|

市場調查報告書

商品編碼

1844349

自體免疫疾病診斷市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Autoimmune Disease Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

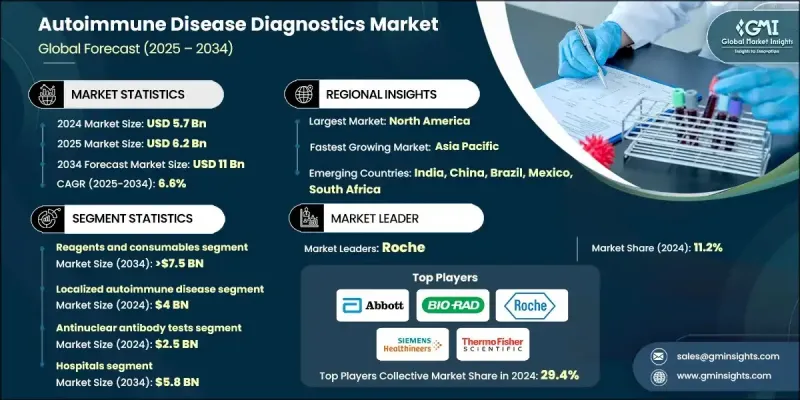

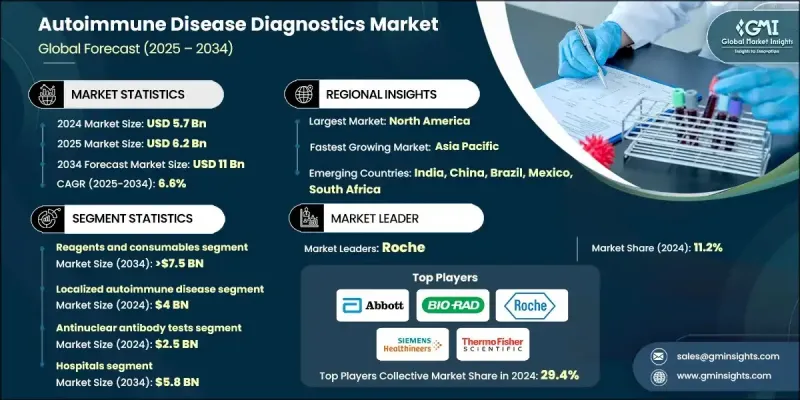

2024 年全球自體免疫疾病診斷市場價值為 57 億美元,預計將以 6.6% 的複合年成長率成長,到 2034 年達到 110 億美元。

自體免疫疾病發生率的上升、早期診斷意識的增強、篩檢計畫的持續推進以及診斷技術的穩步進步,正在推動市場擴張。醫療保健支出的增加和創新早期檢測工具的引入也增強了對精準快速檢測的需求。從分子檢測到免疫測定和基於生物標記的檢測,診斷能力正在不斷發展,以滿足日益成長的臨床需求。由政府和醫療機構主導的患者教育活動正在顯著提高檢測量。同時,利用特定生物標記的精準診斷技術正得到更廣泛的應用,透過早期疾病檢測和針對患者的監測來改善治療效果。攜帶式快速自體免疫疾病檢測解決方案也越來越受歡迎,能夠在各種護理環境中提供更快的結果,進一步推動市場發展。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 57億美元 |

| 預測值 | 110億美元 |

| 複合年成長率 | 6.6% |

2024年,試劑和耗材細分市場佔據67%的市場佔有率,這得益於其在自體免疫檢測程序中的重複使用。診斷應用對檢測試劑盒、抗體和緩衝液的持續需求推動了該細分市場的持續成長。隨著診斷和長期疾病監測的檢測越來越頻繁,對這些材料的需求也持續成長。實驗室和診所嚴重依賴耗材進行準確且有效率的診斷,從而為該細分市場創造了穩定的收入來源。

局部自體免疫疾病領域在2024年創造了40億美元的市場規模,預計到2034年將以6.4%的複合年成長率成長。該領域包括甲狀腺疾病、發炎性腸道疾病和第1型糖尿病等針對特定器官的疾病,這些疾病在全球的診斷率日益上升。這些器官特異性疾病的增多,推動了對局部疾病檢測的高敏感度和精準診斷的需求。為了避免長期併發症,早期介入和持續監測的需求推動了該領域的持續成長。

2024年,北美自體免疫疾病診斷市場佔36.6%的市場。該地區是全球自體免疫疾病發生率最高的地區之一,包括多發性硬化症、紅斑性狼瘡、類風濕性關節炎和第1型糖尿病。不斷成長的患者群體推動了對高級診斷檢測的巨大需求。憑藉強大的醫療基礎設施和廣泛的篩檢計劃,該地區持續支持常規和高級自體免疫檢測。對早期診斷和個人化護理的重視進一步維持了市場的成長。

全球自體免疫疾病診斷市場的主要活躍參與者包括歐陸、賽默飛世爾科技、羅氏、Quest Diagnostics、Inova Diagnostics (Werfen)、DIAsource、Trinity Biotech、Revvity、Labcorp、西門子醫療、GRIFOLS、Hemagen Diagnostics、BIO-UX、RADBIOMERIE 和雅培。自體免疫疾病診斷市場的公司正在透過策略合作、收購和對先進技術的投資來擴大其產品組合。許多公司專注於開發基於生物標記的診斷方法和下一代分子工具,以提高靈敏度和速度。研發投入的增加使公司能夠推出更精確、更方便用戶使用的診斷平台,包括即時檢測試劑盒。公司還優先考慮自動化,以簡化實驗室工作流程並提高通量。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 自體免疫疾病發生率高、盛行率高

- 對自體免疫疾病的認知不斷提高

- 政府對自體免疫疾病研究活動的支持政策

- 技術進步和實驗室自動化技術的日益普及

- 產業陷阱與挑戰

- 進階診斷測試成本高昂

- 測試結果的周轉時間較長,需要進行多次診斷測試

- 市場機會

- 人工智慧和機器學習在診斷領域的應用日益廣泛

- 家庭和自我診斷試劑盒的成長

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 技術格局

- 當前的技術趨勢

- 新興技術

- 差距分析

- 波特的分析

- PESTEL分析

- 未來市場趨勢

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲和中東

- 競爭定位矩陣

- 主要市場參與者的競爭分析

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 試劑和耗材

- 儀器

第6章:市場估計與預測:依疾病類型,2021 - 2034 年

- 主要趨勢

- 局限性自體免疫疾病

- 1型糖尿病

- 發炎性腸道疾病

- 甲狀腺

- 其他局部自體免疫疾病

- 系統性自體免疫疾病

- 類風濕關節炎

- 系統性紅斑狼瘡(SLE)

- 多發性硬化症

- 牛皮癬

- 其他系統性自體免疫疾病

第7章:市場估計與預測:按測試類型,2021 - 2034

- 主要趨勢

- 抗核抗體檢測

- 自體抗體檢測

- 全血球計數(CBC)

- C反應蛋白(CRP)

- 尿液分析

- 其他測試類型

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 診斷中心

- 其他最終用途

第9章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Abbott

- BIOMERIEUX

- BIO-RAD

- DIAsource

- Euroimmun

- GRIFOLS

- Hemagen Diagnostics

- Inova Diagnostics (Werfen)

- Labcorp

- Quest Diagnostics

- Revvity

- Roche

- SIEMENS Healthineers

- Thermo Fisher Scientific

- Trinity Biotech

The Global Autoimmune Disease Diagnostics Market was valued at USD 5.7 billion in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 11 billion by 2034.

Rising incidence rates of autoimmune conditions, higher awareness about early diagnosis, ongoing screening programs, and steady advancements in diagnostic technologies are fueling market expansion. Improved healthcare spending and the introduction of innovative tools for early detection have also strengthened the demand for accurate and rapid testing. From molecular assays to immunoassays and biomarker-based detection, diagnostic capabilities are evolving to meet growing clinical needs. Patient education campaigns, led by both governments and healthcare organizations, are significantly raising testing volumes. At the same time, precision diagnostics utilizing specific biomarkers are seeing greater adoption, improving outcomes through early disease detection and patient-specific monitoring. Portable and rapid testing solutions for autoimmune disorders are also gaining popularity, offering quicker results in various care settings and further driving market momentum.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.7 Billion |

| Forecast Value | $11 Billion |

| CAGR | 6.6% |

In 2024, the reagents and consumables segment held 67% share owing to their recurring use in autoimmune testing procedures. The constant need for assay kits, antibodies, and buffers across diagnostic applications is contributing to the segment's consistent growth. As testing becomes more frequent for both diagnosis and long-term disease monitoring, the demand for these materials continues to rise. Laboratories and clinics rely heavily on consumables to perform accurate and efficient diagnostics, creating a steady revenue stream within the segment.

The localized autoimmune disease segment generated USD 4 billion in 2024 and is expected to grow at a CAGR of 6.4% through 2034. This segment includes conditions such as thyroid disorders, inflammatory bowel diseases, and Type 1 diabetes diseases targeting specific organs and increasingly being diagnosed worldwide. The rise in these organ-specific conditions fuels the need for highly sensitive and precise diagnostics tailored to localized disease detection. Continued growth in this area is supported by the need for early intervention and consistent monitoring to avoid long-term complications.

North America Autoimmune Disease Diagnostics Market held 36.6% share in 2024. The region reports one of the highest rates of autoimmune disorders globally, including multiple sclerosis, lupus, rheumatoid arthritis, and Type 1 diabetes. This growing patient population drives significant demand for advanced diagnostic testing. With a strong healthcare infrastructure and widespread screening initiatives, the region continues to support both routine and advanced autoimmune testing. The emphasis on early diagnosis and personalized care further sustains market growth.

Major players active in the Global Autoimmune Disease Diagnostics Market include Euroimmun, Thermo Fisher Scientific, Roche, Quest Diagnostics, Inova Diagnostics (Werfen), DIAsource, Trinity Biotech, Revvity, Labcorp, Siemens Healthineers, GRIFOLS, Hemagen Diagnostics, BIO-RAD, BIOMERIEUX, and Abbott. Companies in the autoimmune disease diagnostics market are expanding their portfolios through strategic collaborations, acquisitions, and investments in advanced technologies. Many are focusing on developing biomarker-based diagnostics and next-generation molecular tools to improve sensitivity and speed. Increased investment in R&D is enabling firms to introduce more precise and user-friendly diagnostic platforms, including point-of-care testing kits. Companies are also prioritizing automation to streamline lab workflows and enhance throughput.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Disease Type trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 High incidence and prevalence of autoimmune diseases

- 3.2.1.2 Growing awareness about autoimmune diseases

- 3.2.1.3 Supportive government policies for research activities on autoimmune diseases

- 3.2.1.4 Technological advancements and increasing adoption of lab automation technologies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced diagnostic tests

- 3.2.2.2 Slow turnaround time for test results and need for multiple diagnostic tests

- 3.2.3 Market opportunities

- 3.2.3.1 Increasing adoption of AI and machine learning in diagnostics

- 3.2.3.2 Growth in home-based and self-diagnostic kits

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Reagents and consumables

- 5.3 Instruments

Chapter 6 Market Estimates and Forecast, By Disease Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Localized autoimmune disease

- 6.2.1 Type 1 diabetes

- 6.2.2 Inflammatory bowel disease

- 6.2.3 Thyroid

- 6.2.4 Other localized autoimmune diseases

- 6.3 Systemic autoimmune disease

- 6.3.1 Rheumatoid arthritis

- 6.3.2 Systemic lupus erythematosus (SLE)

- 6.3.3 Multiple sclerosis

- 6.3.4 Psoriasis

- 6.3.5 Other systemic autoimmune diseases

Chapter 7 Market Estimates and Forecast, By Test Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Antinuclear antibody tests

- 7.3 Autoantibody tests

- 7.4 Complete blood count (CBC)

- 7.5 C-reactive protein (CRP)

- 7.6 Urinalysis

- 7.7 Other test types

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Diagnostics centers

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott

- 10.2 BIOMERIEUX

- 10.3 BIO-RAD

- 10.4 DIAsource

- 10.5 Euroimmun

- 10.6 GRIFOLS

- 10.7 Hemagen Diagnostics

- 10.8 Inova Diagnostics (Werfen)

- 10.9 Labcorp

- 10.10 Quest Diagnostics

- 10.11 Revvity

- 10.12 Roche

- 10.13 SIEMENS Healthineers

- 10.14 Thermo Fisher Scientific

- 10.15 Trinity Biotech