|

市場調查報告書

商品編碼

1844357

寵物牙齒保健市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Pet Dental Health Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

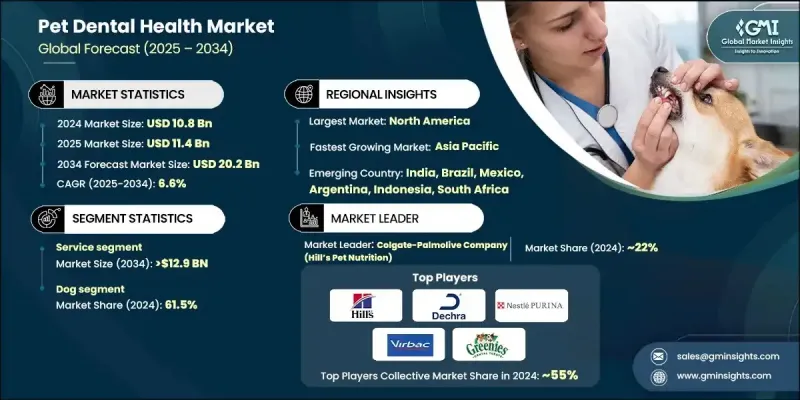

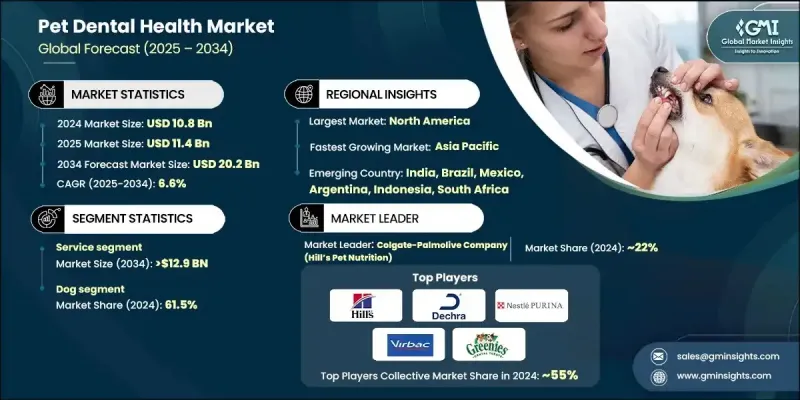

2024 年全球寵物牙齒保健市場價值為 108 億美元,預計到 2034 年將以 6.6% 的複合年成長率成長至 202 億美元。

市場成長的驅動力包括寵物擁有量的增加、動物口腔健康意識的增強以及獸醫護理支出的增加。牙齒健康是寵物整體健康的重要組成部分,口腔疾病是伴侶動物(尤其是犬貓)最常見的健康問題之一。人們日益認知到口腔衛生與全身健康之間的聯繫,這刺激了對預防性和治療性牙科護理解決方案的需求,使寵物口腔健康行業成為全球獸醫市場的重要組成部分。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 108億美元 |

| 預測值 | 202億美元 |

| 複合年成長率 | 6.6% |

寵物人性化趨勢進一步推動了市場的成長,寵物主人越來越將動物視為家庭成員,並投資於先進的醫療保健解決方案。隨著寵物主人尋求延長寵物的壽命和生活品質,包括常規體檢、專業清潔和牙齒護理在內的預防性護理日益受到重視。此外,獸醫協會和寵物醫療保健組織正在積極進行宣傳活動,強調口腔護理在預防疼痛、牙齒脫落以及心臟病和腎臟病等繼發性疾病方面的重要性。這加速了已開發市場和新興市場對寵物牙科產品和服務的採用。

2024年,服務業收入達67億美元,涵蓋獸醫診所和醫院提供的專業牙齒清潔、潔治、拋光、拔牙以及預防性口腔檢查。寵物主人意識到定期進行牙科檢查對於預防口腔疾病及相關併發症的重要性。由於寵物牙周病的發生率不斷上升,獸醫牙科服務的需求也日益成長,近70%至80%的三歲以上犬貓都患有牙周病。

就動物類型而言,2024年犬類消費比61.5%。與其他伴侶動物相比,犬類更容易出現牙齒問題,這增加了對專業口腔護理產品和獸醫牙科服務的需求。犬類健康領域對預防性口腔護理的日益重視,以及各種咀嚼物、漱口水、牙刷和專業清潔服務的普及,持續推動著這個細分市場的發展。寵物主人越來越積極主動地關注愛犬的牙齒健康需求,這與高階獸醫服務支出不斷成長的整體趨勢一致。

2024年,北美寵物口腔保健市場佔據44.9%的市場佔有率,這得益於較高的寵物擁有率、先進的獸醫基礎設施以及消費者對預防性口腔護理的強烈認知。美國尤其佔據了該地區寵物口腔保健市場的大部分需求,寵物保險的普及率和高階寵物護理支出推動了市場的成長。

全球寵物口腔保健市場的主要參與者包括瑪氏寵物護理、維克、雀巢普瑞納寵物護理、希爾思寵物營養、德克薩製藥、PetIQ、TropiClean 和 Vetoquinol。這些公司在推動創新和擴大全球影響力方面處於領先地位,透過推出新產品、收購以及與獸醫服務提供者的合作。寵物口腔保健市場的競爭格局由對產品創新的大力投資、與獸醫診所的合作以及有針對性的行銷策略決定。各公司正致力於擴展其產品組合,包括功能性咀嚼物、酵素口腔護理解決方案和先進的牙齒清潔服務。

目錄

第1章:方法論與範圍

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 寵物收養率上升

- 寵物牙齒問題日益增多

- 寵物口腔健康意識不斷增強

- 動物保健支出增加

- 產業陷阱與挑戰

- 先進的牙科手術費用高昂

- 專業獸醫牙醫短缺

- 市場機會

- 擴大寵物牙科的技術進步

- 天然和有機產品需求

- 預防性牙科日益受到重視

- 成長動力

- 成長潛力分析

- 技術格局

- 當前的技術趨勢

- 新興技術

- 監管格局

- 2024年寵物數量統計

- 定價分析

- 報銷場景

- 動物保健產業的創投場景

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 - 2034

- 主要趨勢

- 服務

- 按服務類型

- 治療

- 診斷

- 按最終用途

- 獸醫診所

- 獸醫院

- 按服務類型

- 產品

- 依產品類型

- 牙齒咀嚼物和零食

- 口腔護理解決方案

- 牙膏和牙刷

- 牙齒噴霧

- 其他產品類型

- 按配銷通路

- 零售藥局

- 網路藥局

- 寵物店

- 其他分銷管道

- 依產品類型

第6章:市場估計與預測:依動物類型,2021 - 2034 年

- 主要趨勢

- 狗

- 貓

- 其他動物類型

第7章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 南非

- 沙烏地阿拉伯

第8章:公司簡介

- Animalcare Group

- BarkBox

- Bo International

- Boehringer Ingelheim

- Ceva Sante Animale

- Colgate-Palmolive Company (Hill's Pet Nutrition)

- H. von Gimborn

- imRex

- Ingenious Probiotics

- Mars (GREENIES)

- PetDine

- Petsona

- Petzlife Products

- Purina PetCare (Nestle)

- TropiClean Pet Products

- Vetoquinol

- Virbac

The Global Pet Dental Health Market was valued at USD 10.8 billion in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 20.2 billion by 2034.

Market growth is driven by rising pet ownership, increasing awareness of animal oral health, and higher spending on veterinary care. Dental health is a critical component of overall pet wellness, with oral diseases among the most common health issues in companion animals, particularly dogs and cats. Growing recognition of the link between oral hygiene and systemic health has spurred demand for preventive and therapeutic dental care solutions, positioning the pet dental health industry as a vital segment of the global veterinary market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.8 Billion |

| Forecast Value | $20.2 Billion |

| CAGR | 6.6% |

The market's growth is further supported by the humanization of pets, where owners increasingly view animals as family members and invest in advanced healthcare solutions. Preventive care, including routine checkups, professional cleanings, and dental diets, has gained traction as pet parents seek to extend the longevity and quality of life of their animals. Additionally, veterinary associations and pet healthcare organizations are actively running awareness campaigns that highlight the importance of oral care in preventing pain, tooth loss, and secondary conditions such as heart and kidney disease. This has accelerated the adoption of pet dental products and services across developed and emerging markets alike.

The services segment generated USD 6.7 billion in 2024, encompassing professional dental cleanings, scaling, polishing, tooth extractions, and preventive oral checkups offered by veterinary clinics and hospitals. Pet owners recognized the importance of routine dental visits to prevent oral diseases and associated health complications. Veterinary dental services are increasingly in demand due to the rising prevalence of periodontal disease in pets, which affects nearly 70-80% of dogs and cats over the age of three.

In terms of animal type, the dogs segment held a 61.5% share in 2024. Dogs are more prone to dental issues compared to other companion animals, which has heightened demand for specialized oral care products and veterinary dental services. The growing emphasis on preventive oral care in canine health, supported by the availability of a wide range of chews, rinses, toothbrushes, and professional cleaning services, continues to drive this segment forward. Pet owners are increasingly proactive in addressing their dogs' dental health needs, aligning with the broader trend of rising expenditure on premium veterinary services.

North America Pet Dental Health Market held a 44.9% share in 2024, supported by high pet ownership rates, advanced veterinary infrastructure, and strong consumer awareness regarding preventive oral care. The United States, in particular, accounts for the bulk of regional demand, with pet insurance penetration and premium pet care spending fueling market growth.

Key players in the Global Pet Dental Health Market include Mars Petcare, Virbac, Nestle Purina PetCare, Hill's Pet Nutrition, Dechra Pharmaceuticals, PetIQ, TropiClean, and Vetoquinol. These companies are at the forefront of driving innovation and expanding their global footprint through new product launches, acquisitions, and partnerships with veterinary service providers. The competitive landscape of the pet dental health market is defined by strong investments in product innovation, partnerships with veterinary clinics, and targeted marketing strategies. Companies are focusing on expanding their product portfolios to include functional chews, enzymatic oral care solutions, and advanced dental cleaning services.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Animal type

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising pet adoption

- 3.2.1.2 Increasing cases of pet dental problems

- 3.2.1.3 Growing awareness of pet oral health

- 3.2.1.4 Increasing animal healthcare expenditure

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced dental procedures

- 3.2.2.2 Shortage of specialized veterinary dentists

- 3.2.3 Market opportunities

- 3.2.3.1 Expanding technological advancements in pet dentistry

- 3.2.3.2 Natural and organic product demand

- 3.2.3.3 Growing focus on preventive dental

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.4.1 Current technological trends

- 3.4.2 Emerging technologies

- 3.5 Regulatory landscape

- 3.6 Pet population statistics 2024

- 3.7 Pricing analysis

- 3.8 Reimbursement scenario

- 3.9 Venture capitalist scenario in animal health industry

- 3.10 Future market trends

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Key developments

- 4.5.1 Merger and acquisition

- 4.5.2 Partnership and collaboration

- 4.5.3 New product launches

- 4.5.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Service

- 5.2.1 By service type

- 5.2.1.1 Treatment

- 5.2.1.2 Diagnosis

- 5.2.2 By end use

- 5.2.2.1 Veterinary clinics

- 5.2.2.2 Veterinary hospitals

- 5.2.1 By service type

- 5.3 Product

- 5.3.1 By product type

- 5.3.1.1 Dental chews and treats

- 5.3.1.2 Oral care solutions

- 5.3.1.3 Toothpastes and brushes

- 5.3.1.4 Dental spray

- 5.3.1.5 Other product types

- 5.3.2 By distribution channel

- 5.3.2.1 Retail pharmacies

- 5.3.2.2 Online pharmacies

- 5.3.2.3 Pet stores

- 5.3.2.4 Other distribution channels

- 5.3.1 By product type

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Dogs

- 6.3 Cats

- 6.4 Other animal types

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

Chapter 8 Company Profiles

- 8.1 Animalcare Group

- 8.2 BarkBox

- 8.3 Bo International

- 8.4 Boehringer Ingelheim

- 8.5 Ceva Sante Animale

- 8.6 Colgate-Palmolive Company (Hill’s Pet Nutrition)

- 8.7 H. von Gimborn

- 8.8 imRex

- 8.9 Ingenious Probiotics

- 8.10 Mars (GREENIES)

- 8.11 PetDine

- 8.12 Petsona

- 8.13 Petzlife Products

- 8.14 Purina PetCare (Nestle)

- 8.15 TropiClean Pet Products

- 8.16 Vetoquinol

- 8.17 Virbac