|

市場調查報告書

商品編碼

1844346

維生素 D 檢測市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Vitamin D Testing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

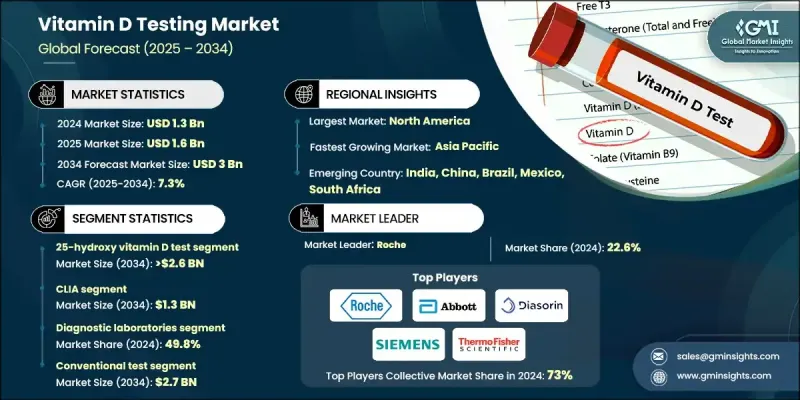

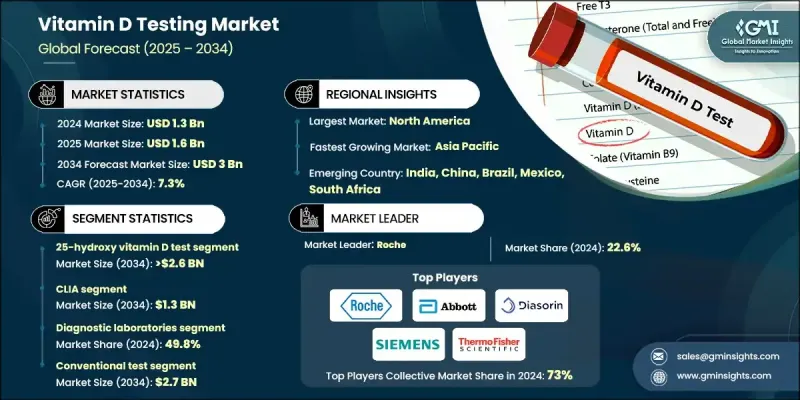

2024 年全球維生素 D 檢測市場價值為 13 億美元,預計將以 7.3% 的複合年成長率成長,到 2034 年達到 30 億美元。

這一成長受到全球維生素D缺乏症盛行率上升、預防性醫療保健日益受到重視以及診斷檢測需求不斷成長的影響。先進技術不斷融入醫療保健系統,加速了維生素D診斷方法的普及。隨著糖尿病、自體免疫疾病、心血管疾病和骨質疏鬆症等慢性疾病的發生率上升,維生素D檢測正成為臨床工作流程中的關鍵組成部分。醫療保健機構正在將這些檢測納入常規診斷,以更準確地管理維生素D缺乏症並監測補充結果。診斷實驗室、支付方和數位健康平台正在轉向液相層析串聯質譜法 (LC-MS/MS)、酶聯免疫吸附試驗 (ELISA) 和化學發光免疫分析法等解決方案,以提高準確性並更好地監測患者。這支持了向個人化醫療保健的重大轉變,其中早期檢測起著關鍵作用。醫院、診所甚至家庭機構均可進行維生素D檢測,有助於提高維生素D的可近性。對慢性病預防、婦幼保健和老年護理計畫的日益關注,進一步支持了市場持續的成長軌跡。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 13億美元 |

| 預測值 | 30億美元 |

| 複合年成長率 | 7.3% |

25-羥基維生素D檢測市場在2024年佔據了86.2%的市場佔有率,因為它仍然是評估血液中維生素D水平的首選標準。預計到2034年,該市場規模將達到26億美元,複合年成長率為7.6%。其用途涵蓋多種臨床應用,包括慢性病管理、常規健康體檢、老年護理和營養評估。此檢測被廣泛用於評估日照不足、飲食攝取量低或代謝紊亂影響維生素D吸收的個體的維生素D缺乏症。它在全民篩檢和標靶診斷中的作用將繼續鞏固其市場主導地位。

化學發光免疫分析 (CLIA) 領域在 2024 年佔據 43.5% 的市場佔有率,預計到 2034 年將達到 13 億美元。化學發光免疫分析 (CLIA) 檢測需求的不斷成長,得益於其優於傳統免疫分析方法的靈敏度和精確度。 CLIA 能夠準確定量關鍵維生素 D 代謝物,而這些代謝物是評估維生素 D 缺乏相關風險的重要指標。由於其可靠性、速度和可擴展的通量,CLIA 在中心實驗室和即時檢測機構的應用日益廣泛。

2024年,北美維生素D檢測市場佔據37.7%的市場佔有率,這得益於先進的醫療基礎設施、患者認知度的提升以及積極的篩檢措施。該地區尤其受到普遍存在的維生素D缺乏症的影響,尤其是在日照較少的地區。因此,檢測擴大被納入常規健康評估。醫生經常建議患有長期疾病的患者進行這些檢測,這促進了需求的成長。廣泛的保險覆蓋、政府的健康宣傳活動以及日益成長的家庭診斷服務,進一步加速了美國和加拿大市場的擴張。

影響全球維生素 D 檢測市場的關鍵公司包括雅培、賽默飛世爾科技、羅氏、丹納赫(貝克曼庫爾特)、邁瑞醫療國際、NanoSpeed Diagnostics、西門子、Diasorin、朗道實驗室、Bio-Rad 實驗室、東曹、Qualigen Therapeutics、歐蒙、生物梅里埃和 NanoAEnek。為了鞏固市場地位,維生素 D 檢測市場的領導者正在實施一系列策略性舉措。許多企業專注於透過推出高靈敏度、可縮短週轉時間的新一代檢測試劑盒來擴展其診斷產品組合。企業也正在投資自動化和基於人工智慧的分析技術,以提高工作流程效率和資料準確性。透過與分銷商合作和本地製造,企業正優先考慮向高成長地區進行地理擴張。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 零件和技術供應商

- 診斷設備與試劑盒製造商

- 每個階段的增值

- 產業衝擊力

- 成長動力

- 維生素D缺乏症盛行率不斷上升

- 消費者意識不斷提高

- 公共衛生運動和報銷政策的興起

- 不斷進步的技術

- 產業陷阱與挑戰

- 先進診斷方法成本高昂

- 市場機會

- 擴展到即時診斷和家庭檢測

- 進軍新興市場

- 成長動力

- 成長潛力分析

- 監管情景

- 北美洲

- 歐洲

- 亞太地區

- 報銷場景

- 技術格局

- 當前的技術趨勢

- 新興技術

- 未來市場趨勢

- 2024年定價分析

- 專利格局

- 專利持有人分析

- 臨床指引和標準化

- 投資與融資趨勢

- 流行病學情景

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 多邊環境協定

- 競爭定位矩陣

- 主要市場參與者的競爭分析

- 關鍵進展

- 併購

- 夥伴關係與合作

- 推出新服務類型

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 25-羥基維生素D檢測

- 1,25-二羥基維生素D檢測

第6章:市場估計與預測:按技術,2021 - 2034 年

- 主要趨勢

- 化學發光免疫分析

- 酵素連結免疫吸附試驗

- 液相層析質譜聯用

- 放射免疫分析法

- 其他技術

第7章:市場估計與預測:按適應症,2021 - 2034

- 主要趨勢

- 維生素 D 缺乏症

- 骨質疏鬆症

- 心血管

- 疳

- 甲狀腺疾病

- 其他適應症

第 8 章:市場估計與預測:按患者,2021 - 2034 年

- 主要趨勢

- 成人

- 兒科

第9章:市場估計與預測:按測試類型,2021 - 2034

- 主要趨勢

- 常規測試

- 即時檢驗

第 10 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 診斷實驗室

- 醫院

- 居家護理

- 其他最終用途

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 12 章:公司簡介

- Abbott

- bioMerieux

- Bio-Rad Laboratories

- Danaher (Beckman Coulter)

- Diasorin

- EUROIMMUN

- Roche

- Mindray Medical International

- NanoEnTek

- NanoSpeed Diagnostics

- Qualigen Therapeutics

- Randox Laboratories

- Siemens

- Thermo Fisher Scientific

- Tosoh

The Global Vitamin D Testing Market was valued at USD 1.3 billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 3 billion by 2034.

The growth is influenced by the increasing prevalence of vitamin D deficiency worldwide, a greater focus on preventive healthcare, and rising demand for diagnostic testing. The continued integration of advanced technologies into healthcare systems is accelerating the adoption of vitamin D diagnostics. With chronic illnesses such as diabetes, autoimmune disorders, cardiovascular diseases, and osteoporosis on the rise, vitamin D testing is becoming a critical part of clinical workflows. Healthcare providers are incorporating these tests into routine diagnostics to manage deficiencies and monitor supplementation outcomes more accurately. Diagnostic labs, payers, and digital health platforms are turning to solutions like LC-MS/MS, ELISA, and chemiluminescence immunoassays for enhanced accuracy and patient monitoring. This is supporting a major shift toward personalized healthcare, where early detection plays a key role. The availability of vitamin D testing in hospitals, clinics, and even at-home setups contributes to increasing accessibility. The expanding focus on chronic disease prevention, maternal and child health, and elderly care programs is further supporting the market's consistent growth trajectory.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $3 Billion |

| CAGR | 7.3% |

The 25-hydroxy vitamin D test segment held 86.2% share in 2024, as it remains the preferred standard for evaluating vitamin D levels in the blood. This segment is projected to reach USD 2.6 billion by 2034, growing at a CAGR of 7.6%. Its use spans multiple clinical applications, including chronic disease management, routine wellness checkups, elderly care, and nutritional assessments. The test is widely adopted to assess deficiency in individuals with limited sunlight exposure, low dietary intake, or metabolic disorders affecting vitamin D absorption. Its role in both population-wide screenings and targeted diagnostics continues to solidify its market dominance.

The CLIA segment held a 43.5% share in 2024 and is expected to reach USD 1.3 billion by 2034. The growing demand for chemiluminescence immunoassay testing is driven by its superior sensitivity and precision over traditional immunoassay methods. CLIA enables accurate quantification of key vitamin D metabolites, which are essential markers in assessing deficiency-related risks. Its adoption is increasing across both centralized labs and point-of-care testing setups due to its reliability, speed, and scalable throughput.

North America Vitamin D Testing Market held a 37.7% share in 2024, driven by advanced healthcare infrastructure, high patient awareness, and proactive screening initiatives. The region is particularly impacted by widespread vitamin D deficiency, especially in areas with reduced sun exposure. As a result, testing is increasingly integrated into routine health evaluations. Physicians regularly recommend these tests for patients with long-term conditions, contributing to increased demand. Widespread insurance coverage, government health campaigns, and growing home-based diagnostics are further accelerating market expansion across the US and Canada.

Key companies shaping the Global Vitamin D Testing Market include Abbott, Thermo Fisher Scientific, Roche, Danaher (Beckman Coulter), Mindray Medical International, NanoSpeed Diagnostics, Siemens, Diasorin, Randox Laboratories, Bio-Rad Laboratories, Tosoh, Qualigen Therapeutics, EUROIMMUN, bioMerieux, and NanoEnTek. To strengthen their foothold, leading players in the vitamin D testing market are implementing a range of strategic initiatives. Many are focused on expanding their diagnostic portfolios by launching highly sensitive, next-generation assay kits that offer faster turnaround times. Companies are also investing in automation and AI-based analytics for enhanced workflow efficiency and data accuracy. Geographic expansion into high-growth regions is being prioritized through distributor partnerships and local manufacturing.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Technique trends

- 2.2.4 Indication trends

- 2.2.5 Patient trends

- 2.2.6 Test type trends

- 2.2.7 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Component & technology suppliers

- 3.1.2 Diagnostic device & kit manufacturers

- 3.1.3 Value addition at each stage

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of vitamin D deficiency disorders

- 3.2.1.2 Rising awareness among consumers

- 3.2.1.3 Rise in public health campaigns and reimbursement policies

- 3.2.1.4 Increasing technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced diagnostic methods

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into point-of-care and home testing

- 3.2.3.2 Growth into emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory scenario

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Reimbursement scenario

- 3.6 Technology landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Future market trends

- 3.8 Pricing analysis, 2024

- 3.9 Patent landscape

- 3.9.1 Patent holder analysis

- 3.10 Clinical guidelines & standardization

- 3.11 Investment & funding trends

- 3.12 Epidemiology scenario

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 Latin America

- 4.3.6 MEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New service type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 25-hydroxy vitamin D test

- 5.3 1,25-dihydroxy vitamin D test

Chapter 6 Market Estimates and Forecast, By Technique, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 CLIA

- 6.3 ELISA

- 6.4 LC-MS

- 6.5 Radioimmunoassay

- 6.6 Other techniques

Chapter 7 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Vitamin D deficiency

- 7.3 Osteoporosis

- 7.4 Cardiovascular

- 7.5 Rickets

- 7.6 Thyroid disorders

- 7.7 Other indications

Chapter 8 Market Estimates and Forecast, By Patient, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Adult

- 8.3 Pediatric

Chapter 9 Market Estimates and Forecast, By Test Type, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Conventional test

- 9.3 Point-of-care test

Chapter 10 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Diagnostic laboratories

- 10.3 Hospitals

- 10.4 Homecare

- 10.5 Other end use

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Abbott

- 12.2 bioMerieux

- 12.3 Bio-Rad Laboratories

- 12.4 Danaher (Beckman Coulter)

- 12.5 Diasorin

- 12.6 EUROIMMUN

- 12.7 Roche

- 12.8 Mindray Medical International

- 12.9 NanoEnTek

- 12.10 NanoSpeed Diagnostics

- 12.11 Qualigen Therapeutics

- 12.12 Randox Laboratories

- 12.13 Siemens

- 12.14 Thermo Fisher Scientific

- 12.15 Tosoh