|

市場調查報告書

商品編碼

1844368

電子道路收費(ETC) 市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Electronic Toll Collection (ETC) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

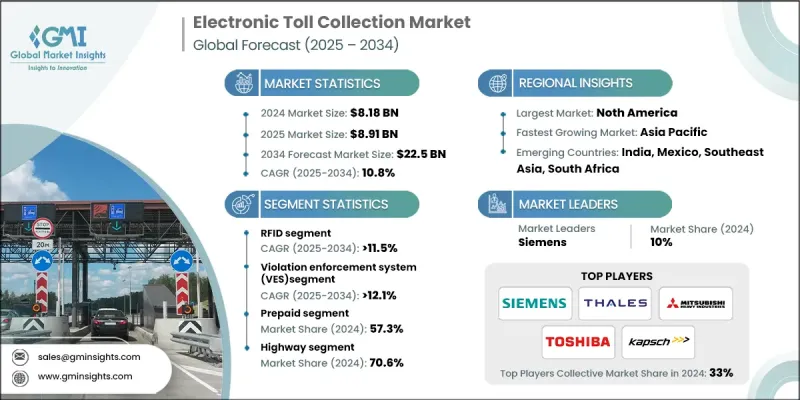

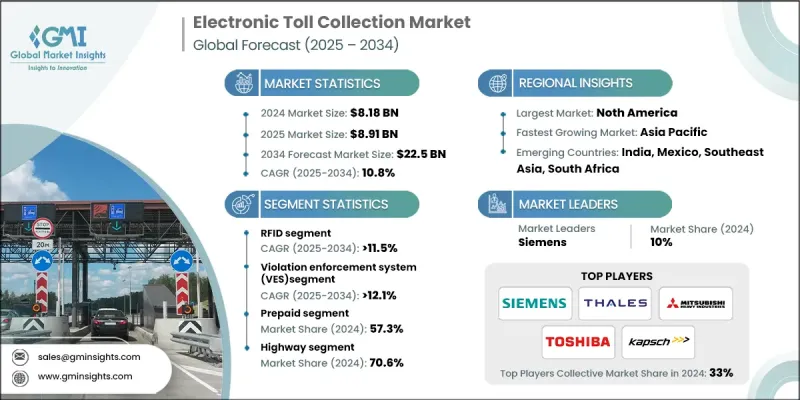

2024 年全球電子道路收費(ETC) 市值為 81.8 億美元,預計到 2034 年將以 10.8% 的複合年成長率成長至 225 億美元。

城市人口激增和私家車保有量的上升導致了交通堵塞,尤其是在高速公路和城市走廊。 ETC系統旨在透過自動化收費支付、緩解擁塞和提高收費站的吞吐量來減少交通延誤。世界各國政府都在優先考慮向數位收費框架過渡,推動互通性標準,並消除人工收款。 RFID、人工智慧、雲端平台和ANPR系統的技術進步使現代ETC解決方案更加準確、高效和安全。這些技術還有助於降低營運成本並實現更廣泛的部署。此外,行動錢包和數位支付解決方案的廣泛使用進一步提高了用戶的便利性。 ETC系統透過減少怠速時間和燃料消耗來促進環境永續性,從而降低排放。隨著各國致力於永續發展計劃和脫碳目標,ETC在建立更清潔、更智慧的交通系統方面發揮著至關重要的作用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 81.8億美元 |

| 預測值 | 225億美元 |

| 複合年成長率 | 10.8% |

2024年,RFID技術領域佔據46%的市場佔有率,預計到2034年將以11.5%的複合年成長率成長。 RFID仍然是全球收費網路(尤其是在亞洲地區)中占主導地位且經濟高效的解決方案。這些系統因其價格實惠、操作簡便且廣泛採用而備受青睞。同時,DSRC(專用短程通訊)仍在歐洲和韓國等特定地區使用,主要用於高速開放道路收費環境和V2X通訊。雖然RFID引領全球市場,但DSRC在特定的區域生態系中也佔有一席之地。

違規執法系統 (VES) 細分市場預計在 2025 年至 2034 年期間的複合年成長率為 12.1%。隨著開放道路、無現金收費模式的加速,自動化執法工具的需求顯著成長。 VES 技術利用攝影機、感測器系統和 ANPR 來識別違規收費者並強制執行。這些系統透過自動化違規檢測,有助於防止收入損失並確保遵守與收費相關的法規。在人工智慧和分析技術的加持下,現代 VES 解決方案如今可提供更高的偵測準確性,使其成為下一代收費基礎設施中不可或缺的一部分。

2024年,美國電子道路收費(ETC) 市場佔有87.4%的市佔率。全電子收費系統 (AET) 的廣泛推廣正在改變收費公路的運作方式,消除現金支付,並實現更順暢的交通。這些系統不僅降低了營運成本,還透過動態定價模型支援擁塞管理。基於即時交通資料的浮動收費費率正日益受到青睞,它透過鼓勵錯峰出行和提高交通效率來影響出行行為。

全球電子道路收費(ETC) 市場的主要領導者包括西門子、泰雷茲、Conduent、東芝、Kapsch TrafficCom、三菱重工、Neology、EFKON、Cubic 和 TransCore / ST Engineering。為了鞏固市場地位,ETC 市場參與者正致力於與交通部門和政府進行策略合作,以推出一體化收費基礎設施。研發投入是提高準確性、降低系統成本和實施人工智慧驅動分析的首要任務。各公司正積極透過簽訂長期合約來擴大其全球影響力,尤其是在快速成長的地區。許多公司也致力於開發互通性協議,以實現跨轄區的無縫出行。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 電子道路收費價值鏈

- 政府與私部門關係

- 技術提供者-營運商動態

- 標準組織的影響

- 交通運輸管理局整合中斷

- 產業衝擊力

- 成長動力

- 交通擁擠加劇

- 政府政策法規

- 技術進步

- 環境永續目標

- 無縫旅行需求不斷成長

- 產業陷阱與挑戰

- 實施成本高

- 隱私和資料安全問題

- 市場機會

- 新興市場的擴張

- 與智慧移動及其整合

- 採用人工智慧和分析技術

- 環境與永續發展舉措

- 成長動力

- 成長潛力分析

- 監管格局

- FHWA電子收費標準

- DOT智慧交通系統指南

- FCC 為 DSRC 分配的頻譜

- 國際標準(ISO、CEN、ETSI)

- 區域交通管理局法規

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利分析

- 價格趨勢分析

- 營運成本比較

- 總擁有成本分析

- 成本明細分析

- 基礎設施開發成本

- 技術實施費用

- 系統整合與客製化

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 市場部署統計

- ETC系統安裝率

- 應答器採用指標

- 交通量處理分析

- 投資格局分析

- 政府基礎建設投資

- 私部門收費公路投資

- PPP專案資金分析

- 競爭情報

- 技術領導力評估

- 按解決方案類別分類的市場佔有率

- 合約勝負分析

- 客戶行為分析

- 商業模式演變

- 傳統系統整合模型

- 建設-營運-移轉(BOT)模式

- 性能和品質標準

- 交易準確性要求

- 系統可用性標準

- 風險評估框架

- 實施時間表分析

- 系統設計與規劃階段

- 基礎設施安裝時間表

- 互通性和標準框架

- 技術互通性要求

- 業務規則協調

- 隱私和資料安全

- 交通管理整合

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 多邊環境協定

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 市場進入壁壘

- 重要新聞和舉措

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 射頻識別

- 專用短程通訊

- GPS/GNSS

- 影片分析

- 其他

第6章:市場估計與預測:按類型,2021 - 2034

- 主要趨勢

- 自動車輛分類(AVC)

- 違規執法系統(VES)

- 自動車輛辨識系統(AVIS)

- 其他(後台和服務)

第7章:市場估計與預測:按支付方式,2021 - 2034

- 主要趨勢

- 預付費

- 混合

- 後付費

第 8 章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 城市區域

- 高速公路

第9章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐人

- 荷蘭

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- 全球頂尖玩家

- Kapsch TrafficCom

- TransCore (Roper Technologies)

- Cubic Transportation Systems

- Siemens Mobility

- Thales

- EFKON

- Q-Free

- Conduent

- Neology

- Toshiba

- Regional Champions

- TagMaster

- TOLL COLLECT

- Autostrade Tech

- VINCI Highways

- Mitsubishi Heavy Industries

- DENSO

- Huawei Technologies

- Dahua Technology

- International Road Dynamics

- 新興企業和創新者

- Genetec

- Raytheon Technologies

- Bosch Mobility Solutions

- Continental

- Atos

- NEC

- Hitachi Vantara

- Accenture

- Cognizant Technology Solutions

- Tata Consultancy Services

The Global Electronic Toll Collection (ETC) Market was valued at USD 8.18 billion in 2024 and is estimated to grow at a CAGR of 10.8% to reach USD 22.5 billion by 2034.

The surge in urban populations and rising private vehicle ownership has resulted in traffic congestion, particularly across highways and city corridors. ETC systems are designed to reduce traffic delays by automating toll payments, easing congestion, and increasing throughput at tolling points. Governments worldwide are prioritizing the transition to digital tolling frameworks, pushing for interoperability standards, and eliminating manual cash collection. Technological advancements in RFID, artificial intelligence, cloud platforms, and ANPR systems are making modern ETC solutions more accurate, efficient, and secure. These technologies also help cut operational costs and allow for broader deployment. In addition, the widespread use of mobile wallets and digital payment solutions further increases user convenience. ETC systems contribute to environmental sustainability by reducing idling times and fuel consumption, which leads to lower emissions. As nations commit to sustainability initiatives and decarbonization targets, ETC plays an essential role in building cleaner and smarter transportation systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.18 Billion |

| Forecast Value | $22.5 Billion |

| CAGR | 10.8% |

In 2024, the RFID technology segment held a 46% share and is projected to grow at a CAGR of 11.5% through 2034. RFID remains a dominant and cost-effective solution across global tolling networks, particularly in regions across Asia. These systems are highly favored due to their affordability, simplicity, and widespread adoption. Meanwhile, DSRC (Dedicated Short-Range Communication) continues to be used across select regions like Europe and South Korea, primarily in high-speed open-road tolling environments and V2X communications. While RFID leads the global market, DSRC maintains a presence in specific regional ecosystems.

The violation enforcement system (VES) segment is expected to grow at a CAGR of 12.1% from 2025 to 2034. As the shift toward open-road, cashless tolling accelerates, the demand for automated enforcement tools rises significantly. VES technologies utilize cameras, sensor systems, and ANPR to identify toll violators and enforce compliance. These systems help prevent revenue loss and ensure adherence to toll-related legislation by automating violation detection. Enhanced by AI and analytics, modern VES solutions now offer improved detection accuracy, making them indispensable in next-gen toll infrastructure.

United States Electronic Toll Collection (ETC) Market held 87.4% share in 2024. The widespread rollout of All-Electronic Tolling (AET) systems is transforming how toll roads operate, eliminating cash payments and enabling smoother traffic flow. These systems not only reduce operational costs but also support congestion management through dynamic pricing models. Variable toll rates based on real-time traffic data are gaining traction, helping to influence travel behavior by encouraging off-peak travel and improving traffic efficiency.

Major companies leading the Global Electronic Toll Collection (ETC) Market include Siemens, Thales, Conduent, Toshiba, Kapsch TrafficCom, Mitsubishi Heavy Industries, Neology, EFKON, Cubic, and TransCore / ST Engineering. To strengthen their position, ETC market players are focusing on strategic collaborations with transport authorities and governments to roll out integrated tolling infrastructure. Investment in research and development is a priority to enhance accuracy, reduce system costs, and implement AI-driven analytics. Companies are actively expanding their global footprint by securing long-term contracts, particularly in fast-growing regions. Many are also working on interoperability protocols to enable seamless travel across jurisdictions.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Technology

- 2.2.2 Type

- 2.2.3 Payment method

- 2.2.4 Application

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Electronic Toll Collection Value Chain

- 3.1.2 Government-Private Sector Relationships

- 3.1.3 Technology Provider-Operator Dynamics

- 3.1.4 Standards Organization Influence

- 3.1.5 Transportation Authority Integration Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing traffic congestion

- 3.2.1.2 Government policies & regulations

- 3.2.1.3 Technological advancements

- 3.2.1.4 Environmental sustainability goals

- 3.2.1.5 Rising demand for seamless travel

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High implementation costs

- 3.2.2.2 Privacy and data security concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging markets

- 3.2.3.2 Integration with smart mobility & its

- 3.2.3.3 Adoption of ai and analytics

- 3.2.3.4 Environmental & sustainability initiatives

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 FHWA electronic toll collection standards

- 3.4.2 DOT intelligent transportation system guidelines

- 3.4.3 FCC spectrum allocation for DSRC

- 3.4.4 International Standards (ISO, CEN, ETSI)

- 3.4.5 Regional transportation authority regulations

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Price Trends Analysis

- 3.9.1 Operational Cost Comparison

- 3.9.2 Total Cost of Ownership Analysis

- 3.10 Cost Breakdown Analysis

- 3.10.1 Infrastructure development costs

- 3.10.2 Technology implementation expenses

- 3.10.3 System integration & customization

- 3.11 Sustainability and Environmental Aspects

- 3.11.1 Sustainable Practices

- 3.11.2 Waste Reduction Strategies

- 3.11.3 Energy Efficiency in Production

- 3.11.4 Eco-friendly Initiatives

- 3.11.5 Carbon Footprint Considerations

- 3.12 Market Deployment Statistics

- 3.12.1 ETC system installation rates

- 3.12.2 Transponder adoption metrics

- 3.12.3 Traffic volume processing analysis

- 3.13 Investment Landscape Analysis

- 3.13.1 Government infrastructure investment

- 3.13.2 Private sector toll road investment

- 3.13.3 PPP project funding analysis

- 3.14 Competitive Intelligence

- 3.14.1 Technology Leadership Assessment

- 3.14.2 Market Share by Solution Category

- 3.14.3 Contract Win/Loss Analysis

- 3.15 Customer Behavior Analysis

- 3.16 Business Model Evolution

- 3.16.1 Traditional system integration models

- 3.16.2 Build-Operate-Transfer (BOT) Models

- 3.17 Performance & Quality Standards

- 3.17.1 Transaction accuracy requirements

- 3.17.2 System availability standards

- 3.18 Risk Assessment Framework

- 3.19 Implementation Timeline Analysis

- 3.19.1 System design & planning phase

- 3.19.2 Infrastructure installation timeline

- 3.20 Interoperability & Standards Framework

- 3.20.1 Technical interoperability requirements

- 3.20.2 Business rule harmonization

- 3.21 Privacy & Data Security

- 3.22 Traffic Management Integration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Market Entry Barriers

- 4.7 Key news and initiatives

- 4.7.1 Mergers & acquisitions

- 4.7.2 Partnerships & collaborations

- 4.7.3 New Product Launches

- 4.7.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 RFID

- 5.3 DSRC

- 5.4 GPS/GNSS

- 5.5 Video analytics

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Automatic Vehicle Classification (AVC)

- 6.3 Violation Enforcement System (VES)

- 6.4 Automatic Vehicle Identification System (AVIS)

- 6.5 Others (Back office & services)

Chapter 7 Market Estimates & Forecast, By Payment method, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Prepaid

- 7.3 Hybrid

- 7.4 Postpaid

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Urban zones

- 8.3 Highways

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Netherlands

- 9.3.8 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Top Global Players

- 10.1.1 Kapsch TrafficCom

- 10.1.2 TransCore (Roper Technologies)

- 10.1.3 Cubic Transportation Systems

- 10.1.4 Siemens Mobility

- 10.1.5 Thales

- 10.1.6 EFKON

- 10.1.7 Q-Free

- 10.1.8 Conduent

- 10.1.9 Neology

- 10.1.10 Toshiba

- 10.2 Regional Champions

- 10.2.1 TagMaster

- 10.2.2 TOLL COLLECT

- 10.2.3 Autostrade Tech

- 10.2.4 VINCI Highways

- 10.2.5 Mitsubishi Heavy Industries

- 10.2.6 DENSO

- 10.2.7 Huawei Technologies

- 10.2.8 Dahua Technology

- 10.2.9 International Road Dynamics

- 10.3 Emerging Players & Innovators

- 10.3.1 Genetec

- 10.3.2 Raytheon Technologies

- 10.3.3 Bosch Mobility Solutions

- 10.3.4 Continental

- 10.3.5 Atos

- 10.3.6 NEC

- 10.3.7 Hitachi Vantara

- 10.3.8 Accenture

- 10.3.9 Cognizant Technology Solutions

- 10.3.10 Tata Consultancy Services