5.1 Key trends

- 5.2 Built-in ovens

- 5.3 Countertop ovens

- 5.4 Freestanding ovens

Chapter 6 Market Estimates & Forecast, By Configuration Type, 2021 - 2034 ($Million, Thousand Units)

- 6.1 Key trends

- 6.2 Single ovens

- 6.3 Double ovens

Chapter 7 Market Estimates & Forecast, By Cooking Technology, 2021 - 2034 ($Million, Thousand Units)

- 7.1 Key trends

- 7.2 Convection

- 7.3 Traditional

- 7.4 Steam injection

- 7.5 Others (advantium etc.)

Chapter 8 Market Estimates & Forecast, By Price Range, 2021 - 2034 ($Million, Thousand Units)

- 8.1 Key trends

- 8.2 Below $1000

- 8.3 $1000-$2000

- 8.4 Above $2000

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Million, Thousand Units)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

- 9.3.1 HoReCa

- 9.3.2 Offices

- 9.3.3 Hospitality

- 9.3.4 Healthcare

- 9.3.5 Others (resort & cruise etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Million, Thousand Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce

- 10.2.2 Company websites

- 10.3 Offline

- 10.3.1 Supermarkets/hypermarket

- 10.3.2 Specialty retail stores

- 10.3.3 Others (independent retailer etc.)

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Million, Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Alto-Shaam

- 12.2 Breville

- 12.3 BSH Home Appliances

- 12.4 Electrolux

- 12.5 Fagor Professional

- 12.6 GE Appliances

- 12.7 Haier

- 12.8 June Oven

- 12.9 KitchenAid

- 12.10 LG Electronics

- 12.11 Nuwave

- 12.12 Samsung

- 12.13 Sharp

- 12.14 UNOX

- 12.15 Whirlpool