|

市場調查報告書

商品編碼

1844363

膜式空氣乾燥機市場機會、成長動力、產業趨勢分析及2025-2034年預測Membrane Air Dryers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球膜式空氣乾燥機市值為 9.923 億美元,預計到 2034 年將以 7.3% 的複合年成長率成長至 19.7 億美元。

這一上升趨勢歸因於對高純度壓縮空氣日益成長的需求、工業自動化的不斷擴展以及膜系統提供的顯著營運優勢,尤其是其節能和極低的維護要求。清潔、無濕氣的壓縮空氣對許多行業至關重要,因為即使是微量的濕氣也可能損害敏感組件、中斷生產或導致腐蝕。全球對空氣品質標準的日益嚴格促使越來越多的製造商採用膜式空氣乾燥器,這種乾燥器無需龐大的基礎設施即可提供可靠的空氣淨化。其緊湊的設計和持續運作使其在空間受限的高性能環境中佔據優勢。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 9.923億美元 |

| 預測值 | 19.7億美元 |

| 複合年成長率 | 7.3% |

自動化熱潮是關鍵的成長引擎。隨著自動化系統日益普及,為機器人、CNC設備和氣動工具提供動力,對持續乾燥空氣的需求也日益成長。這些系統對污染物高度敏感,因此膜式乾燥機對於維持正常運作時間和避免系統故障至關重要。其模組化緊湊的結構使其能夠在使用點輕鬆部署,尤其適合現代工業設備和工業 4.0 應用。

2024年,多孔膜市場規模達8.49億美元,預計到2034年複合年成長率將達到7.4%。這類薄膜因其高效的濕氣傳輸能力和持續的空氣流通能力而備受青睞。其卓越的壓力降和乾燥效率使其在空氣純度至關重要的關鍵產業中具有極強的適應性。

2024年,工廠空氣/車間空氣市場佔24.6%的佔有率,預計2025年至2034年的複合年成長率將達到7.4%。該市場仍將佔據主導地位,因為乾燥壓縮空氣是通用工業應用的主要組成部分,從驅動工具和執行器到防止腐蝕和提高設備可靠性。製造業、汽車業、食品加工和電子業都嚴重依賴清潔空氣系統,這使得清潔空氣系統成為膜式乾燥機的核心應用場景。

美國膜式空氣乾燥機市場佔78.5%的市場佔有率,2024年市場規模達2.351億美元。這一領先地位源自於其強大的工業基礎和先進生產技術的廣泛應用。各主要行業的高性能標準以及嚴格的效率和安全規範正在推動膜式乾燥器的應用。此外,主要製造商的佈局、良好的監管框架以及清潔壓縮空氣系統的持續創新,使美國始終處於市場成長的前沿。

影響全球薄膜空氣乾燥機市場的關鍵參與者包括 Zeks Compressed Air Solutions、Norgren、Atlas Copco、SMC Corporation、Mikropor、Donaldson Company、Ingersoll Rand、Kaeser Compressors、Wilkerson Corporation、AIRPAX、SPX FLOW、Hankison International、Graco、Gardner Denver 和 Parker Hannifin Corporation。為了鞏固市場地位,膜空氣乾燥機市場的公司正專注於技術升級、產品創新和市場擴張。許多公司正在投資研發,以開發更緊湊、更節能、更高性能的膜系統,以滿足不同的工業需求。與自動化和氣動系統供應商的策略合作夥伴關係使這些製造商能夠將其產品整合到更大的工業生態系統中。一些參與者也致力於模組化和可自訂的解決方案,以滿足空間受限環境中的利基應用。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 對清潔乾燥壓縮空氣的需求不斷成長

- 工業自動化的成長

- 能源效率與維修優勢

- 產業陷阱與挑戰

- 初始資本投入高

- 露點範圍有限

- 機會

- 與智慧和物聯網壓縮空氣系統整合

- 環保節能解決方案

- 客製化和高容量解決方案

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監管格局

- 標準和合規要求

- 區域監理框架

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 多孔

- 無孔

第6章:市場估計與預測:依技術類型,2021 - 2034 年

- 主要趨勢

- 中空纖維膜乾燥機

- 聚合物/複合膜乾燥機

- 混合膜乾燥器

第7章:市場估計與預測:依產能,2021 - 2034

- 主要趨勢

- 低容量(<100 cfm / 170 m³/h)

- 中等容量(100-500 cfm / 170-850 m³/h)

- 高容量(>500 cfm / 850 m³/h)

第8章:市場估計與預測:按操作壓力,2021 - 2034 年

- 主要趨勢

- 低壓(<10 bar / 145 psi)

- 中壓(10-20 bar / 145-290 psi)

- 高壓(>20 bar / 290 psi)

第9章:市場估計與預測:按應用,2021 - 2034

- 主要趨勢

- 工廠空氣/車間空氣

- 儀表空氣

- 處理空氣

- 呼吸空氣

- 其他

第 10 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 化學

- 石油和天然氣

- 醫療的

- 食品和飲料

- 電子產品

- 一般製造業

- 其他

第 11 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直接的

- 間接

第 12 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第13章:公司簡介

- AIRPAX

- Atlas Copco

- Donaldson Company

- Gardner Denver

- Graco

- Hankison International

- Ingersoll Rand

- Kaeser Compressors

- Mikropor

- Norgren

- Parker Hannifin Corporation

- SMC Corporation

- SPX FLOW

- Wilkerson Corporation

- Zeks Compressed Air Solutions

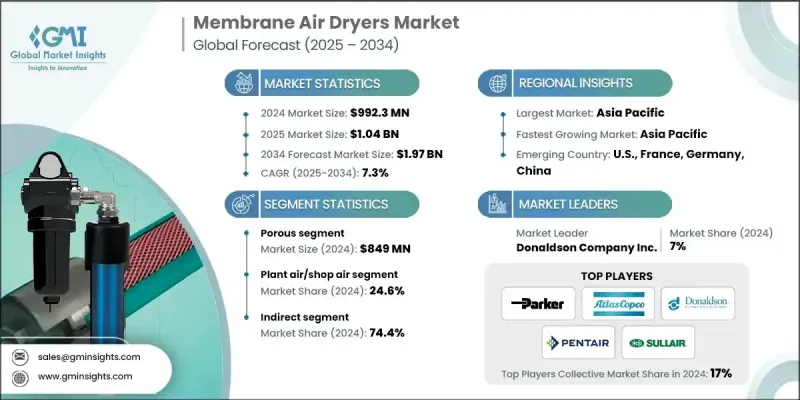

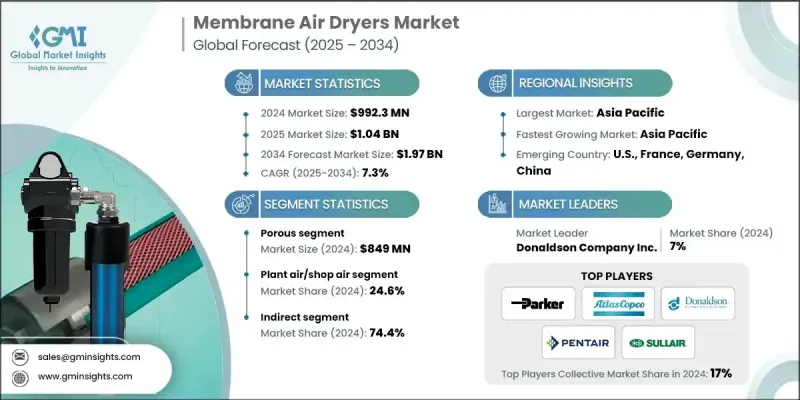

The Global Membrane Air Dryers Market was valued at USD 992.3 million in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 1.97 billion by 2034.

The upward trajectory is attributed to increasing demand for high-purity compressed air, the growing footprint of industrial automation, and the clear operational advantages membrane systems offer, particularly their energy efficiency and minimal maintenance requirements. Clean, moisture-free compressed air is essential across several industries where even trace humidity can compromise sensitive components, disrupt production, or lead to corrosion. Rising global adherence to air quality benchmarks is pushing more manufacturers to adopt membrane air dryers, which provide reliable air purification without requiring bulky infrastructure. Their compact design and continuous operation give them an edge in space-constrained, high-performance environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $992.3 Million |

| Forecast Value | $1.97 Billion |

| CAGR | 7.3% |

The automation boom is a critical growth engine. As automated systems become widespread, powering robotics, CNC equipment, and pneumatic tools, the demand for consistently dry air increases. These systems are highly sensitive to contaminants, making membrane dryers vital for maintaining uptime and avoiding system failures. Their modular and compact structure allows easy deployment right at the point of use, making them particularly well-suited to modern industrial setups and Industry 4.0 applications.

In 2024, the porous membrane segment generated USD 849 million and is expected to grow at a CAGR of 7.4% through 2034. These membranes are favored for their effective moisture vapor transfer capabilities while maintaining uninterrupted air flow. Their superior performance in pressure drop and drying efficiency makes them highly adaptable to key industries where air purity is non-negotiable.

The plant air/shop air segment held a 24.6% share in 2024 and is forecasted to grow at a 7.4% CAGR from 2025 to 2034. This segment remains dominant because dry compressed air is a staple across general-purpose industrial applications, from driving tools and actuators to preventing corrosion and improving equipment reliability. Manufacturing, automotive, food processing, and electronics sectors all rely heavily on clean air systems, making this a core use case for membrane dryers.

U.S. Membrane Air Dryers Market held 78.5% share and generated USD 235.1 million in 2024. This leadership stems from a strong industrial foundation and widespread implementation of advanced production technologies. High-performance standards across major sectors, along with stringent efficiency and safety norms, are pushing the adoption of membrane dryers. Additionally, the presence of key manufacturers, a favorable regulatory framework, and continuous innovation in clean compressed air systems keep the U.S. at the forefront of market growth.

Key players shaping the Global Membrane Air Dryers Market include Zeks Compressed Air Solutions, Norgren, Atlas Copco, SMC Corporation, Mikropor, Donaldson Company, Ingersoll Rand, Kaeser Compressors, Wilkerson Corporation, AIRPAX, SPX FLOW, Hankison International, Graco, Gardner Denver, and Parker Hannifin Corporation. To strengthen their market foothold, companies in the Membrane Air Dryers Market are focusing on technology upgrades, product innovation, and market expansion. Many are investing in R&D to develop more compact, energy-efficient, and high-performance membrane systems tailored to diverse industrial requirements. Strategic partnerships with automation and pneumatic system providers allow these manufacturers to integrate their products into larger industrial ecosystems. Several players are also working on modular and customizable solutions to serve niche applications in space-constrained environments.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.3 Data collection methods

- 1.4 Data mining sources

- 1.4.1 Global

- 1.4.2 Regional/Country

- 1.5 Base estimates and calculations

- 1.5.1 Base year calculation

- 1.5.2 Key trends for market estimation

- 1.6 Primary research and validation

- 1.6.1 Primary sources

- 1.7 Forecast model

- 1.8 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Technology type

- 2.2.4 Capacity

- 2.2.5 Operating pressure

- 2.2.6 Application

- 2.2.7 End use

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for clean and dry compressed air

- 3.2.1.2 Growth of industrial automation

- 3.2.1.3 Energy efficiency and maintenance advantages

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial capital investment

- 3.2.2.2 Limited dew point range

- 3.2.3 Opportunities

- 3.2.3.1 Integration with smart & IoT-enabled compressed air systems

- 3.2.3.2 Eco-friendly & energy-saving solutions

- 3.2.3.3 Customized & high-capacity solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Bn, Thousand Units)

- 5.1 Key trends

- 5.2 Porous

- 5.3 Non-Porous

Chapter 6 Market Estimates & Forecast, By Technology Type, 2021 - 2034 ($Bn, Thousand Units)

- 6.1 Key trends

- 6.2 Hollow fiber membrane dryers

- 6.3 Polymeric/composite membrane dryers

- 6.4 Hybrid membrane dryers

Chapter 7 Market Estimates & Forecast, By Capacity, 2021 - 2034 ($Bn, Thousand Units)

- 7.1 Key trends

- 7.2 Low capacity (<100 cfm / 170 m³/h)

- 7.3 Medium-capacity (100-500 cfm / 170-850 m³/h)

- 7.4 High capacity (>500 cfm / 850 m³/h)

Chapter 8 Market Estimates & Forecast, By Operating Pressure, 2021 - 2034 ($Bn, Thousand Units)

- 8.1 Key trends

- 8.2 Low pressure (<10 bar / 145 psi)

- 8.3 Medium pressure (10-20 bar / 145-290 psi)

- 8.4 High pressure (>20 bar / 290 psi)

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Thousand Units)

- 9.1 Key trends

- 9.2 Plant air/ Shop air

- 9.3 Instrument air

- 9.4 Process air

- 9.5 Breathing air

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Thousand Units)

- 10.1 Key trends

- 10.2 Chemical

- 10.3 Oil & gas

- 10.4 Medical

- 10.5 Food and beverage

- 10.6 Electronics

- 10.7 General manufacturing

- 10.8 Others

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Thousand Units)

- 11.1 Key trends

- 11.2 Direct

- 11.3 Indirect

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 UK

- 12.3.2 Germany

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 UAE

- 12.6.2 South Africa

- 12.6.3 Saudi Arabia

Chapter 13 Company Profiles

- 13.1 AIRPAX

- 13.2 Atlas Copco

- 13.3 Donaldson Company

- 13.4 Gardner Denver

- 13.5 Graco

- 13.6 Hankison International

- 13.7 Ingersoll Rand

- 13.8 Kaeser Compressors

- 13.9 Mikropor

- 13.10 Norgren

- 13.11 Parker Hannifin Corporation

- 13.12 SMC Corporation

- 13.13 SPX FLOW

- 13.14 Wilkerson Corporation

- 13.15 Zeks Compressed Air Solutions