|

市場調查報告書

商品編碼

1844350

消防灑水系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Fire Sprinkler Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

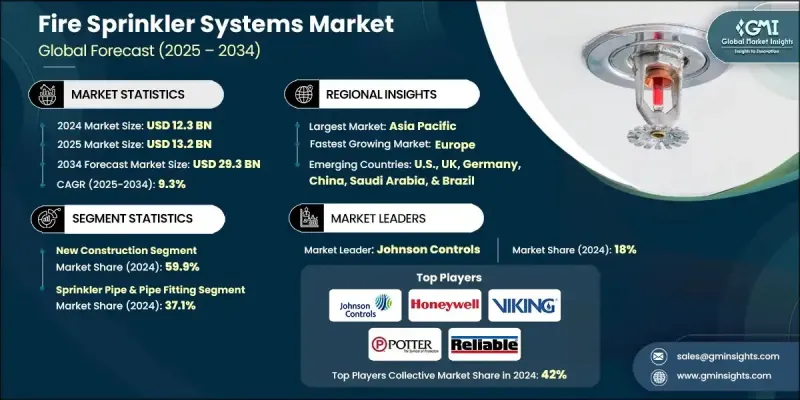

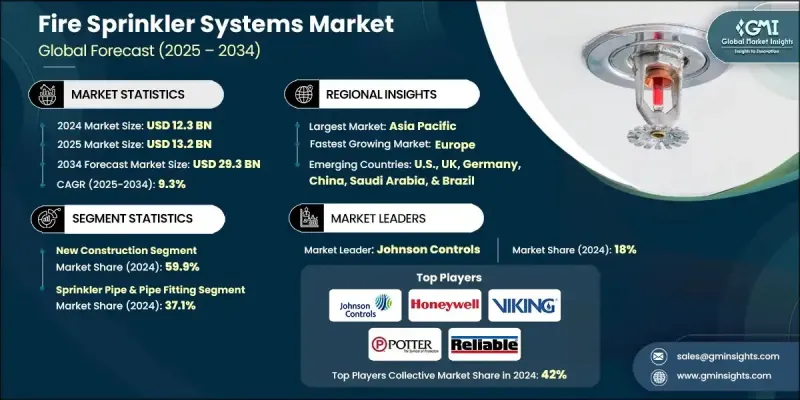

2024 年全球消防灑水系統市場價值為 123 億美元,預計到 2034 年將以 9.3% 的複合年成長率成長至 293 億美元。

安全規程執行力度的加強、建築規範合規性的提升以及各類基礎設施對消防安全的日益重視,推動市場擴張。科技的快速進步正在徹底改變傳統的灑水系統,使其更加智慧化,反應更快。先進的感測器和自動控制模組的整合,使這些系統能夠精準地探測火災威脅並迅速採取行動,最大限度地減少用水量和財產損失。此外,從住宅建築到工業園區,不同環境對客製化解決方案的需求正促使製造商設計自適應滅火系統。監管機構正在推出更嚴格的安全規定,推動建築工程安裝經過認證的灑水系統。永續發展趨勢也在影響系統設計,環保、低影響的滅火解決方案越來越受到青睞,尤其是在獲得綠色認證的建築中。人們日益增強的生命和財產保護意識,確保灑水系統不再是可有可無的,而是必需品,尤其是在新建築中。由於對火災相關事故和財產損失的抵禦能力日益增強,市場也越來越受到關注。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 123億美元 |

| 預測值 | 293億美元 |

| 複合年成長率 | 9.3% |

2024年,新建建築領域佔據59.9%的佔有率,預計到2034年將以9%的複合年成長率成長。強勁的城市發展、不斷升級的安全法規以及住宅、商業和工業建築防火優先順序的轉變,將繼續推動這一領域的發展。日益完善的消防法規和強制安裝灑水系統以降低風險的保險政策,推動了新建建築對現代化滅火系統的需求。

2024年,噴水管道及管件市場佔據37.1%的市場佔有率,預計到2034年將以8%的複合年成長率成長。城市建設的加速推動了對符合先進安全要求的高性能、耐用管道材料的持續需求。這些部件對於系統可靠性至關重要,在執行滅火任務和維護緊急情況下的基礎設施完整性方面發揮關鍵作用。

美國消防灑水系統市場佔85.3%的市場佔有率,2024年市場規模達35億美元。人口持續成長、建築安全意識增強以及建築規範的修訂,都推動了對高效消防系統的需求不斷成長。法規更新也擴大要求在新建築中安裝噴淋裝置,這推動了住宅和商業領域大量此類產品的部署。

全球消防灑水系統市場的主要參與者包括霍尼韋爾、江森自控、唯特利、維京集團、伊頓、Minimax、NAFFCO、EuroSprinkler AG、Rapidrop Global、GW Sprinkler、Safeguard Industries、AGNi、MAFCO ENTERPRISE、Potter Electric Signal、Senjui、Safeguard Industries、AGNi、MAFCO ENTERPRISE、Potter Electric Signal、Senju Spire、Krinker、UNS. Ltd. 消防灑水系統市場的領先製造商正專注於先進的產品開發、監管協調和全球擴張,以鞏固其市場地位。重點放在創建與建築自動化技術和智慧感測器整合的智慧系統,以實現即時火災威脅偵測和更快的啟動。各公司也正在加大研發投入,設計環保、節水的灑水系統,以滿足綠建築日益成長的需求。正在利用與建築公司、建築管理系統提供者和市政機構的策略性合併和合作來增加市場滲透率。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 原料可用性和採購分析

- 影響價值鏈的關鍵因素

- 中斷

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL分析

- 消防灑水系統成本結構分析

- 新興機會和趨勢

- 利用物聯網技術進行數位轉型

- 新興市場滲透

- 投資分析及未來展望

第4章:競爭格局

- 介紹

- 公司市佔率(按地區分類)

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 策略舉措

- 重要夥伴關係與合作

- 重大併購活動

- 產品創新與發布

- 市場擴張策略

- 競爭基準測試

- 戰略儀表板

- 創新與永續發展格局

第5章:市場規模及預測:依建築類型,2021 - 2034

- 主要趨勢

- 新建築

- 改造

第6章:市場規模及預測:依組件分類,2021 - 2034 年

- 主要趨勢

- 噴水管及管件

- 灑水噴頭

- 閥門

- 壓縮機

- 泵浦和泵浦控制器

- 其他

第7章:市場規模及預測:依系統類型,2021 - 2034

- 主要趨勢

- 濕式灑水系統

- 乾式灑水系統

- 預作用灑水系統

- 雨淋灑水系統

- 其他

第 8 章:市場規模與預測:按應用,2021 - 2034 年

- 主要趨勢

- 住宅

- 商業的

- 工業的

第9章:市場規模及預測:依反應時間,2021 - 2034 年

- 主要趨勢

- 標準

- 快的

第 10 章:市場規模與預測:按材料,2021 - 2034 年

- 主要趨勢

- 金屬

- 黑鋼

- 低碳鋼

- 鍍鋅鋼

- 不銹鋼

- 其他

- 非金屬

- CPVC(氯化聚氯乙烯)

- PEX(交聯聚乙烯)

- HDPE(高密度聚乙烯)

- PP-R(聚丙烯無規則共聚物)

第 11 章:市場規模與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 拉丁美洲

- 巴西

- 墨西哥

第12章:公司簡介

- AGNi

- Ca-Fire Protection Co.,Ltd.

- Eaton

- EuroSprinkler AG

- GW Sprinkler

- HD Fire Protect

- Honeywell

- Johnson Controls

- Kauffman

- MAFCO ENTERPRISE

- Minimax

- NAFFCO

- Potter Electric Signal

- Rapidrop Global

- Reliable

- SAFEGUARD INDUSTRIES

- Senju Sprinkler

- UNITED Fire Systems

- Victaulic

- Viking Group

The Global Fire Sprinkler Systems Market was valued at USD 12.3 billion in 2024 and is estimated to grow at a CAGR of 9.3% to reach USD 29.3 billion by 2034.

Market expansion is being driven by stronger enforcement of safety protocols, enhanced building code compliance, and increased emphasis on fire protection across various types of infrastructure. Rapid advancements in technology are revolutionizing traditional sprinkler systems, making them more intelligent and responsive. Integration of advanced sensors and automated control modules allows these systems to detect and act swiftly on fire threats with pinpoint accuracy, minimizing water usage and property damage. Additionally, the demand for tailored solutions for different environments, from residential buildings to industrial complexes, is pushing manufacturers to design adaptive fire suppression systems. Regulatory bodies are introducing stricter safety mandates, pushing construction projects to include certified sprinkler installations. Sustainability trends are also impacting system design, as eco-friendly, low-impact fire suppression solutions gain preference, especially in green-certified buildings. Growing awareness around protecting lives and assets is ensuring that sprinkler systems are no longer optional, but a necessity, particularly in newly built spaces. The market is also seeing growing traction due to the rising urgency for resilience against fire-related incidents and property losses.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.3 Billion |

| Forecast Value | $29.3 Billion |

| CAGR | 9.3% |

In 2024, the new construction segment held a 59.9% share and is expected to grow at a CAGR of 9% through 2034. This segment continues to benefit from robust urban development, evolving safety mandates, and a shift in how residential, commercial, and industrial structures prioritize fire protection. Demand for modernized fire suppression systems in new buildings is driven by increasingly sophisticated fire codes and insurance policies mandating sprinkler system installations to mitigate risk.

The sprinkler pipe and pipe fitting segment held a 37.1% share in 2024 and is poised to grow at a CAGR of 8% through 2034. Accelerated urban construction is generating a consistent need for high-performance and long-lasting piping materials that meet advanced safety requirements. These components are essential to system reliability, playing a critical role in carrying out fire suppression tasks and maintaining infrastructure integrity during emergencies.

U.S. Fire Sprinkler Systems Market held 85.3% share, generating USD 3.5 billion in 2024. Continued population growth, heightened awareness around building safety, and revised construction codes are all contributing to rising demand for efficient fire protection systems. Regulatory updates are increasingly requiring the inclusion of sprinklers in newly developed structures, driving significant product deployment across residential and commercial sectors.

Key players operating in the Global Fire Sprinkler Systems Market include Honeywell, Johnson Controls, Victaulic, Viking Group, Eaton, Minimax, NAFFCO, EuroSprinkler AG, Rapidrop Global, GW Sprinkler, Safeguard Industries, AGNi, MAFCO ENTERPRISE, Potter Electric Signal, Senju Sprinkler, Kauffman, HD Fire Protect, UNITED Fire Systems, Reliable, and Ca-Fire Protection Co., Ltd. Leading manufacturers in the Fire Sprinkler Systems Market are focusing on advanced product development, regulatory alignment, and global expansion to solidify their market position. Emphasis is being placed on creating intelligent systems that integrate with building automation technologies and smart sensors for real-time fire threat detection and faster activation. Firms are also enhancing R&D investments to engineer eco-friendly, water-efficient sprinkler designs to meet growing demand from green buildings. Strategic mergers and partnerships with construction firms, building management system providers, and municipal bodies are being used to increase market penetration.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.2.1 Market share of 3 leading players

- 2.3 Component trends

- 2.4 Product trends

- 2.5 Application trends

- 2.6 Response time trends

- 2.7 Material trends

- 2.8 Regional trends

- 2.8.1 Market size of leading countries

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Key factors affecting the value chain

- 3.1.3 Disruptions

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of fire sprinkler systems

- 3.8 Emerging opportunities & trends

- 3.8.1 Digital transformation with IoT technologies

- 3.8.2 Emerging market penetration

- 3.9 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.3.1 Key partnerships & collaborations

- 4.3.2 Major M&A activities

- 4.3.3 Product innovations & launches

- 4.3.4 Market expansion strategies

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Construction Type, 2021 - 2034, (USD Million)

- 5.1 Key trends

- 5.2 New construction

- 5.3 Retrofit

Chapter 6 Market Size and Forecast, By Component, 2021 - 2034, (USD Million)

- 6.1 Key trends

- 6.2 Sprinkler pipe and pipe fittings

- 6.3 Sprinkler heads

- 6.4 Valves

- 6.5 Compressors

- 6.6 Pumps and pump controllers

- 6.7 Others

Chapter 7 Market Size and Forecast, By System Type, 2021 - 2034, (USD Million)

- 7.1 Key trends

- 7.2 Wet-pipe sprinkler system

- 7.3 Dry-pipe sprinkler system

- 7.4 Pre-action sprinkler system

- 7.5 Deluge sprinkler system

- 7.6 Others

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034, (USD Million)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.4 Industrial

Chapter 9 Market Size and Forecast, By Response Time, 2021 - 2034, (USD Million)

- 9.1 Key trends

- 9.2 Standard

- 9.3 Quick

Chapter 10 Market Size and Forecast, By Material, 2021 - 2034, (USD Million)

- 10.1 Key trends

- 10.2 Metallic

- 10.2.1 Black steel

- 10.2.2 Mild steel

- 10.2.3 Galvanized steel

- 10.2.4 Stainless steel

- 10.2.5 Others

- 10.3 Non-metallic

- 10.3.1 CPVC (Chlorinated polyvinyl chloride)

- 10.3.2 PEX (Cross-linked polyethylene)

- 10.3.3 HDPE (High-density polyethylene)

- 10.3.4 PP-R (Polypropylene random copolymer)

Chapter 11 Market Size and Forecast, By Region, 2021 - 2034, (USD Million)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.5 Middle East & Africa

- 11.5.1 UAE

- 11.5.2 Saudi Arabia

- 11.5.3 South Africa

- 11.6 Latin America

- 11.6.1 Brazil

- 11.6.2 Mexico

Chapter 12 Company Profiles

- 12.1 AGNi

- 12.2 Ca-Fire Protection Co.,Ltd.

- 12.3 Eaton

- 12.4 EuroSprinkler AG

- 12.5 GW Sprinkler

- 12.6 HD Fire Protect

- 12.7 Honeywell

- 12.8 Johnson Controls

- 12.9 Kauffman

- 12.10 MAFCO ENTERPRISE

- 12.11 Minimax

- 12.12 NAFFCO

- 12.13 Potter Electric Signal

- 12.14 Rapidrop Global

- 12.15 Reliable

- 12.16 SAFEGUARD INDUSTRIES

- 12.17 Senju Sprinkler

- 12.18 UNITED Fire Systems

- 12.19 Victaulic

- 12.20 Viking Group