|

市場調查報告書

商品編碼

1844367

癬治療市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Ringworm Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

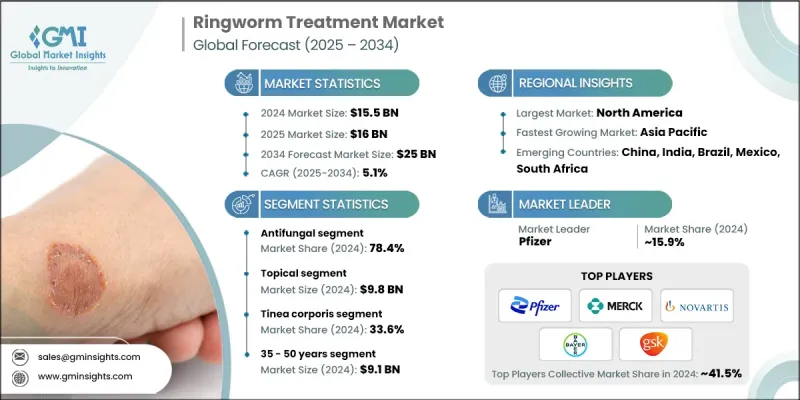

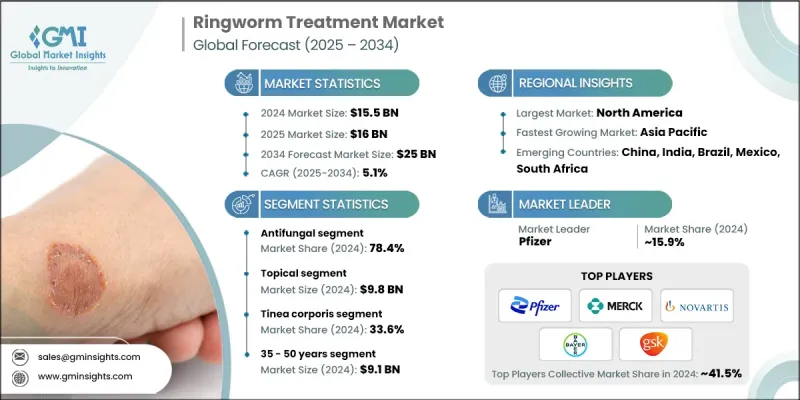

2024 年全球癬治療市場價值為 155 億美元,預計將以 5.1% 的複合年成長率成長,到 2034 年達到 250 億美元。

在已開發國家和新興國家,皮癬菌病等表淺真菌感染的發生率不斷上升,這極大地推動了對有效治療方案的需求。這一成長的關鍵因素是非處方藥 (OTC) 的普及,這使得消費者更容易獲得治療。由於這些製劑在零售藥局和數位平台上均有銷售,它們通常用於日常自我護理,尤其適用於輕度至中度感染。城鎮化和醫療保健可近性的提高也發揮了作用,促進了治療方案的更快應用。正規零售藥局和線上藥局的不斷擴張進一步推動了市場發展。消費者對便利性、隱私性和價格實惠的解決方案表現出強烈的偏好,促使製藥公司加強在電商管道的佈局。這種轉變也促進了捆綁治療套裝和直接面對消費者的互動策略的推出。感染通常出現在手臂、腿部或頭皮上,根據嚴重程度,需要局部用藥或口服抗真菌藥物。配方技術的進步和更廣泛的分銷網路使得癬治療更加有效,並且適用於所有人群。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 155億美元 |

| 預測值 | 250億美元 |

| 複合年成長率 | 5.1% |

2024年,抗真菌藥物市場佔據78.4%的市場佔有率,反映出其作為各類皮癬菌病的一線治療手段的廣泛應用。含有咪康唑、克黴唑、特比萘芬和酮康唑等活性成分的產品因其已被證實能夠抑制真菌生長并快速緩解症狀而被廣泛使用。這些藥物價格實惠、療效廣譜且劑型多樣,使其在治療領域中佔據主導地位。這些抗真菌藥物常用於治療體癬、足癬、頭癬、股癬和甲癬等常見疾病,並常作為處方藥或自行服用。

局部治療領域佔63%的市場佔有率,2024年市場規模達98億美元。該領域的領先地位源於日益成長的自我治療趨勢,這使得非處方外用產品成為首選。這些產品可透過實體藥局和線上藥局輕鬆購買,尤其適用於治療單純性感染。製藥公司越來越注重推出更容易使用的新型外用製劑,例如泡沫劑、噴霧劑、乳霜劑、粉末、凝膠劑和藥用濕紙巾。這些創新產品,加上人們對早期介入意識的提升,正在顯著推動全球對外用抗真菌藥物的需求。

2024年,北美癬治療市場佔據40.3%的市場佔有率,這得益於其完善的醫療基礎設施和領先的製藥公司。處方藥和非處方藥的廣泛可及性,加上日益成長的認知度和自我照護趨勢,鞏固了該地區的主導地位。該市場的消費者擴大選擇居家治療方案,以方便獲得可靠的治療方案。零售藥局和電商平台繼續對該地區的產品供應和消費者行為產生重大影響。

全球癬治療市場的主要公司包括強生、Mankind Pharma、Sun Pharmaceuticals、艾伯維、輝瑞、賽諾菲、諾華、Glenmark Pharmaceuticals、Cipla、Biofield Pharma、吉利德科學、梯瓦製藥工業、拜耳、默克、百利戈公司、葛蘭素史克和禮來公司。為了保持競爭優勢,癬治療領域的公司正專注於多通路分銷,包括電子商務和有組織的零售藥局,以提高產品的可及性。許多公司正在投資開發新型外用製劑,以提高用戶的依從性和有效性。與數位健康平台和連鎖藥局的策略合作夥伴關係可以擴大覆蓋範圍,而行銷活動則針對真菌感染和早期干預的宣傳活動。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 癬感染的盛行率不斷上升

- 非處方抗真菌藥物容易取得

- 提高對癬感染及其症狀的認知

- 產業陷阱與挑戰

- 常見抗真菌藥物的抗藥性不斷增強

- 患者缺乏治療依從性

- 市場機會

- 新型藥物製劑的開發

- 聯合用藥的採用率不斷上升

- 成長動力

- 成長潛力分析

- 監管格局

- 癬感染的流行病學分析

- 管道分析

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按藥物類別,2021 - 2034 年

- 主要趨勢

- 抗真菌

- 聯合用藥

第6章:市場估計與預測:按管理路線,2021 - 2034 年

- 主要趨勢

- 外用

- 口服

- 腸外

第7章:市場估計與預測:按感染類型,2021 - 2034 年

- 主要趨勢

- 體癬

- 足癬

- 股癬

- 頭癬

- 手癬

- 其他類型

第8章:市場估計與預測:按年齡層,2021 - 2034 年

- 主要趨勢

- 18歲以下

- 18 - 35歲

- 35 - 50歲

- 50歲以上

第9章:市場估計與預測:按藥物類型,2021 - 2034

- 主要趨勢

- 處方

- 場外交易

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 醫院藥房

- 零售藥局

- 網路藥局

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 日本

- 中國

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 12 章:公司簡介

- AbbVie

- Biofield Pharma

- Bayer

- Cipla

- Eli Lilly and Company

- Gilead Sciences

- GlaxoSmithKline

- Glenmark Pharmaceuticals

- Johnson and Johnson

- Mankind Pharma

- Merck

- Novartis

- Perrigo Company

- Pfizer

- Sanofi

- Sun Pharmaceuticals

- Teva Pharmaceutical Industries

The Global Ringworm Treatment Market was valued at USD 15.5 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 25 billion by 2034.

The increasing prevalence of superficial fungal infections like dermatophytosis across both developed and emerging nations is significantly driving the demand for effective treatment options. A key contributor to this growth is the rising adoption of over-the-counter (OTC) medications, making treatments more accessible for consumers. These formulations are commonly used in self-care routines, especially for mild to moderate infections, thanks to their availability across retail pharmacies and digital platforms. Urbanization and better healthcare access have also played a role, encouraging faster treatment adoption. The growing expansion of organized retail and online pharmacies is further fueling market momentum. Consumers are showing a strong preference for convenience, privacy, and affordable solutions, prompting pharmaceutical companies to enhance their presence in e-commerce channels. This shift also supports the introduction of bundled treatment kits and direct-to-consumer engagement strategies. Infections typically appear on the arms, legs, or scalp, and depending on severity, require either topical application or oral antifungal therapies. Advancements in formulation technology and broader distribution networks have made ringworm treatments more effective and accessible across all demographics.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.5 Billion |

| Forecast Value | $25 Billion |

| CAGR | 5.1% |

In 2024, the antifungal drugs segment accounted for 78.4% share, reflecting their widespread usage as the frontline treatment for various types of dermatophytosis. Products containing active ingredients like miconazole, clotrimazole, terbinafine, and ketoconazole are widely utilized due to their proven ability to stop fungal growth and relieve symptoms quickly. Their affordability, broad-spectrum efficacy, and availability in multiple formats contribute to their dominance in the treatment landscape. These antifungals are frequently prescribed or self-administered for common conditions like tinea corporis, tinea pedis, tinea capitis, tinea cruris, and tinea unguium.

The topical treatments segment held a 63% share and generated USD 9.8 billion in 2024. Their leadership position stems from the growing trend of self-treatment, which has made OTC topical products a preferred option. These are easily accessible via both physical and online pharmacies, especially for uncomplicated infections. Pharmaceutical companies are increasingly focused on launching new and more user-friendly topical formulations like foams, sprays, creams, powders, gels, and medicated wipes. This innovation, coupled with increased awareness around early intervention, is significantly driving global demand for topical antifungals.

North America Ringworm Treatment Market held 40.3% share in 2024, due to its well-established healthcare infrastructure and the presence of leading pharmaceutical companies. Widespread access to both prescription and OTC medications, coupled with growing awareness and self-care trends, supports the region's dominance. Consumers in this market increasingly opt for at-home solutions, leveraging convenient access to trusted treatment options. Retail drugstores and e-commerce platforms continue to make a strong impact on product availability and consumer behavior in this region.

Key companies operating in the Global Ringworm Treatment Market include Johnson and Johnson, Mankind Pharma, Sun Pharmaceuticals, AbbVie, Pfizer, Sanofi, Novartis, Glenmark Pharmaceuticals, Cipla, Biofield Pharma, Gilead Sciences, Teva Pharmaceutical Industries, Bayer, Merck, Perrigo Company, GlaxoSmithKline, and Eli Lilly and Company. To maintain a competitive edge, companies in the ringworm treatment space are focusing on multi-channel distribution, including e-commerce and organized retail pharmacies, to increase product accessibility. Many are investing in the development of novel topical formulations that enhance user compliance and effectiveness. Strategic partnerships with digital health platforms and pharmacy chains allow for broader outreach, while marketing initiatives target awareness campaigns around fungal infections and early intervention.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Drug class trends

- 2.2.3 Route of administration trends

- 2.2.4 Infection type trends

- 2.2.5 Age group trends

- 2.2.6 Medication type trends

- 2.2.7 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of ringworm infections

- 3.2.1.2 Easy availability of over-the-counter antifungal medications

- 3.2.1.3 Increased awareness about ringworm infections and their symptoms

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Increasing drug resistance to common antifungal medications

- 3.2.2.2 Lack of patient compliance with treatment

- 3.2.3 Market opportunities

- 3.2.3.1 Development of novel drug formulations

- 3.2.3.2 Rising adoption of combination drugs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Epidemiology analysis of ringworm infection

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Antifungal

- 5.3 Combination drugs

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Topical

- 6.3 Oral

- 6.4 Parenteral

Chapter 7 Market Estimates and Forecast, By Infection Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Tinea corporis

- 7.3 Tinea pedis

- 7.4 Tinea cruris

- 7.5 Tinea capitis

- 7.6 Tinea manuum

- 7.7 Other types

Chapter 8 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Below 18 years

- 8.3 18 - 35 years

- 8.4 35 - 50 years

- 8.5 50 years and above

Chapter 9 Market Estimates and Forecast, By Medication Type, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Prescription

- 9.3 OTC

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Hospital pharmacies

- 10.3 Retail pharmacies

- 10.4 Online pharmacies

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 Japan

- 11.4.2 China

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 AbbVie

- 12.2 Biofield Pharma

- 12.3 Bayer

- 12.4 Cipla

- 12.5 Eli Lilly and Company

- 12.6 Gilead Sciences

- 12.7 GlaxoSmithKline

- 12.8 Glenmark Pharmaceuticals

- 12.9 Johnson and Johnson

- 12.10 Mankind Pharma

- 12.11 Merck

- 12.12 Novartis

- 12.13 Perrigo Company

- 12.14 Pfizer

- 12.15 Sanofi

- 12.16 Sun Pharmaceuticals

- 12.17 Teva Pharmaceutical Industries